Property Tax Break For Seniors In Georgia The one time Property Tax Relief Grant is a budget proposal by Governor Brian Kemp to refund 950 million in property taxes back to homestead owners in the Amended Fiscal Year 2023 budget This proposal became law when Governor Kemp signed HB 18 on March 13 2023

If you re a Georgia senior there are a number of tax exemptions and benefits you may qualify for benefits that will ease your tax burden GeorgiaLegalAid does a great job of explaining the different exemptions and benefits which include Floating inflation proof exemption Double homestead exemption Property tax deferral School tax There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence

Property Tax Break For Seniors In Georgia

Property Tax Break For Seniors In Georgia

https://wehco.media.clients.ellingtoncms.com/img/photos/2023/04/10/102712242_carpenter-crossover_t800.jpeg?90232451fbcadccc64a17de7521d859a8f88077d

The Real Truth About Property Tax Break For Senior Citizens

https://www.seniorassistance.club/img/blog/property-tax-break-for-senior-citizens/01.jpg

Proposition 5 A Property Tax Break For Seniors What You Need To Know

https://media.abc10.com/assets/KXTV/images/2e19dc98-db53-45f4-b9ec-d4bd99c69895/2e19dc98-db53-45f4-b9ec-d4bd99c69895_1920x1080.jpg

A homestead exemption can give you tax breaks on what you pay in property taxes A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence You must file with the county or city where your home is located The L5A Senior School Tax Exemption is a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up to one acre of property You must be 65 years old as of January 1 of the application year or 100 totally and permanently disabled and must occupy your residence within the Gwinnett County

Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10 000 or less you qualify for a 4 000 property tax exemption See Georgia Code 48 5 47 State Senior Age 65 4 000 10 000 Income Limit This is a 4 000 exemption in the state county bond and fire district tax categories In order to qualify you must be 65 years of age on or before January 1 and your annual net income cannot exceed 10 000 for the immediately preceding tax year

Download Property Tax Break For Seniors In Georgia

More picture related to Property Tax Break For Seniors In Georgia

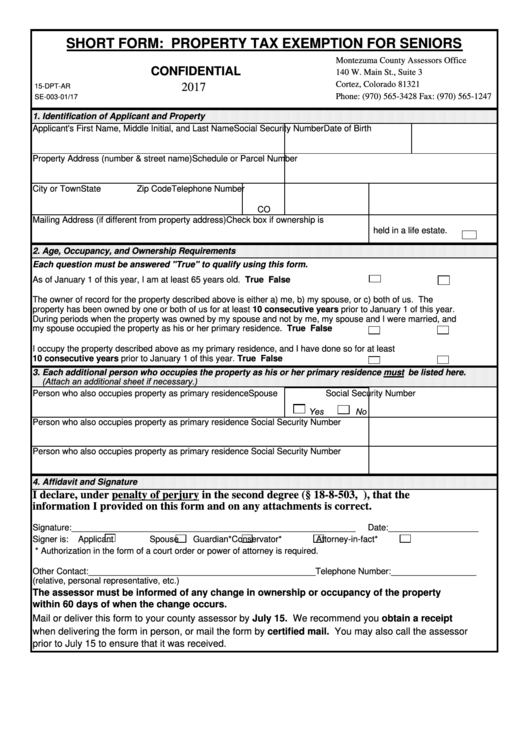

Fillable Short Form Property Tax Exemption For Seniors 2017

https://data.formsbank.com/pdf_docs_html/134/1344/134427/page_1_thumb_big.png

Property Tax Relief For Seniors The Consumer HQ

https://d330kfagldeqw1.cloudfront.net/media/Senior-Tax-relief-.jpg

Tax Breaks For Seniors In Assisted Living Rome GA Riverwood Senior Living

https://riverwoodretirement.com/wp-content/uploads/2020/02/Riverwood-taxes.jpg

DeKalb County offers our Senior Citizens special property tax exemptions The qualifying applicant receives a substantial reduction in property taxes Currently there are two basic requirements Age Requirements Must be 65 years old as of January 1 of the application year Income Requirements Claimant and spouse income cannot exceed 10 000 after deductions compare to line 15C of your Georgia tax return

Property Tax Aide features three property tax relief programs in Georgia Homestead Exemption for 65 Disabled Veteran Surviving Spouse Exemption and the Standard Homestead Exemption A property tax exemption for seniors is a great benefit for homeowners 65 years of age or older Here s how to qualify for one in your state

Property Tax Exemptions Can Give Seniors A Break

https://www.seniorhousingnet.com/wp-content/uploads/2020/04/explanation.jpg

Tax Breaks For Seniors Georgia Living Senior Care

https://georgialivingseniorcare.com/wp-content/uploads/2016/03/business-money-pink-coins.jpg

https://dor.georgia.gov/2023-property-tax-relief-grant

The one time Property Tax Relief Grant is a budget proposal by Governor Brian Kemp to refund 950 million in property taxes back to homestead owners in the Amended Fiscal Year 2023 budget This proposal became law when Governor Kemp signed HB 18 on March 13 2023

https://atlantaseniorsrealestate.com/senior-tax-benefits-and-exemptions

If you re a Georgia senior there are a number of tax exemptions and benefits you may qualify for benefits that will ease your tax burden GeorgiaLegalAid does a great job of explaining the different exemptions and benefits which include Floating inflation proof exemption Double homestead exemption Property tax deferral School tax

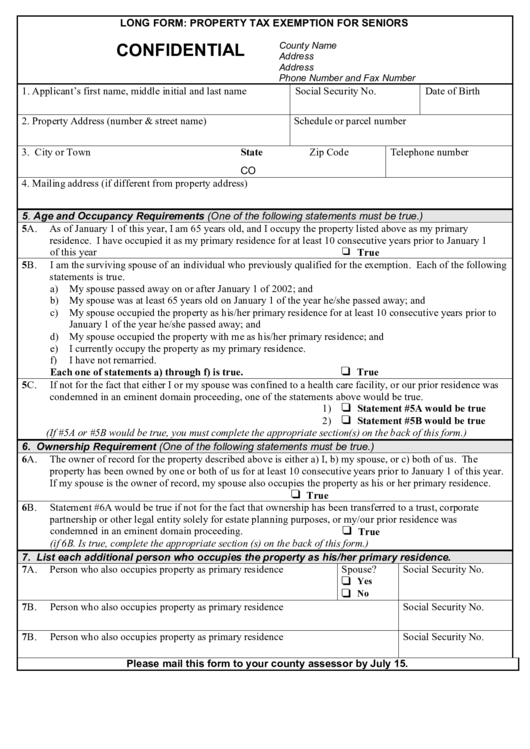

Long Form Property Tax Exemption For Seniors Printable Pdf Download

Property Tax Exemptions Can Give Seniors A Break

Deadline Nears To Apply For Property Tax Break For Seniors

Property Tax Rebate For Seniors Ben Jessome

Miss Lawmakers Propose Property Tax Break For Seniors

300681258

300681258

How To Avoid Tax Mistakes And Enjoy Senior Tax Breaks

Top Tax Breaks For Seniors Happier At Home

The Table Shows The Tax Brackets That Affect Seniors Once You Include

Property Tax Break For Seniors In Georgia - Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10 000 or less you qualify for a 4 000 property tax exemption See Georgia Code 48 5 47