Primary Rebate Web 10 mars 2014 nbsp 0183 32 The primary rebate is the tax threshold that is the income level which you do not pay tax multiplied by the lowest tax bracket In other words it is the

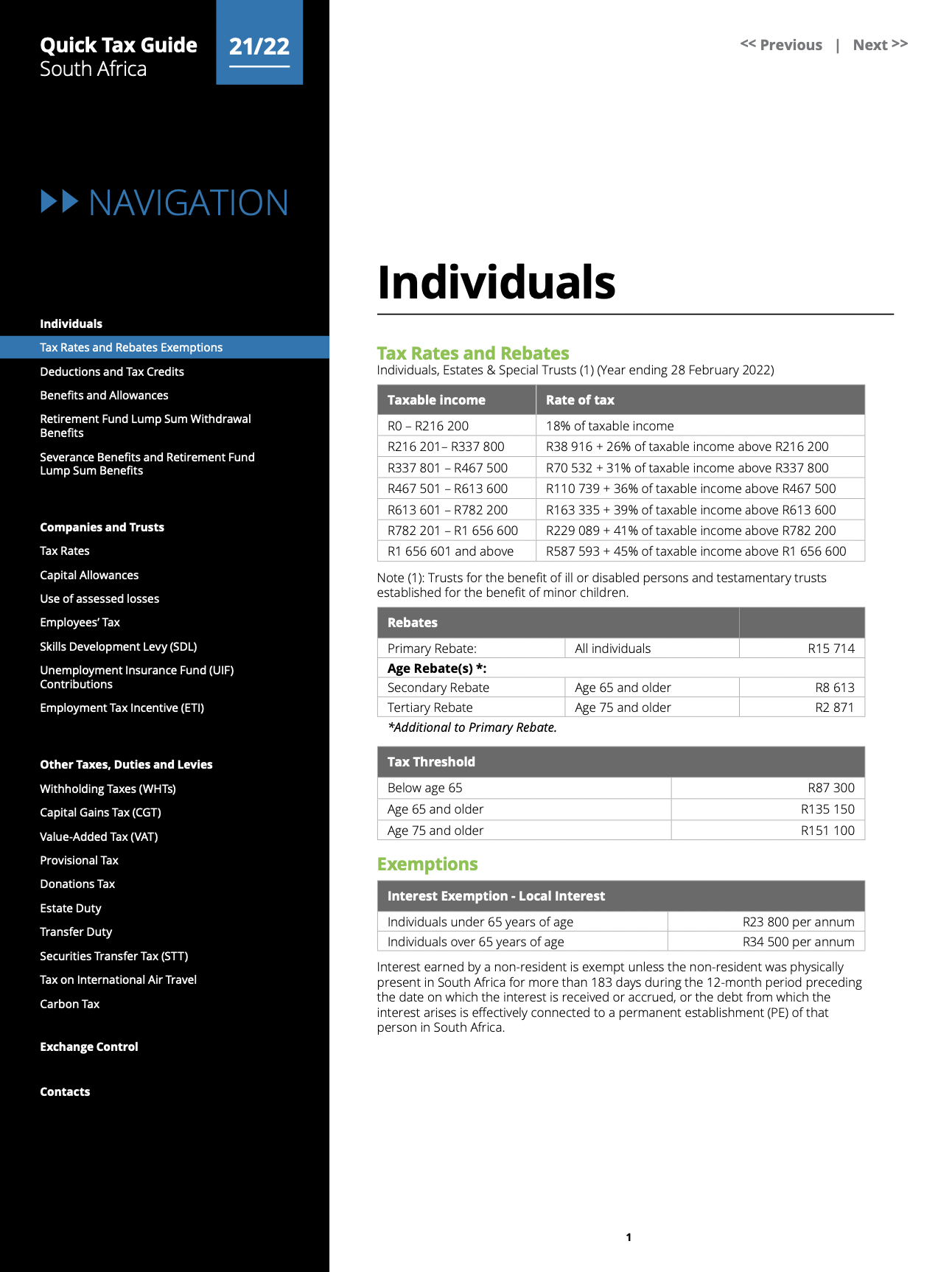

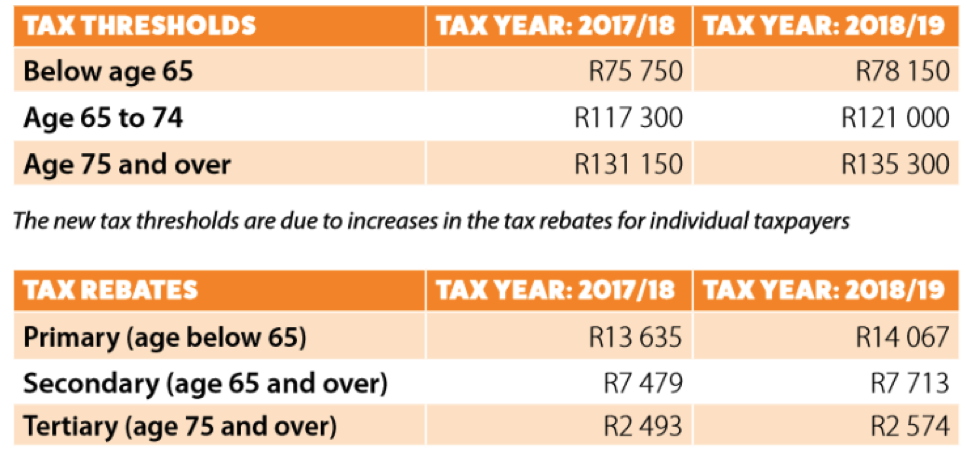

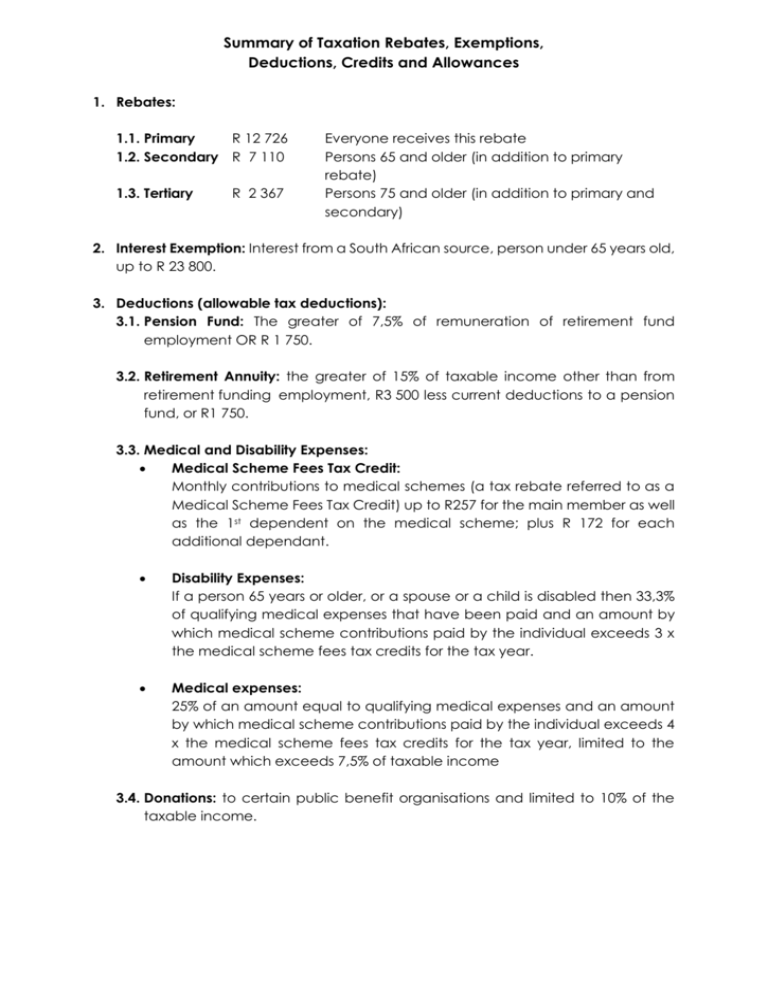

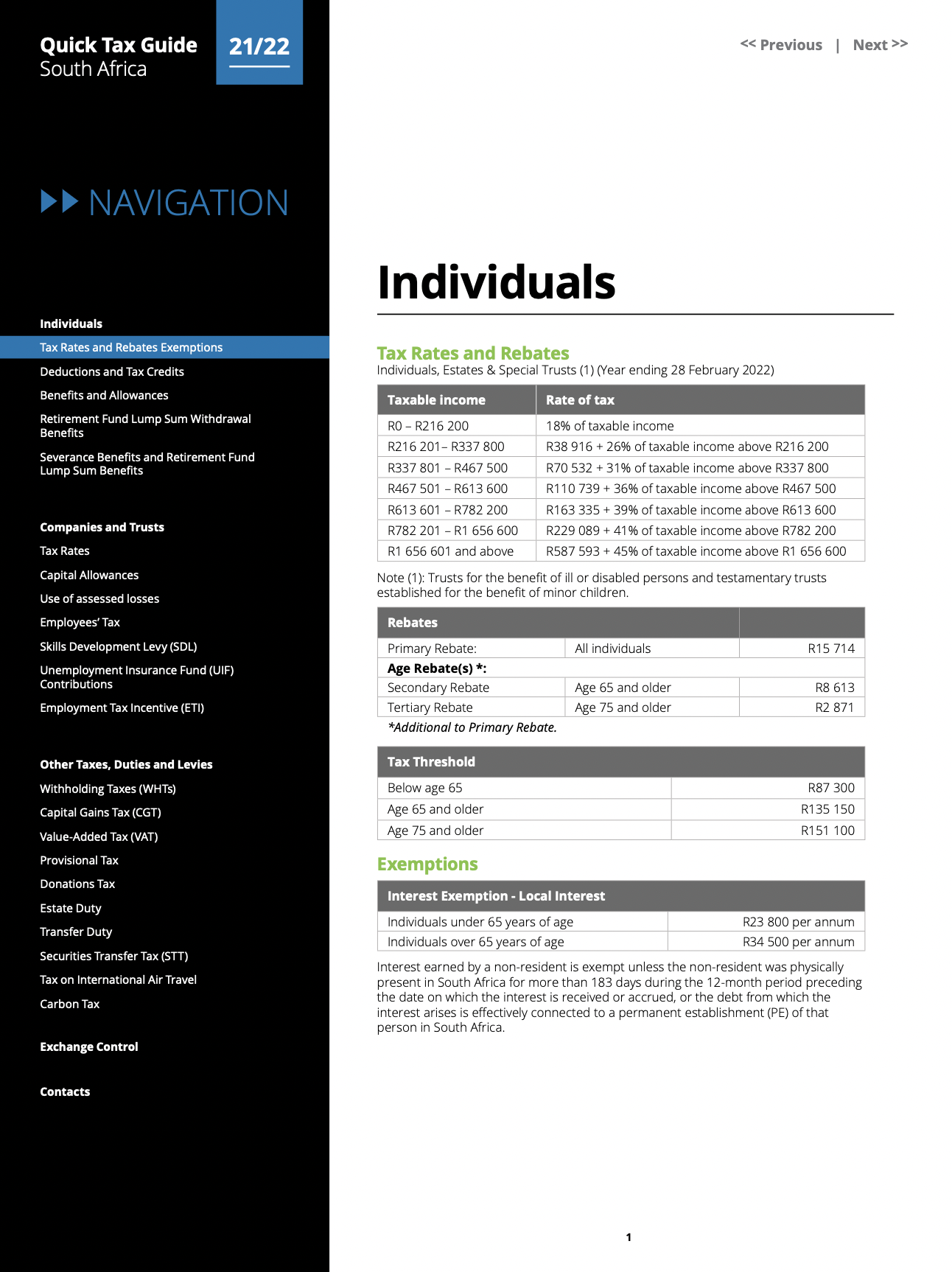

Web 19 avr 2022 nbsp 0183 32 The following rebates are available for the 2023 tax years i e which begins on the 1 March 2021 and ends on the 28 February 2023 Primary Tax Rebate ZAR 15 714 all natural persons Secondary Tax Web Primary Rebate All individuals R16 425 Age Rebate s Secondary Rebate Age 65 and older R9 000 Tertiary Rebate Age 75 and older R2 997 Additional to Primary Rebate

Primary Rebate

Primary Rebate

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022-Guideline.png

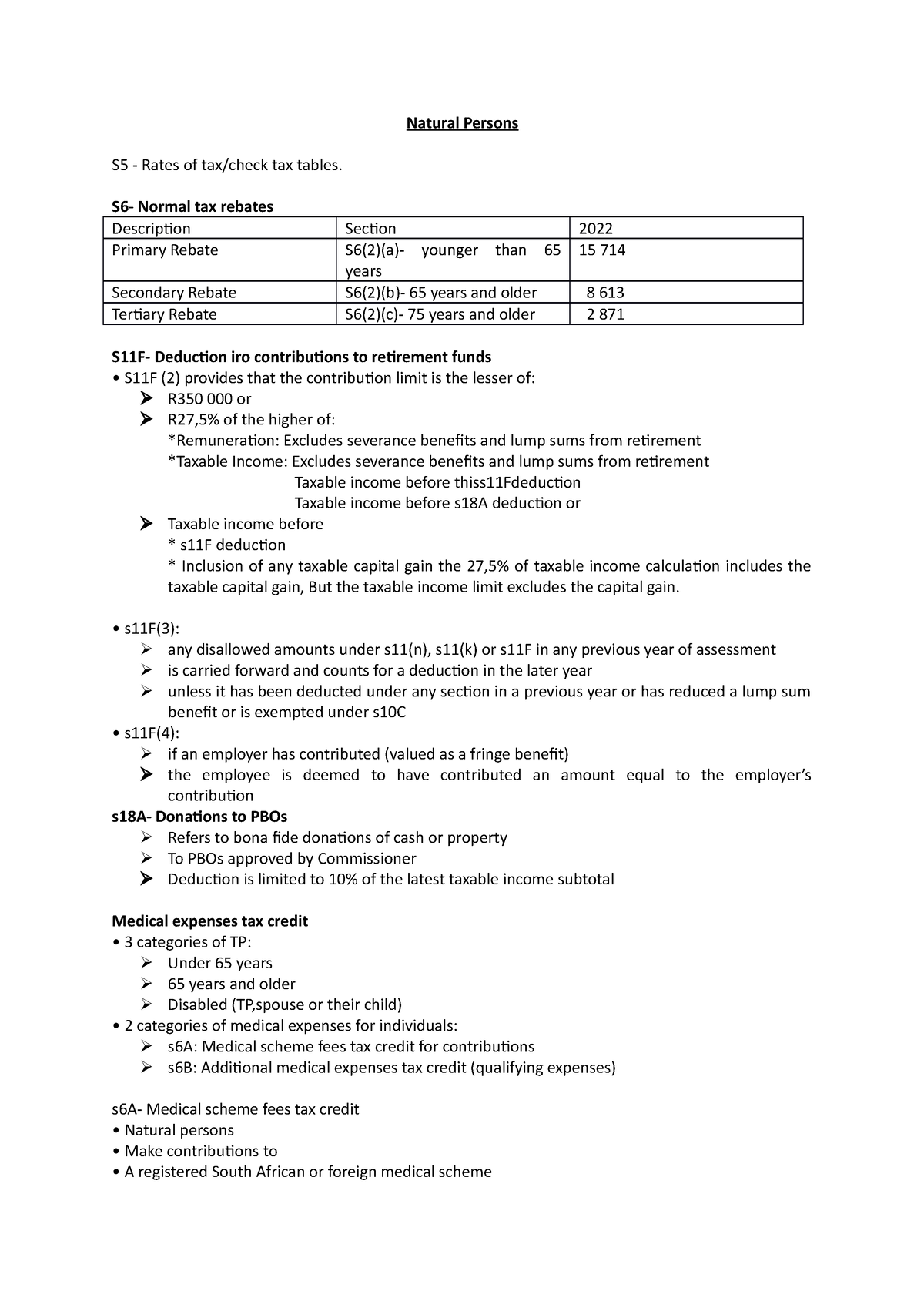

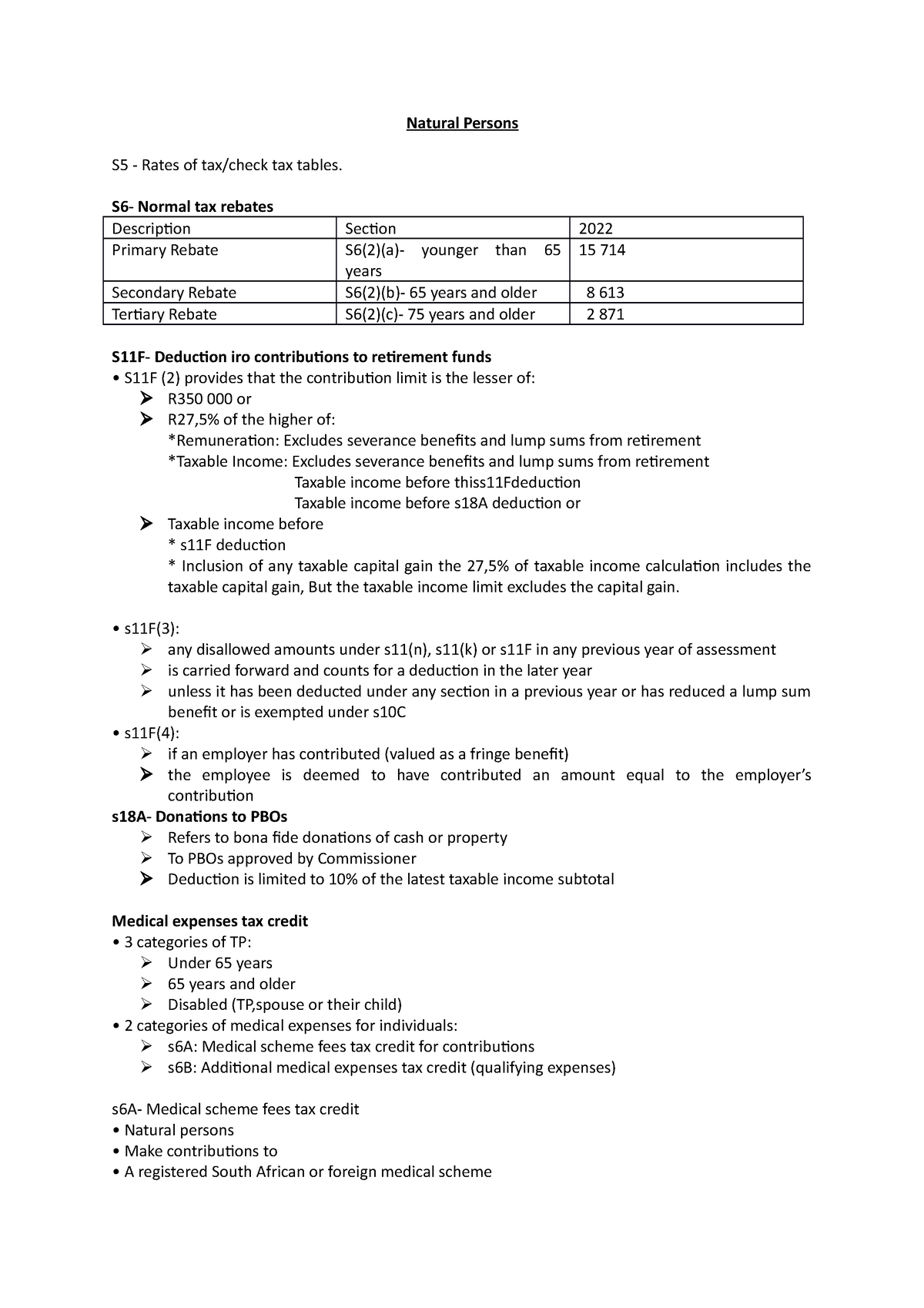

Natural Persons S6 Normal Tax Rebates Description Section 2022

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/23ba96b4fa37a36a694787301b4f0add/thumb_1200_1698.png

Taxpayers Get Surprise R14bn In Tax Relief In Tito Mboweni s Budget

https://lh3.googleusercontent.com/xhnfQpbuNYUqbP_I8de7dQlZzjPJaULdz5GkXUhdpDLD789sDuieXzu7atWxx2LVzRhoUqGRN6vFtfiG8I-t8FVZ5ecZdiAE=s750

Web 25 of the aggregate of the amount of fees paid to a medical scheme as exceeds 4 times the medical scheme fees tax credit and qualifying medical expenses as Web Primary Rebate All individuals R17 235 Age Rebate s Secondary Rebate Age 65 and older R9 444 Tertiary Rebate Age 75 and older R3 145 Additional to Primary Rebate

Web Primary rebate R15 714 Secondary rebate for persons 65 years and older R 8 613 Tertiary rebate for persons 75 years and older R 2 871 Tax thresholds applicable to Web Yes for years 2023 2024 SARS has set the primary rebate at R17 235 The Secondary for persons 65 and over is R9 444 Meanwhile the Tertiary Persons 75 and older is at R3

Download Primary Rebate

More picture related to Primary Rebate

Budget 2018 How It Will Affect Your Life

https://s.aolcdn.com/hss/storage/midas/de45781631cba98c940b5592de225c4/206148130/AKAZI+3.png

Primary Producer Safety Rebate Scheme Delmade

https://www.delmade.com.au/assets/components/phpthumbof/cache/25835 Primary Producer Safety Rebate Scheme E-Sig_01-01.eef6f59553d5c8124da2f6aeef830999.jpg

HST Rebate Form For New Housing 2022 Printable Rebate Form

https://www.printablerebateform.com/wp-content/uploads/2021/08/HST-Rebate-Form-2021.png

Web 27 juin 2023 nbsp 0183 32 Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over Tertiary rebate ZAR 3 145 if the Web A rebate is the amount by which SARS reduces the actual amount of tax you owe the government The most common rebate applied by SARS is according to age There are

Web 1 mars 2022 nbsp 0183 32 Primary Rebate R 16 425 Secondary Rebate Persons 65 and older R 9 000 Tertiary Rebate Persons 75 and older R 2 997 Web Relevant rates Inclusion rate 40 Statutory rate 0 45 Effective rate 0 18 Exemptions Exclusions from CGT The annual exclusion for individuals and special

How To Calculate Your Wholesaler Rebates

https://rx-post.com/wp-content/uploads/2023/01/Screenshot-2023-01-26-113515.png

PAYE

https://s3.studylib.net/store/data/009096067_1-43ed0c8750f8b928eedcaa5cd0d5b757-768x994.png

https://www.taxtim.com/za/answers/understanding-the-primary-rebate-b…

Web 10 mars 2014 nbsp 0183 32 The primary rebate is the tax threshold that is the income level which you do not pay tax multiplied by the lowest tax bracket In other words it is the

https://printablerebateform.net/primary-rebate

Web 19 avr 2022 nbsp 0183 32 The following rebates are available for the 2023 tax years i e which begins on the 1 March 2021 and ends on the 28 February 2023 Primary Tax Rebate ZAR 15 714 all natural persons Secondary Tax

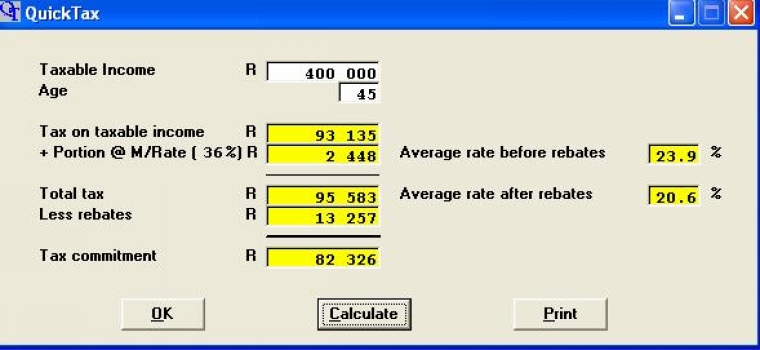

BACKTAX Softbyte Computers

How To Calculate Your Wholesaler Rebates

Alliant Energy Rebates 2022 Printable Rebate Form

JetBlue Plus MasterCard 10 Point Rebate Is For Primary Cardholders Only

Rebates Upper District

Rebates Mission Springs Water District CA

Rebates Mission Springs Water District CA

Simplifications In Rebate Processing With Condition Contract In S 4HANA

Baxter Rebate Product Offerings Community Hospital Corporation

Rebates Finder In Green Door Pearl Certification

Primary Rebate - Web Yes for years 2023 2024 SARS has set the primary rebate at R17 235 The Secondary for persons 65 and over is R9 444 Meanwhile the Tertiary Persons 75 and older is at R3