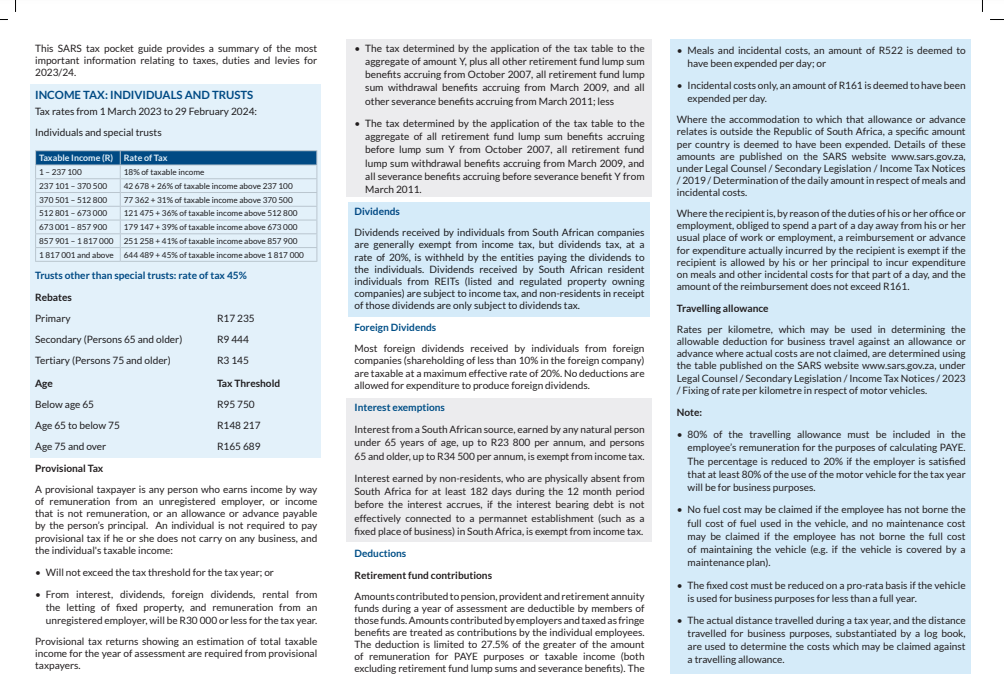

Primary Rebate Amount Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over Tertiary rebate ZAR 3 145 if the taxpayer is 75

Primary Rebate The primary rebate is based on the taxpayer s age and ranges from ZAR 3 145 to ZAR 17 235 per year Investment Rebates Rebates related to investments such as the Section 12J Venture Capital In his Budget Speech on 22 February 2023 the Minister of Finance announced new tax rates tax rebates tax thresholds and other tax amendments for individuals Details of these proposals

Primary Rebate Amount

Primary Rebate Amount

https://www.strathbogie.vic.gov.au/wp-content/uploads/2022/08/20220729ClothNappyRebate2Crop.jpg

Consumer Rebates Are You Getting Your Fair Share A Rebate Is An

https://i.pinimg.com/originals/24/2f/eb/242febcbd7f7183a96e09f0202d1b8e1.jpg

Many Alberta Apartment And Condo Dwellers Unlikely To See 300

https://smartcdn.gprod.postmedia.digital/nexus/wp-content/uploads/2022/07/rebate.jpg

For the 2024 tax year March 2023 to February 2024 the primary rebate stands at R17 235 This is the amount that will be deducted from your total taxable earnings provided you qualify Secondary Rebate Rebate A rebate is the amount that SARS allows as an effective tax free portion This rebate will depend on your age and which rebate you qualify for The following rebates

TAX GUIDE 2022 This SARS tax pocket guide provides a synopsis of the most important tax duty and levy related information for 2022 23 INCOME TAX INDIVIDUALS AND TRUSTS South African Income Tax Rates from 2018 to 2025 Individuals Rates A summary of older individual rates is available in the archive Individuals Rebates Individuals Monthly Medical

Download Primary Rebate Amount

More picture related to Primary Rebate Amount

2022 Menards Rebate Forms RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/2022-menards-rebate-forms.jpg?fit=1024%2C963&ssl=1

Greek Rebate Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/270000/velka/greek-rebate.jpg

Traderider Rebate Program Verify Trade ID

https://traderider.com/rebate/assets/img/rebate-forex.jpg

Yes for years 2023 2024 SARS has set the primary rebate at R17 235 The Secondary for persons 65 and over is R9 444 Meanwhile the Tertiary Persons 75 and older is at R3 145 If you calculate 18 of R75 750 which is the entry level tax rate you get R13 635 This is the primary rebate amount and will be deducted off your tax liability after deductions have been processed The rebate amounts

Income tax tables with rebates and car allowance fix cost tables for the 2024 tax year as provided by SARS The primary and additional age rebate is available to all South African individual taxpayers The rebate is not reduced where a person has taxable income for less than the

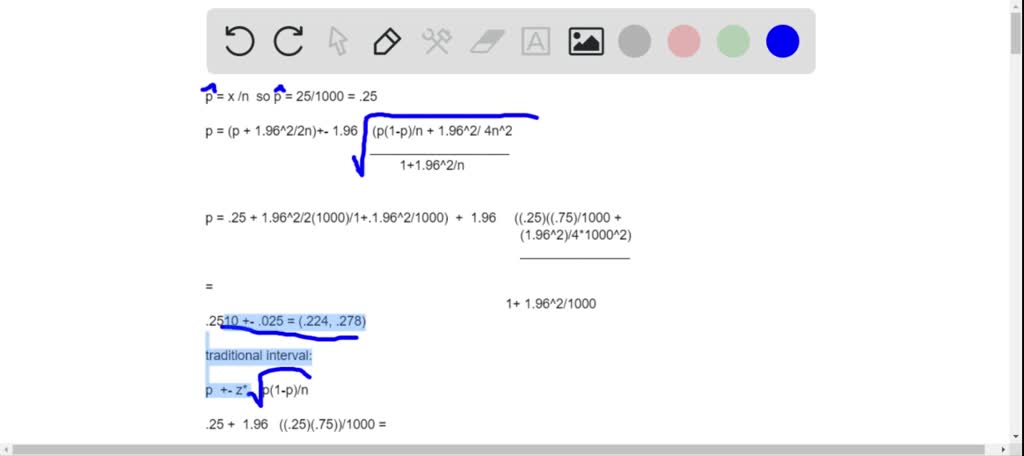

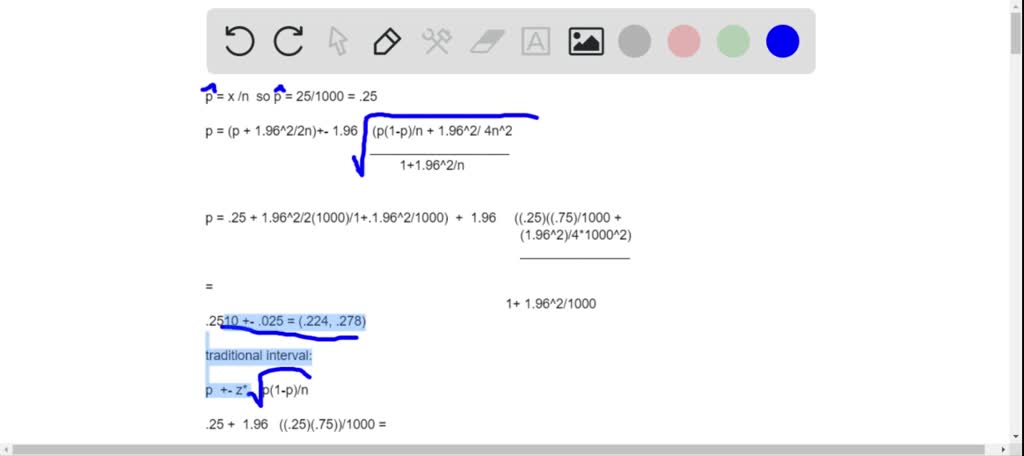

SOLVED In A Sample Of 1000 Randomly Selected Consumers Who Had

https://cdn.numerade.com/previews/975d9a62-31fd-4302-a844-3c7b6c0f93ed_large.jpg

Rebate Management Software QuyaSoft

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/61f95ecbe938df0d4bae19c2_Rebate-Pyramid.png

https://taxsummaries.pwc.com/south-africa/...

Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over Tertiary rebate ZAR 3 145 if the taxpayer is 75

https://www.searche.co.za/how-tax-reba…

Primary Rebate The primary rebate is based on the taxpayer s age and ranges from ZAR 3 145 to ZAR 17 235 per year Investment Rebates Rebates related to investments such as the Section 12J Venture Capital

XM Rebates 12 45 USD Daily And Direct PipRebate

SOLVED In A Sample Of 1000 Randomly Selected Consumers Who Had

Battery Rebate Coordinator Zonaebt

Rebate Management HubHero

Primary Rebate South Africa PrintableRebateForm

Rebates Zilla

Rebates Zilla

Rebate Guidelines Application Anaheim CA Official Website

Rebate Logo LogoDix

Government Solar Rebate QLD Everything You Need To Know

Primary Rebate Amount - TAX GUIDE 2022 This SARS tax pocket guide provides a synopsis of the most important tax duty and levy related information for 2022 23 INCOME TAX INDIVIDUALS AND TRUSTS