Property Tax Deduction Limit Change In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes

This article will explore how the property tax deduction limit applies to you Before the change individual taxpayers who itemized were allowed a deduction The 2017 Tax Cuts and Jobs Act temporarily capped the deduction for aggregate state and local taxes including income and property taxes or sales taxes in

Property Tax Deduction Limit Change

Property Tax Deduction Limit Change

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

Tax Deductions For Investment Property What To Claim Joust

https://assets-global.website-files.com/5f7d102e662c0b9f1c78a8eb/625520c3a8e5d3e44b863f7a_Tax Deduction.png

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

The House tax bill would eliminate the deduction for state and local income or sales taxes and it would limit the property tax deduction to 10 000 The Senate bill fully repeals the Limiting the property tax deductions hit upper middle class and wealthy families in the New York City suburbs where property taxes easily can exceed 10 000 a year thus curbing homeowners

Real estate taxes Personal property taxes This 10 000 cap applies to all tax filers regardless of their filing status except for married filing separately Separate filers face a 5 000 SALT Second the 2017 law capped the SALT deduction at 10 000 5 000 if you re married and file separately from your spouse This means you can deduct no

Download Property Tax Deduction Limit Change

More picture related to Property Tax Deduction Limit Change

Tax Deductions 2022 Hot Sex Picture

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

The total amount you can deduct depends on changes to the Tax Cuts and Jobs Act passed at the end of 2017 It affects both itemized and standard deductions Itemized The maximum deduction allowed for state local and property taxes combined is 10 000 So if you paid 5 000 in state and local taxes and 10 000 in property taxes you can deduct 5 000 of the

You can only deduct your property taxes if you itemize your deductions on Schedule A of Form 1040 This means that your total itemized deductions must exceed Previously there was no cap meaning taxpayers could deduct all their property and state income taxes from their federal income taxes Currently the

Income Tax Return Deduction Limit In Budget 2022 23

https://gservants.com/wp-content/uploads/2022/02/1.jpg

Did You Know The Section 179 Tax Deduction Limit Increased To 1

https://i.pinimg.com/originals/99/f8/76/99f87665db9fe8fe308b0f7a53292fb5.jpg

https://www.nerdwallet.com/.../property-tax …

In 2023 and 2024 the SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes

https://www.ssacpa.com/real-estate-taxes-are...

This article will explore how the property tax deduction limit applies to you Before the change individual taxpayers who itemized were allowed a deduction

The Standard Deduction And Itemized Deductions After Tax Reform

Income Tax Return Deduction Limit In Budget 2022 23

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

Income Tax Slabs 2022 23 LIVE Updates Will Sitharaman Give Much Needed

Tax Savings Deductions Under Chapter VI A Learn By Quicko

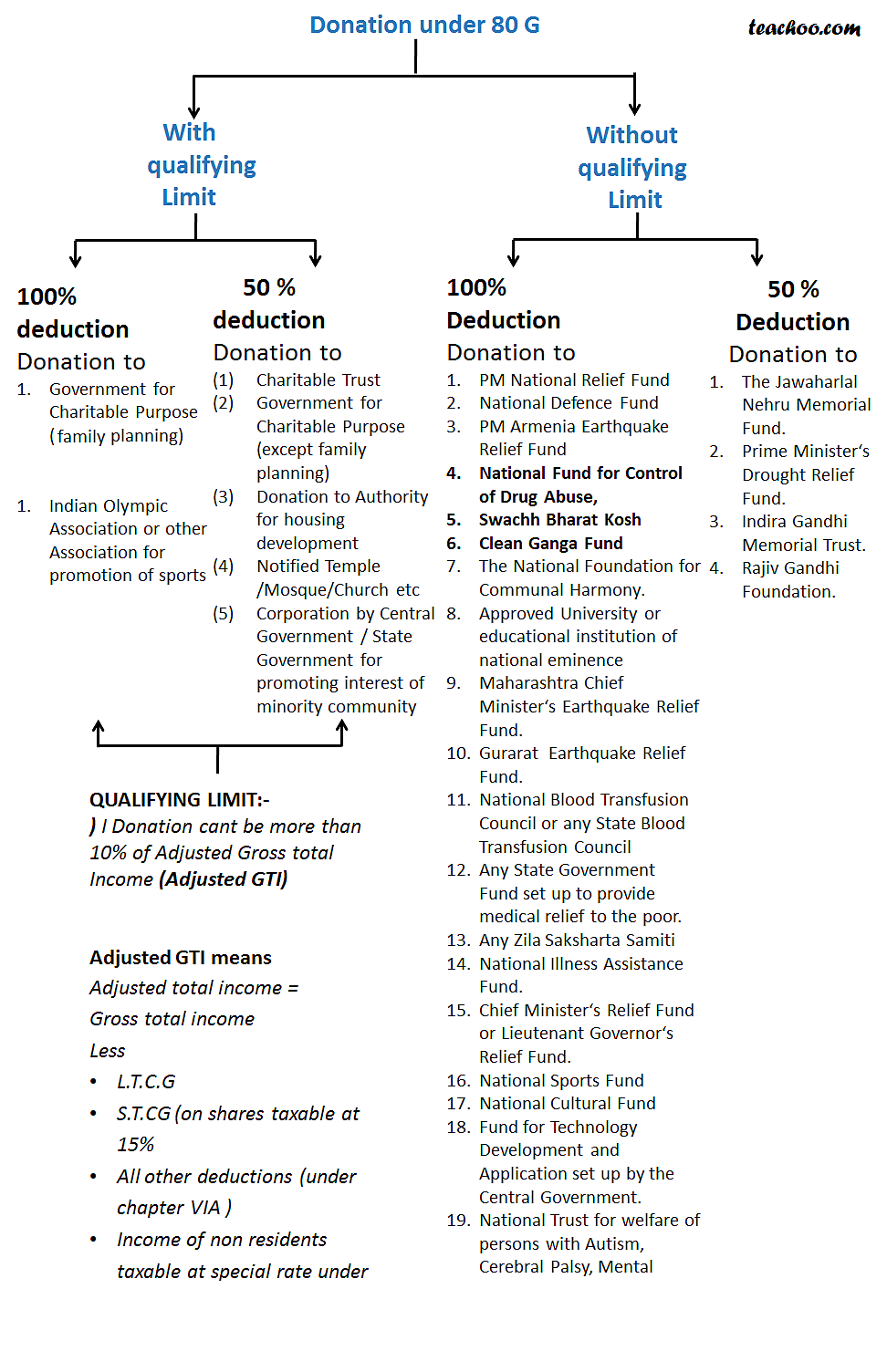

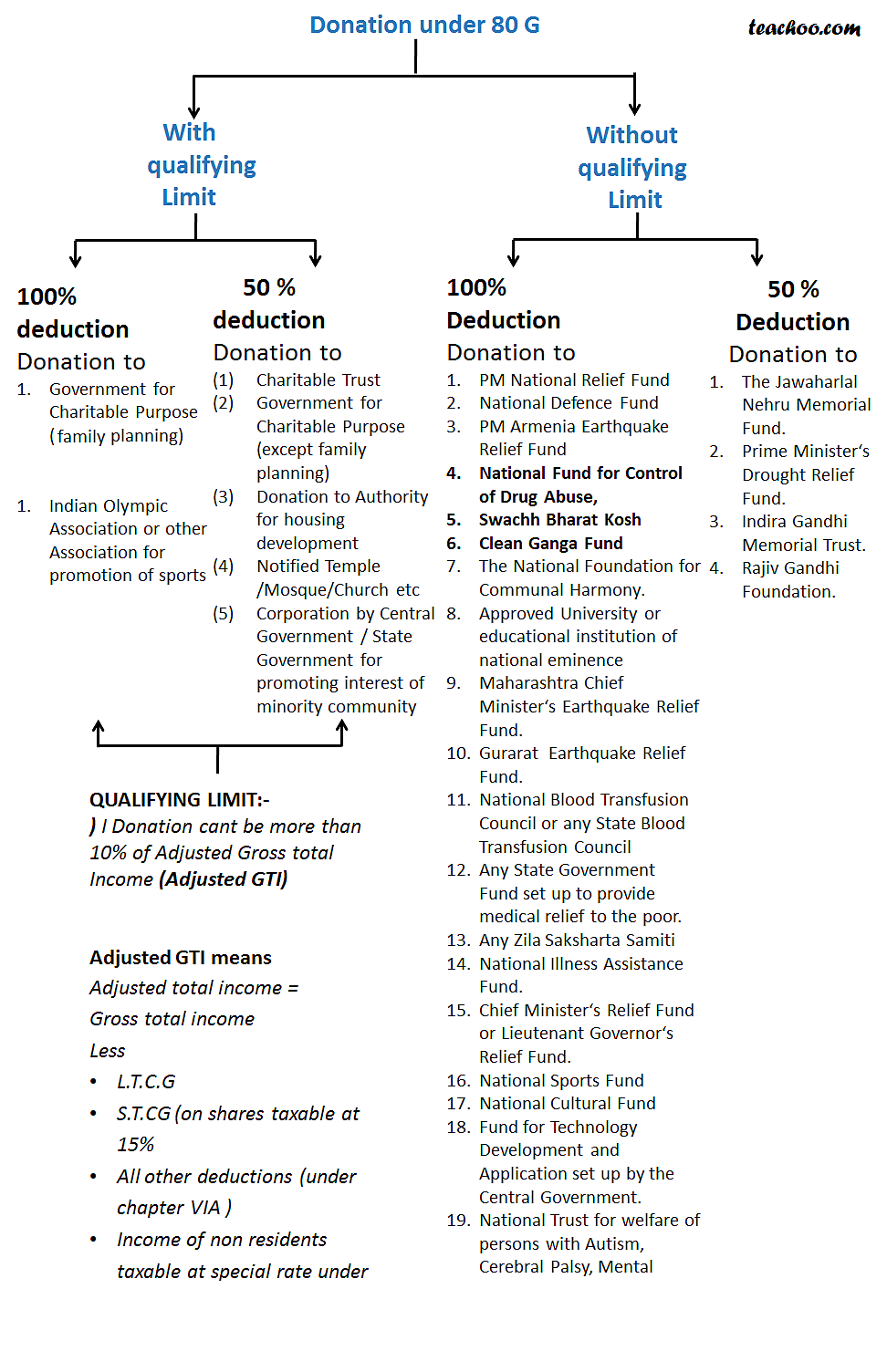

Donations Under Section 80G Deductions In Income Tax Teachoo

Donations Under Section 80G Deductions In Income Tax Teachoo

Budget 2022 Tax Deduction Limit For State Govt Employees Hiked From 10

Standard Deduction 2020 Self Employed Standard Deduction 2021

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Property Tax Deduction Limit Change - Real estate taxes Personal property taxes This 10 000 cap applies to all tax filers regardless of their filing status except for married filing separately Separate filers face a 5 000 SALT