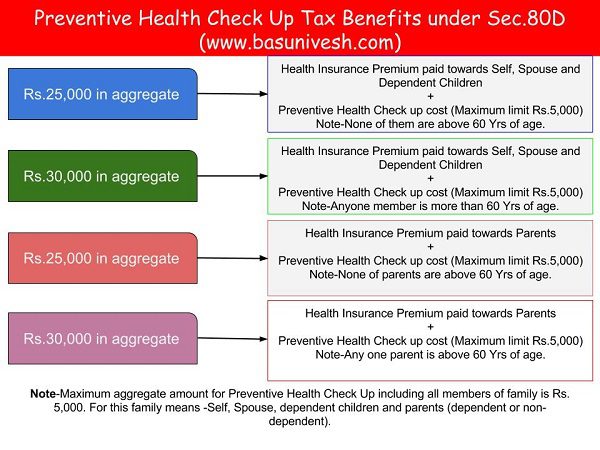

Preventive Health Check Up Tax Benefit Apart from the health benefits preventive health check ups benefit you in terms of tax deductions as well You can use the preventive health checkup 80D proof to get a concession on the income tax you pay

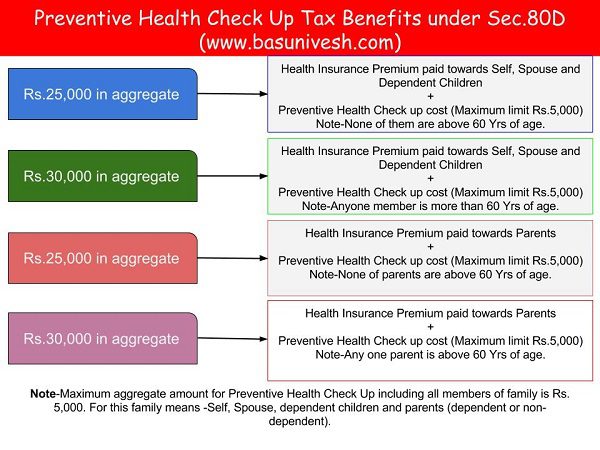

Under Section 80D you can claim an overall deduction of Rs 25 000 on the expenses of Preventive Health Checkups either for yourself your spouse or your dependent children You can also claim an additional deduction of up to Rs 25 000 for insurance of The deduction of amount spent on preventive health checkup cannot exceed INR 5 000 individually i e to say INR 5 000 for individual spouse dependent children and separate limit of INR 5 000 for parents or ii

Preventive Health Check Up Tax Benefit

Preventive Health Check Up Tax Benefit

https://www.gujaratsuperspecialityhospital.com/wp-content/uploads/2022/04/PreventiveHealthCheck-ups.jpg

5 Reasons Why You Should Be Scheduling Your Preventive Care Now

https://www.motivationalliance.org/wp-content/uploads/2023/01/low_Preventive-Care_TGC-Infographic_11x17-scaled.jpg

Preventive Health Check Up Benefits Tax Deductions

https://images.ctfassets.net/uwf0n1j71a7j/76knwryILCxFdd8oQGiTDt/79062fd764146f15917f323f9e066289/preventive-health-check-up.png?w=3840&q=75

Tax Deduction The Income Tax Act provides a tax deduction under Section 80D for expenses incurred on preventive health check ups Taxpayers can claim up to 5 000 per financial year for themselves their spouses children and parents Tax deductions on preventive health check ups When getting health insurance one should be aware of the Income Tax Act 1961 Under Section 80D of the Income Tax Act one claims an overall deduction of INR 25 000 and an additional deduction of

Anybody with valid health insurance who undergoes preventive health check ups can avail of a tax benefit of Rs 5 000 Note this tax benefit for preventive healthcare comes under the overall limit of Rs 25 000 medical insurance tax Under Section 80D of the Income Tax India Act individuals who undergo preventive health check ups can enjoy tax deductions of up to INR 5000 per financial year You can also avail tax benefits on the amount spent on preventive health check ups

Download Preventive Health Check Up Tax Benefit

More picture related to Preventive Health Check Up Tax Benefit

Preventive Health Check Up

https://image.slidesharecdn.com/preventivehealthcheckup-180212090849/95/preventive-health-check-up-6-1024.jpg?cb=1518426591

Preventive Health Checkups Pathology Lab In Delhi NCR Top Ten Labs

https://www.niramayahealthcare.com/img/covid/preventive-health-check-up.jpg

Preventive Health Checkup Neptune Diagnostics Center

https://neptunediagnostics.in/wp-content/uploads/2020/04/Preventive-Healthcare.jpg

Section 80D allows an individual to claim tax benefit for preventive health check up of Rs 5 000 This tax benefit is available within the maximum deduction limit of Rs 25 000 or Rs 50 000 as the case maybe Under Section 80D deduction super senior citizens above 80 years of age qualify for a tax deduction for health insurance premiums or other medical expenditures upto 50 000 It is also applicable and inclusive for preventive health checkups every

Under Section 80D of the Income Tax Act a tax deduction of Rs 5 000 per financial year is allowed towards preventive health check ups within the overall limit of Rs 25 000 for individuals and Rs 50 000 for senior citizens You can claim tax benefits on preventive health check ups even if the payments are made through cash With effect from 1 July 2017 all financial services are charged at a GST of 18 Consider opting for health insurance plans that

Preventive Health Check Up Tax Benefits Under Sec 80D

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2016/02/Sec.80D-and-Preventive-Health-Check-Up-Tax-Benefits.jpg?lossy=1&strip=1&webp=1

Preventive Health Checkup 80D Proof Deduction And Tax Benefits

https://www.paybima.com/blog/wp-content/uploads/2022/03/Preventive-health-check-up-and-Its-tax-benefit.jpg

https://www.paybima.com/blog/health-insurance/...

Apart from the health benefits preventive health check ups benefit you in terms of tax deductions as well You can use the preventive health checkup 80D proof to get a concession on the income tax you pay

https://www.acko.com/health-insurance/preventive-health-check-up

Under Section 80D you can claim an overall deduction of Rs 25 000 on the expenses of Preventive Health Checkups either for yourself your spouse or your dependent children You can also claim an additional deduction of up to Rs 25 000 for insurance of

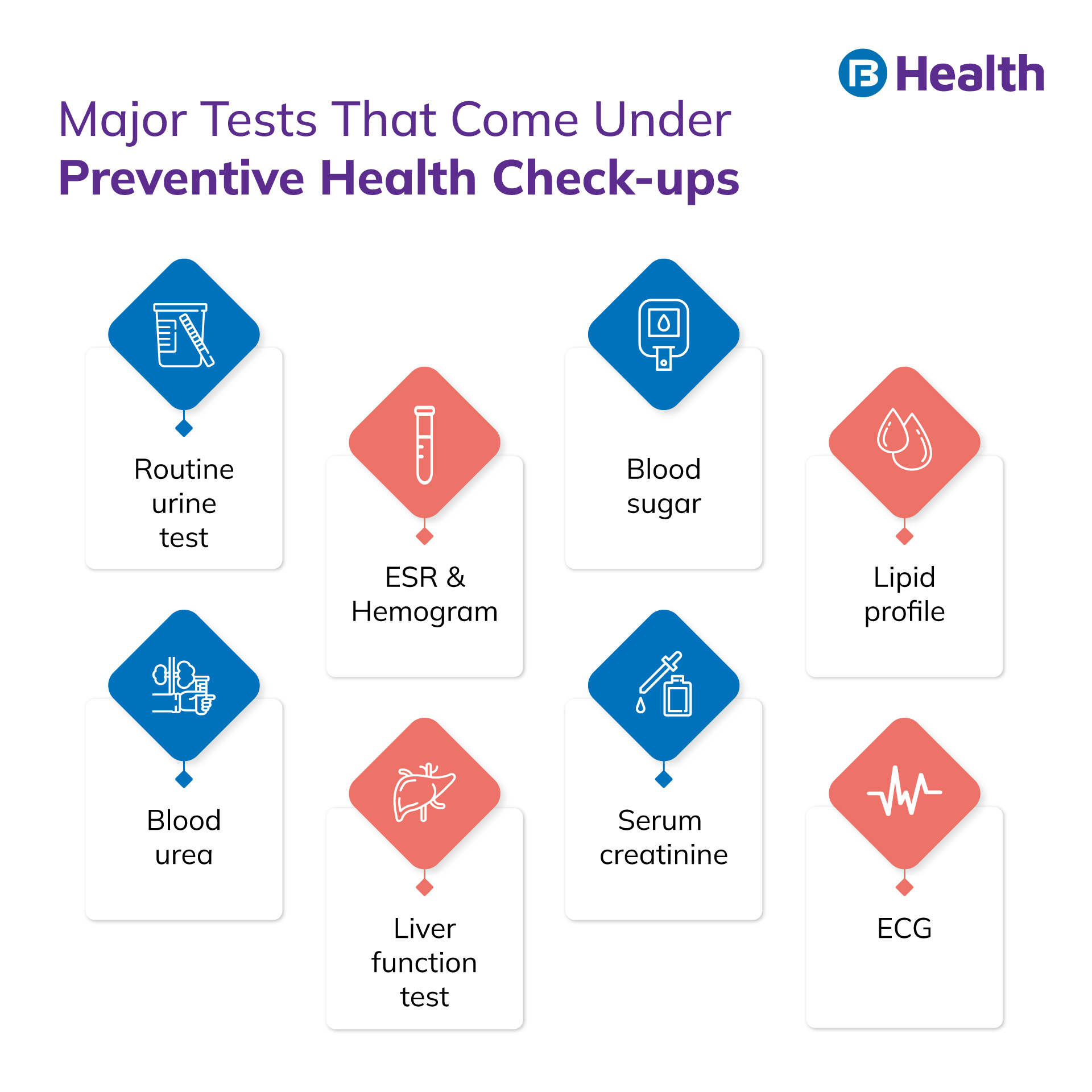

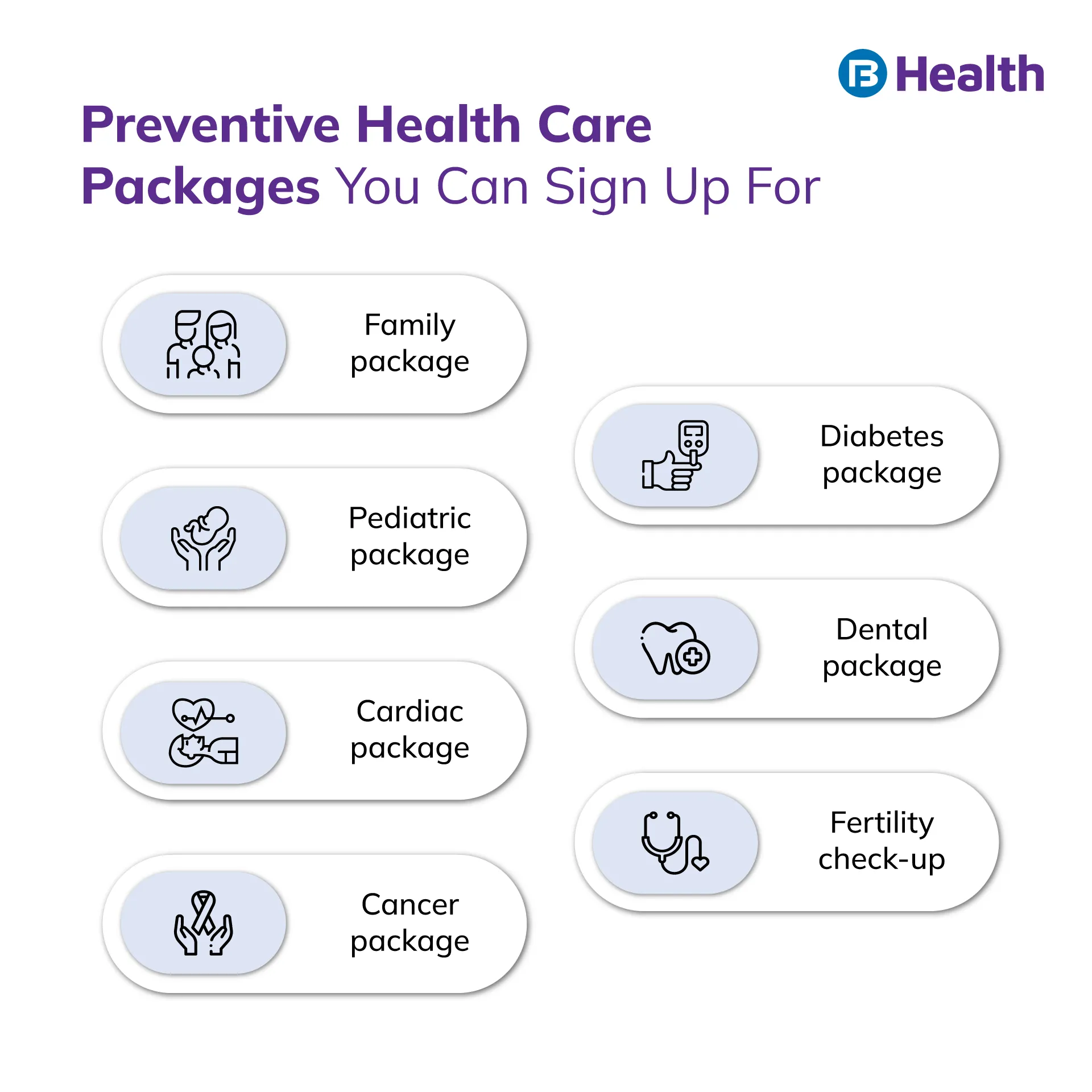

Preventive Health Check up Major Benefits You Should Know

Preventive Health Check Up Tax Benefits Under Sec 80D

Health Insurance Tax Benefit Under Section 80d Of Income Tax Act

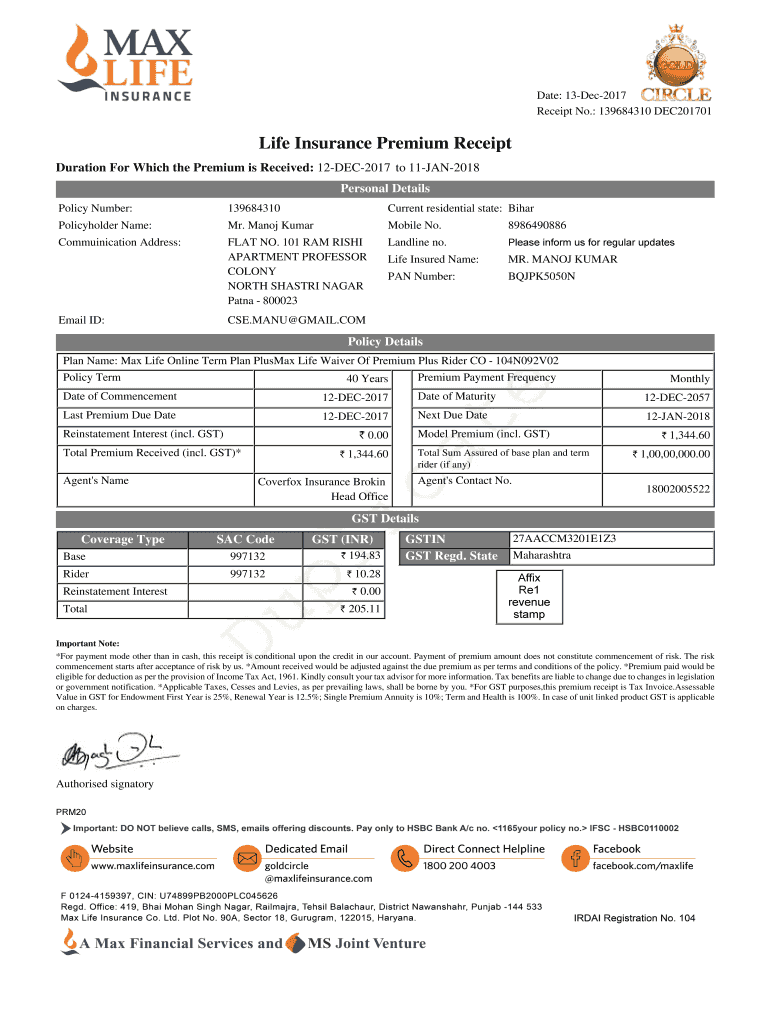

Medical Insurance Premium Receipt PDF Complete With Ease AirSlate

What Is Included In An Executive Check up Wellness Proposals

Advantages And Necessity Of Preventive Health Check Ups

Advantages And Necessity Of Preventive Health Check Ups

Annual Check Up PULSE CLINIC Asia s Leading Sexual Healthcare Network

Preventive Health Checkup 80d Proof Deduction And Income Tax Benefits

Tax Benefits On Preventive Health Check ups

Preventive Health Check Up Tax Benefit - Under Section 80D of the Income Tax India Act individuals who undergo preventive health check ups can enjoy tax deductions of up to INR 5000 per financial year You can also avail tax benefits on the amount spent on preventive health check ups