Production Tax Credit Renewable Energy The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars

The Clean Electricity Production Credit is a newly established tech neutral production tax credit that replaces the Energy Production Tax Credit once it phases out at the end of 2024 For investment in renewable energy projects including fuel cell solar geothermal small wind energy storage biogas microgrid controllers and combined heat and power properties Credit

Production Tax Credit Renewable Energy

Production Tax Credit Renewable Energy

https://urbansolar.com/wp-content/uploads/2015/12/tax-credits-extended-for-renewable-energy.jpg

Extending Tax Credits For Renewable Energy Projects Is It An

https://www.law.georgetown.edu/environmental-law-review/wp-content/uploads/sites/18/2021/01/renewable-energy-montage-705444748-Shutterstock_FotoIdee-980x552.jpg

Energy Tax Credits Armanino

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Use Form 8835 to claim the renewable electricity production credit The credit is allowed only for the sale of electricity produced in the United States or U S territories from qualified energy The Production Tax Credit PTC allows owners and developers of wind energy facilities land based and offshore to claim a federal income tax credit on every kilowatt hour of electricity

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment WASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS released proposed guidance on the Clean Electricity Production

Download Production Tax Credit Renewable Energy

More picture related to Production Tax Credit Renewable Energy

Let The Sunshine In Solar Energy Tax Reduction Frost Brown Todd

https://frostbrowntodd.com/app/uploads/2023/03/clean-renewable-energy-or-electricity-production-tax-credits-and-incentives-financial-concept-green-energy-symbols-atop-coin-stack-eg-solar-panel-wind-turbine-fuel-cell-battery-and-the-word-tax-stockpack-gettyimages-scaled.jpg

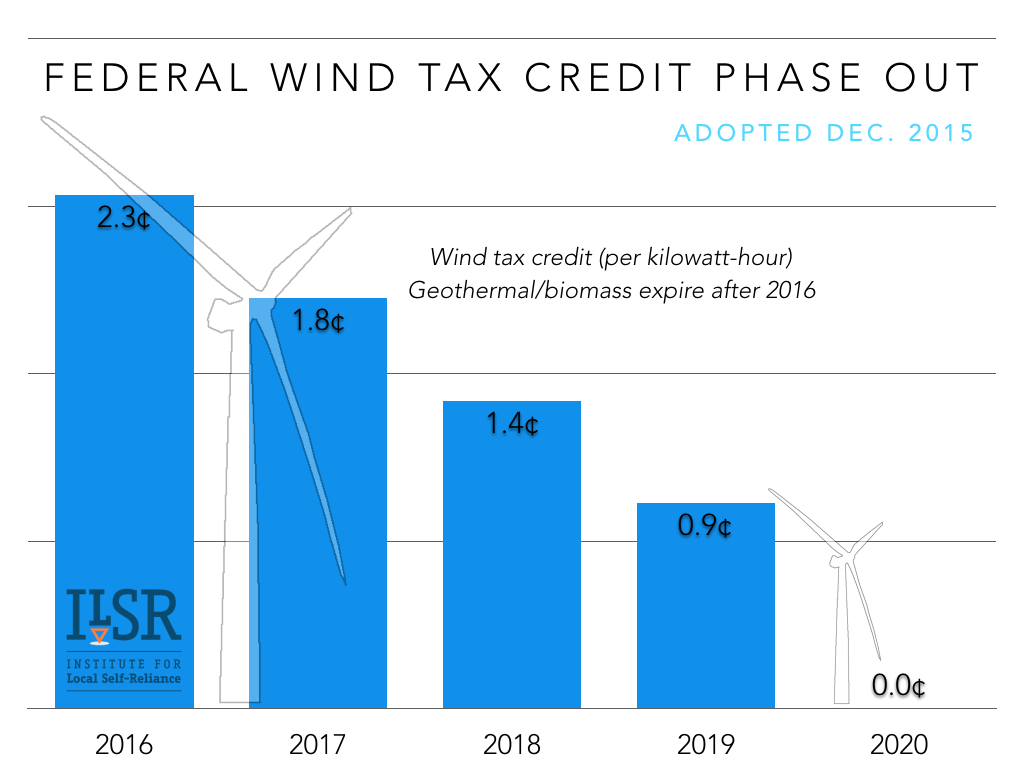

Congress Gets Renewable Tax Credit Extension Right Institute For

https://ilsr.org/wp-content/uploads/2016/01/federal-wind-tax-credit-phase-out-ILSR-2015-v3.jpg

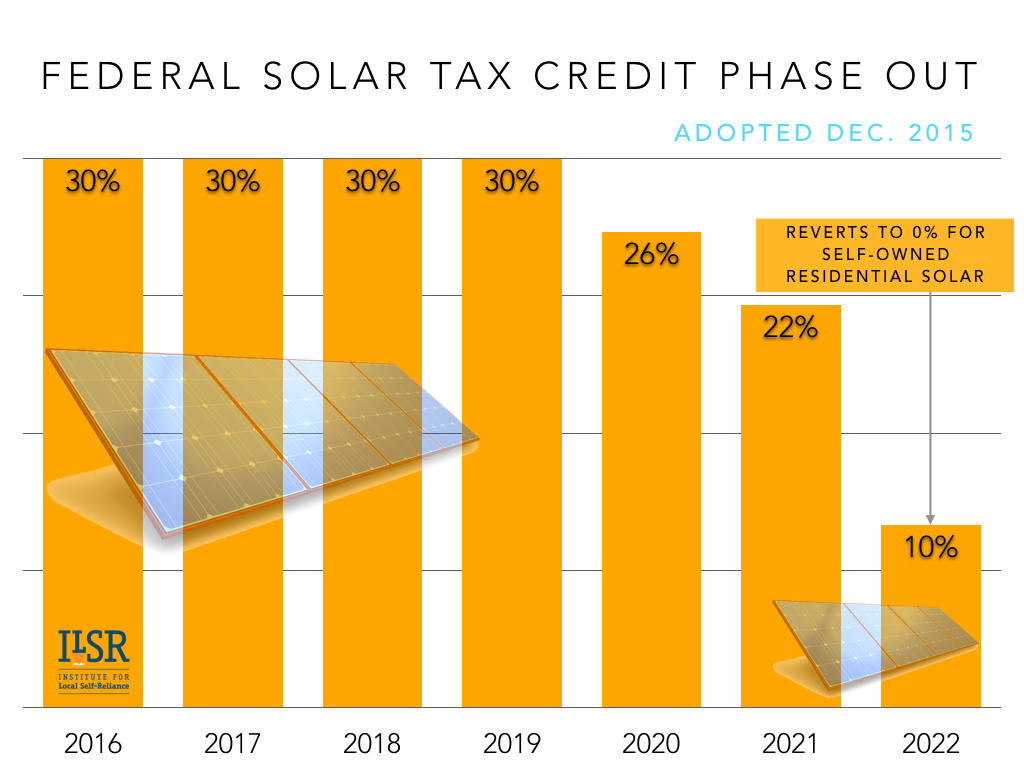

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The production tax credit PTC is a per kilowatt hour kWh tax credit for electricity generated by solar and other qualifying technologies for the first 10 years of a system s operation It reduces the federal income tax liability and is On August 16 2022 President Biden signed the Inflation Reduction Act into law marking the most significant action Congress has taken on clean energy and climate change

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of 2 5 cents per kilowatt hour in 2021 dollars adjusted for inflation annually The Business Energy Investment Tax Credit ITC and Renewable Energy Production Tax Credit PTC allow businesses to deduct a percentage of the cost of

Renewable Energy Tax Credits Iowa Utilities Board

https://iub.iowa.gov/sites/default/files/banner/renewable_tax_credits.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars

https://www.irs.gov/credits-deductions/clean...

The Clean Electricity Production Credit is a newly established tech neutral production tax credit that replaces the Energy Production Tax Credit once it phases out at the end of 2024

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Renewable Energy Tax Credits Iowa Utilities Board

Congress Gets Renewable Tax Credit Extension Right Institute For

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

Lazard LCOE Report Sees zero Cost Solar And Wind Due To IRA Pv

Rebates Tax Incentives Residential Renewable Energy Tax Credit

The Residential Renewable Energy Tax Credit Is A Little known

Production Tax Credit Renewable Energy - The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment