Property Tax Exemption In Pa The Homestead Exclusion allows eligible Pennsylvania homeowners to lower the taxable value of their primary residences thereby reducing their overall

You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer You were 65 years of With this exemption the property s assessed value is reduced by 80 000 Most homeowners will save about 1 119 a year on their Real Estate Tax bill starting in

Property Tax Exemption In Pa

Property Tax Exemption In Pa

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

Property Tax Exemption Frequently Asked Questions

https://www.fivestonetax.com/wp-content/uploads/2021/08/Exemption-FAQs.png

Texas Homestead Tax Exemption Cedar Park Texas Living

https://cedarparktxliving.com/wp-content/uploads/2020/12/Homestead-Tax-Exemption-810x810.jpg

Tax exemptions provide tax relief by reducing a property s assessed value Abatements Get a property tax abatement Guidelines for determining which CBS 21 Many Pennsylvania homeowners are eligible for a tax break but they must act fast The Homestead Exclusion Program allows homeowners in their

PENNSYLVANIA DEPARTMENT OF REVENUE PROPERTY TAX RENT REBATE PROGRAM Expanded Income Eligibility and Larger Rebates Now Available Governor All homeowners are eligible for this tax relief as long as they use the property as their primary residence Act quickly The deadline is March 1 For more on

Download Property Tax Exemption In Pa

More picture related to Property Tax Exemption In Pa

Jefferson County Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-short-form-property-tax-exemption-for-seniors-2017-3.png

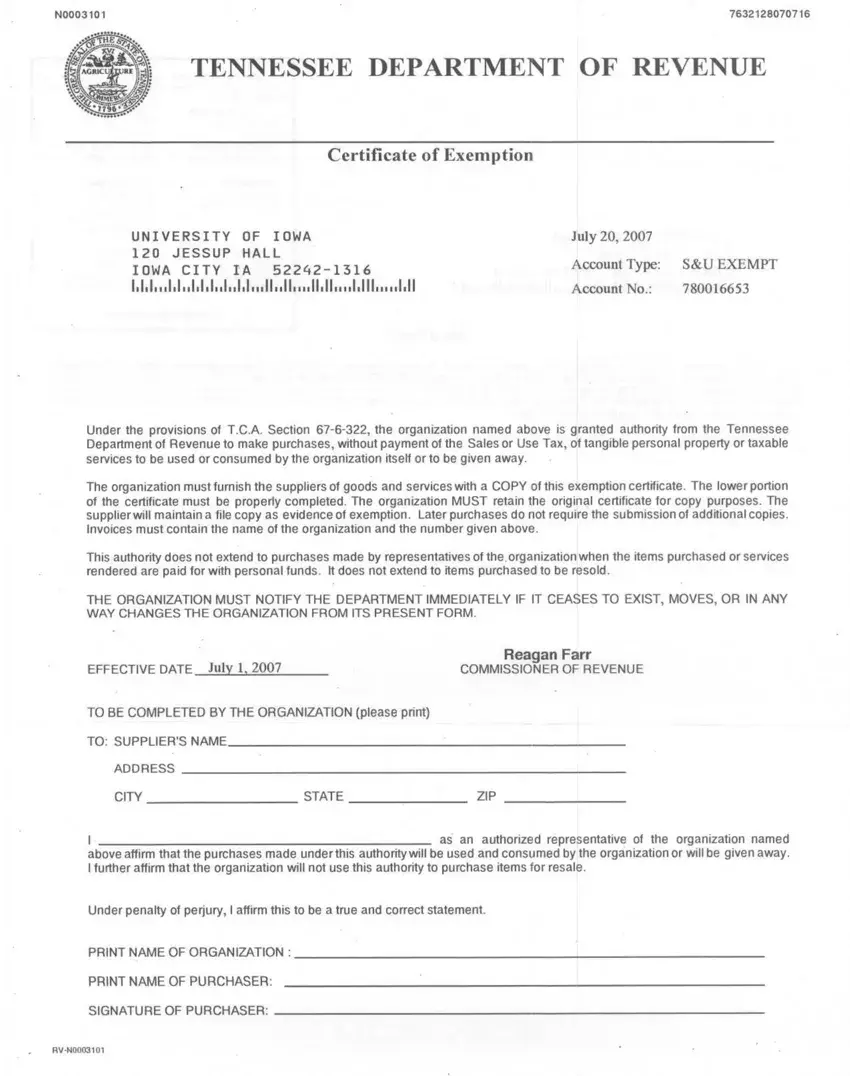

Certificate Of Compliance Template Inspirational Tax Pliance

https://i.pinimg.com/originals/88/3a/dc/883adc3c350a96df6ae4582be0581f7b.jpg

Tennessee Exemption Certificate PDF Form FormsPal

https://formspal.com/pdf-forms/other/tennessee-exemption-certificate/tennessee-exemption-certificate-preview.webp

WKBN Pennsylvania Governor Josh Shapiro signed a historic expansion of a property tax rebate for seniors HB 1100 was signed into law Friday during the August 19 2014 by Law Offices of Spadea Associates LLC If you own a property that is regularly used by a charity or falls into one of the 8 categories below you may be exempt

PA Property Tax Exemptions Some PA homeowners may qualify for exemptions that may lower their property taxes Homestead Farmstead Exemption If Overview of Pennsylvania Taxes Overall Pennsylvania has property tax rates that are higher than national averages In fact the state carries a 1 36 average effective

What Contractors Need To Know About The PA BME Exemption

https://www.troutcpa.com/hs-fs/hubfs/Sales Tax 1.jpg?width=816&name=Sales Tax 1.jpg

Property Tax Exemptions Do You Qualify

https://pics.harstatic.com/content/hr/749-775_pic.jpg

https://www.montcoliving.com/real-estate/2024/2/9/...

The Homestead Exclusion allows eligible Pennsylvania homeowners to lower the taxable value of their primary residences thereby reducing their overall

https://revenue-pa.custhelp.com/app/answers/detail/a_id/181

You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer You were 65 years of

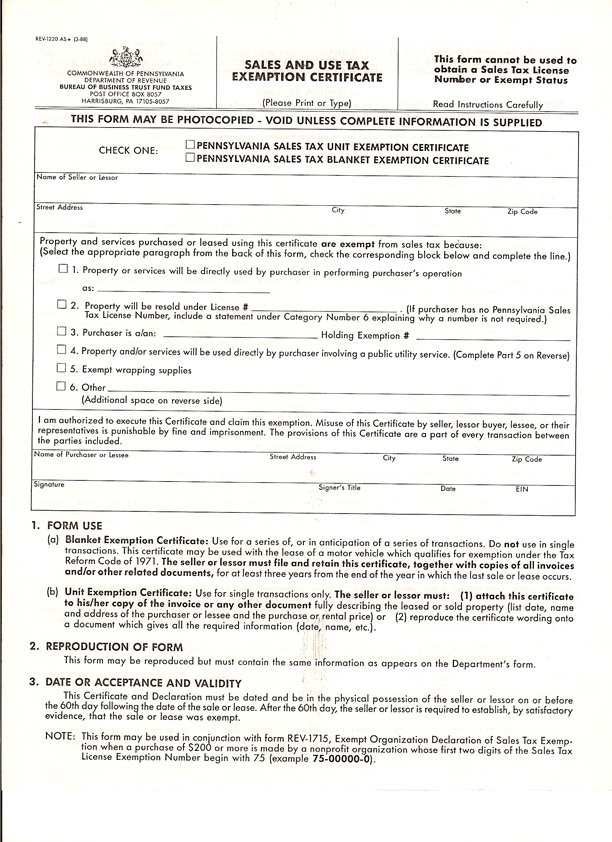

State Sales Tax Pa State Sales Tax Exemption Form

What Contractors Need To Know About The PA BME Exemption

Pa Tax Exempt Form Rev 1220 ExemptForm

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

How To Pay Less Property Taxes Benefit From The Homestead Exemption

Application For Real And Personal Property Tax Exemption 087 Edit

Application For Real And Personal Property Tax Exemption 087 Edit

Pa Estate Tax Exemption 2020 Great If Log Book Efecto

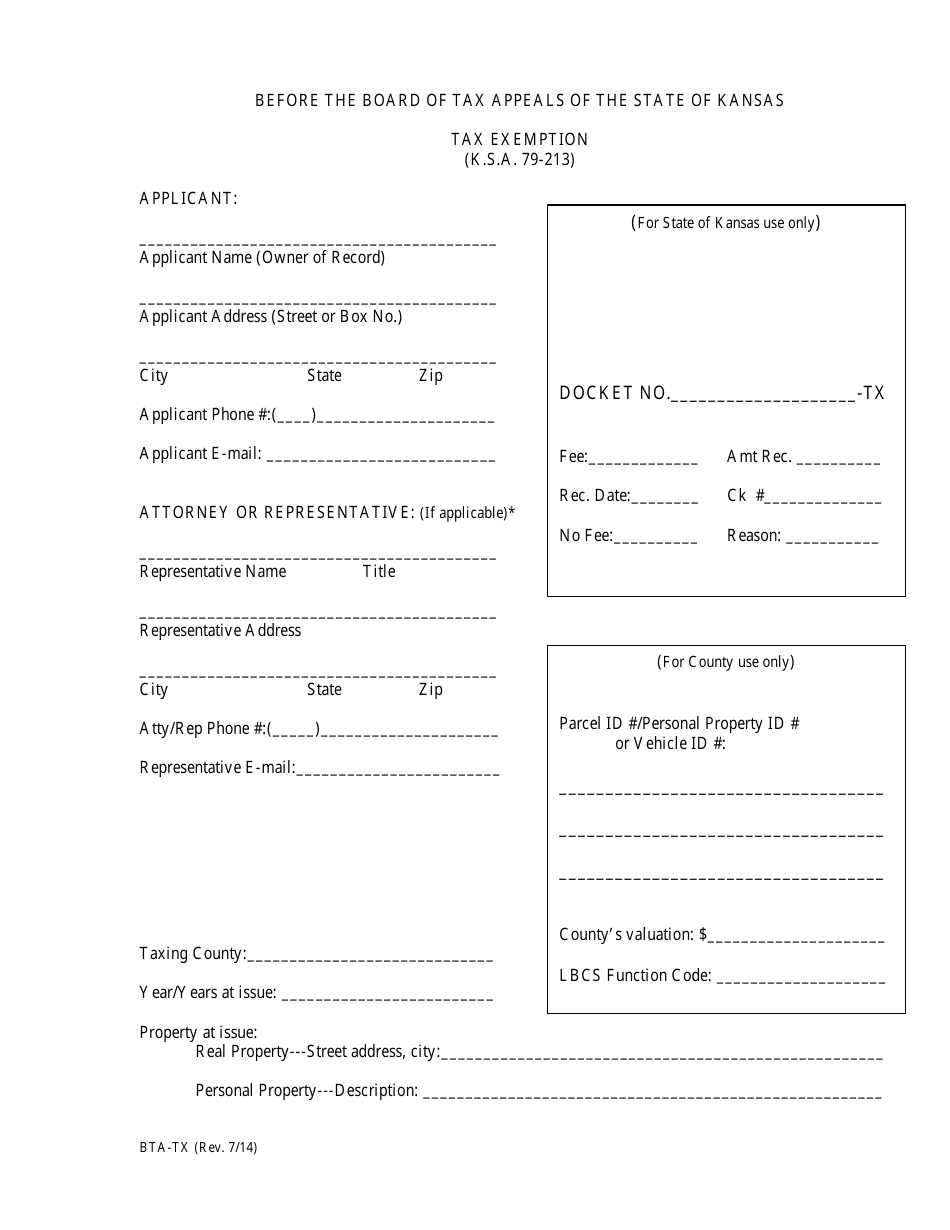

Form BTA TX Fill Out Sign Online And Download Fillable PDF Kansas

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Property Tax Exemption In Pa - CBS 21 Many Pennsylvania homeowners are eligible for a tax break but they must act fast The Homestead Exclusion Program allows homeowners in their