Property Tax Deduction Limit 2024 You owned the home in 2023 for 243 days May 3 to December 31 so you can take a tax deduction on your 2024 return of 946 243 365 1 425 paid in 2024 for 2023 You add the remaining 479 1 425 946 of taxes paid in 2024 to the cost basis of your home

Overall limit As an individual your deduction of state and local income general sales and property taxes is limited to a combined total deduction of 10 000 5 000 if married filing separately You may be subject to a limit on some of your other itemized deductions also Discover the 2024 Property Tax Deduction Limit and key tips to optimize your deductions Stay informed about tax saving opportunities

Property Tax Deduction Limit 2024

Property Tax Deduction Limit 2024

https://pix4free.org/assets/library/2021-03-17/originals/property_tax_deduction.jpg

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

A group of bipartisan House representatives relaunched the state and local tax caucus last week calling for relief from the 10 000 limit on the federal deduction for state and local taxes Nov 5 2024 10 48 a m ET called for the restoration of a huge tax break the state and local tax deduction That deduction is currently capped at 10 000 but the limit expires after next

Deductions for state and local sales income and property taxes remain in place and are limited to a combined total of 10 000 or 5 000 for married taxpayers filing separately In 2024 the limit is 10 000 for both single and married taxpayers filing jointly and 5 000 for married taxpayers filing separately The process of claiming a property tax deduction involves several steps First the taxpayer must ensure that they are eligible to claim the deduction

Download Property Tax Deduction Limit 2024

More picture related to Property Tax Deduction Limit 2024

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Income Tax Return Deduction Limit In Budget 2022 23

https://gservants.com/wp-content/uploads/2022/02/1.jpg

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local income taxes including property taxes is limited to 10 000 per year The maximum amount you can take for the SALT deduction for 2024 taxes filed in 2025 is 10 000 The limit for those married filing separately is 5 000

[desc-10] [desc-11]

2021 Taxes For Retirees Explained Cardinal Guide

https://cardinalguide.com/app/uploads/2021/02/Standard_deductions_2021-751x550.jpg

Maximize Your Paycheck Understanding FICA Tax In 2024

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png

https://www.irs.gov/publications/p530

You owned the home in 2023 for 243 days May 3 to December 31 so you can take a tax deduction on your 2024 return of 946 243 365 1 425 paid in 2024 for 2023 You add the remaining 479 1 425 946 of taxes paid in 2024 to the cost basis of your home

https://www.irs.gov/taxtopics/tc503

Overall limit As an individual your deduction of state and local income general sales and property taxes is limited to a combined total deduction of 10 000 5 000 if married filing separately You may be subject to a limit on some of your other itemized deductions also

Budget 2022 Tax Deduction Limit For State Govt Employees Hiked From 10

2021 Taxes For Retirees Explained Cardinal Guide

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Standard Deduction 2020 Over 65 Standard Deduction 2021

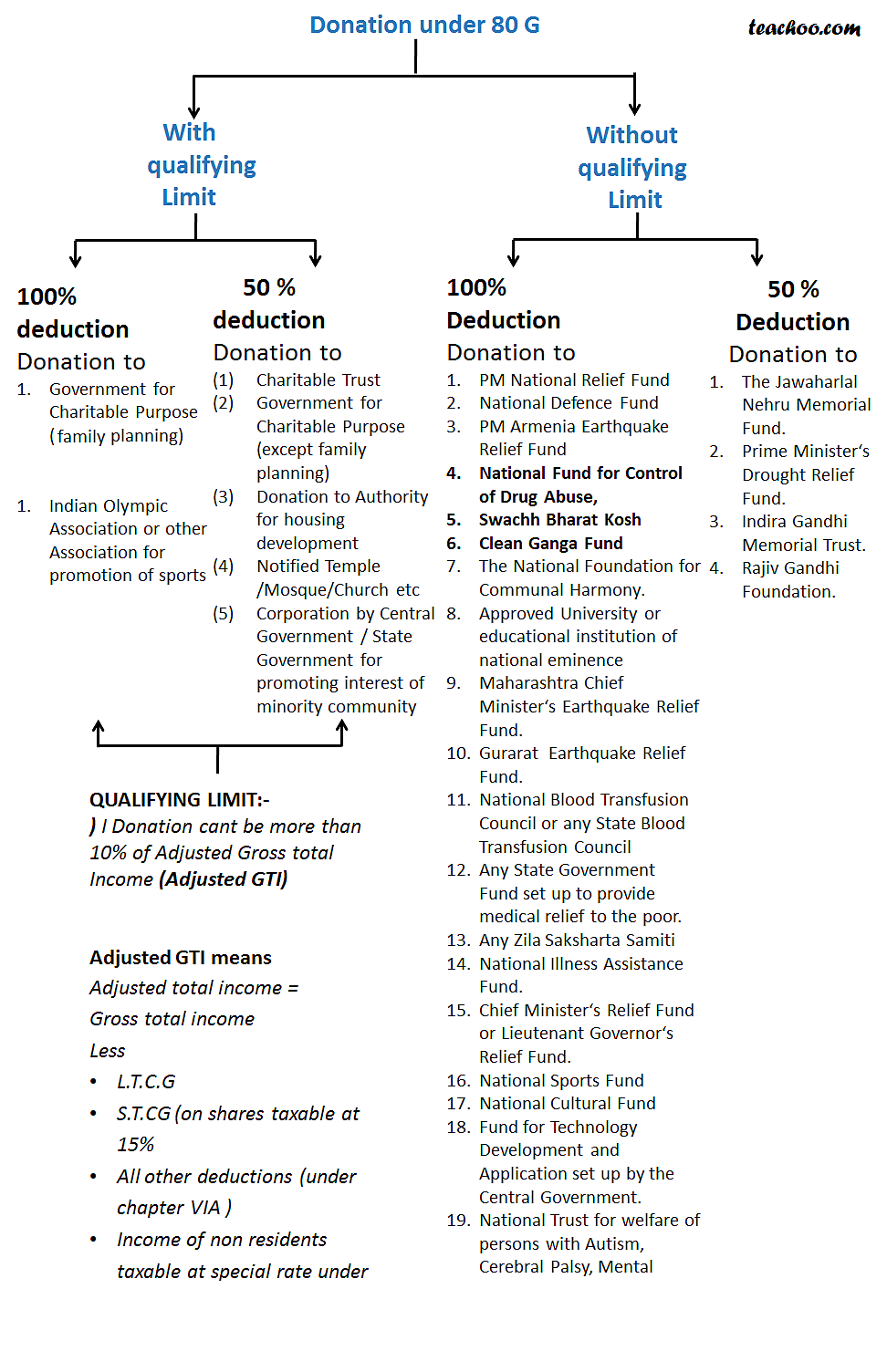

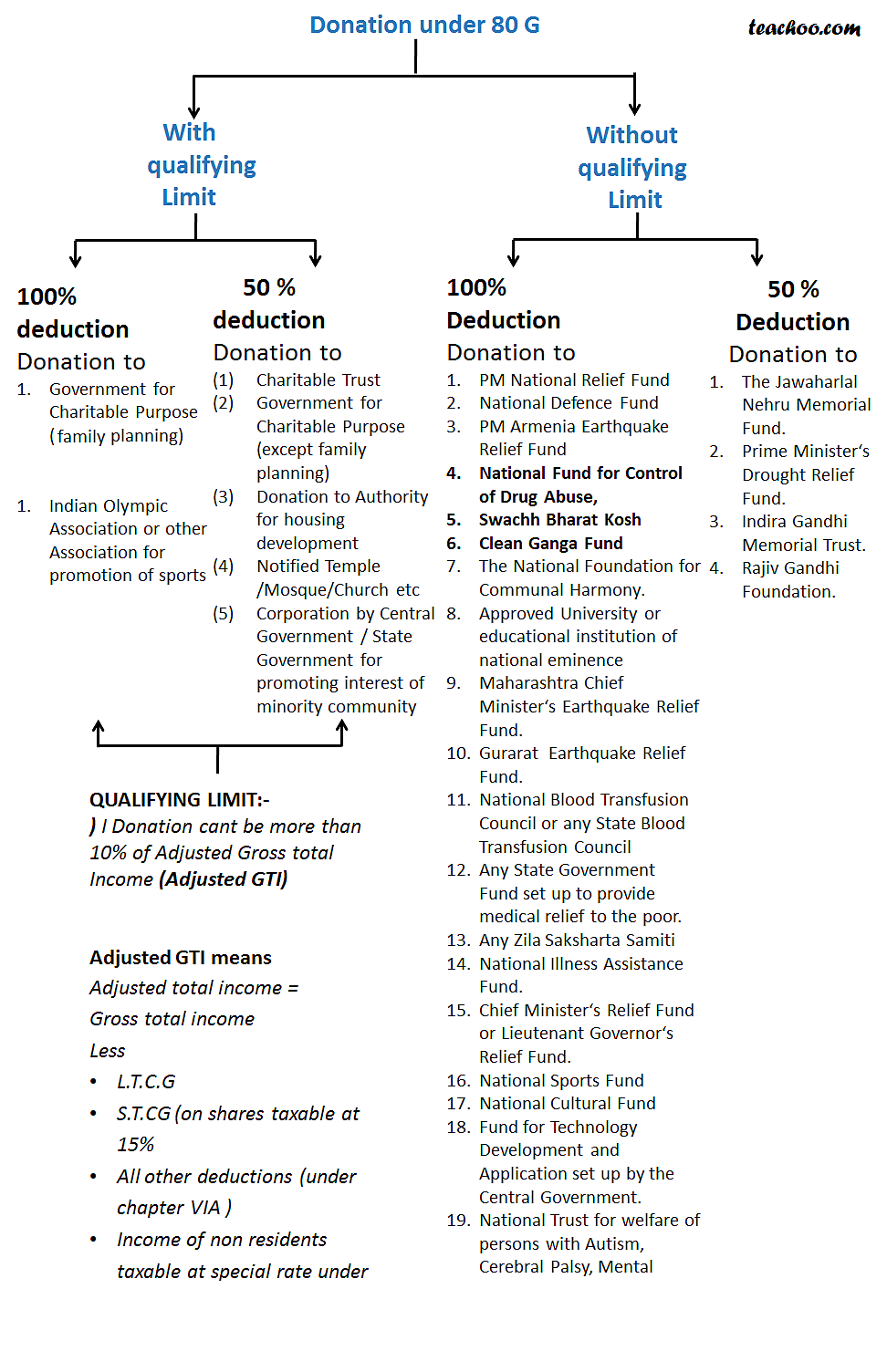

Donations Under Section 80G Deductions In Income Tax Teachoo

Donations Under Section 80G Deductions In Income Tax Teachoo

Earned Income Tax Credit For Households With One Child 2023 Center

What s The Maximum 401k Contribution Limit In 2022 MintLife Blog

Income Tax Deductions For The FY 2019 20 ComparePolicy

Property Tax Deduction Limit 2024 - [desc-12]