Professional Tax Limit For Female In Maharashtra Govt of Maharashtra notifies Maharashtra State Tax on Professions Trades Callings and Employments Amendment Bill 2023 to notify changes in

Compliance under Maharashtra State Tax on Professions Traders Callings and Employments Act 1975 Every employer not having employees should only pay Professional Tax Slab Rate in Maharashtra 2024 Check latest tax rates for Men and Women Also Know more on how to pay and Penalties for not paying tax

Professional Tax Limit For Female In Maharashtra

Professional Tax Limit For Female In Maharashtra

https://www.legalmantra.net/admin/assets/upload_image/blog/ptax.jpg

Professional Tax Registration Process In India

https://www.taxaj.com/files/Images/Blogs -7--1.jpg

2023 FICA Tax Limits And Rates How It Affects You

https://erctoday.com/wp-content/uploads/2023/03/FICA-tax-limit-rates-768x402.jpg

Get accurate Professional Tax Slab rate for Maharashtra other details like PT act rule filing of returns p tax registration due dates PT deduction PT exemption PT challan Currently employed women must pay professional tax if their monthly wage exceeds Rs 10 000 It is recommended that this threshold be raised to Rs 25 000 in

Self employed salaried individuals and companies are liable to pay professional tax on their income in Maharashtra While this is true for every state in Maharashtra every company must go through Exemption to certain female employees from professional tax payment The New Amendment ushers in changes under Schedule I of the Maharashtra

Download Professional Tax Limit For Female In Maharashtra

More picture related to Professional Tax Limit For Female In Maharashtra

Gujarat Professional Tax Slab 2022 23 Commercialtax gujarat gov in

https://vakilsearch.com/blog/wp-content/uploads/2022/08/gujarat-professional-tax.png

Professional Tax Registration In Ahmedabad Professional Tax Consultant

https://legaladda.com/wp-content/uploads/2021/10/Professional-Tax-Registration-Consultant-in-Gujarat.jpg

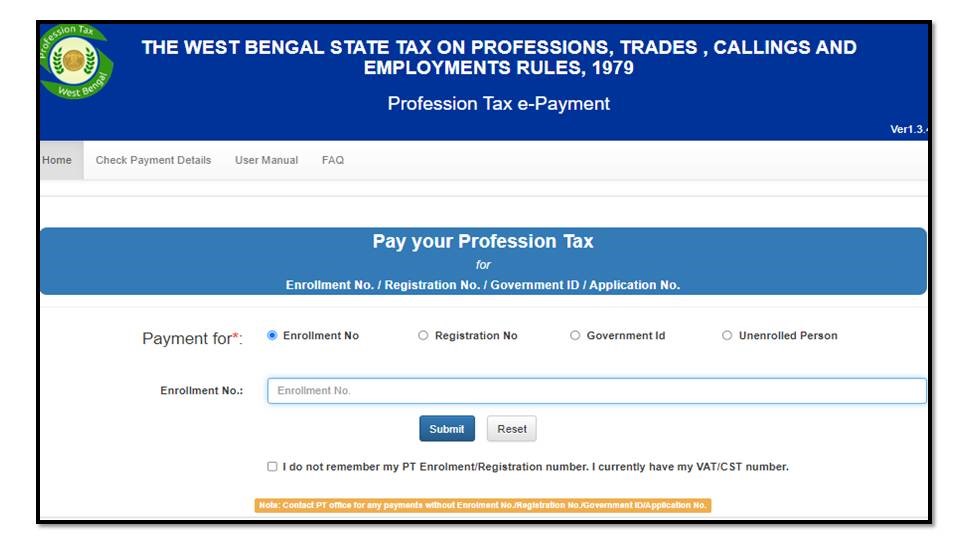

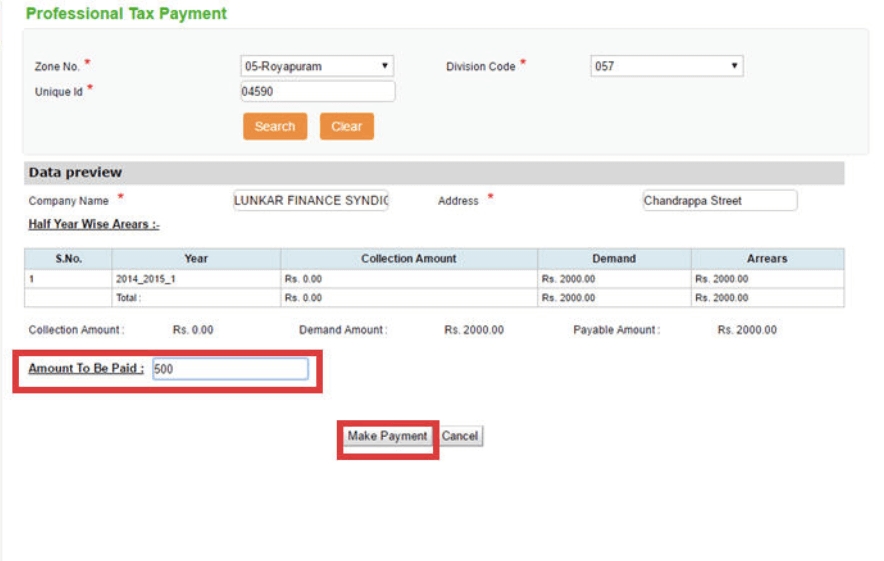

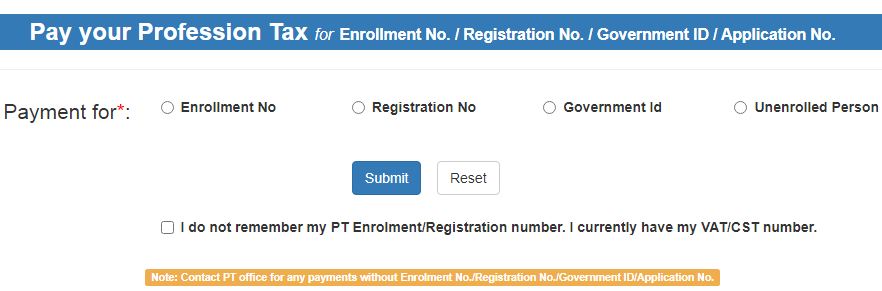

Professional Tax Online Payment Method Professional Tax West Bengal

https://www.techiequality.com/wp-content/uploads/2022/06/409FEE94-ADCB-4AD5-84CE-B6C9D8B29ADD.jpeg

Professional tax is levied by Maharashtra on most employees and organizations Learn about applicability latest tax slabs rules filing and more in this article The professional tax rate is based on the income slabs set by the Government The State Government has now increased the Maharashtra professional

For Women it is Up to Rs 25 000 monthly salary NIL Above Rs 25 000 monthly salary Rs 200 per month except for the month of February and Rs 300 for the Professional tax is a direct tax levied by the state government As a result the form of payment may differ from one state to the next Professional tax on the other hand can

Tax Professionals Small Business Bookkeeping Tax

https://www.gannett-cdn.com/-mm-/d8340c24781da72edad3ed5c705ee2a1eba422cf/c=0-22-2114-1217/local/-/media/2017/01/29/USATODAY/USATODAY/636213215291027598-GettyImages-518322266.jpg?width=3200&height=1680&fit=crop

Maharashtra Government Pays Rs 435 Crore For OBC Data

https://laybhari.in/wp-content/uploads/2021/12/Govt-of-Maharashtra.jpg

https://taxguru.in/goods-and-service-tax/...

Govt of Maharashtra notifies Maharashtra State Tax on Professions Trades Callings and Employments Amendment Bill 2023 to notify changes in

https://taxguru.in/.../analysis-profession-tax-provisions-maharashtra.html

Compliance under Maharashtra State Tax on Professions Traders Callings and Employments Act 1975 Every employer not having employees should only pay

A Brief Overview Of Professional Tax In India

Tax Professionals Small Business Bookkeeping Tax

How To Pay Professional Tax Online Exemption Due Dates Penalties

Professional Tax In Madhya Pradesh Tax Slab Rates How To Pay Due

Collection Of Professional Tax In Tamil Nadu

Kerala Professional Tax

Kerala Professional Tax

Landen Met De Hoogste En Laagste Vennootschapsbelastingtarieven In

What Is A Professional Tax Payment Eligibility To Pay PT

West Bengal EPayment Of Commercial Tax How To Pay Professional Tax

Professional Tax Limit For Female In Maharashtra - Self employed salaried individuals and companies are liable to pay professional tax on their income in Maharashtra While this is true for every state in Maharashtra every company must go through