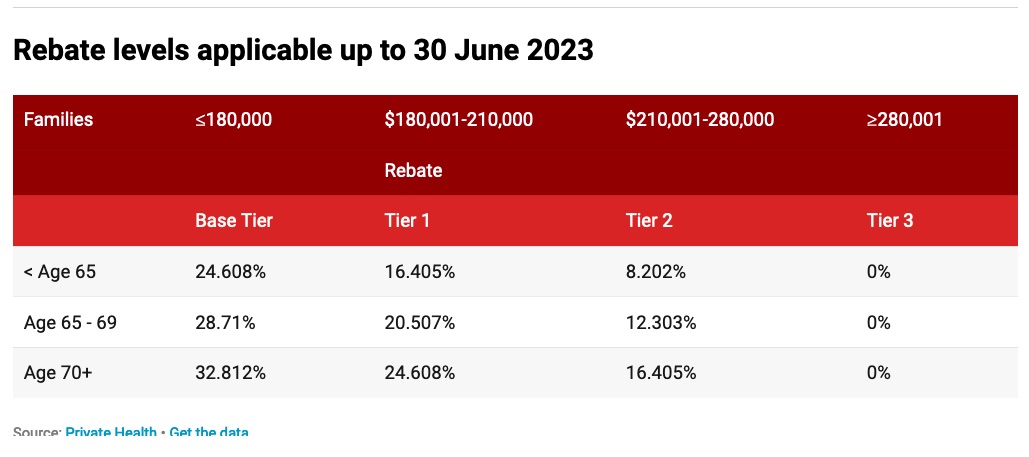

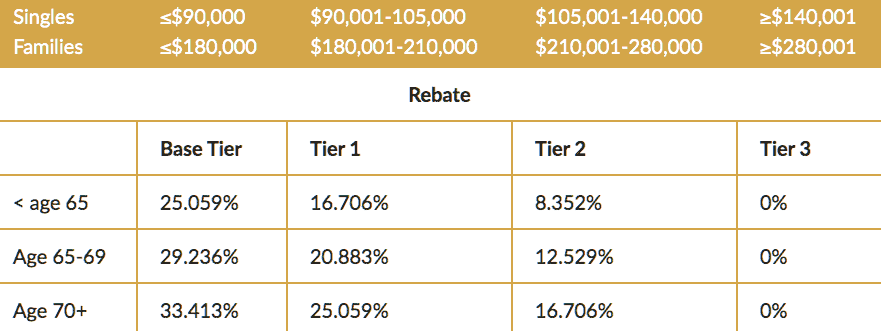

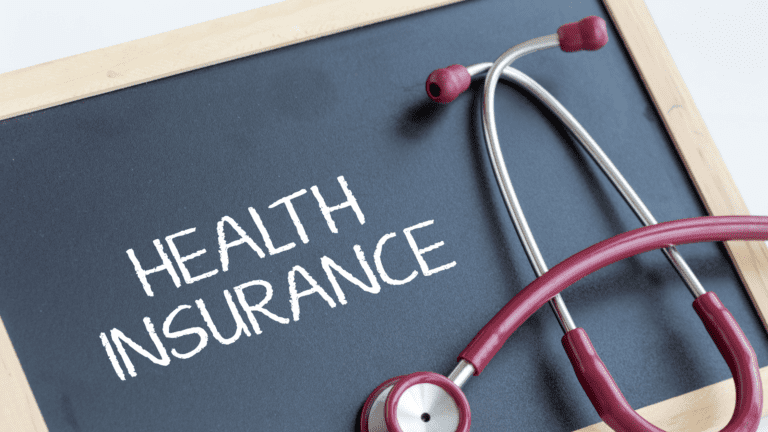

Private Health Insurance Tax Rebate Web The income thresholds used to calculate the Medicare levy surcharge and private health insurance rebate have increased from 1 July 2023 Before 1 July 2023 they remained

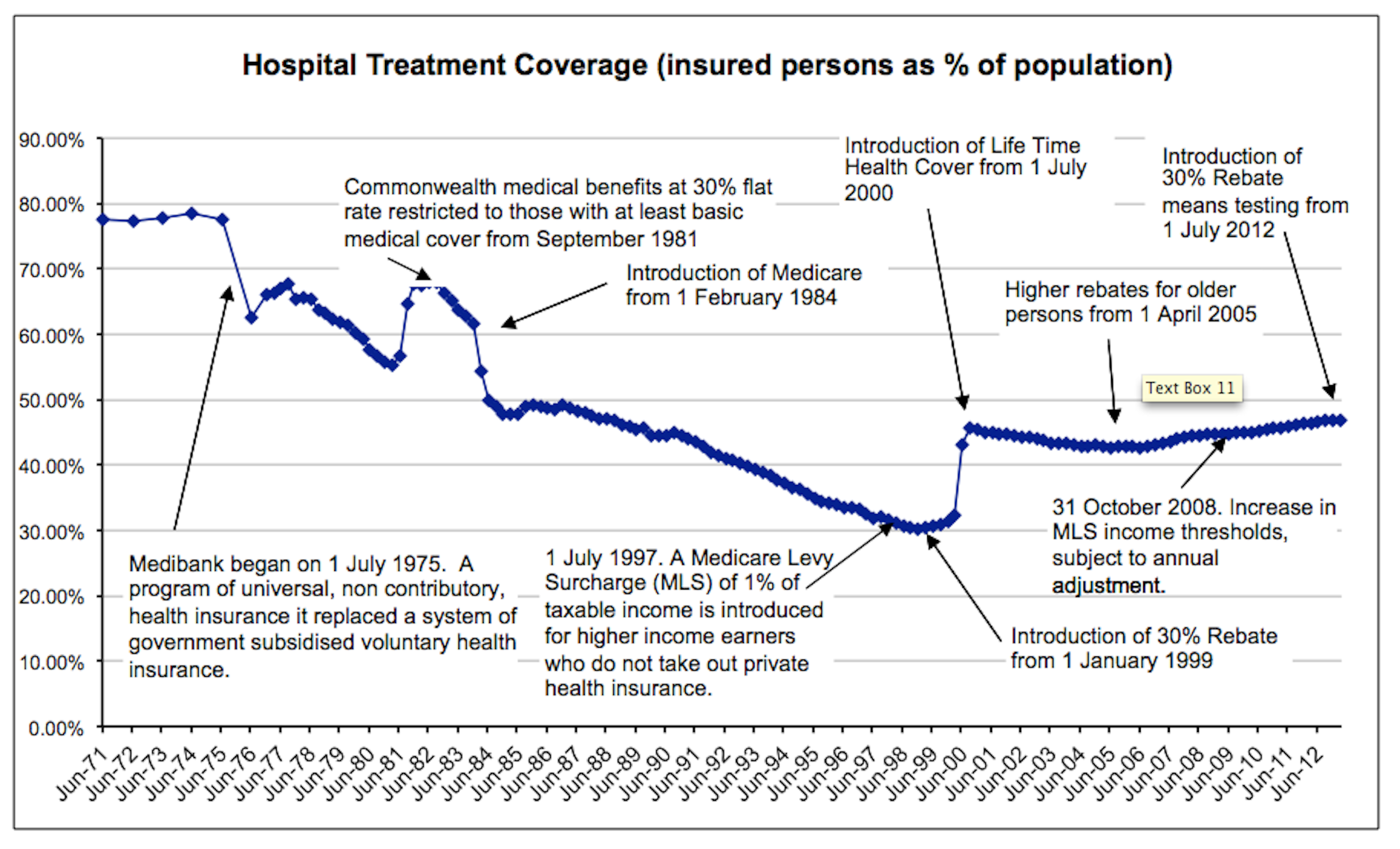

Web 19 avr 2022 nbsp 0183 32 The private health insurance rebate costs Australian taxpayers nearly A 7 billion per year and has cost over 100 billion since its introduction Yet the rebate s Web Eligibility to claim the rebate To claim the private health insurance rebate depends on your circumstances regardless of your residency status in Australia You must have a

Private Health Insurance Tax Rebate

Private Health Insurance Tax Rebate

https://asset.compareclub.com.au/content/guides/health-insurance/tax-return/private-health-rebate-levels.jpg

What Should Happen To The Private Health Insurance Rebate This Election

https://www.croakey.org/wp-content/uploads/2022/04/REBATELEVELS.jpg

Things You Should Know About Private Health Insurance Rebates

https://images.theconversation.com/files/26579/original/w7cdb62w-1372652566.jpg?ixlib=rb-1.1.0&q=15&auto=format&w=754&h=457&fit=crop&dpr=3

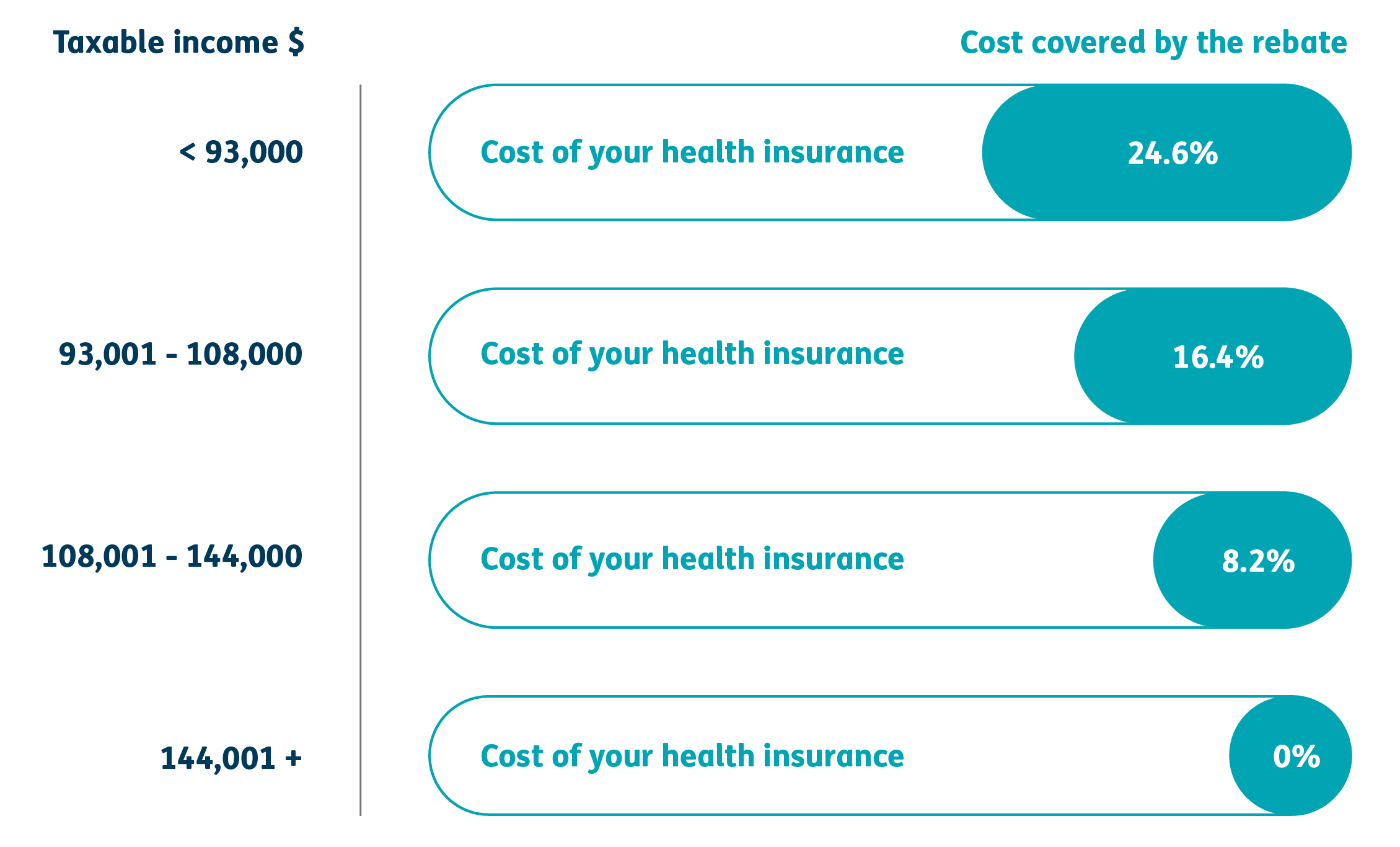

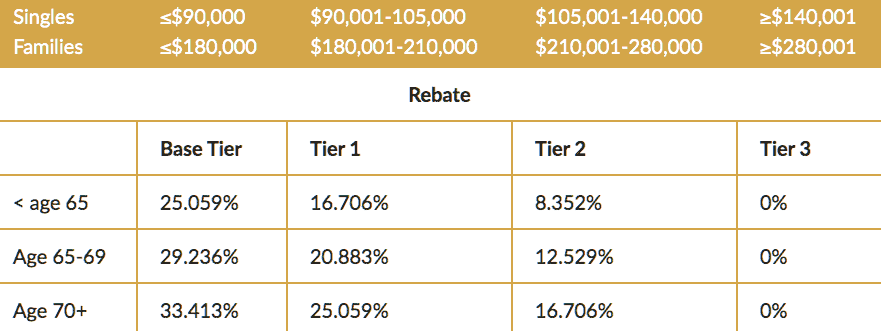

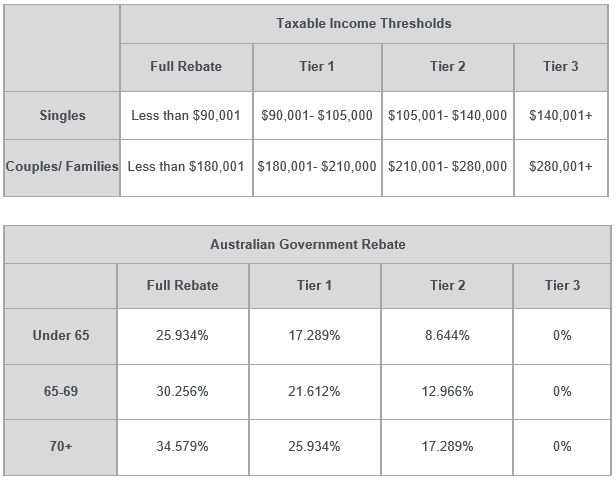

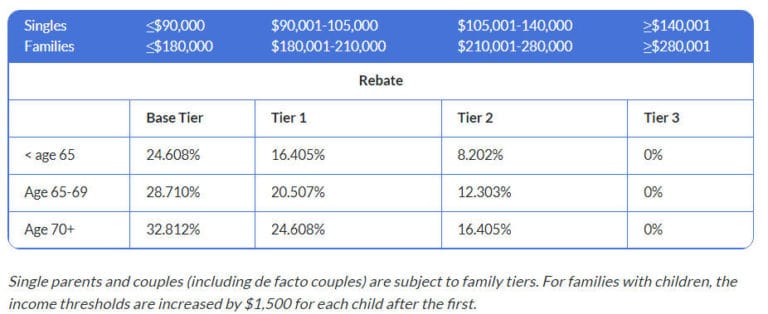

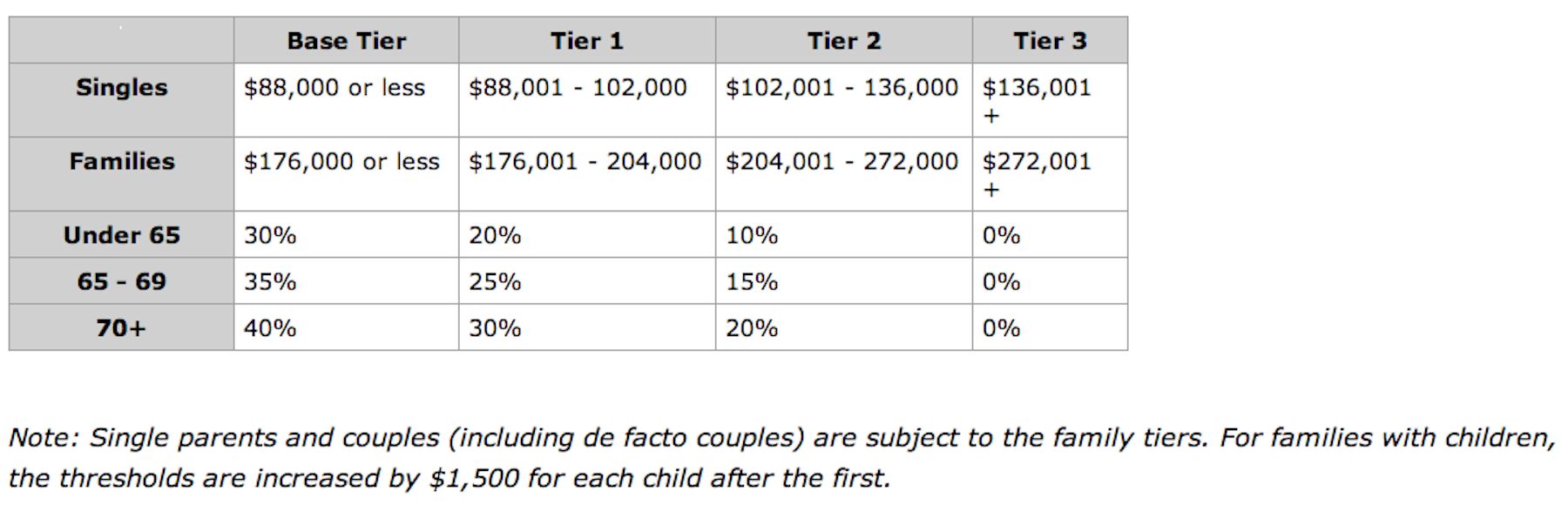

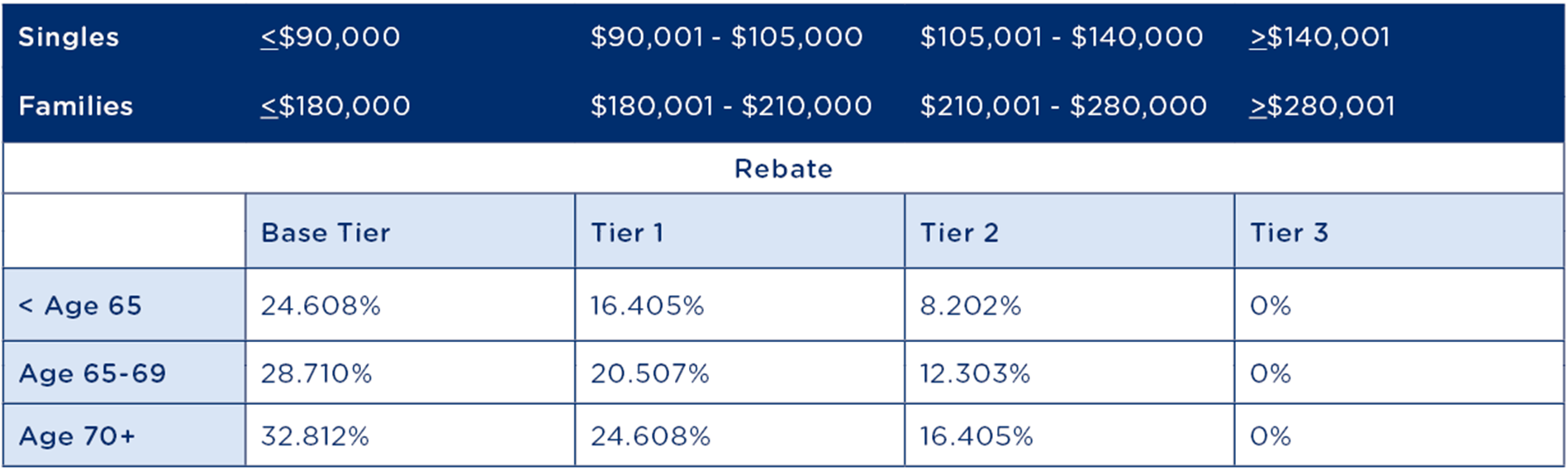

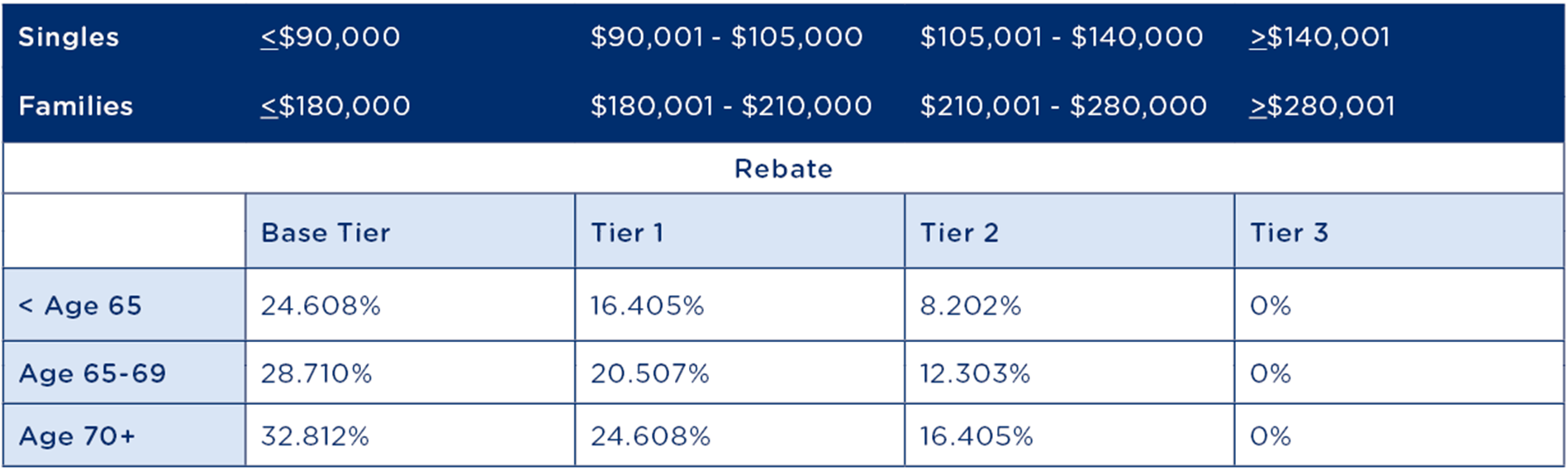

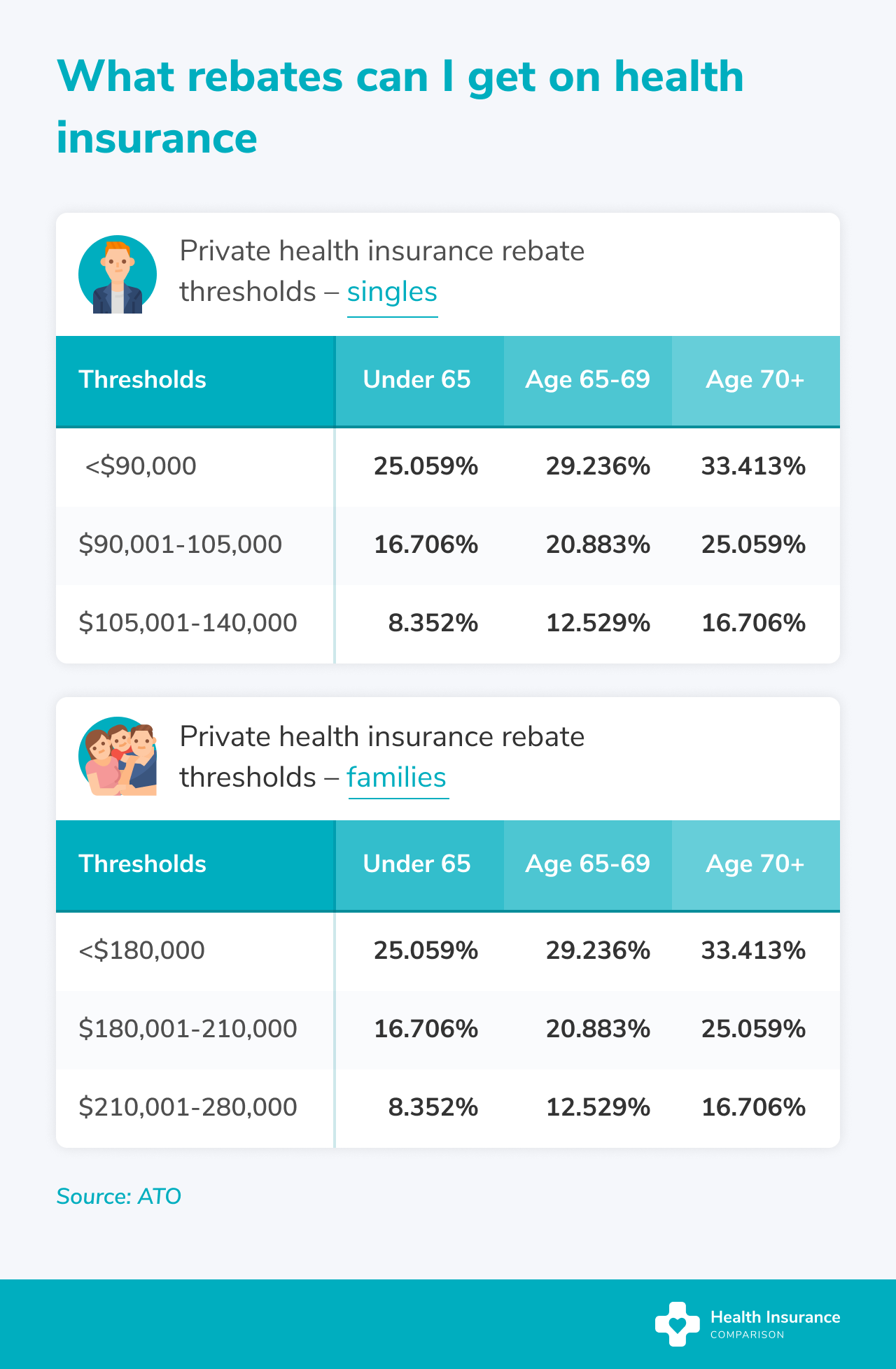

Web If you meet the eligibility requirements for a private health insurance rebate you can claim your rebate as either a premium reduction which lowers the policy price charged by your Web 21 ao 251 t 2023 nbsp 0183 32 The private health insurance rebate applies to people with taxable incomes of under 144 001 singles or 288 001 couples or families These thresholds went up slightly on 1 July 2023 The rebate

Web Use the calculator below to work out your private health reduction percentage income for Medicare levy surcharge purposes Private health insurance offset calculator How to Web Taking out private health insurance may entitle you to a tax rebate Earn a tax rebate if you have a taxable income of under 140 000 singles or 280 000 couples or

Download Private Health Insurance Tax Rebate

More picture related to Private Health Insurance Tax Rebate

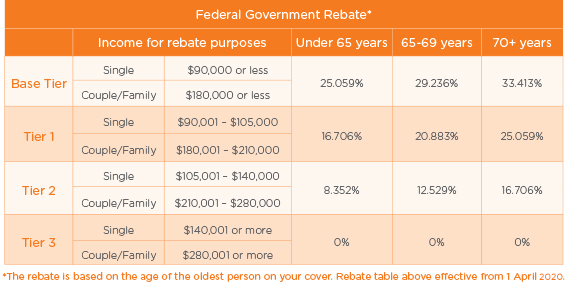

What Is Australian Government Rebate On Private Health Insurance

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Article-35-PrivateHealthInsuranceTax_v2_3.png

New To Private Health Insurance HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

How Does Private Health Insurance Affect My Tax Return Compare Club

https://asset.compareclub.com.au/content/guides/health-insurance/tax-return/private-health-rebate-levels-mobile.jpg

Web 30 juin 2023 nbsp 0183 32 The rebate applies to hospital general treatment and ambulance policies It does not apply to overseas visitors health cover The current rebate levels and income Web The private health insurance rebate is a contribution the Australian Government makes towards your private health insurance premium It is based on your income and age A

Web If you or your family don t have private health insurance hospital cover or you choose to cancel your cover you will pay the Medicare levy surcharge if you earn more than Web 23 ao 251 t 2023 nbsp 0183 32 The private health insurance rebate is an amount of money the government may contribute towards the cost of your private health insurance

Health Insurance Rebate Is It Time To Ditch The Private Health

https://healthdeal.com.au/wp-content/uploads/2020/02/rebate-tier.png

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates-WORKING_DE1.1.jpg

https://www.ato.gov.au/Individuals/Medicare-and-private-health...

Web The income thresholds used to calculate the Medicare levy surcharge and private health insurance rebate have increased from 1 July 2023 Before 1 July 2023 they remained

https://theconversation.com/the-private-health-insurance-rebate-has...

Web 19 avr 2022 nbsp 0183 32 The private health insurance rebate costs Australian taxpayers nearly A 7 billion per year and has cost over 100 billion since its introduction Yet the rebate s

Private Health Insurance Rebate Taxwise Australia

Health Insurance Rebate Is It Time To Ditch The Private Health

Should You Get Private Health Insurance BCV Financial

Private Health Insurance Tax Offset Atotaxrates info

FactCheck Could Private Lifetime Health Cover Changes Cost 1000 More

Private Health Insurance Rebate Navy Health

Private Health Insurance Rebate Navy Health

What Is The Annual Private Health Insurance Rate Rise

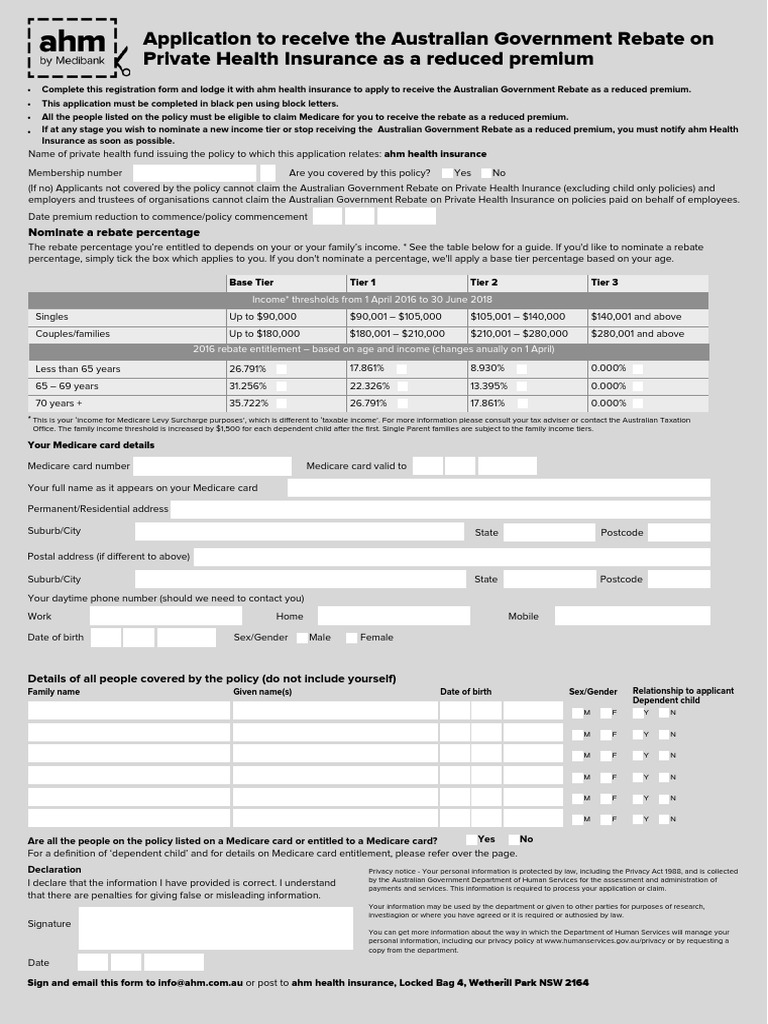

Australian Government Rebate On Private Health Insurance Form

Can I Claim Tax Back On Private Health Insurance Gallerybdesign

Private Health Insurance Tax Rebate - Web 3 mars 2022 nbsp 0183 32 You can claim the rebate as an upfront reduction to your private health insurance premium We ll pay the rebate to your health insurer and they ll reduce the