Property Tax Deduction Limit 2023 A group of House representatives wants to repeal or modify the cap on the federal deduction for state and local taxes which affects high tax states The cap is set to expire in 2025 but some states have enacted a

Learn about the tax benefits and credits for homeowners such as the energy efficient home improvement credit the mortgage debt forgiveness exclusion and the Homeowner Assistance Fund Find out the latest changes and updates for Key Takeaways If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local income taxes including

Property Tax Deduction Limit 2023

Property Tax Deduction Limit 2023

https://media.consumeraffairs.com/files/news/Filing_taxes_concept_ShaneKato_Getty_Images.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

For the 2023 tax year for forms you file in 2024 the standard deduction is 13 850 for single filers and married couples filing separately 27 700 for married couples filing jointly and Section 179 deduction dollar limits For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during

This means that your total itemized deductions must exceed the standard deduction which is 12 950 for single filers and 25 900 for married couples filing jointly in 2023 If your itemized deductions are less than the The TCJA limits the amount of property taxes you can claim It placed a 10 000 cap on deductions for state local and property taxes collectively beginning in 2018 This ceiling applies to any income taxes you

Download Property Tax Deduction Limit 2023

More picture related to Property Tax Deduction Limit 2023

Free Of Charge Creative Commons Property Tax Deduction Image Real

https://pix4free.org/assets/library/2021-03-17/originals/property_tax_deduction.jpg

Tax Deductions 2022 Hot Sex Picture

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

IRS Here Are The New Income Tax Brackets For 2023 Economics

https://politicalbullpen.s3.dualstack.us-east-1.amazonaws.com/original/3X/b/c/bcb63b7f3ab927219753f6ac806316c270a1979a.png

Learn how to deduct property taxes from your federal income taxes but be aware of the 10 000 cap and other limits Find out what property is deductible what is not and how If you re a homeowner you can claim the property tax deduction up to 10 000 5 000 for married filing separately Read this complete guide before you file

Homeowners can write off mortgage interest and points property taxes sustainable and accessible home improvements and losses from a federal disaster on their Under current tax law you may deduct up to 10 000 5 000 if single or married and filing separately of property taxes and either state and local income taxes or sales taxes

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

https://www.cnbc.com

A group of House representatives wants to repeal or modify the cap on the federal deduction for state and local taxes which affects high tax states The cap is set to expire in 2025 but some states have enacted a

https://www.irs.gov › publications

Learn about the tax benefits and credits for homeowners such as the energy efficient home improvement credit the mortgage debt forgiveness exclusion and the Homeowner Assistance Fund Find out the latest changes and updates for

Maximize Your Paycheck Understanding FICA Tax In 2024

10 Business Tax Deductions Worksheet Worksheeto

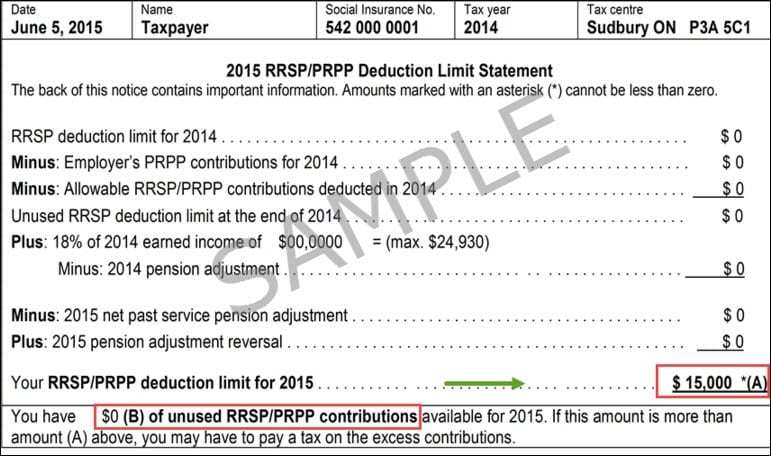

How Much Can I Contribute To My RRSP Common Wealth

Tax Savings Deductions Under Chapter VI A Learn By Quicko

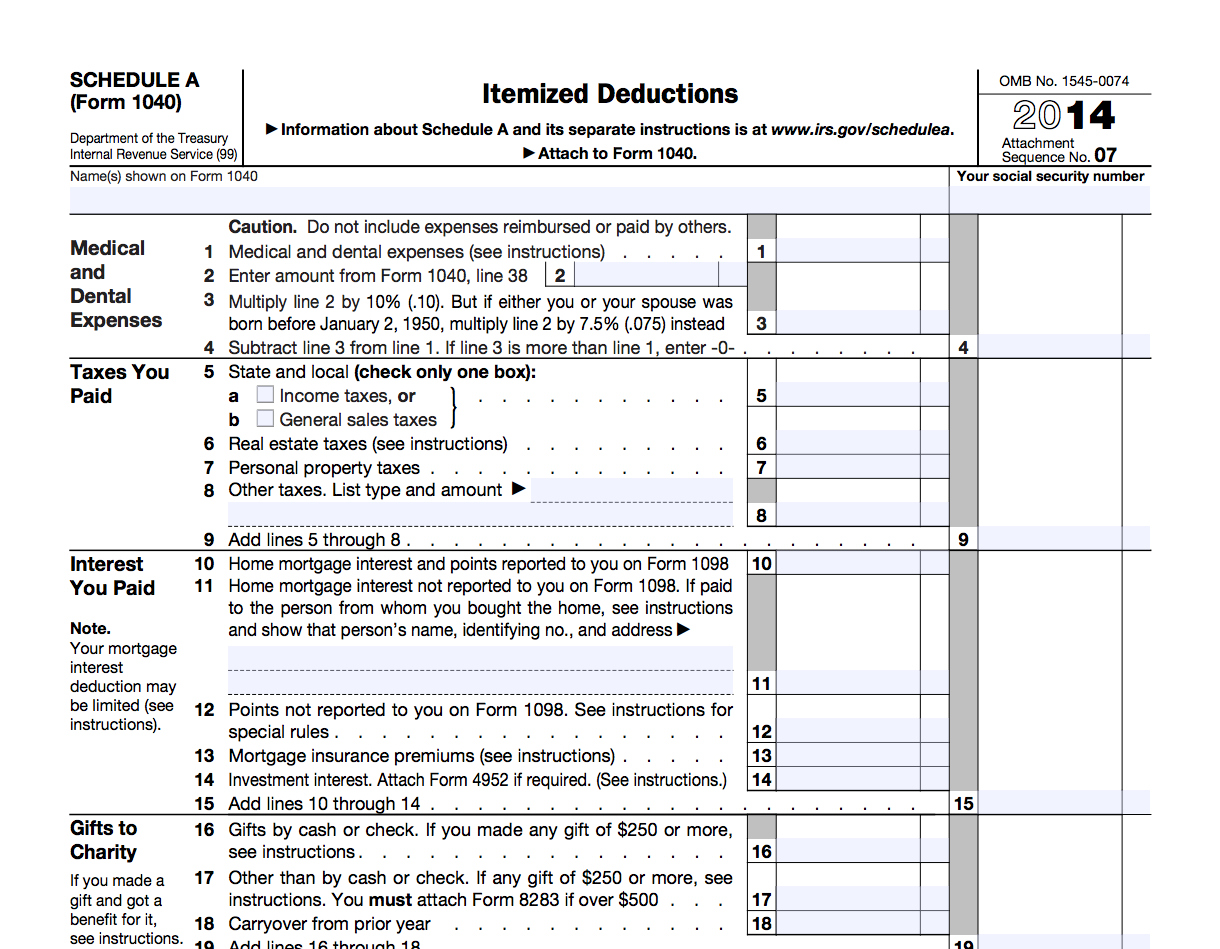

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable

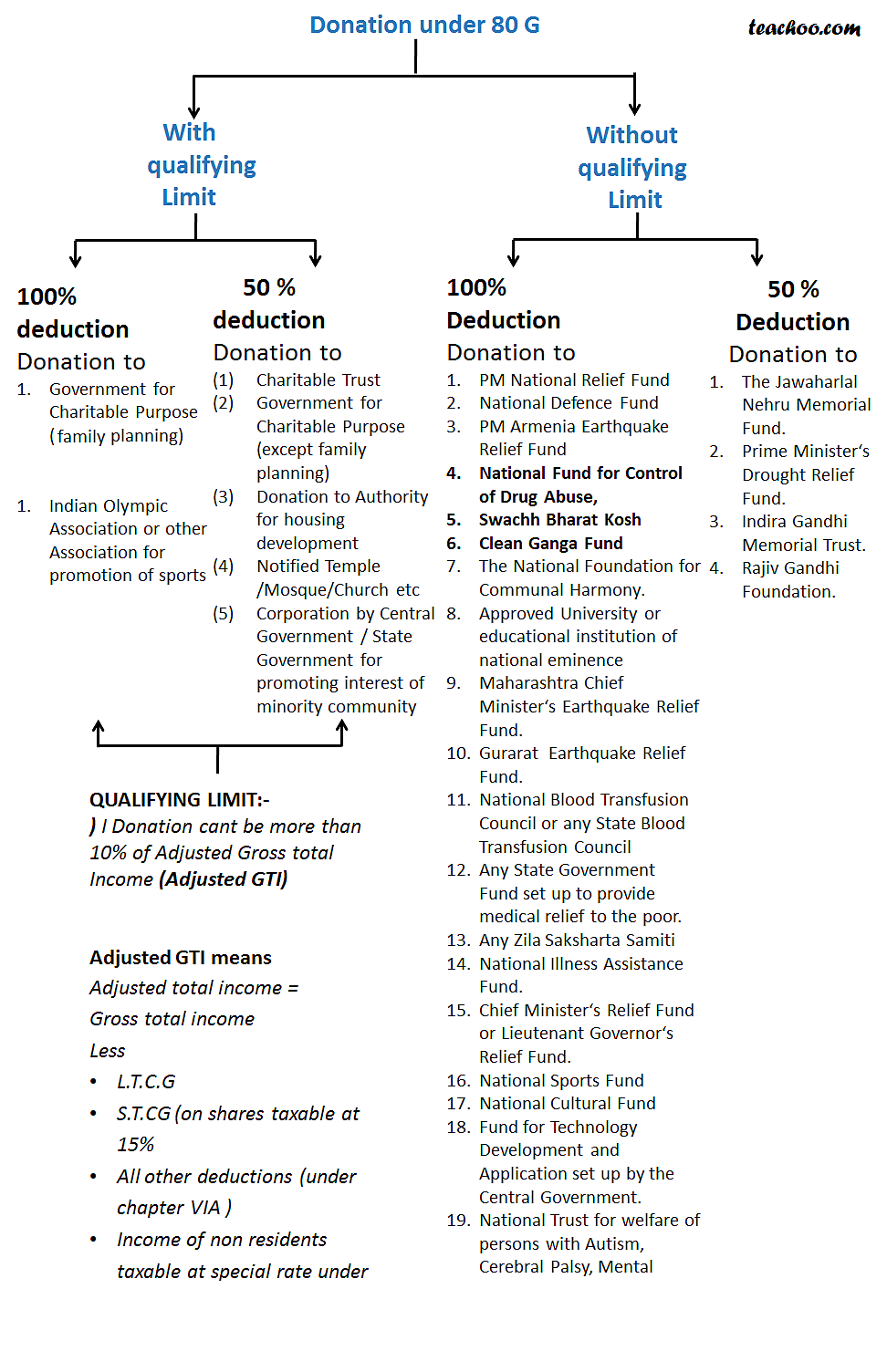

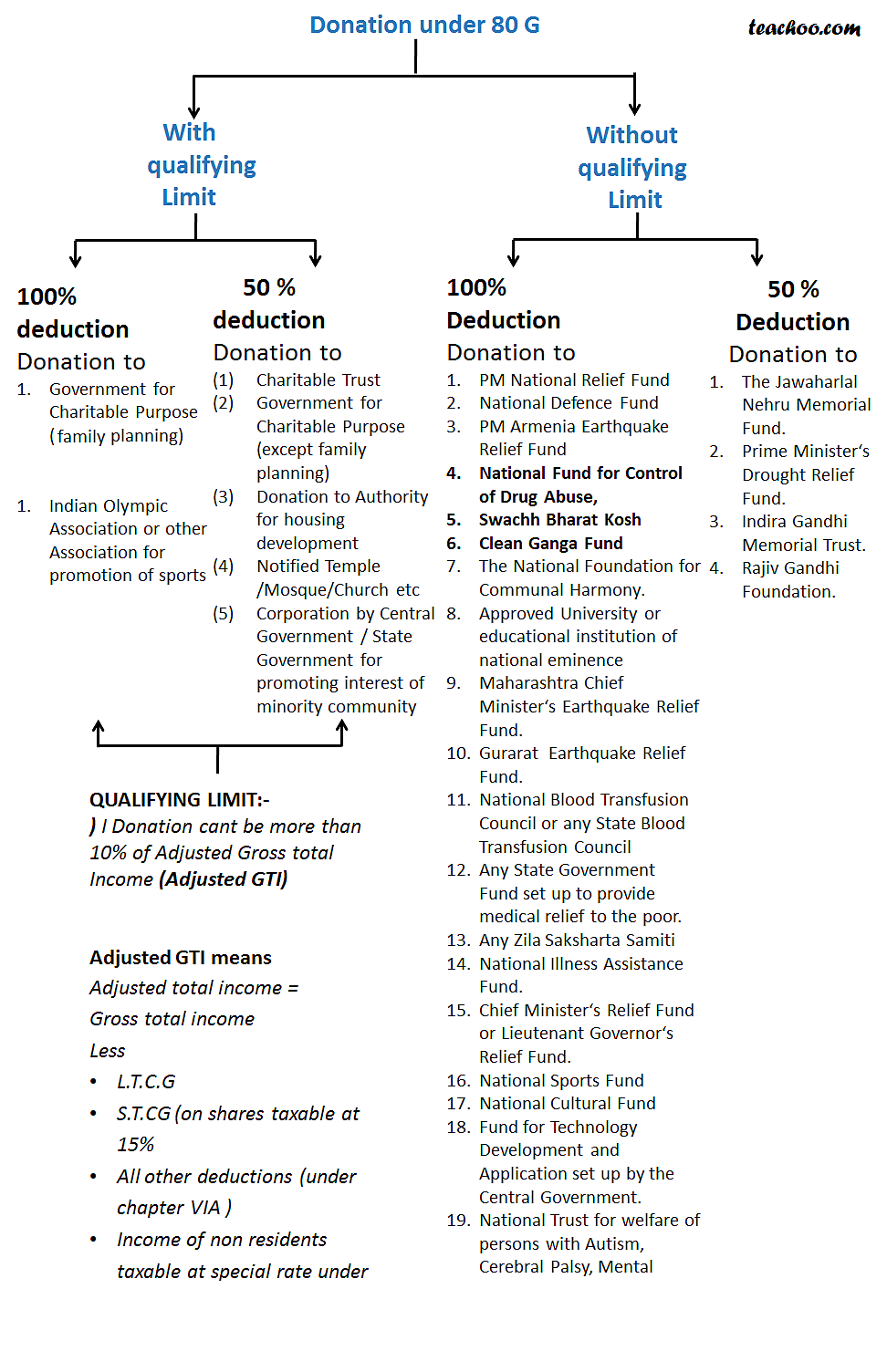

Donations Under Section 80G Deductions In Income Tax Teachoo

Donations Under Section 80G Deductions In Income Tax Teachoo

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog

Income Tax Deductions For The FY 2019 20 ComparePolicy

Standard Deduction 2020 Self Employed Standard Deduction 2021

Property Tax Deduction Limit 2023 - Section 179 deduction dollar limits For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during