Profession Tax Return Due Date Extended Stay compliant with Maharashtra s Profession Tax Rules effective from 01 04 2023 onwards Learn about the analysis of Rule 11 including returns payments and due dates Explore the details of Form III Form IIIB and MTR

Introduction The Goods and Services Tax Practitioners Association of Maharashtra GSTPAM has submitted a formal request to the Commissioner of State Tax in Maharashtra urging an extension of the due If dealer having PTRC liability less than Rs 1 00 000 during the FY 2023 24 he will file annual PTRC return for the FY 2024 25 And the due date will be 31st March 2025

Profession Tax Return Due Date Extended

Profession Tax Return Due Date Extended

https://i.ytimg.com/vi/rUBXXk5uRAA/maxresdefault.jpg

Further Extension Of Profession Tax Return Deadline In Maharashtra

https://i.ytimg.com/vi/Jsc_QvMl0vw/maxresdefault.jpg

Income Tax Returns 2021 Due Date Extended Sinhasi

https://cdn.shopify.com/s/files/1/0538/8779/5396/articles/sinhasi_income_tax_return_due_date_extended_blog_banner_800x.jpg?v=1631599626

Tax Calendar for filing of Return And payment of taxes under MVAT ACT in the State of Maharashtra 1 MONTHLY Due Date 2 QUARTERLY 3 SIX MONTHLY NOTE The Maharashtra State Finance Department has published a notification extending the due date for filing the returns from 31 March 2022 to 31 May 2022

Under the Act The Maharashtra State Tax on Professions Trades Callings and Employments Act 1975 Due date for paying PTRC filing return extended from time to time Due date of paying PTEC and PTRC and filing returns under PTRC extended from time to time due to Covid 19

Download Profession Tax Return Due Date Extended

More picture related to Profession Tax Return Due Date Extended

Due Date Extended For Income Tax Return ITR Tax Audit Report GST

https://i.ytimg.com/vi/csr_lJQJmiI/maxresdefault.jpg

Income Tax Return Due Date Extended New ITR Filing Deadline

https://tradeflock.com/wp-content/uploads/2021/06/income_tax_return-1.webp

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

The Government of Karnataka with The Karnataka Tax on Professions Trades Callings and Employments Removal of Difficulties Order 2021 made an extension to the Professional Tax Employers with a tax liability of up to 3 000 must file quarterly returns within 30 days of each quarter end For those with a liability over 3 000 monthly payments are due within 21 days of the following month with

The due date of professional tax payment in Maharashtra depends on the date of enrolment such as Entities that enrolled before 31st May of a financial year must pay PT in Maharashtra Every person who is liable to pay professional tax should file their return by 31st December for the entire year This is extendable by one month Every person who is liable to

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

https://studycafe.in/wp-content/uploads/2022/07/ITR.jpg

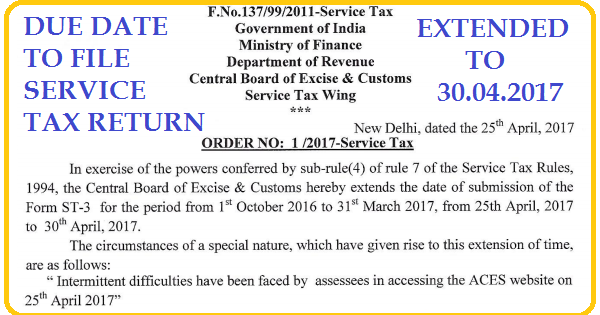

SERVICE TAX RETURN DUE DATE EXTENDED SIMPLE TAX INDIA

https://4.bp.blogspot.com/-bs9N8DpBCMk/WQC5RxcOg-I/AAAAAAAACe4/VE6s9fAU07w43jOoCKIv8AUhCkDAugPBQCLcB/w600-h315-p-k-no-nu/SERVICE%2BTAX%2BRETURN%2BDUE%2BDATE%2BEXTENDED.png

https://taxguru.in › goods-and-service-tax › ...

Stay compliant with Maharashtra s Profession Tax Rules effective from 01 04 2023 onwards Learn about the analysis of Rule 11 including returns payments and due dates Explore the details of Form III Form IIIB and MTR

https://taxguru.in › goods-and-service-tax › request...

Introduction The Goods and Services Tax Practitioners Association of Maharashtra GSTPAM has submitted a formal request to the Commissioner of State Tax in Maharashtra urging an extension of the due

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

Tax Return Due Date Extended By IRS Austin Asset Austin Asset

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

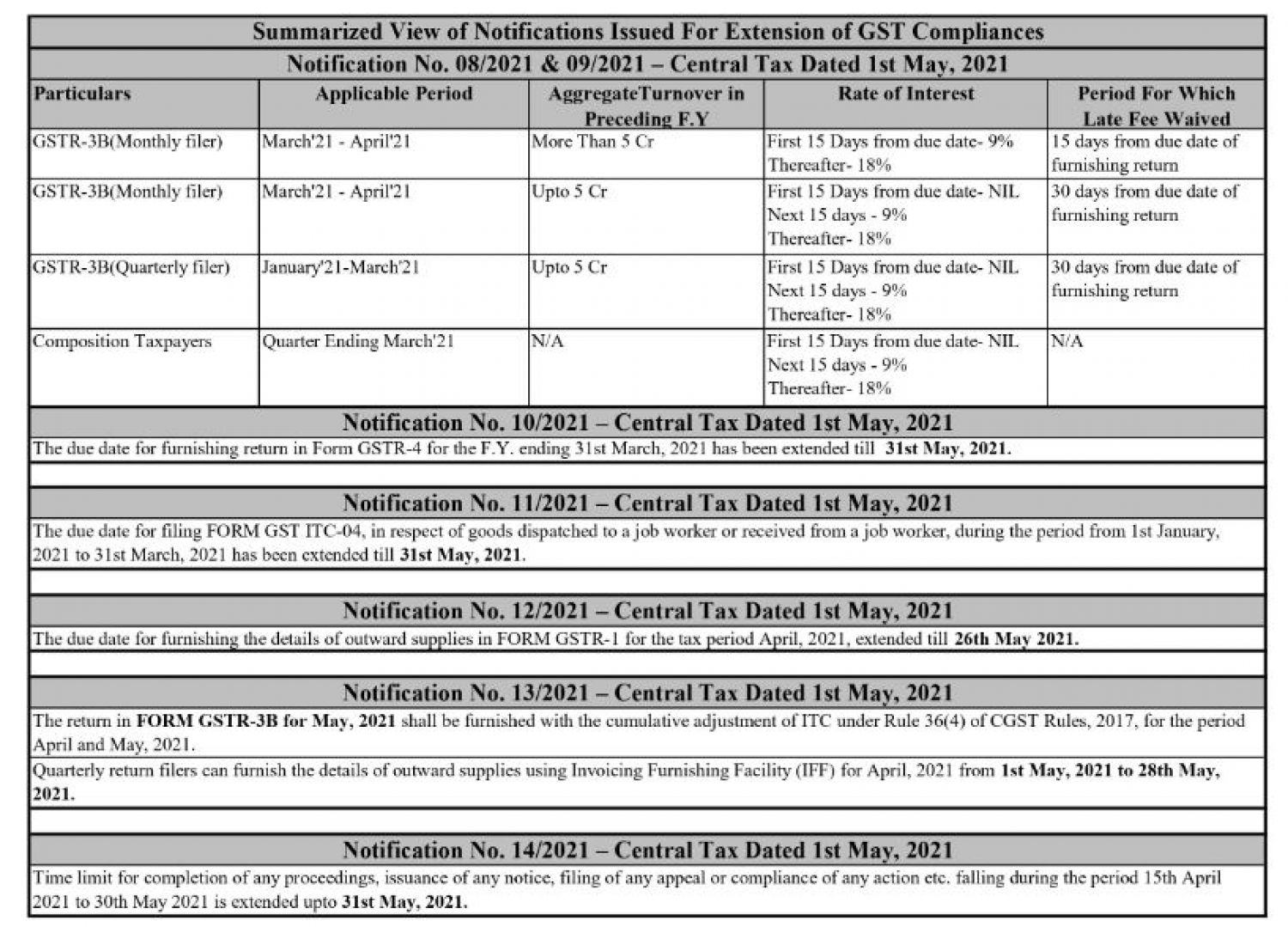

Due Dates Of Various GST Return Falling In Month Of April

Income Tax Returns Filing Due Dates Extended Ebizfiling

Income Tax Returns Filing Due Dates Extended Ebizfiling

ROC Return Due Date Extended Further For FY 2020 21 E StartupIndia

File Your Income Tax Return By 31st July Ebizfiling

What Is A Professional Tax Payment Eligibility To Pay PT

Profession Tax Return Due Date Extended - The Maharashtra State Finance Department has published a notification extending the due date for filing the returns from 31 March 2022 to 31 May 2022