Professional Tax Rebate Under Section Web Overview Working from home Uniforms work clothing and tools Vehicles you use for work Professional fees and subscriptions Travel and overnight expenses Buying other

Web Exon 233 ration L exon 233 ration sp 233 cifique applicable aux contrats de professionnalisation conclus avec les demandeurs d emploi 226 g 233 s de 45 ans et plus ou entre un groupement Web 24 mars 2017 nbsp 0183 32 A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual

Professional Tax Rebate Under Section

Professional Tax Rebate Under Section

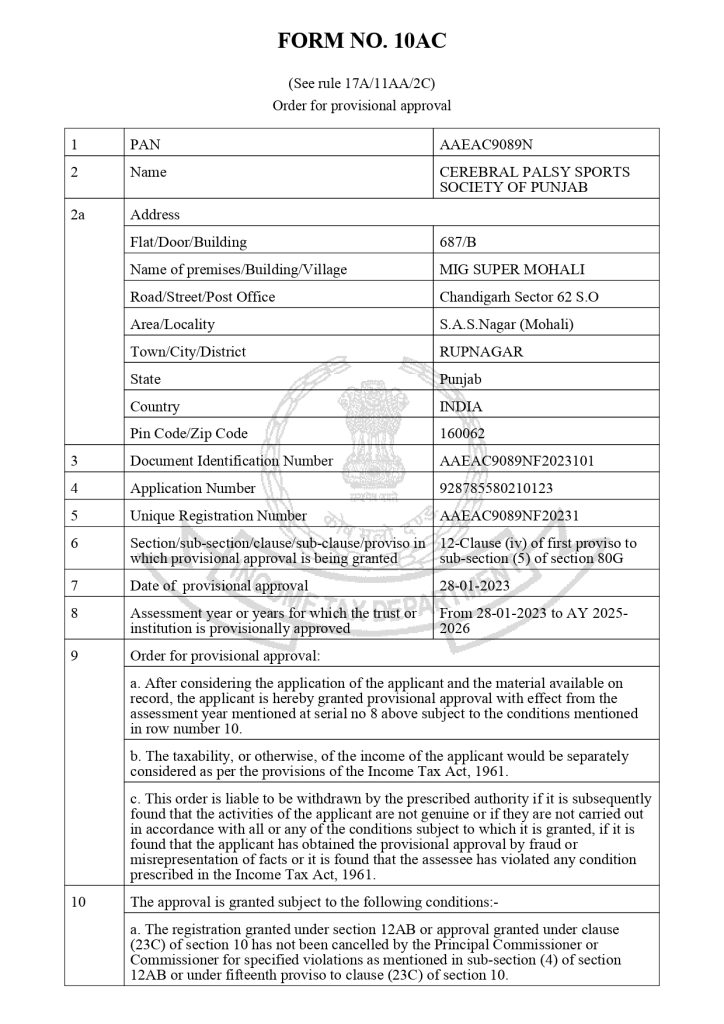

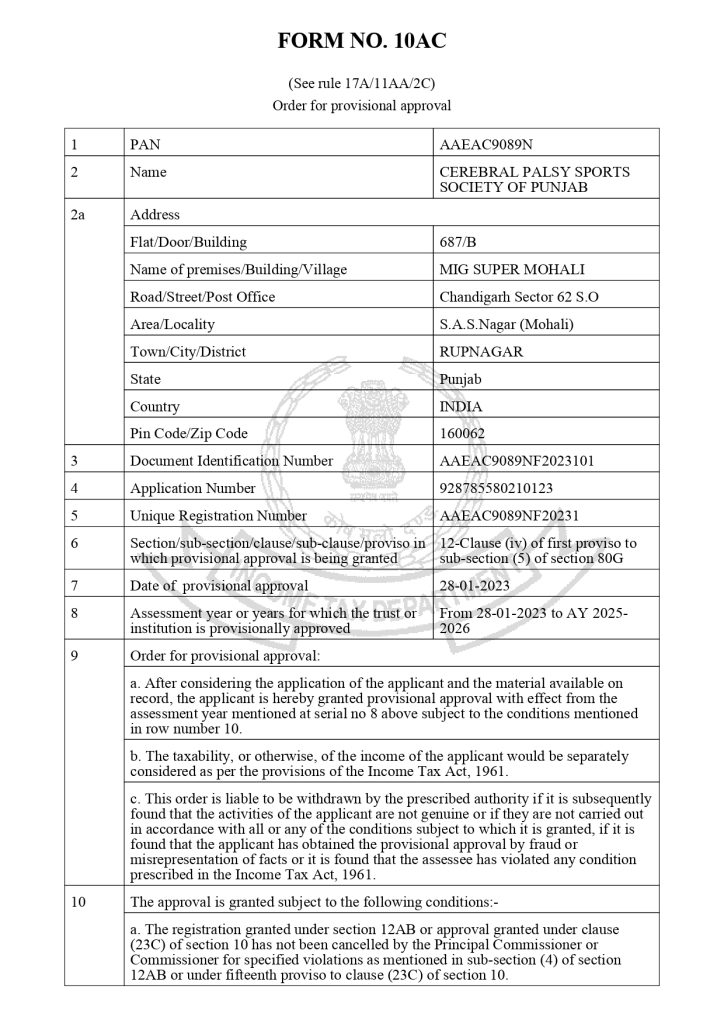

http://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0001-724x1024.jpg

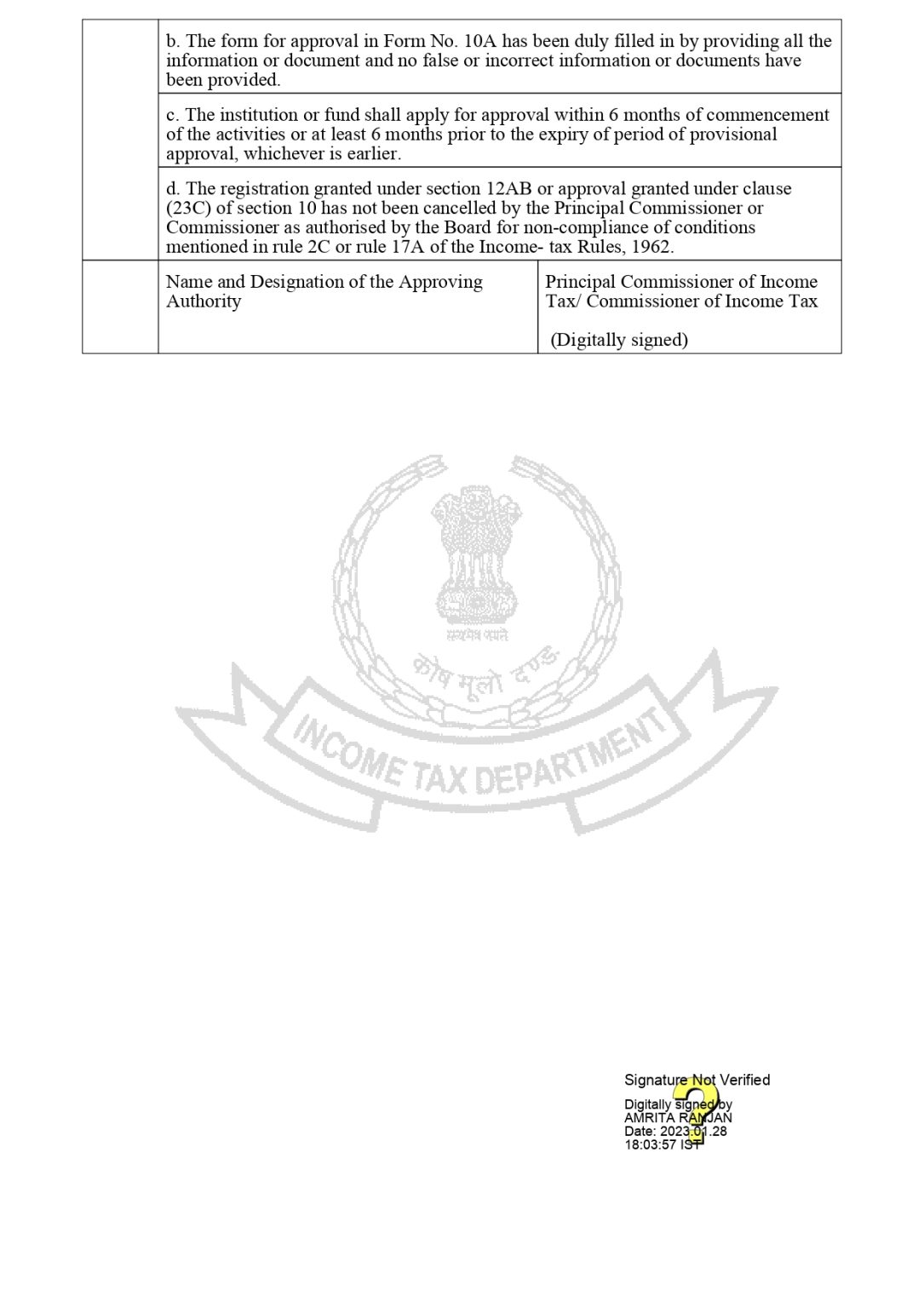

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

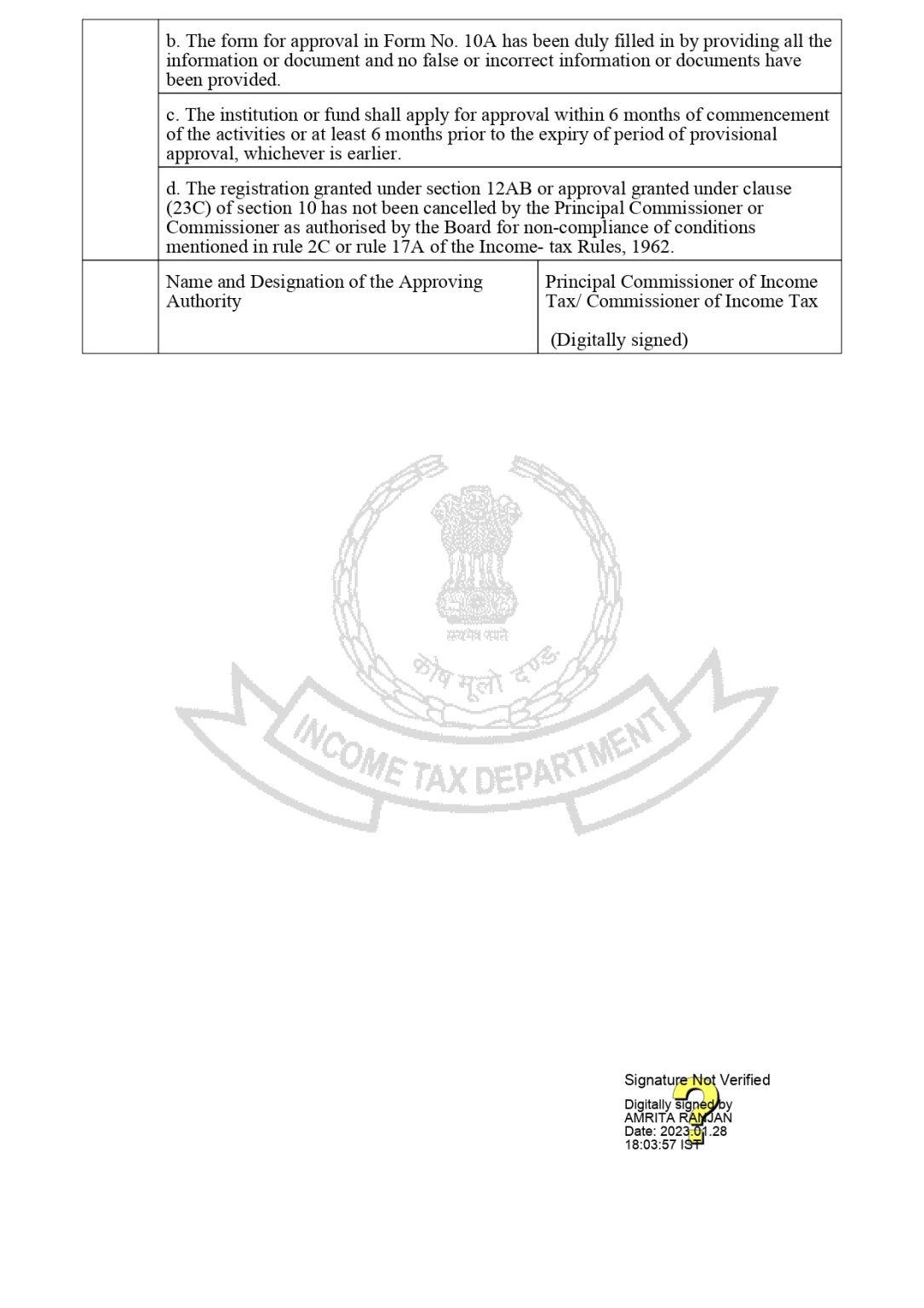

https://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0002-1085x1536.jpg

Income Tax Rebate Under Section 87A

https://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

Web 17 mai 2018 nbsp 0183 32 Professional tax is a tax on all kinds of professions trades and employment and is levied based on the income of such profession trade and employment It is levied Web 31 ao 251 t 2023 nbsp 0183 32 Guidance List of approved professional organisations and learned societies List 3 Check the HMRC list of professional bodies to see if you can claim tax relief on

Web Les professionnels lib 233 raux qui exercent leur activit 233 en entreprise individuelle sont impos 233 s personnellement 224 l imp 244 t sur le revenu sur les b 233 n 233 fices qu ils r 233 alisent Web 20 Travaux publics Conducteurs d engins et de camions d entreprises 10 Article 5 de l annexe IV du code g 233 n 233 ral des imp 244 ts dans sa r 233 daction en vigueur au 31 d 233 cembre

Download Professional Tax Rebate Under Section

More picture related to Professional Tax Rebate Under Section

Rebate Under Section 87A Of Income Tax Act 1961 Taxup India

https://i2.wp.com/taxupindia.com/wp-content/uploads/2017/04/imageedit_8_8254684858.png?w=539&ssl=1

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-1-638.jpg?cb=1666685634

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://i1.wp.com/myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-1-rev.jpg?resize=321%2C543&ssl=1

Web Section 16 of the Income Tax Act allows for a deduction from the income chargeable to tax for salaried individuals It offers standard deduction u s 16 ia entertainment allowance Web Paying Professional Tax in Advance While one can continue clearing professional tax payments every month businesses and individuals can also clear these tax liabilities in

Web Pursuant to the Finance Act 2020 a new Section 6D was introduced into the ITA to provide an income tax rebate of up to RM20 000 per YA for a period of three consecutive YAs Web 3 ao 251 t 2023 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

Education Rebate Income Tested

https://i2.wp.com/assets1.cleartax-cdn.com/s/img/2019/02/01163903/Budget-2019-middle-class-768x402.png

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

https://www.gov.uk/tax-relief-for-employees/professional-fees-and...

Web Overview Working from home Uniforms work clothing and tools Vehicles you use for work Professional fees and subscriptions Travel and overnight expenses Buying other

https://www.urssaf.fr/portail/home/employeur/beneficier-dune...

Web Exon 233 ration L exon 233 ration sp 233 cifique applicable aux contrats de professionnalisation conclus avec les demandeurs d emploi 226 g 233 s de 45 ans et plus ou entre un groupement

Income Tax Rebate Under Section 87A In Telugu Tax Adda Telugu YouTube

Education Rebate Income Tested

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate Under Section 87A

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Income Tax Rebate Under Section 87a Working And Eligibili Flickr

Professional Tax Rebate Under Section - Web 24 juil 2018 nbsp 0183 32 Exemption from payment of Profession Tax under Section 27A of Profession Tax Act Maharashtra State 1 Deduction Under Section 80U of Income Tax Act 1961