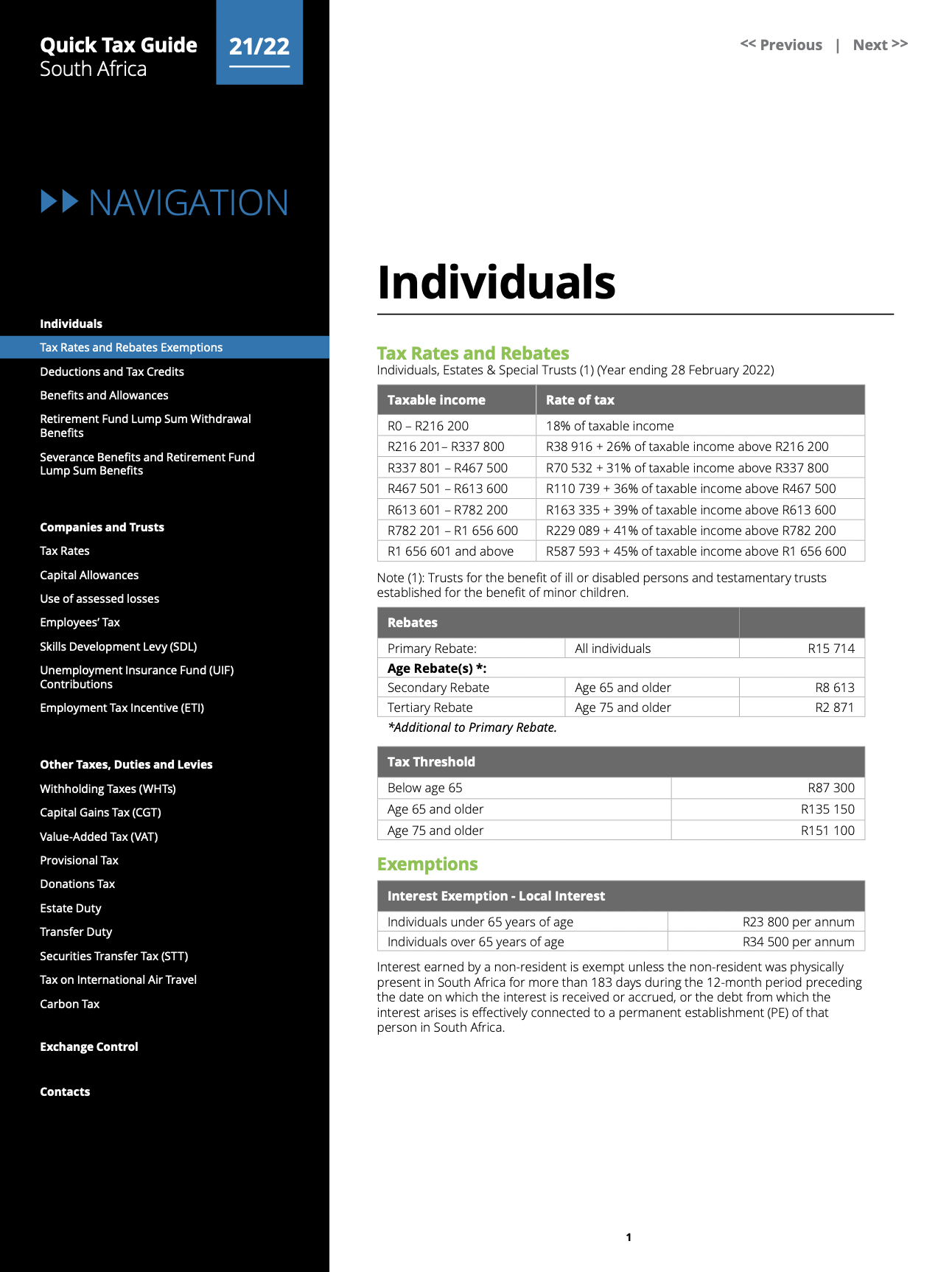

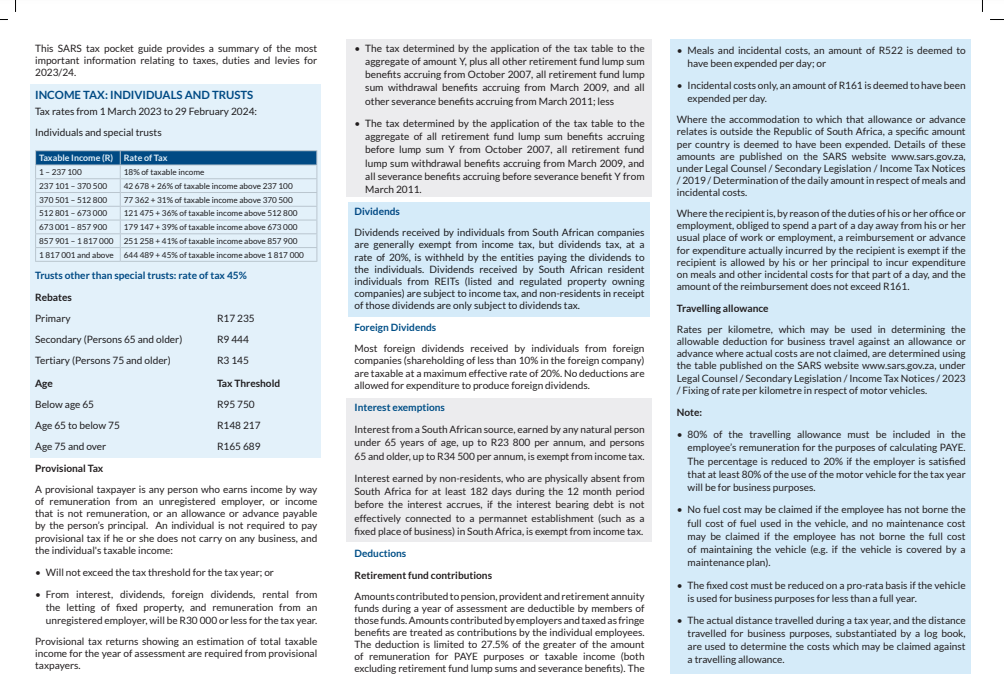

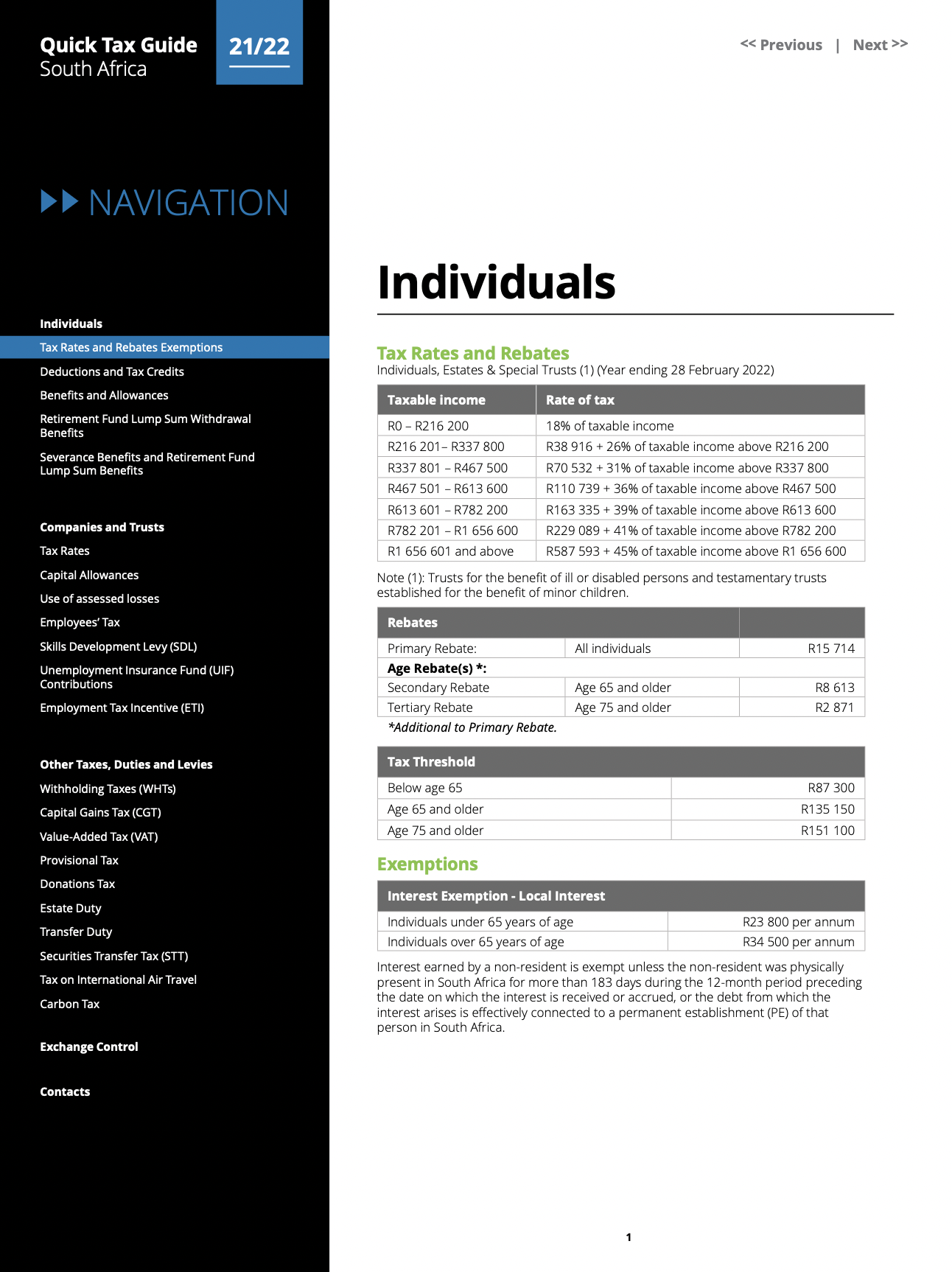

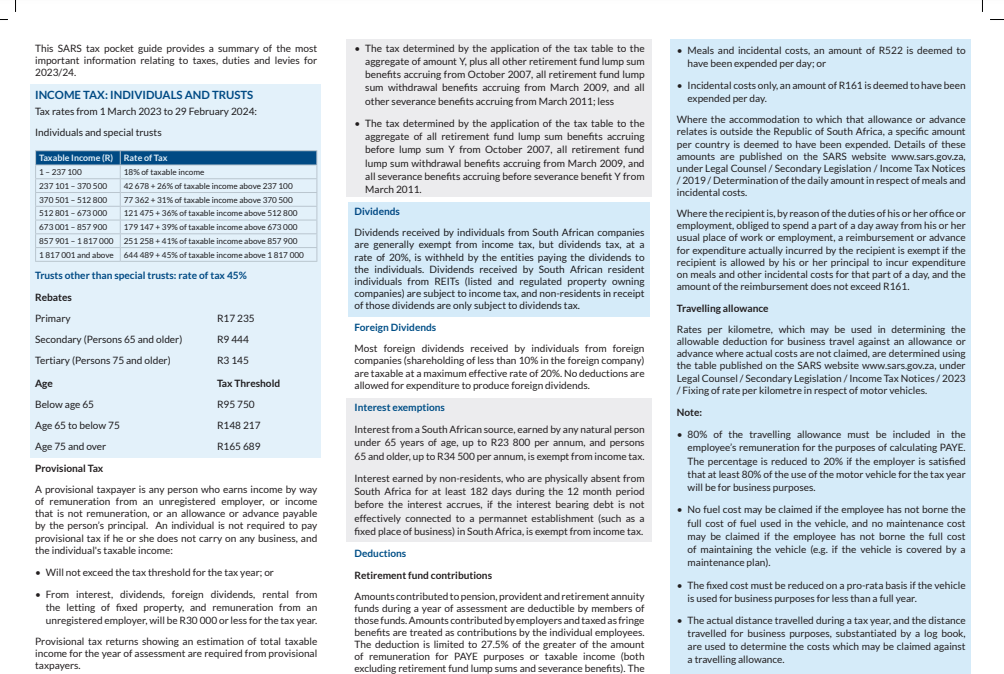

Primary Rebate 2024 In 2024 the primary rebate stands at ZAR 17 235 per annum for individuals under 65 For those aged 65 to 74 the rebate is ZAR 9 444 and for those 75 and above it is ZAR 3 145 per year These rebate sums are directly deducted from an individual s overall taxable income diminishing their total tax responsibility

For the 2025 tax year i e the tax year commencing on 1 March 2024 and ending on 28 February 2025 the following rebates apply Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over PAYE must be withheld by the employer on 80 of the allowance granted to the employee The withholding percentage may be reduced to 20 if the employer is satisfied that at least 80 of the use of the motor vehicle for the tax year will be for business purposes

Primary Rebate 2024

Primary Rebate 2024

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022-Guideline.png

Primary Rebate South Africa Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/04/Primary-Rebate-South-Africa-2023.png

Mobil One Offical Rebate Printable Form Printable Forms Free Online

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

In his Budget Speech on 22 February 2023 the Minister of Finance announced new tax rates tax rebates tax thresholds and other tax amendments for individuals Details of these proposals are listed below and employers must update their payroll systems accordingly The primary rebate is R17 235 for all people The secondary rebate is R9 444 for taxpayers who are 65 years or above The tertiary rebate is R3 145 for taxpayers who are 75 years old or over When Can I Expect My SARS Refund 2024

Tax free savings accounts subject to annual and lifetime contribution limits were introduced in 2015 16 As a result the interest exemptions above will no longer be increased Dividends received from domestic companies were generally exempt from income tax The primary rebate is deductible for all individuals The secondary rebate may only be applied for individuals who will be 65 years or older on the last day of the relevant year of assessment The tertiary rebate is deductible only for individuals who will be 75 years or older on the last day of the relevant year of assessment

Download Primary Rebate 2024

More picture related to Primary Rebate 2024

Lensrebates Alcon Com

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

https://images.squarespace-cdn.com/content/v1/58c880d7893fc0f2350b0bbd/1671046938649-FD50N05XDSCYNJTD97B7/2023-01+to+2023-06-30+B%26L+Rebate+Form+Front.jpg

Alcon Rebate Form 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

Tax rebates Taxpayers also qualify for a R17 235 primary rebate an additional secondary rebate of R9 444 if over 65 and a further tertiary rebate of R3 145 if over 75 Corporate taxpayers who elect to invest in renewables will be able to claim a 125 tax deduction on their investment over the next two years with no threshold limit Individual taxpayers who install solar panels in the next year will be able to claim a 25 rebate on the cost up to a maximum of R15 000

[desc-10] [desc-11]

Comprehensive Guide To Elanco Trifexis Rebate Form How To Claim Your Rebate Elanco Rebate

https://i0.wp.com/www.elancorebate.net/wp-content/uploads/2023/05/Elanco-Trifexis-Rebate-Form.png?fit=1174%2C813&ssl=1

Printable Alcon Rebate Form 2023 Printable Forms Free Online

https://s3.amazonaws.com/VisionSource/Promos/June2023-AlconUpgradeRebate-A.jpg

https://www.searche.co.za › how-tax-rebate-is-calculated

In 2024 the primary rebate stands at ZAR 17 235 per annum for individuals under 65 For those aged 65 to 74 the rebate is ZAR 9 444 and for those 75 and above it is ZAR 3 145 per year These rebate sums are directly deducted from an individual s overall taxable income diminishing their total tax responsibility

https://taxsummaries.pwc.com › south-africa › ...

For the 2025 tax year i e the tax year commencing on 1 March 2024 and ending on 28 February 2025 the following rebates apply Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

Comprehensive Guide To Elanco Trifexis Rebate Form How To Claim Your Rebate Elanco Rebate

Seresto Rebate Form PrintableRebateForm

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

Rebate Air Optix Printable Rebate Form

Primary Pack Customize Your Pack Astro Shop

Primary Pack Customize Your Pack Astro Shop

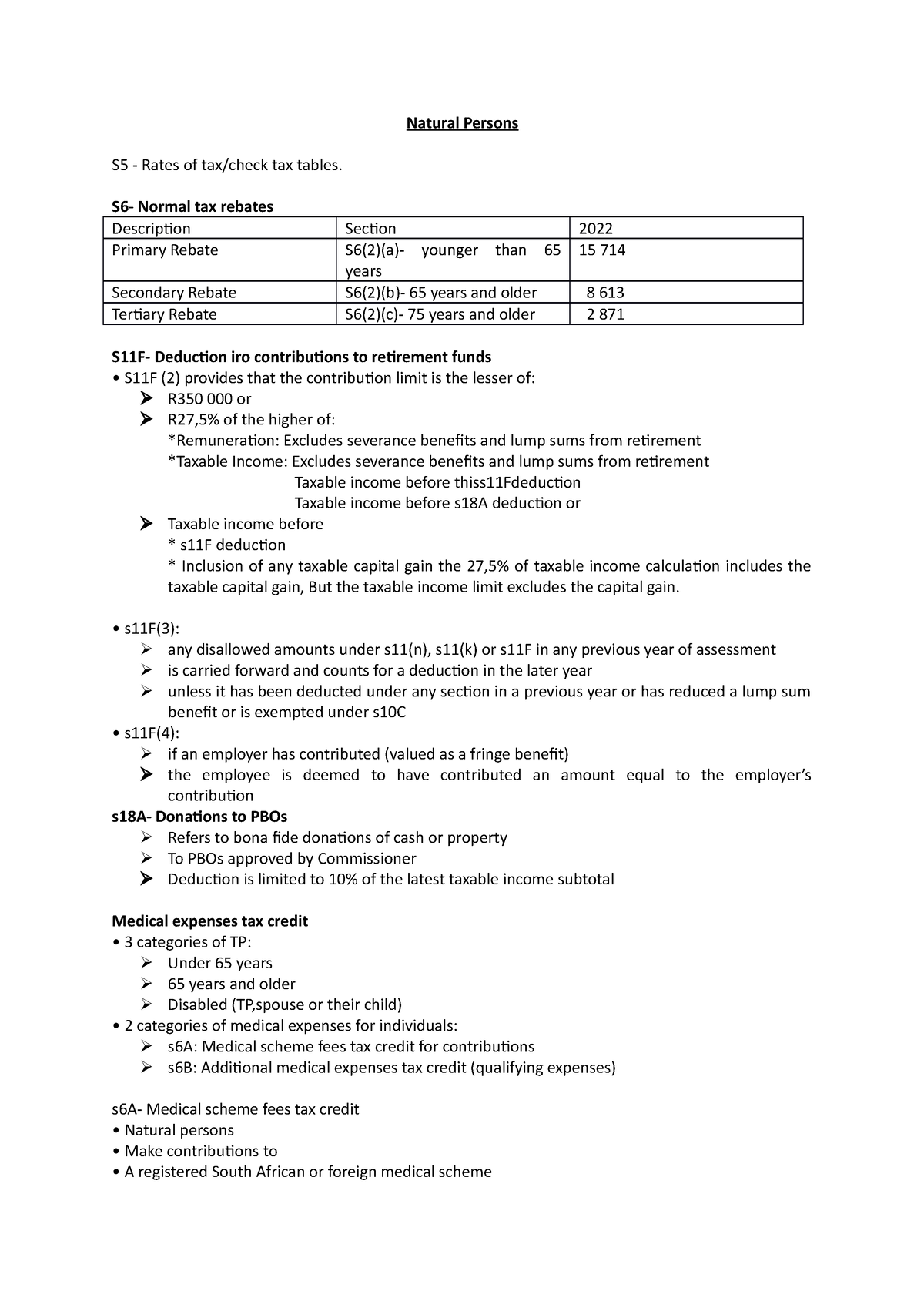

Natural Persons S6 Normal Tax Rebates Description Section 2022 Primary Rebate S6 2 a

NWC Tryouts 2023 2024 NWC Alliance

Traderider Rebate Program Verify Trade ID

Primary Rebate 2024 - [desc-12]