Professional Tax Rebate In Income Tax Web 25 avr 2014 nbsp 0183 32 Les frais professionnels des salari 233 s sont automatiquement pris en compte par le biais d une d 233 duction forfaitaire de 10 Mais s ils estiment y avoir int 233 r 234 t les

Web Professional fees and subscriptions You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to Web It may be noted that professional tax is a deductible amount for the purpose of the Income Tax Act 1961 and can be deducted from taxable income Professional tax

Professional Tax Rebate In Income Tax

Professional Tax Rebate In Income Tax

https://lh3.googleusercontent.com/-GP2J6SJzupw/XkYh9rdqovI/AAAAAAAALmA/mBCF9lyvbmoI-kOZH7S4wr6l33fzQTnMQCLcBGAsYHQ/s1600/Image_3.jpeg

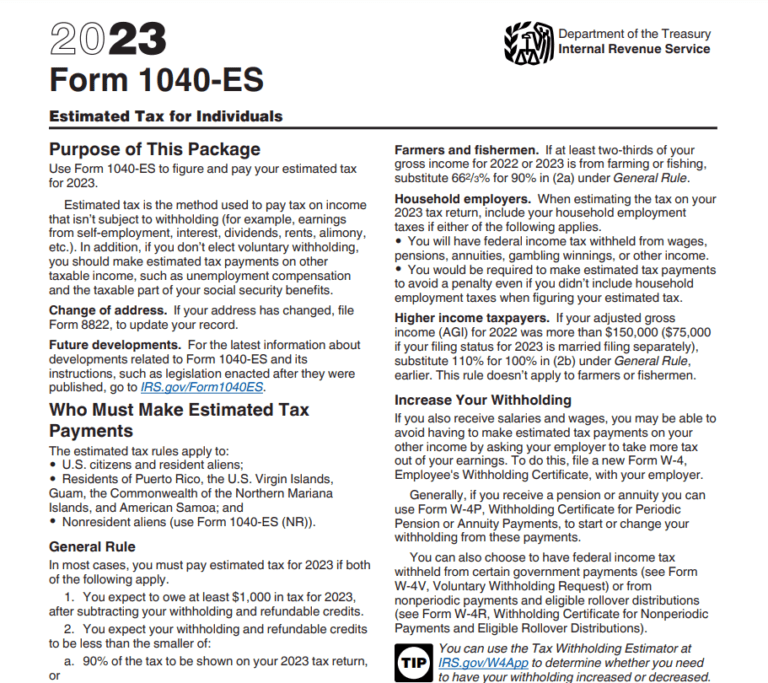

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

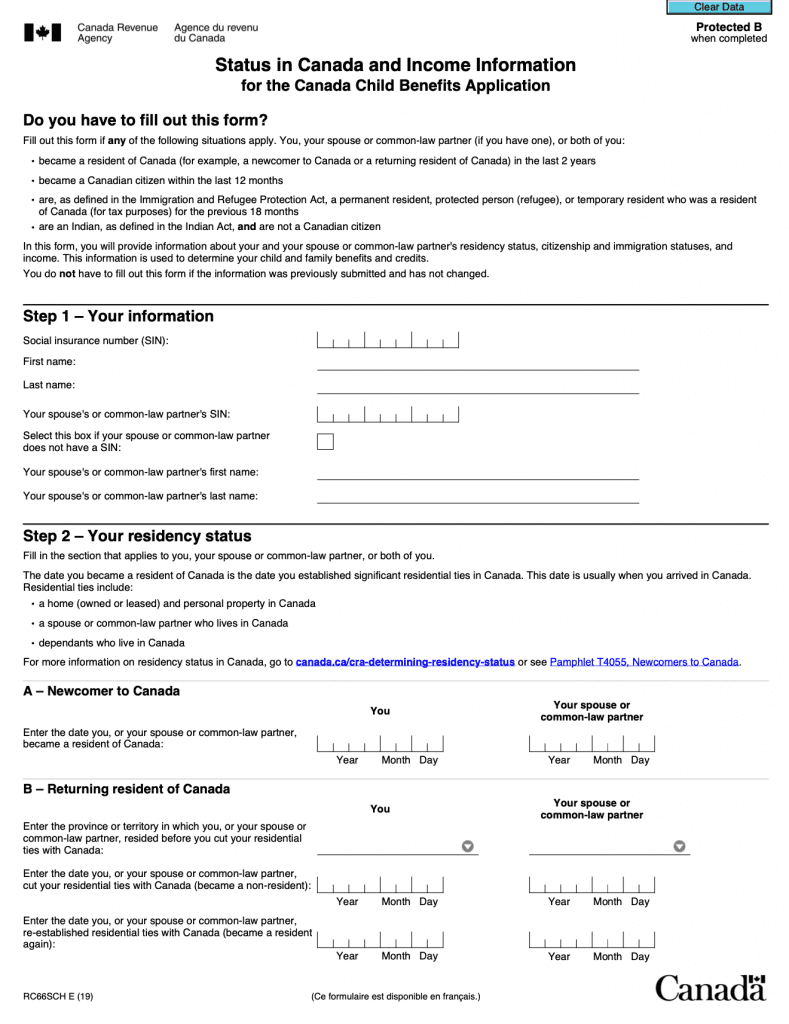

Carbon Tax Rebate 2022 Alberta Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Carbon-Tax-Rebate-2022-Income-Information-789x1024.png

Web Les professionnels lib 233 raux qui exercent leur activit 233 en entreprise individuelle sont impos 233 s personnellement 224 l imp 244 t sur le revenu sur les b 233 n 233 fices qu ils r 233 alisent Web 8 avr 2022 nbsp 0183 32 Article 276 of the Constitution empowers the State Government to levy professional tax but a maximum capping of Rs 2 500 have been placed Thus no state

Web 1 The rates of Surcharge and Health amp Education cess are same under both the tax regimes 2 Rebate u s 87 A Resident Individual whose total income is not more than Web 27 juil 2023 nbsp 0183 32 Section 16 of Income Tax Act 1961 provides deduction from income chargeable to tax under the head salaries It provides deductions for the standard

Download Professional Tax Rebate In Income Tax

More picture related to Professional Tax Rebate In Income Tax

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/dfa3db5ca69b9aab296dae9f4c821aa6/thumb_1200_1698.png

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Web Income Tax Rebate When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money is Web 9 sept 2023 nbsp 0183 32 If you itemize deductions on your federal income tax return and receive a state tax refund or special payment the IRS says you might need to include it in your

Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds Web 9 d 233 c 2022 nbsp 0183 32 As per the Income Tax Act 1961 if you have gross taxable income below 5 lakhs per year you can claim a tax rebate u s 87A We can also easily claim an income

P55 Tax Rebate Form Business Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

https://www.lemonde.fr/guide-des-impots/article/2014/04/25/frais...

Web 25 avr 2014 nbsp 0183 32 Les frais professionnels des salari 233 s sont automatiquement pris en compte par le biais d une d 233 duction forfaitaire de 10 Mais s ils estiment y avoir int 233 r 234 t les

https://www.gov.uk/tax-relief-for-employees/professional-fees-and...

Web Professional fees and subscriptions You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to

Tax Rebate For Individual Deductions For Individuals reliefs

P55 Tax Rebate Form Business Printable Rebate Form

Interim Budget 2019 20 The Talk Of The Town Trade Brains

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

Corporate Tax Rebate Budget 2022 Rebate2022

How To Get Tax Rebate In Income Tax

How To Get Tax Rebate In Income Tax

What Is Rebate In Income Tax Nirmala Sitaraman Gives Big Relief To

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

Pin On Tigri

Professional Tax Rebate In Income Tax - Web 1 The rates of Surcharge and Health amp Education cess are same under both the tax regimes 2 Rebate u s 87 A Resident Individual whose total income is not more than