Professional Tax Rebate Section Web 3 f 233 vr 2022 nbsp 0183 32 Les remboursements de d 233 penses engag 233 es par le salari 233 pour le compte de l entreprise sont toujours exon 233 r 233 s puisque le salari 233 n a fait qu avancer des fonds 224 la

Web 17 mai 2018 nbsp 0183 32 Professional tax is a tax on all kinds of professions trades and employment and is levied based on the income of such profession trade and employment It is levied Web Professional fees and subscriptions You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual

Professional Tax Rebate Section

Professional Tax Rebate Section

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

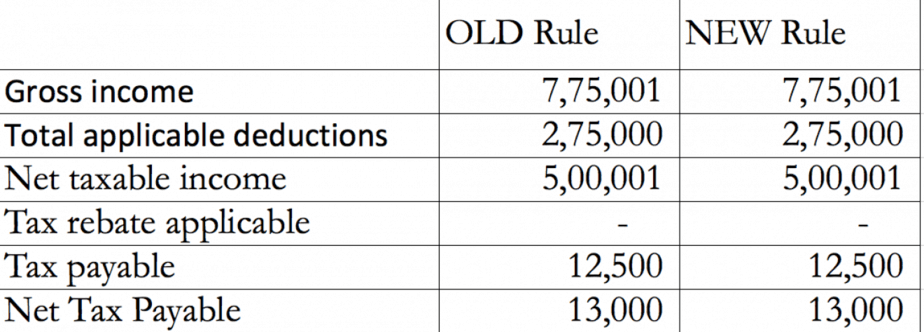

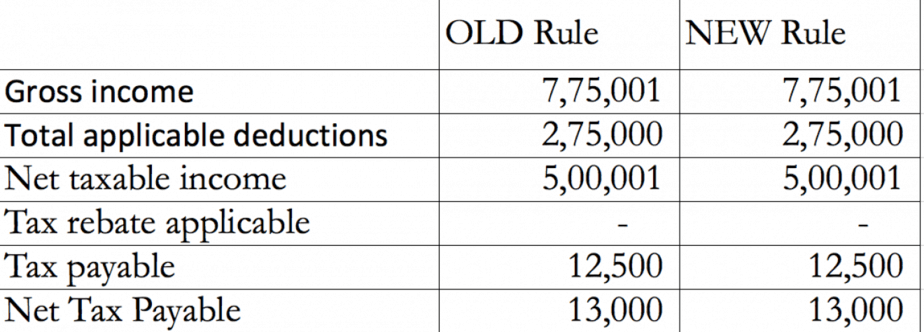

Revised Tax Rebate Section 87A Examples Budget 2019 For FY 2019 20

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM-1320x474.png

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Web 20 Travaux publics Conducteurs d engins et de camions d entreprises 10 Article 5 de l annexe IV du code g 233 n 233 ral des imp 244 ts dans sa r 233 daction en vigueur au 31 d 233 cembre Web 1 janv 2023 nbsp 0183 32 Contribution pour la formation professionnelle CFP due pour 2023 payable en novembre 2023 Profession lib 233 rale r 233 glement 233 e 0 25 de la base forfaitaire 43

Web 27 juil 2023 nbsp 0183 32 The deduction solely depends on the actual amount of professional tax However any state government cannot levy more than rs 2500 annually as a Web 2 f 233 vr 2023 nbsp 0183 32 The maximum deduction that can be claimed under this section is Rs 50 000 Section 80D This deduction is available for premium paid on medical insurance policy

Download Professional Tax Rebate Section

More picture related to Professional Tax Rebate Section

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Tds Slab Rate For Ay 2019 20

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

Web Paying Professional Tax in Advance While one can continue clearing professional tax payments every month businesses and individuals can also clear these tax liabilities in Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Web List of Tax Deductions and Exemptions Not Allowed Under the New Tax Regime Go through the following list of revised deductions and exemptions under the new tax Web 2 mai 2023 nbsp 0183 32 Rebate under Section 87A helps taxpayers reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

Union Budget 2017 18 Proposed Tax Slabs For FY 2017 18 Taxing Tax

http://taxingtax.com/wp-content/uploads/2017/02/Capture6.png

https://droit-finances.commentcamarche.com/impots/guide-impots/2725...

Web 3 f 233 vr 2022 nbsp 0183 32 Les remboursements de d 233 penses engag 233 es par le salari 233 pour le compte de l entreprise sont toujours exon 233 r 233 s puisque le salari 233 n a fait qu avancer des fonds 224 la

https://cleartax.in/s/professional-tax

Web 17 mai 2018 nbsp 0183 32 Professional tax is a tax on all kinds of professions trades and employment and is levied based on the income of such profession trade and employment It is levied

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Professional Tax Rebate Section - Web 2 f 233 vr 2023 nbsp 0183 32 The maximum deduction that can be claimed under this section is Rs 50 000 Section 80D This deduction is available for premium paid on medical insurance policy