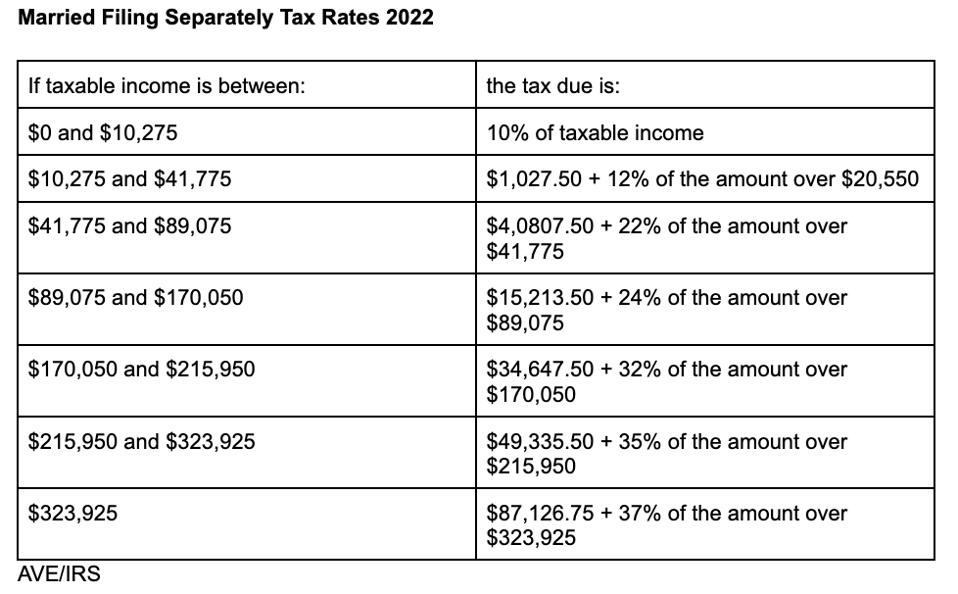

Property Tax Deduction Limit California What is the property tax deduction limit In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes and either state and local

Property taxes in California are assessed based on the value of the property and are typically calculated as a percentage of its assessed value However homeowners can Federal law limits your state and local tax SALT deduction to 10 000 if single or married filing jointly and 5 000 if married filing separately California does not allow a

Property Tax Deduction Limit California

Property Tax Deduction Limit California

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

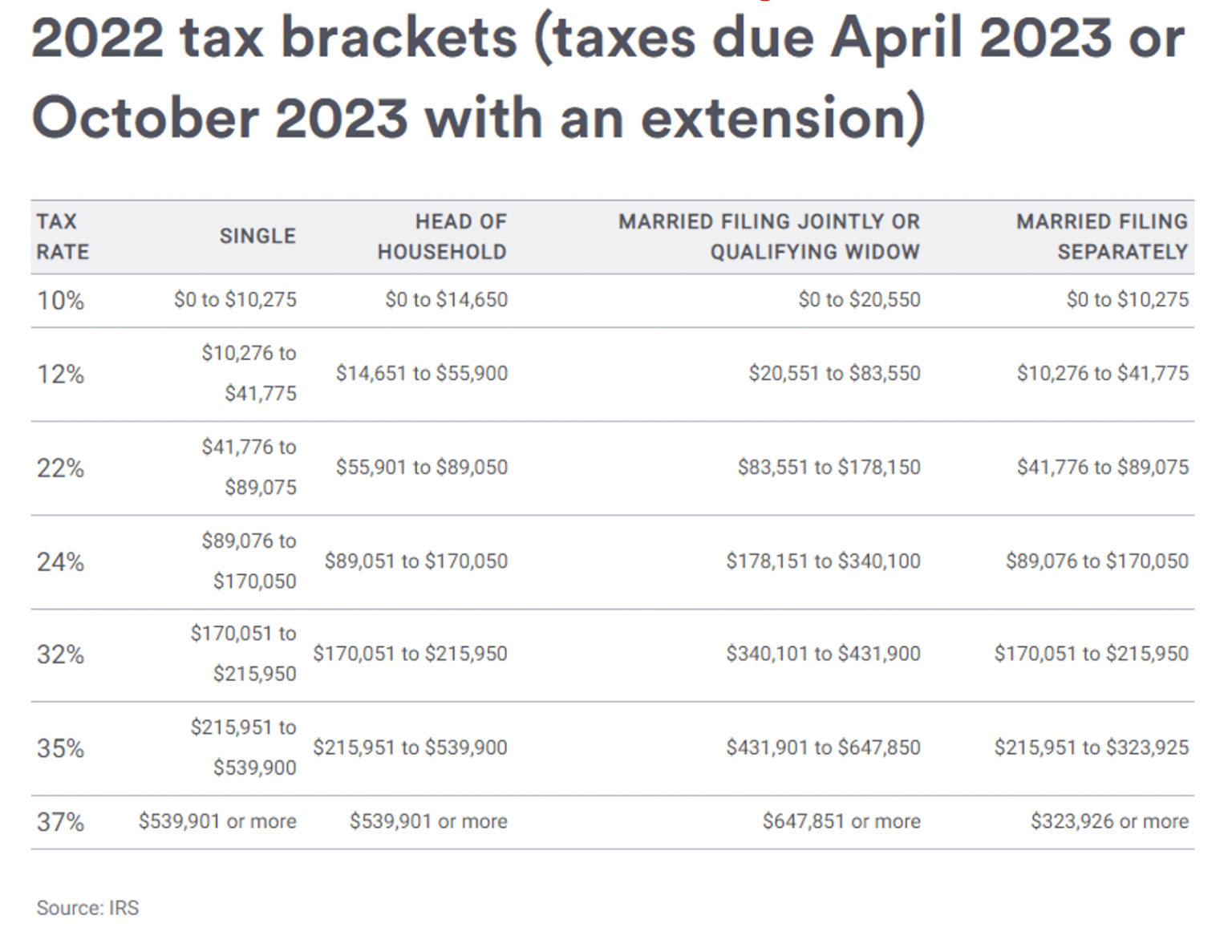

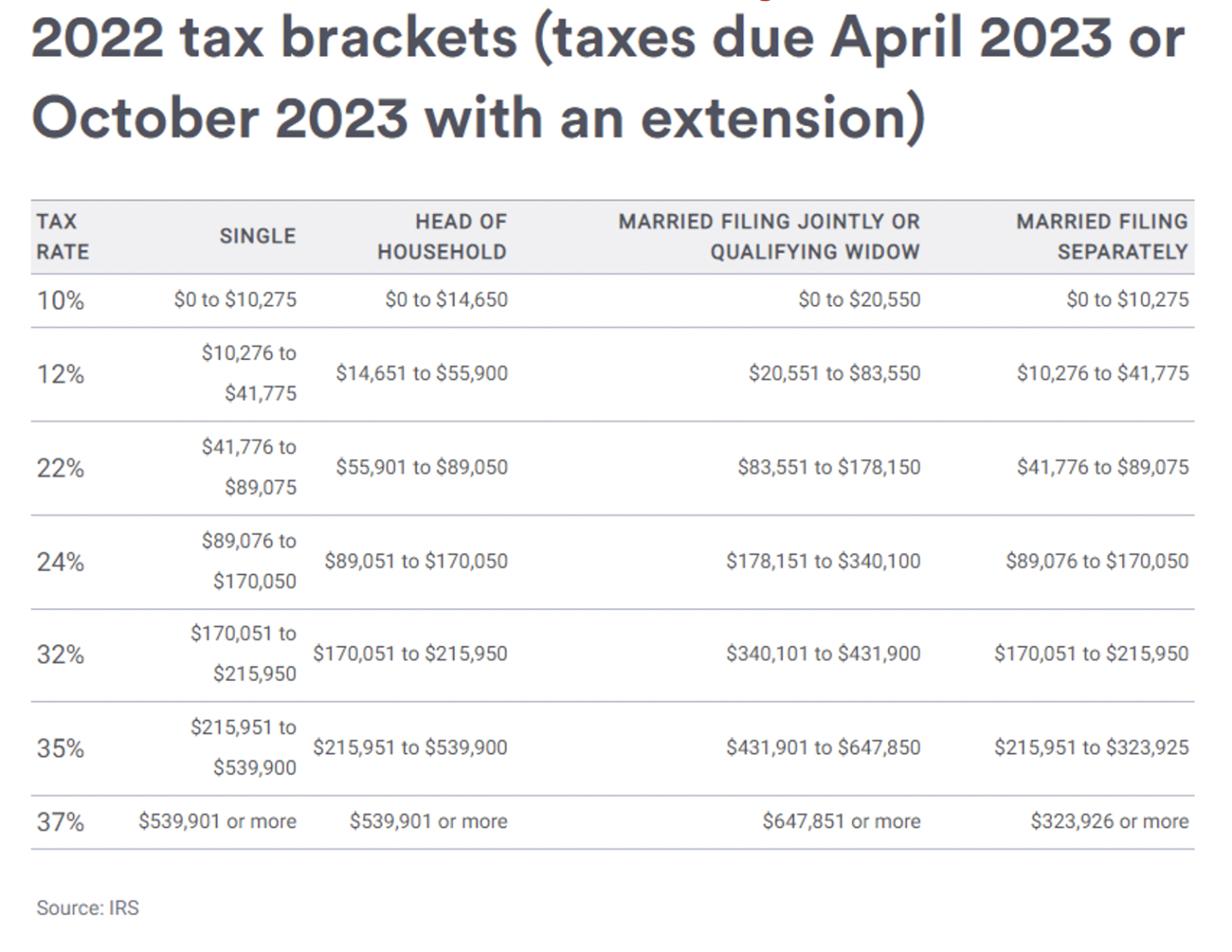

2022 Tax Brackets Pearson Co PC

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Property taxes are generally still tax deductible but this year the deduction is subject to a total cap of 10 000 which includes property taxes plus state and local income The real estate taxes paid on vacant land before the passing of the Tax Cuts and Jobs Act were an itemized deduction on Schedule A Therefore it would appear at first that with the new rules in place these taxes

The California Constitution provides a 7 000 reduction in the taxable value for a qualifying owner occupied home The home must have been the principal place of residence of the owner on Nobody wants to file inaccurate taxes and possibly be hit with penalties However everybody wants to maximize their deductions to minimize the amount of money they owe to the

Download Property Tax Deduction Limit California

More picture related to Property Tax Deduction Limit California

How To Claim The Property Tax Deduction DaveRamsey

https://cdn.ramseysolutions.net/media/blog/taxes/government-and-taxes/property-tax-deduction.jpg

Tax Savings Deductions Under Chapter VI A Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03105750/FigJam-Basics-1-1024x870.jpg

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

Beyond reducing the taxable value of your home California allows for exemptions from property taxes if you meet certain requirements Unlike most states which have Since it is common for California homeowners to pay nearly or in excess of 10 000 of California state taxes alone there will be little to no tax benefit associated with

These scandals led to the passage of Assembly Bill 80 AB 80 in 1966 which imposed standards to hold assessments to market value Some publications and tax form instructions are available in HTML format and can be translated Visit our Forms and Publications search tool for a list of tax forms instructions and

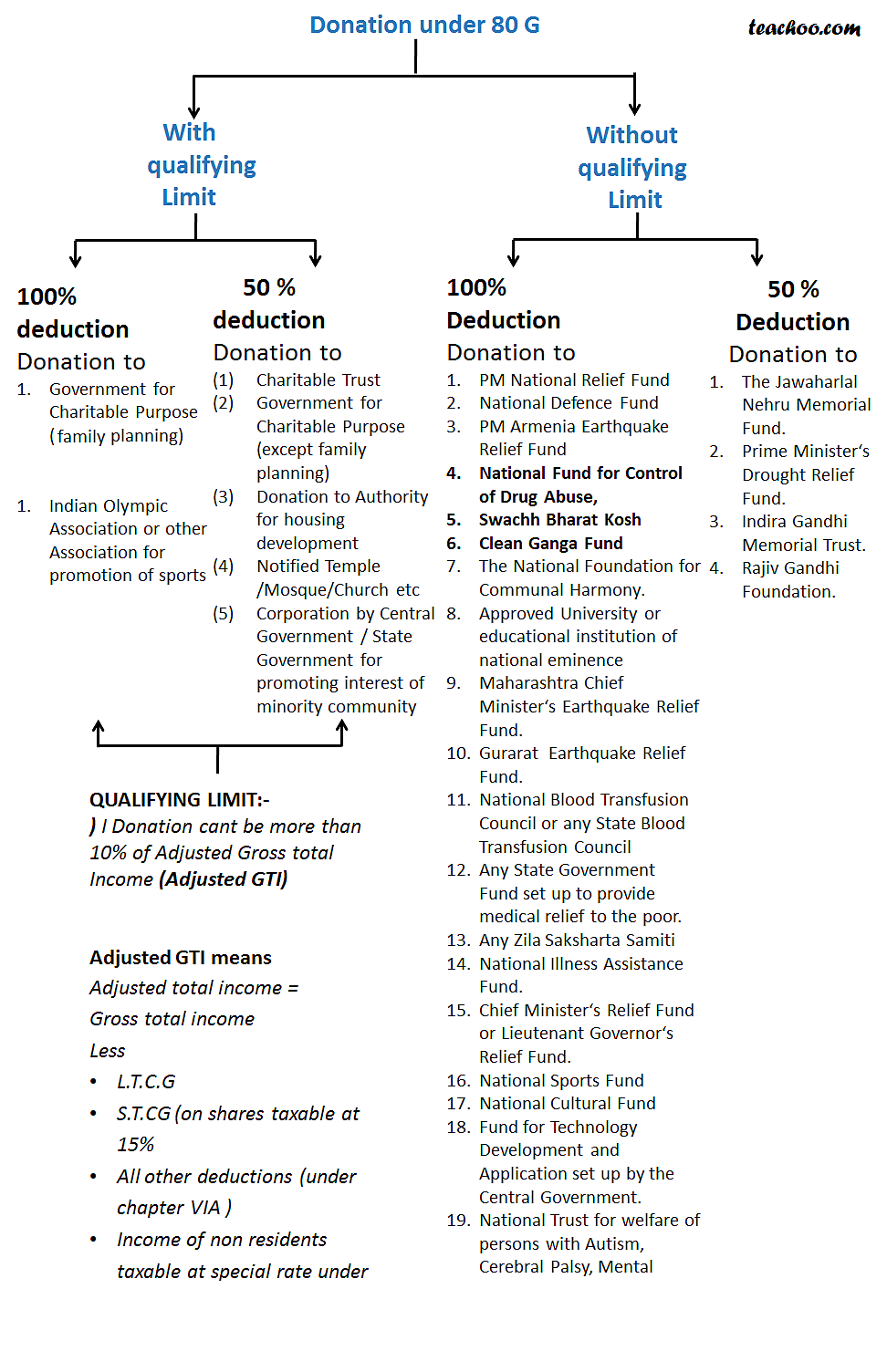

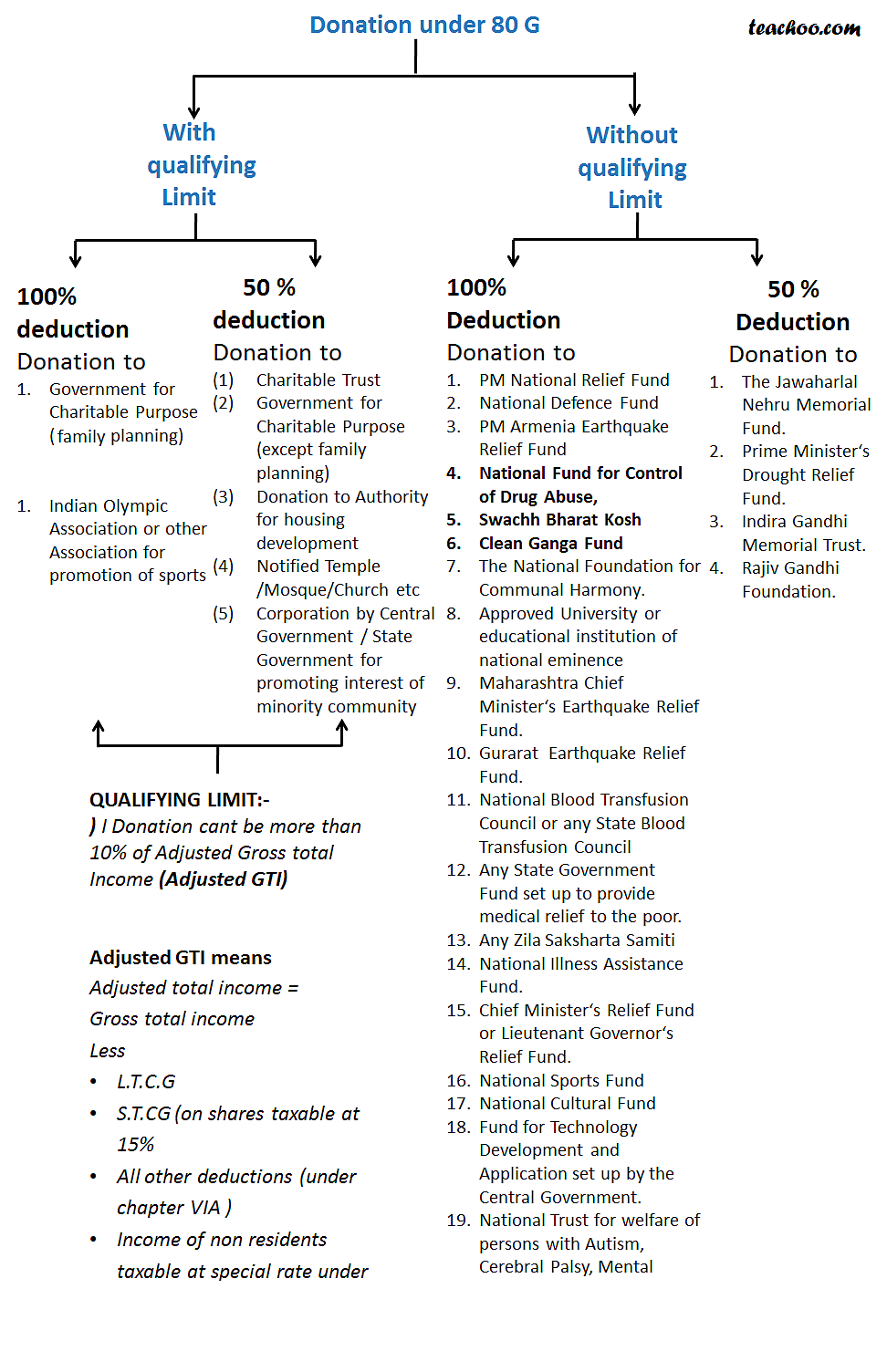

Donations Under Section 80G Deductions In Income Tax Teachoo

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/75f8ccf9-5626-4c24-bf62-37a2b4aa9032/80g-new.png

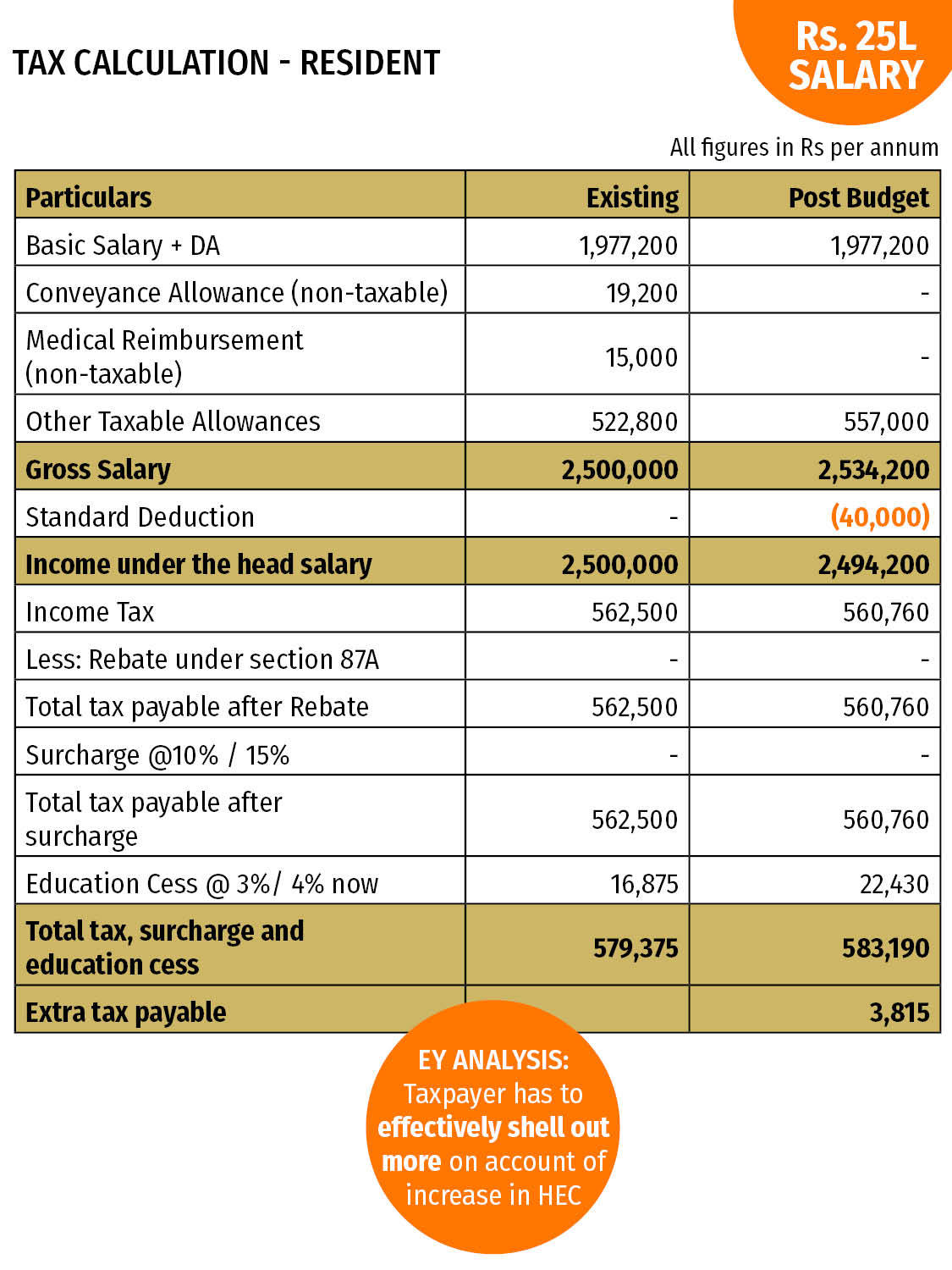

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

https://www.nerdwallet.com › ... › prop…

What is the property tax deduction limit In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes and either state and local

https://www.roberthalltaxes.com › blog › news › ...

Property taxes in California are assessed based on the value of the property and are typically calculated as a percentage of its assessed value However homeowners can

Did You Know The Section 179 Tax Deduction Limit Increased To 1

Donations Under Section 80G Deductions In Income Tax Teachoo

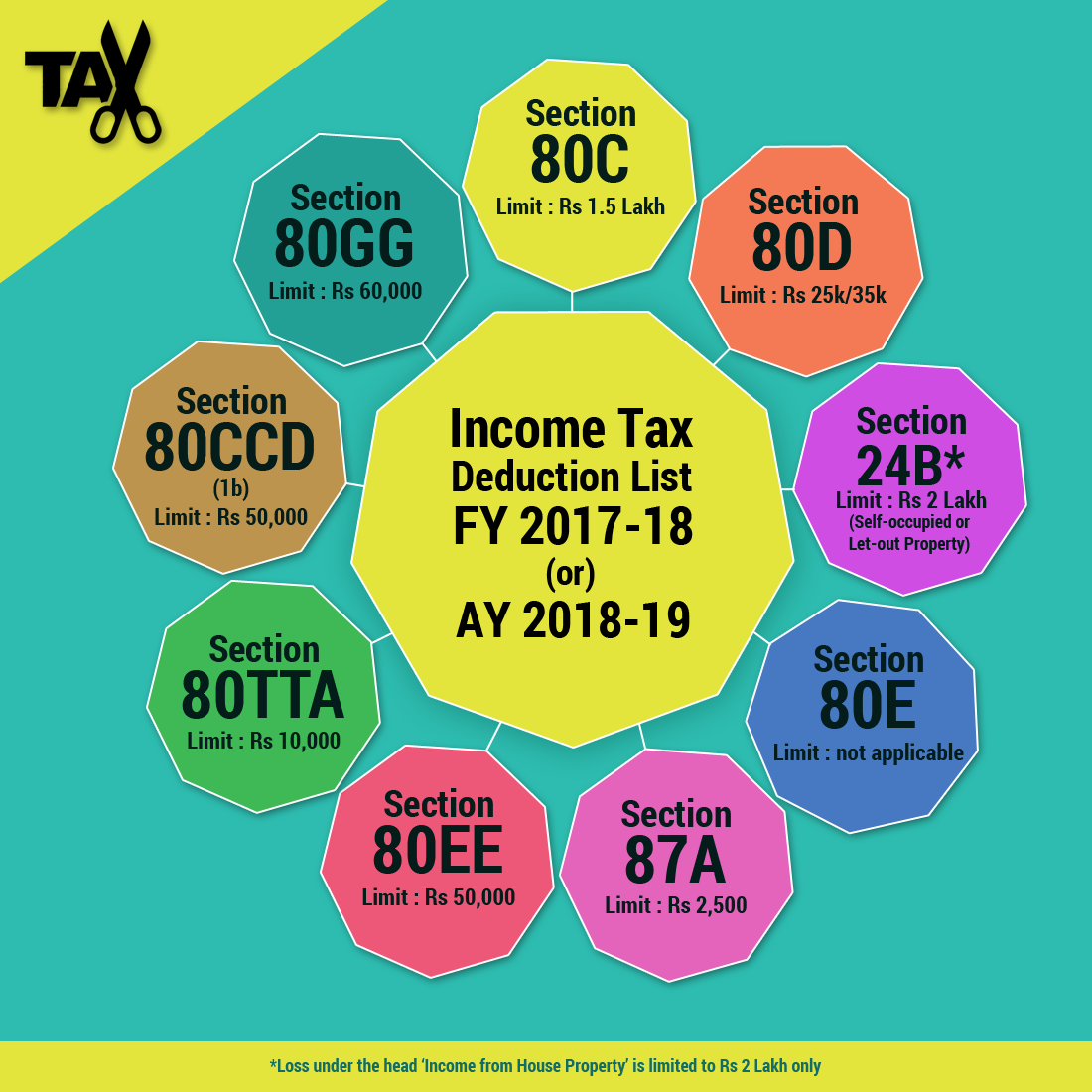

Income Tax Deductions For The FY 2019 20 ComparePolicy

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

How Tax Reform Could Squeeze The Middle Class In Five Scenarios media

IRS Announces 2022 Tax Rates Standard Deduction

How Limit On Property State Tax Deduction Could Hurt Suburbs

Property Tax Deduction Limit California - The California Constitution provides a 7 000 reduction in the taxable value for a qualifying owner occupied home The home must have been the principal place of residence of the owner on