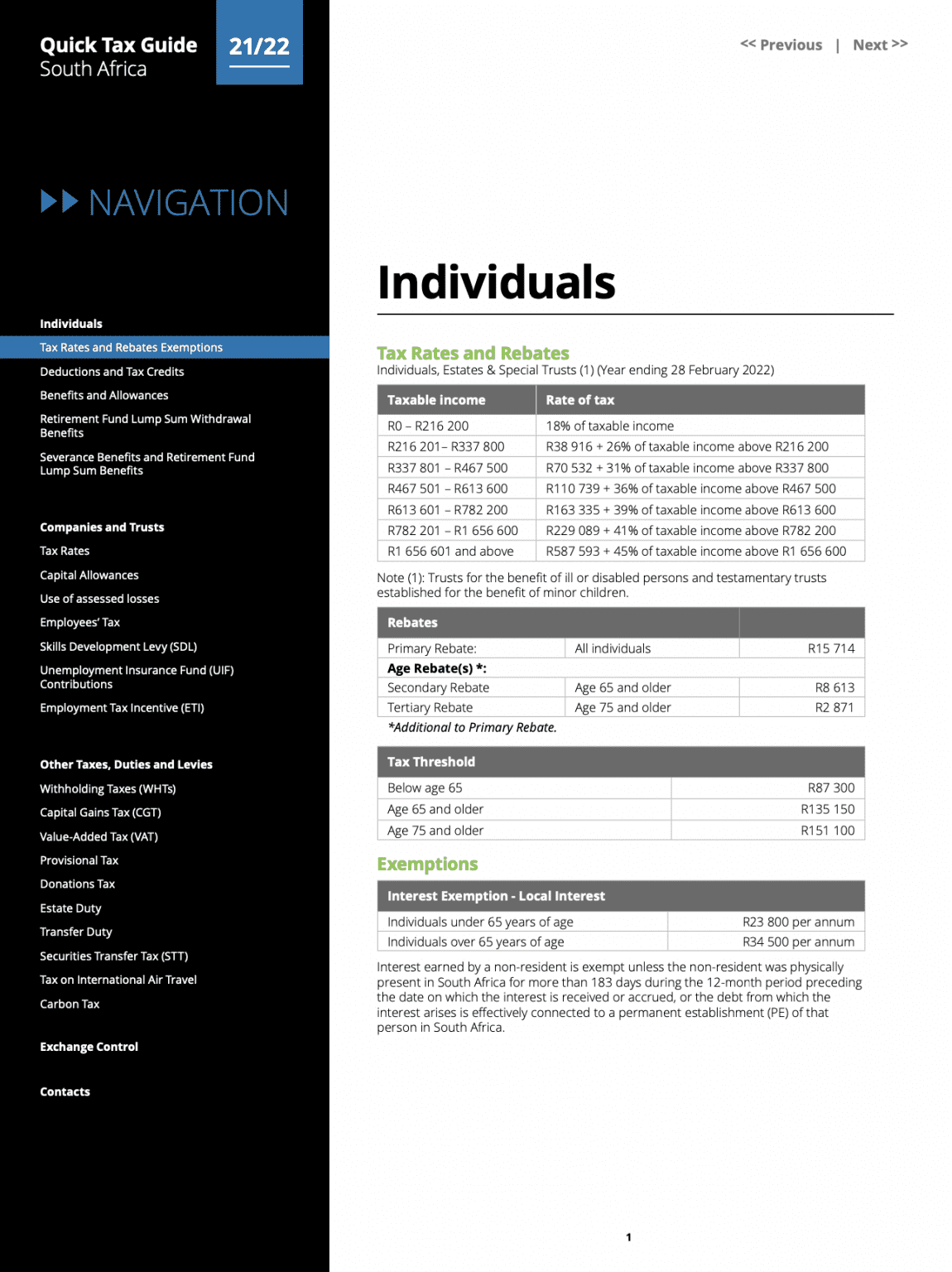

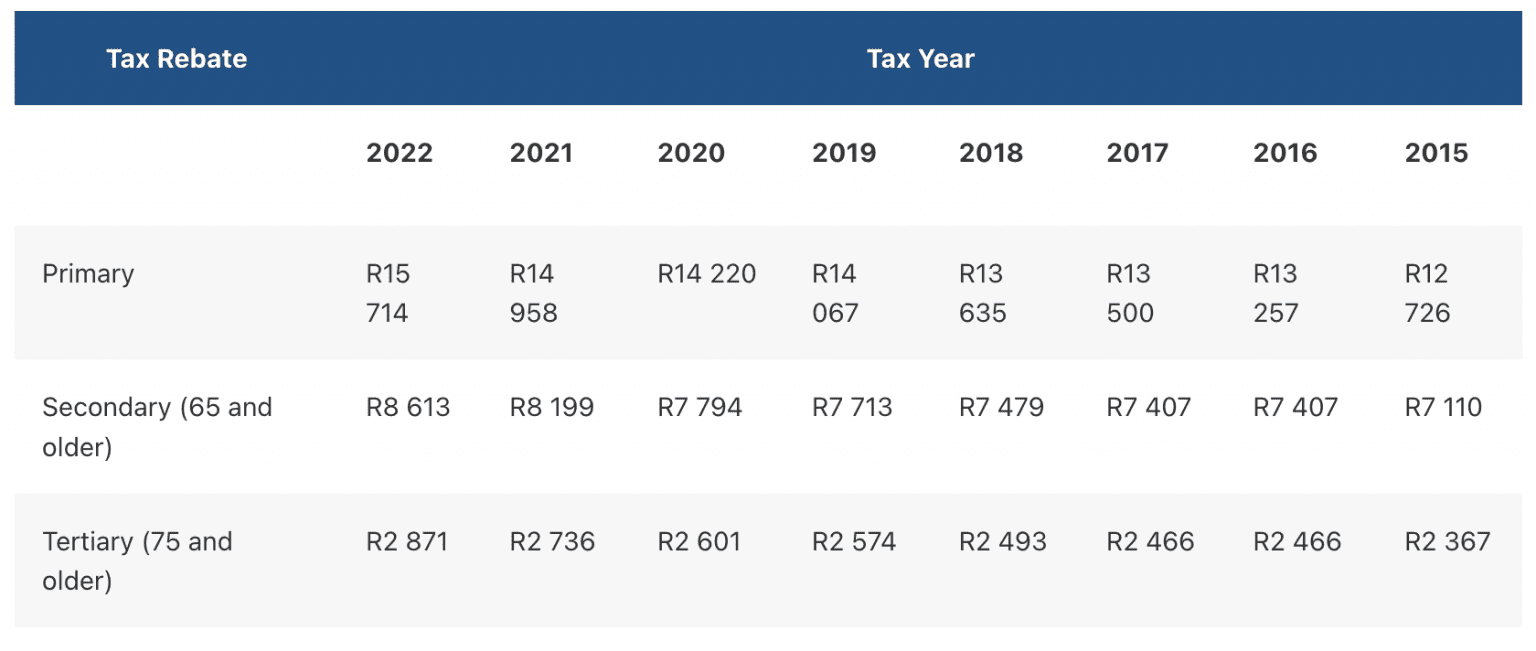

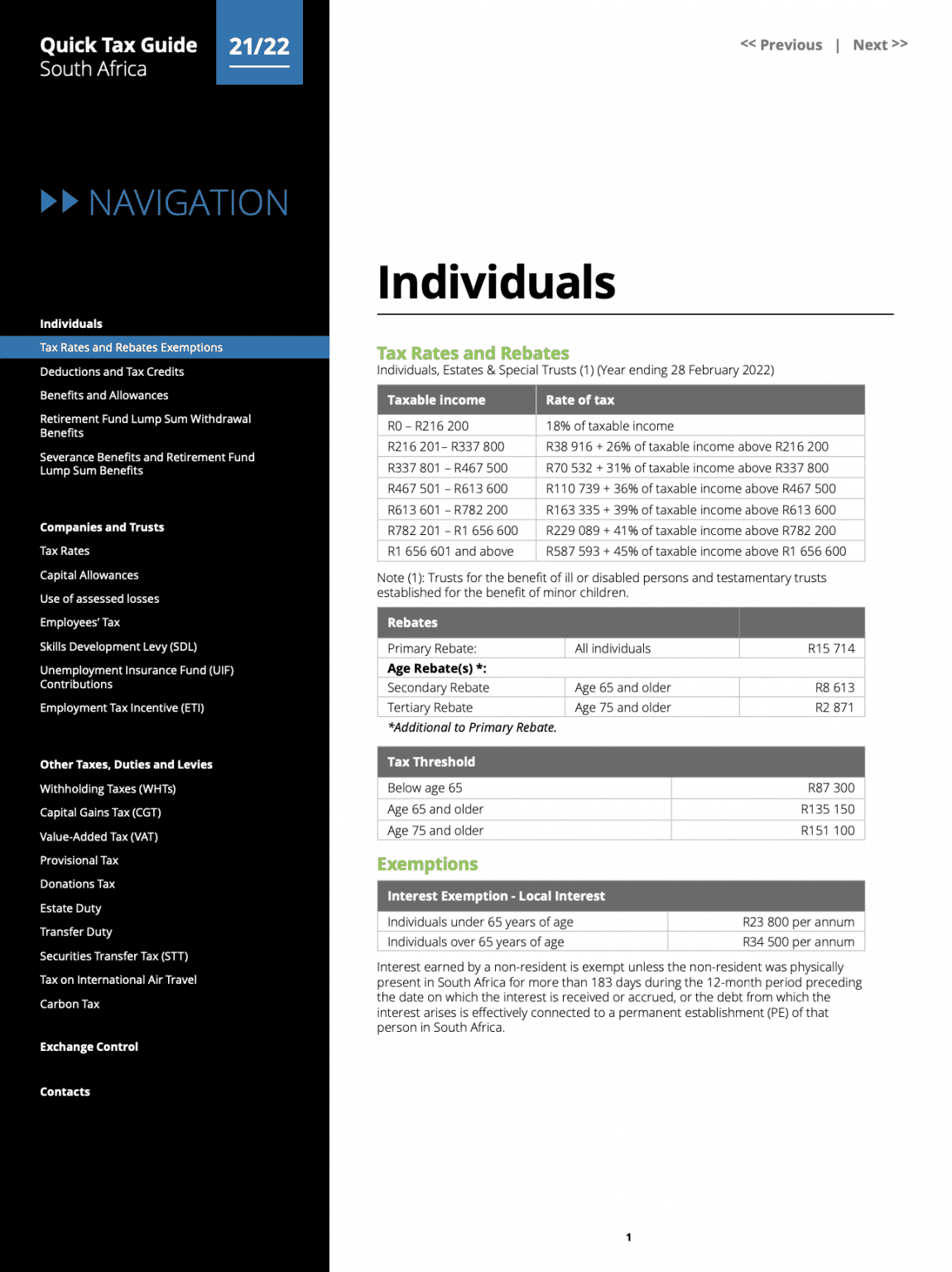

Primary Rebate 2023 This guide provides information on the taxation of employees income for the 2023 tax year including tax tables rates rebates exemptions allowances fringe benefits and more It also covers the registration record keeping payment and reporting of

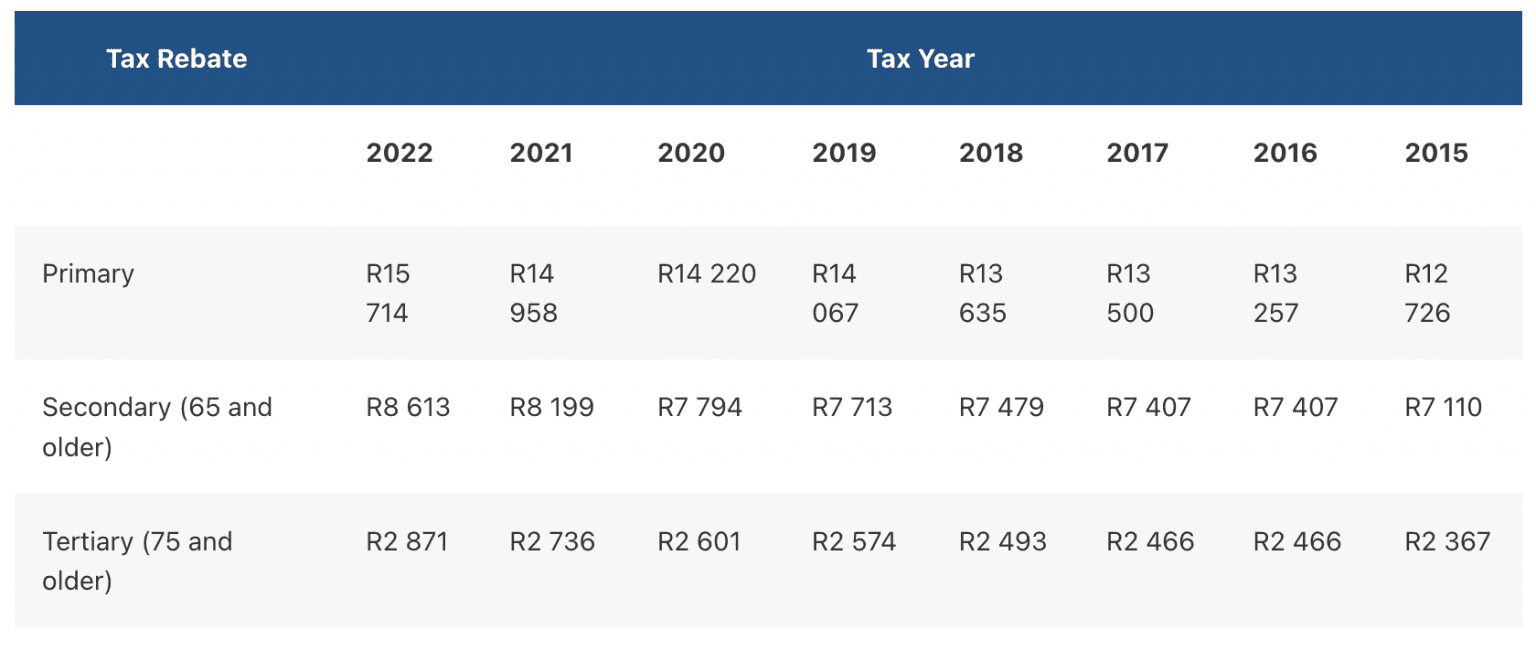

Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over Tertiary rebate ZAR 3 145 if the taxpayer is 75 years of age or over Find out the tax rates deductions exemptions and rebates for individuals and provisional taxpayers in South Africa for the 2023 24 tax year Learn about the primary rebate medical scheme fees tax credit retirement fund contributions and more

Primary Rebate 2023

Primary Rebate 2023

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022-1536x651.png

Primary Rebate 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022-Guideline-1150x1536.png

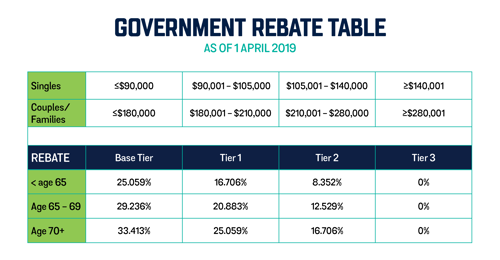

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

The primary rebate is the tax threshold that is the income level which you do not pay tax multiplied by the lowest tax bracket In other words it is the amount of tax SARS says you do not need to pay Find out the latest tax rates and rebates for individuals trusts and companies in South Africa for the year ending 29 February 2024 Learn about the budget highlights renewable energy incentives fuel levy increases and more

Find the income tax rates and car allowance fixed costs for the 2023 tax year in South Africa The tables show the taxable income tax rate primary rebate secondary rebate tertiary rebate and fixed cost for different ranges of income and vehicle value Granting above inflation personal income tax relief of R5 2 billion by adjusting brackets and rebates PLASTIC BAG LEVY Increased by 3 cents to 28 cents per bag from 1 April 2022

Download Primary Rebate 2023

More picture related to Primary Rebate 2023

Maryland Energy Rebates 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Maryland-Renters-Rebate-2023-768x684.png

Budget Speech 2022 SJ A Chartered Accountants

https://sjcasa.co.za/wp-content/uploads/2022/02/2022budgetspeech_headerv2.jpg

Adidas Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Adidas-Rebate-2023.jpg

Learn what tax rebates are how they reduce your tax liability and which ones you can claim for the 2024 tax year Find out about the primary secondary tertiary medical aid and solar panel rebates and how to file your tax return Primary Rebate The primary rebate is based on the taxpayer s age and ranges from ZAR 3 145 to ZAR 17 235 per year Investment Rebates Rebates related to investments such as the Section 12J Venture Capital Company VCC incentive may offer a percentage based rebate on qualifying investments

1 Primary rebate under 65 years 2 Secondary rebate between 65 and 75 years 3 Tertiary rebate over 75 years Depending on your age group you ll qualify for the primary secondary or tertiary rebate which will reduce your tax obligation to SARS Nice All taxpayers who are natural persons qualify for a certain rebate A rebate is the amount by which SARS reduces the actual amount of tax you owe the government The most common rebate applied by SARS is according to age There are 3 different levels Primary rebate under 65 years Secondary rebate between 65 and 75 years

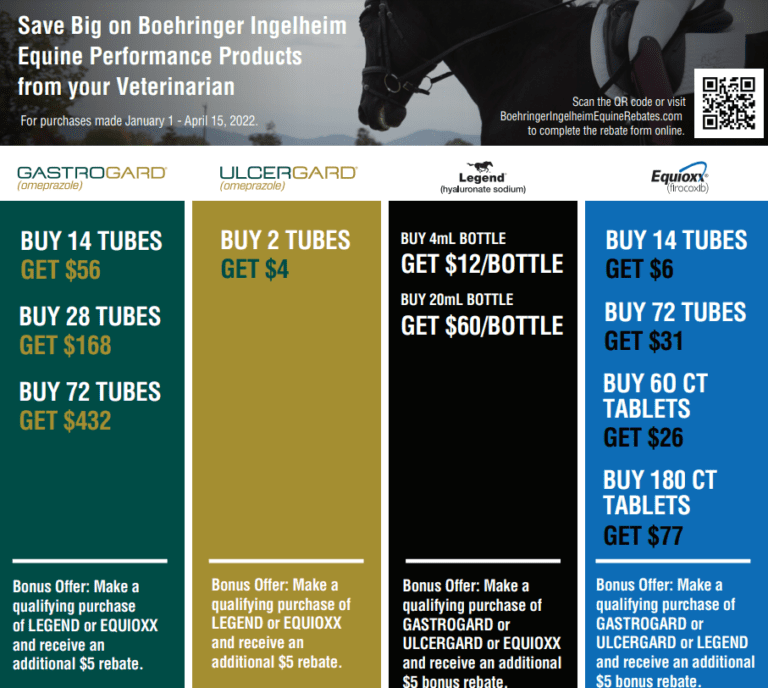

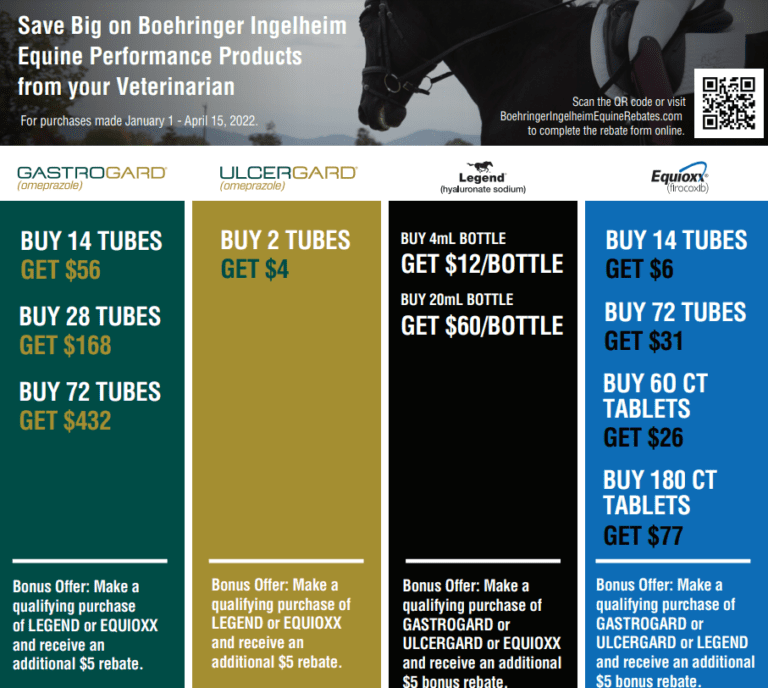

Gastrogard Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/Gastrogard-Rebate-2023-768x688.png

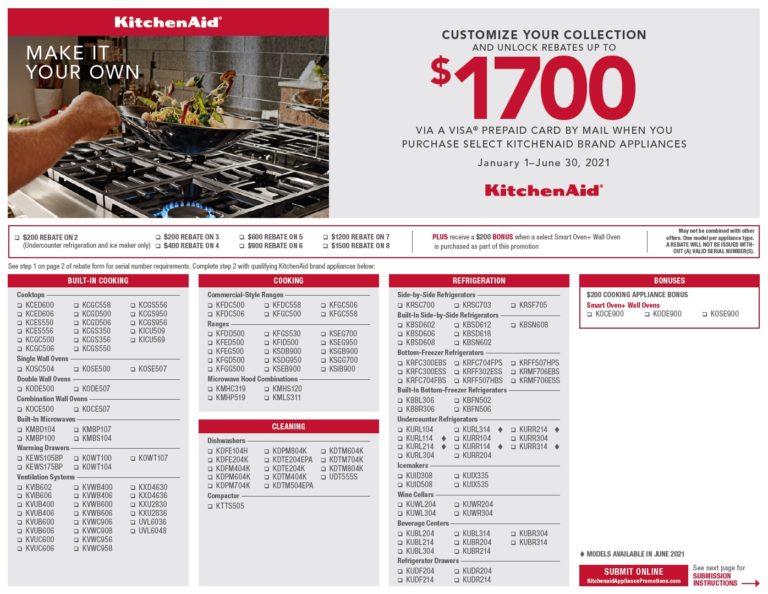

Kitchenaid Rebate Program Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Kitchenaid-Rebate-Form-2021-768x594.jpg

https://www.sars.gov.za/wp-content/uploads/Ops/...

This guide provides information on the taxation of employees income for the 2023 tax year including tax tables rates rebates exemptions allowances fringe benefits and more It also covers the registration record keeping payment and reporting of

https://taxsummaries.pwc.com/south-africa/...

Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over Tertiary rebate ZAR 3 145 if the taxpayer is 75 years of age or over

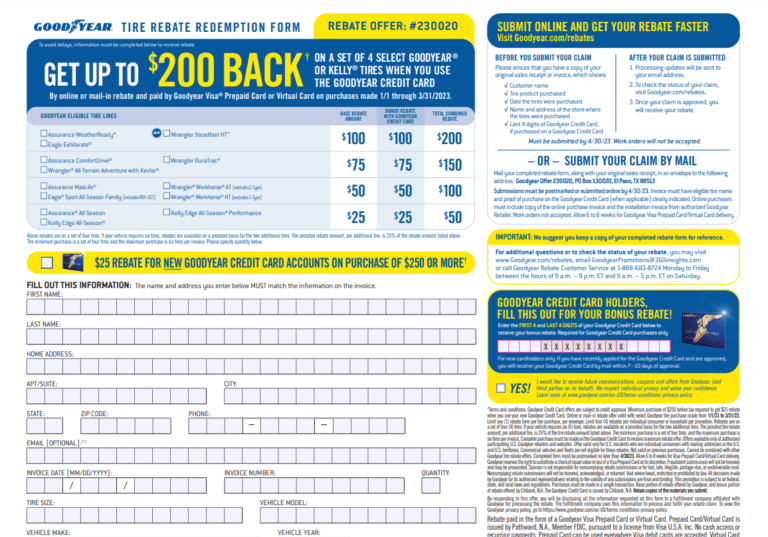

Goodyear Tire Rebate Form October 2023 Printable Rebate Form

Gastrogard Rebate 2023 Printable Rebate Form

Alcon Rebate Redemption Form 2023 Printable Rebate Form

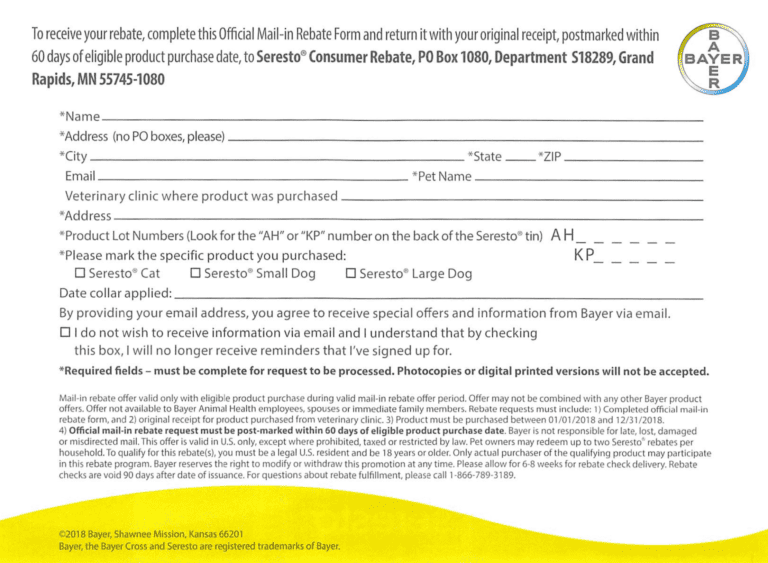

Elanco Seresto Rebate 2023 Printable Rebate Form

Oral b Rebate Form 2023 Printable Printable Rebate Form

Taxation Laws Amendment Bills 2009

Taxation Laws Amendment Bills 2009

Bridgestone Rebates 2023 Printable Rebate Form

Missouri Renters Rebate 2023 Printable Rebate Form

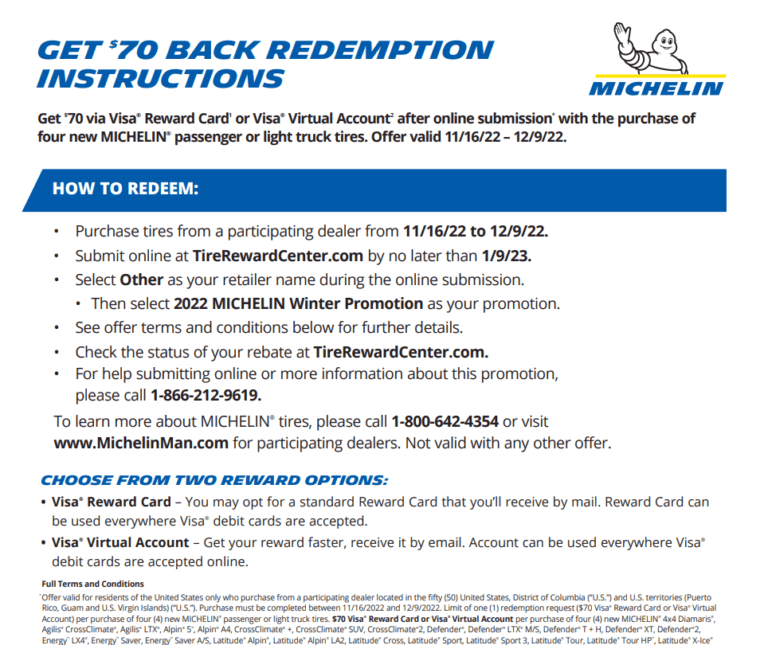

2023 Michelin Rebate Printable Rebate Form

Primary Rebate 2023 - Find out the individual tax rates for different income levels in South Africa from 2018 to 2025 Compare the tax brackets and thresholds for each year and see how they change over time