Professional Tax Exemption In Maharashtra However if an individual s monthly income exceeds Rs 7 500 then they are liable to pay Profession Tax as per the rates prescribed under the Maharashtra State

Exemptions Source Maharashtra Profession Tax portal Following classes of persons are exempt from payment of profession tax 1 Members of armed forces of An Act to provide for settlement of arrears of tax interest penalty or late fee which were levied payable or imposed respectively under various Acts administered by

Professional Tax Exemption In Maharashtra

Professional Tax Exemption In Maharashtra

https://www.signnow.com/preview/497/332/497332566/large.png

Exemption of Special Judicial Allowance from Deduction of Income Tax

https://i0.wp.com/allpaknotifications.com/wp-content/uploads/2021/04/Exemption-of-Special-Judicial-Allowance-from-Deduction-of-Income-Tax.jpg?ssl=1

How Do You Know If Your Business Qualifies For The Employee Retention

https://image.cnbcfm.com/api/v1/image/106880009-1620409189576-gettyimages-1248968342-c0139.jpeg?v=1687093201&w=1920&h=1080

Certain categories of individuals are exempt from paying PT in Maharashtra These include Senior citizens above 60 years of age men and 58 years women Individuals It is important to note that if you are a salaried individual then such professional tax will be collected and remitted by your employer Exemptions in Professional Tax Even though

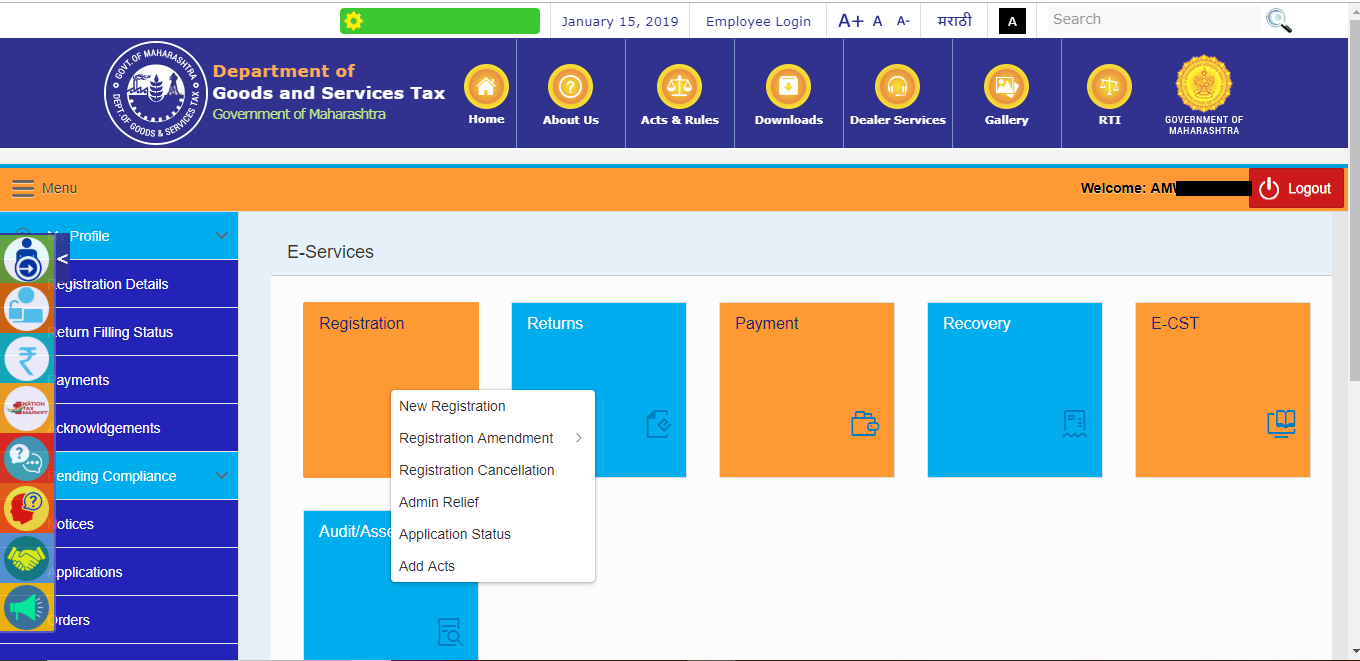

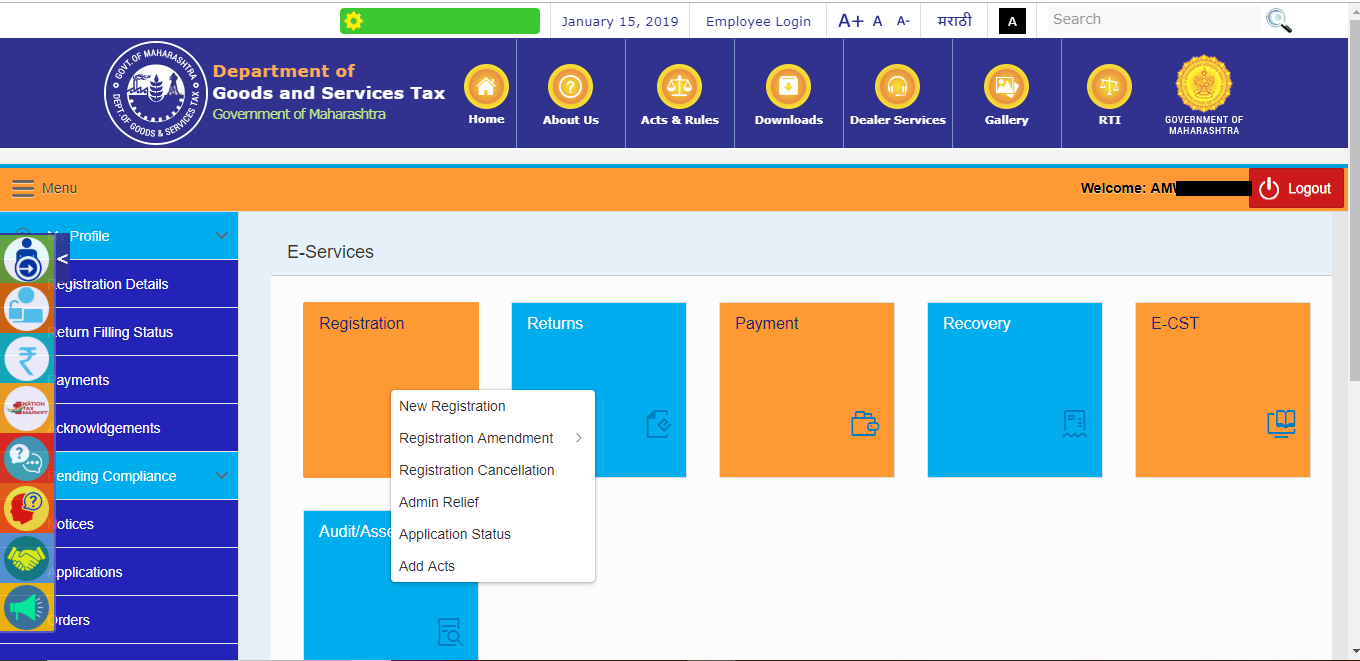

PROFESSIONAL TAX ACT Department of Goods and Services Tax August 8 2024 Employee Login A A A English Get accurate Professional Tax Slab rate for Maharashtra other details like PT act rule filing of returns p tax registration due dates PT deduction PT exemption PT challan

Download Professional Tax Exemption In Maharashtra

More picture related to Professional Tax Exemption In Maharashtra

All About How To Pay Professional Tax Online In Maharashtra Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/Online-payment-of-professional-tax-in-maharashtra-FINAL-1-1-1.png

Zeal

https://www.zeal.com/_next/image?url=https:%2F%2Fimages.prismic.io%2Fzeal%2F586243de-d3ea-4419-a879-6a39af4171b2_Tax_blog_2022.png%3Fauto%3Dcompress%2Cformat&w=3840&q=75

File Professional Tax In Maharashtra Easily Services Gautam Buddha

https://i.pinimg.com/originals/29/48/5a/29485a521750ebfa692a02f18b6ad314.jpg

Who Are Exempt from Paying Professional Tax in Maharashtra Following is a list of individuals who can avoid making professional tax payments in Maharashtra Professional tax is levied by Maharashtra on most employees and organizations Learn about applicability latest tax slabs rules filing and more in this article

1 Who is liable to pay Profession Tax Every person engaged actively or otherwise in any profession trade callings or employment and falling under one or the Understand professional tax registration in Maharashtra Learn tax slabs due dates exemptions and the entire registration process Avoid penalties ensure

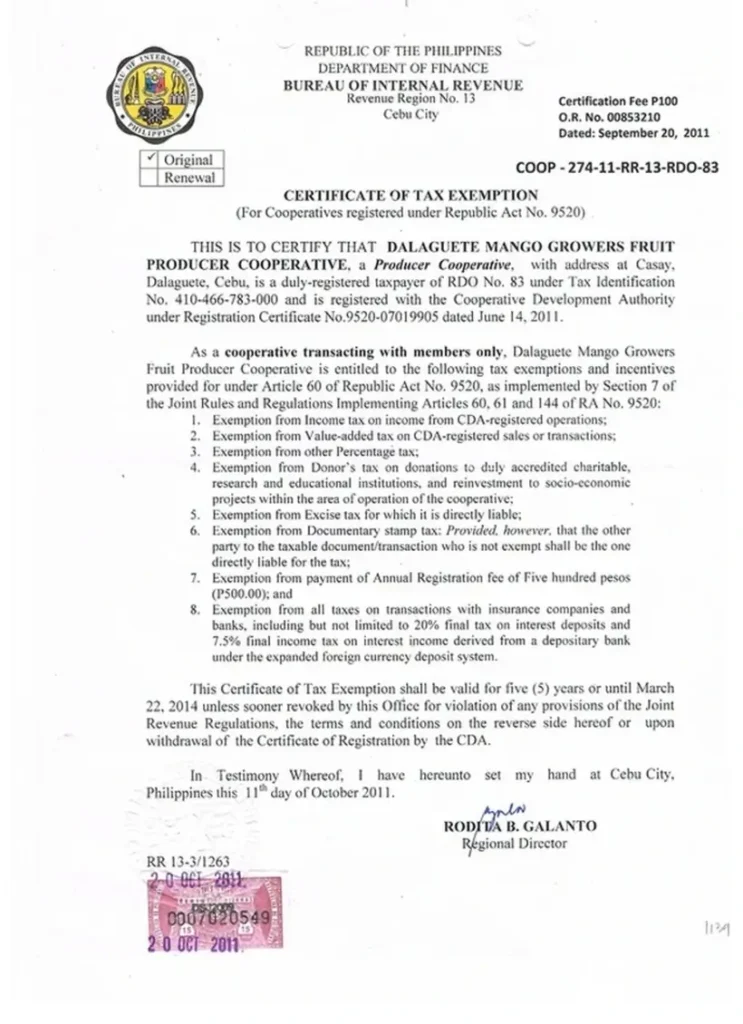

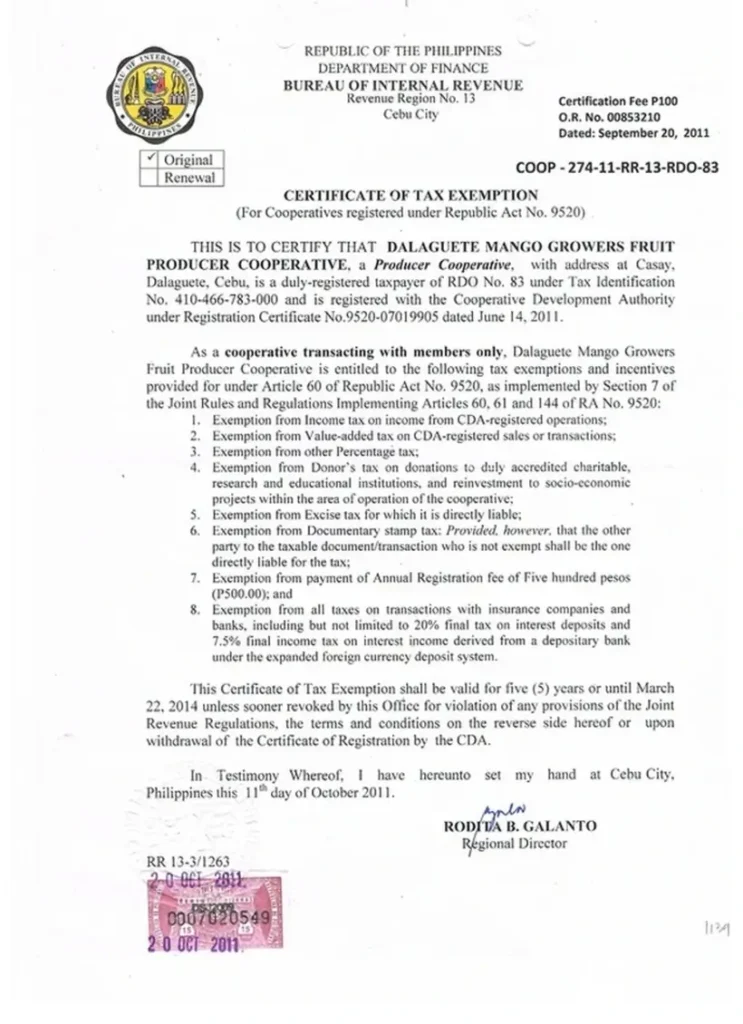

Paano Kumuha Ng Certificate Of Tax Exemption Sa Pilipinas

https://www.sisigexpress.com/wp-content/uploads/2024/02/Certificate-of-Tax-Exemption-Sample-743x1024.webp

Maharashtra Professional Tax Govt Issues Late Fee Waiver Notification 2022

https://www.compliancetalks.in/wp-content/uploads/2022/03/Maharashtra-Professional-tax-Govt-issues-Late-fee-waiver-Notification.jpg

https://taxguru.in/goods-and-service-tax/...

However if an individual s monthly income exceeds Rs 7 500 then they are liable to pay Profession Tax as per the rates prescribed under the Maharashtra State

https://taxguru.in/goods-and-service-tax/analysis...

Exemptions Source Maharashtra Profession Tax portal Following classes of persons are exempt from payment of profession tax 1 Members of armed forces of

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

Paano Kumuha Ng Certificate Of Tax Exemption Sa Pilipinas

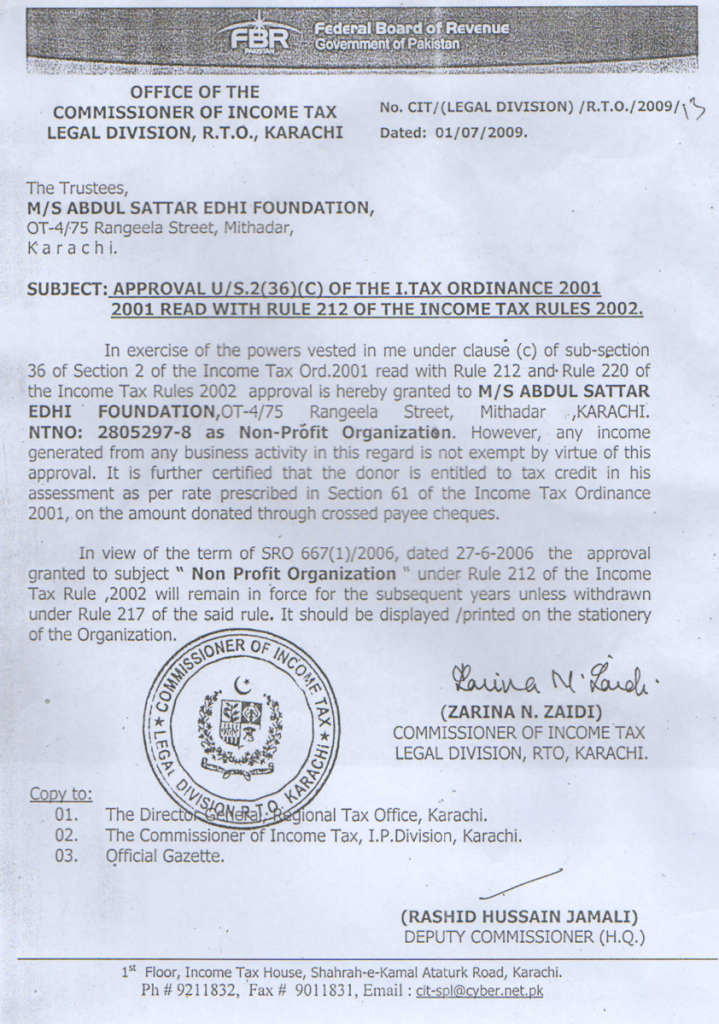

Exemption Certificate Edhi Welfare Organization

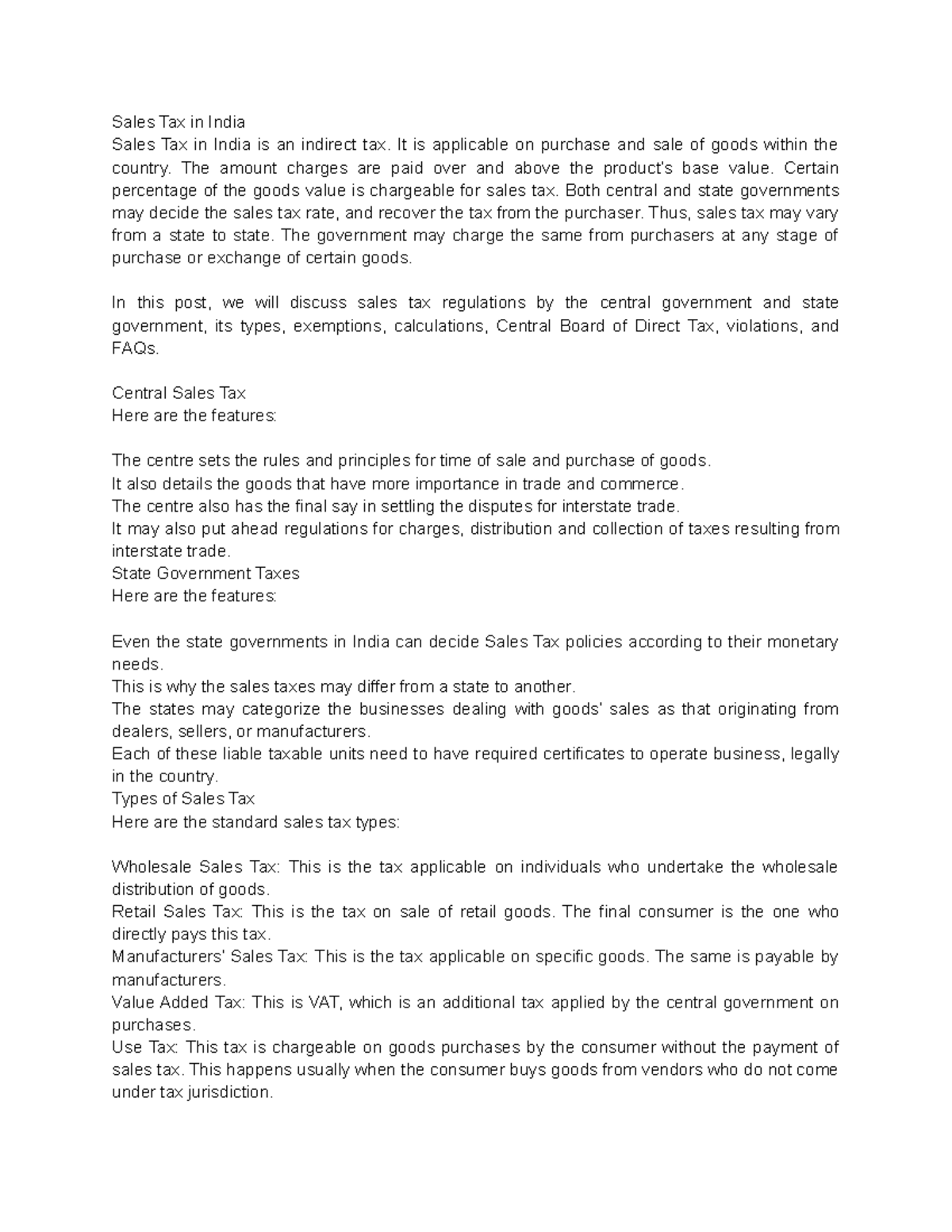

Sales Tax Exemption In India Sales Tax In India Sales Tax In India Is

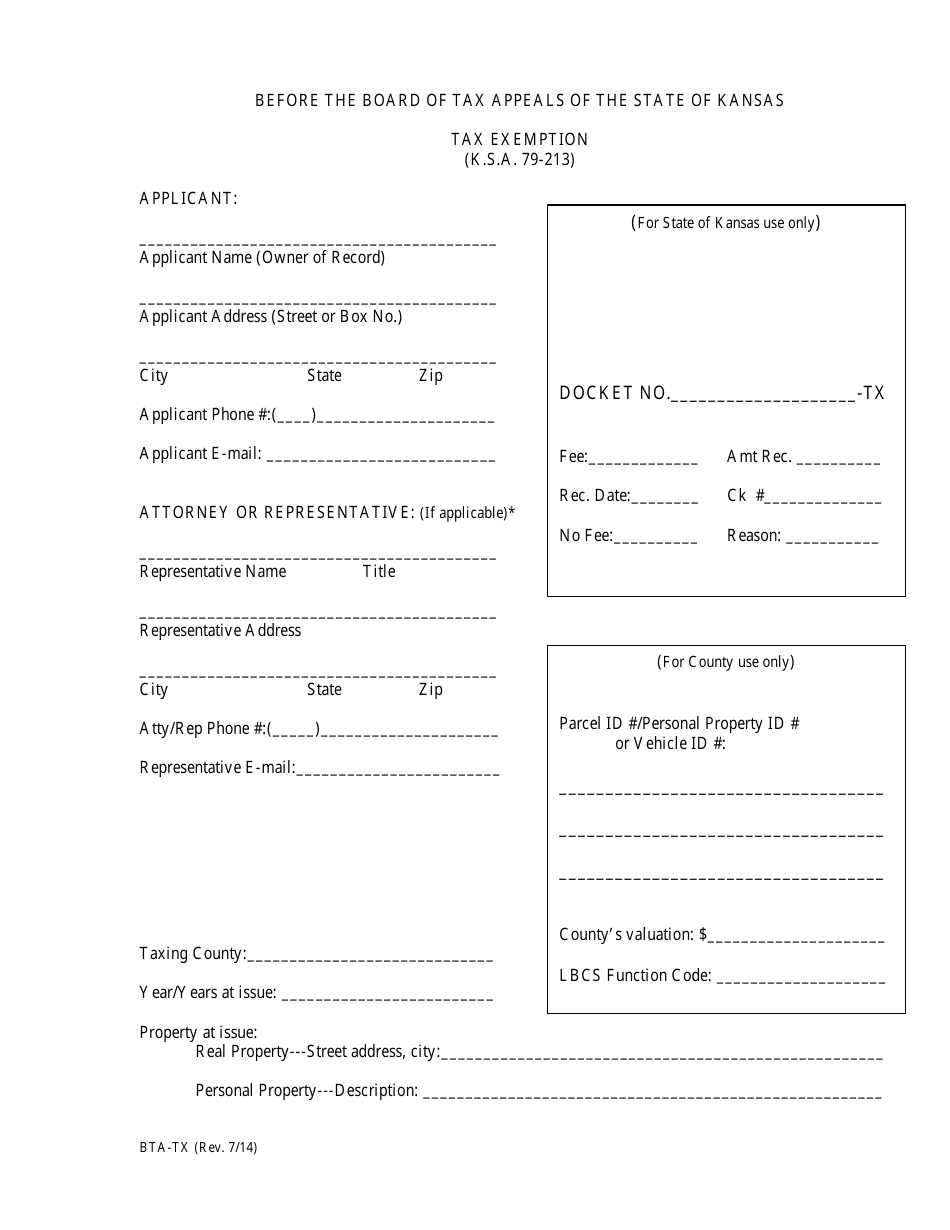

Form BTA TX Fill Out Sign Online And Download Fillable PDF Kansas

Get Enrollment Certificate For Profession Tax Maharashtra How To

Get Enrollment Certificate For Profession Tax Maharashtra How To

Professional Tax In Maharashtra Tax Slab Rates How To Pay Due Dates

How To Pay Professional Tax Online Exemption Due Dates Penalties

Andhra Pradesh Professional Tax Exemption In 2023 Tax Exemption Tax

Professional Tax Exemption In Maharashtra - It is important to note that if you are a salaried individual then such professional tax will be collected and remitted by your employer Exemptions in Professional Tax Even though