Property Tax Exemption For Disabled In Texas Learn about the property tax exemptions for disabled persons and other qualifying property owners in Texas Find out how to apply what are the requirements and what are the

Tax Code Section 11 131 entitles a disabled veteran who receives 100 percent disability compensation due to a service connected disability and a rating of 100 percent disabled or of individual unemployability to a total property tax A Texas homeowner qualifies for a county appraisal district Disabled Person Exemption if the homeowner is under a disability for the purposes of payment of disability benefits under the

Property Tax Exemption For Disabled In Texas

Property Tax Exemption For Disabled In Texas

https://www.esperaiellolawgroup.com/wp-content/uploads/property-tax-exemption-for-disabled-veterans.jpg

Disabled Veteran Property Tax Exemptions In Texas YouTube

https://i.ytimg.com/vi/4d9PnKtDb-A/maxresdefault.jpg

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

How Much is the Texas Over 65 Tax Exemption All homeowners in Texas can apply for a standard residence homestead exemption that can relieve 40 000 of taxable property value Seniors in Texas can get an Property tax exemptions are available to Texas veterans who have been awarded 10 to 100 disability rating from the VA The following are the exemptions based on Veterans Administration disability ratings 100

The available Texas homeowner exemptions are listed below Follow the links for a description of each exemption and to download exemption forms Homestead Exemption Over 65 Disabled Veterans with a service connected disability are encouraged to file an exemption application form to have their property taxes lowered Some veterans may even qualify for a 100 percent tax

Download Property Tax Exemption For Disabled In Texas

More picture related to Property Tax Exemption For Disabled In Texas

Which States Offer Disabled Veteran Property Tax Exemptions Military

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

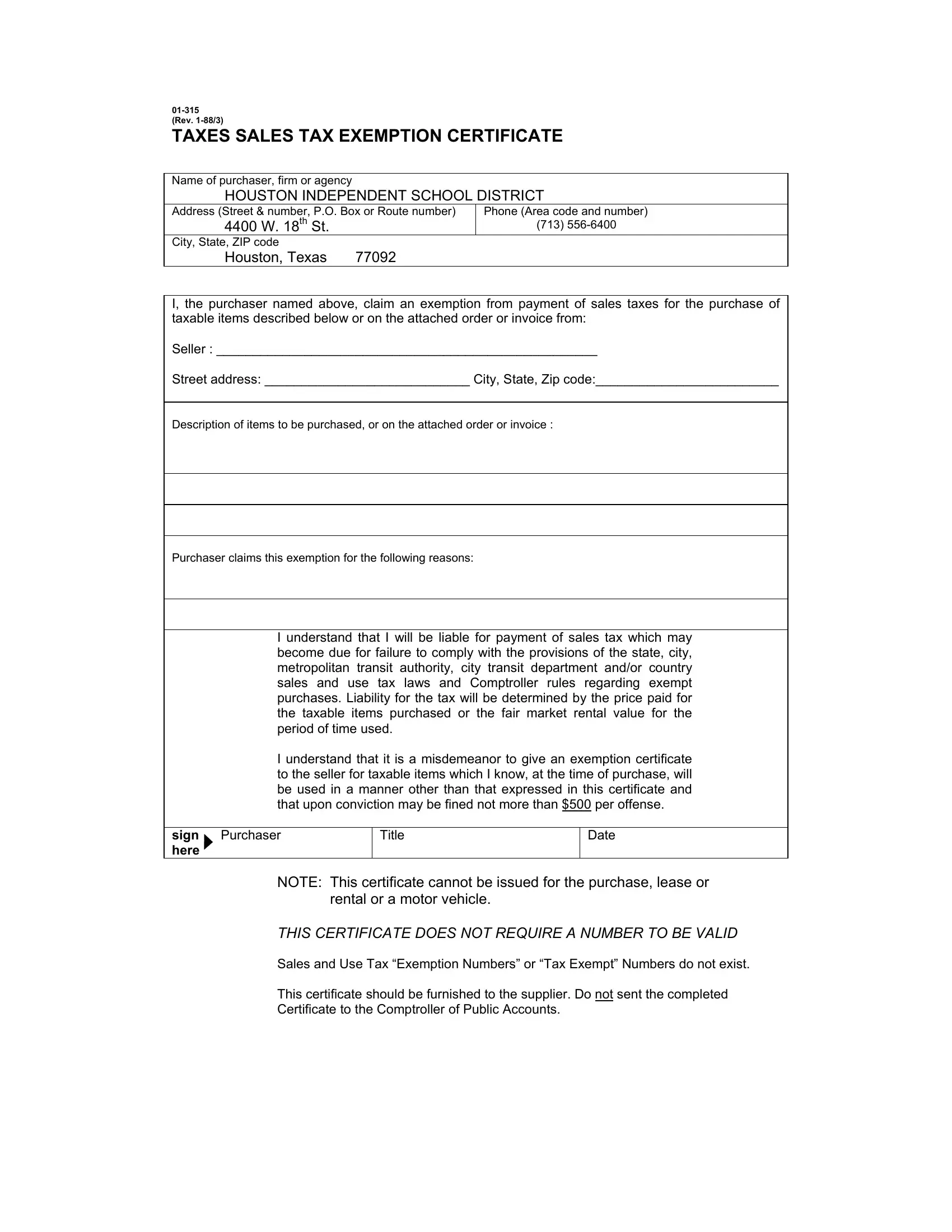

Texas Sales Tax Exemption Certificate PDF Form FormsPal

https://formspal.com/pdf-forms/other/texas-sales-tax-exemption-certificate/texas-sales-tax-exemption-certificate-preview.webp

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

In Texas veterans with a disability rating of 100 are exempt from all property taxes 70 to 100 receive a 12 000 property tax exemption 50 to 69 receive a 10 000 property tax If you qualify for the Age 65 or Older or Disability exemptions you may defer or postpone paying property taxes on your home for as long as you live in it This deferral does not cancel your

If you are a disabled veteran but don t meet the disability ratings required to qualify for 100 disability or Individual Unemployability you can still take advantage of some property However if you re a disabled veteran in Texas there are valuable property tax exemptions available that can significantly reduce or even eliminate the amount you owe Understanding

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

https://img.hechtgroup.com/1664933010645.jpg

https://comptroller.texas.gov/taxes/property-tax/exemptions

Learn about the property tax exemptions for disabled persons and other qualifying property owners in Texas Find out how to apply what are the requirements and what are the

https://texvet.org/propertytax

Tax Code Section 11 131 entitles a disabled veteran who receives 100 percent disability compensation due to a service connected disability and a rating of 100 percent disabled or of individual unemployability to a total property tax

Tax Exemption Form For Veterans ExemptForm

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

Veteran Exemption Ascension Parish Assessor

Disability Car Tax Exemption Form ExemptForm

Property Tax Exemption For Illinois Disabled Veterans

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

Jefferson County Property Tax Exemption Form ExemptForm

2023 Disabled Veteran Property Tax Exemption Lake County Veterans And

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Property Tax Exemption For Disabled In Texas - Age 65 or older and disabled exemptions Over 65 and or disabled residence homestead owners may qualify for a 10 000 homestead exemption for school taxes in addition to the 15 000