Property Tax Exemptions Palm Beach County Several exemptions are available to Palm Beach County residents For more information on each of these click the links provided or visit Additional Exemptions Do You Qualify brochure Forms beginning with the prefix DR are available online or at any Palm Beach County Property Appraiser office

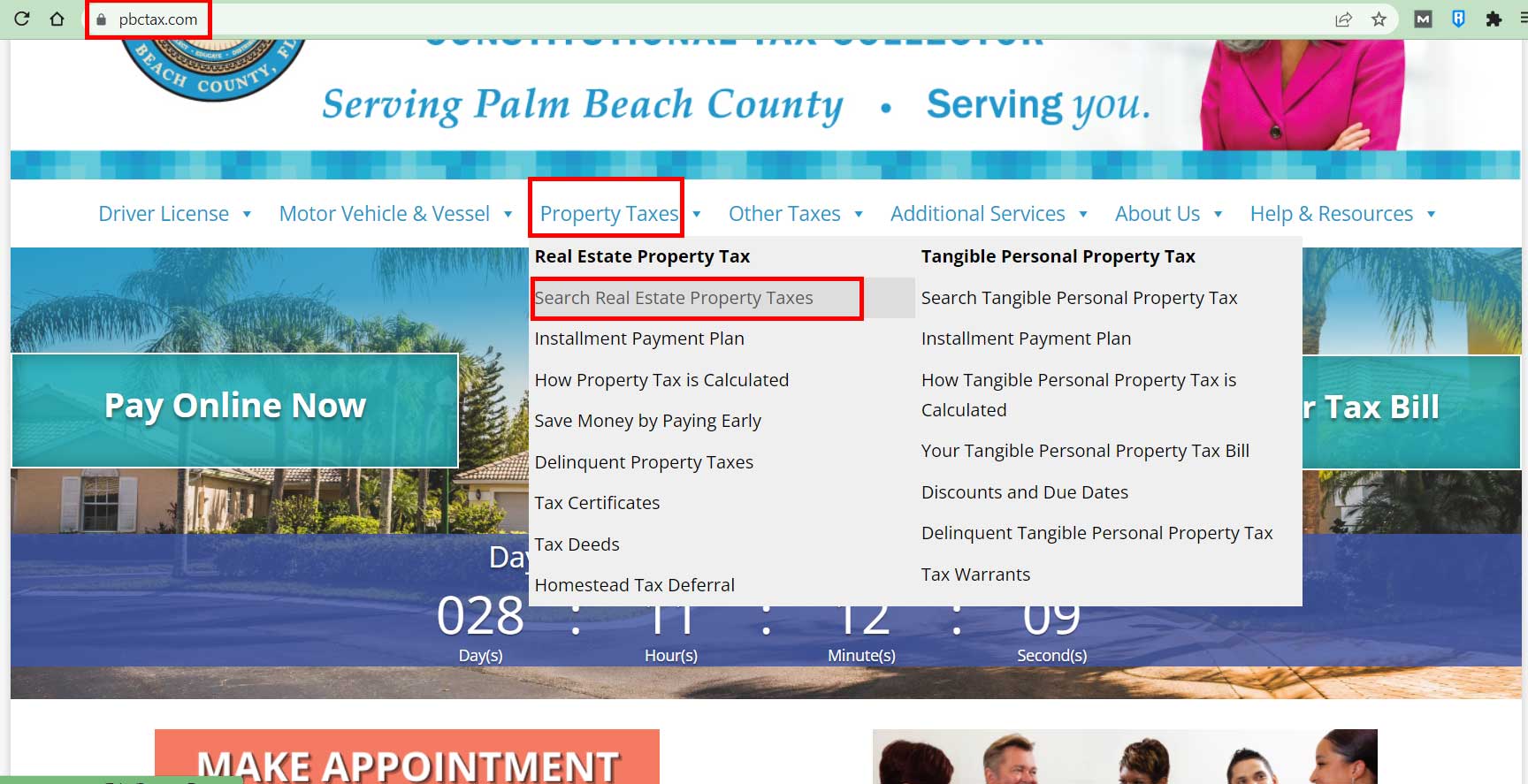

I am committed to having the best staff and systems in place to ensure a fair and equitable determination of property values for all Palm Beach County property owners Quick Links Homestead Exemption E File Florida s property taxes are administered by locally elected officials and supported by the Florida Department of Revenue In Palm Beach County your Constitutional Tax Collector Anne M Gannon collects more than 5 billion annually in property taxes and fees

Property Tax Exemptions Palm Beach County

Property Tax Exemptions Palm Beach County

https://meehansfamilymoving.com/wp-content/uploads/2022/01/Property-taxes-in-Palm-Beach-County.jpg

About Your Property Tax Statement Anoka County MN Official Website

https://anokacountymn.gov/ImageRepository/Document?documentID=21308

Ranking Agency Awards Palm Beach County Fire Rescue Highest Rating

https://www.gannett-cdn.com/presto/2022/07/08/NPPP/843514fe-d8c7-48bc-9ee3-4849742055eb-Photos-_Palm_Beach_County_during_June_2022_01.jpg?crop=5859

Homestead Exemption can provide significant property tax savings and this interactive system will walk you through the qualifications and application process Many other exemptions are also available through our office Taxes Our office collects Property Tax Local Business Tax Tourist Development Tax TDT and Tangible Personal Property Tax The revenue collected from taxes is then efficiently distributed to Palm Beach County s taxing authorities to fund critical county and municipal public services such as the school district fire departments libraries parks and agriculture districts

Schedule Reservation Pay Online From our schools and libraries to public safety healthcare programs and the environment property taxes support our way of life Our office collects and distributes over 4 billion in property taxes annually on behalf of Palm Beach County Only Three Steps to Get Started Request a Personal Identification Number PIN for secure application processing The PIN and your email address will be used as your authorization and electronic signature for filing a Homestead exemption on your property

Download Property Tax Exemptions Palm Beach County

More picture related to Property Tax Exemptions Palm Beach County

Property Appraiser Palm Beach County Florida USA

http://pbcgov.org/papa/_images/PA_LOGO.png

Property Tax Palm Beach 2023

https://propertytaxgov.com/wp-content/uploads/2022/03/Access-Property-Tax-Palm-Beach.jpg

Palm Beach County Knight Foundation

https://knightfoundation.org/wp-content/uploads/2019/06/Water_Taxi_in_West_Palm_Beach__FL.jpg?resize=768

VII of the State Constitution property tax exemptions to new businesses and expansions of existing businesses that are expected to create new full time jobs in Palm Beach County In Palm Beach County Florida a variety of property tax exemptions are available that can help eligible property owners lower their tax liability Commonly applied exemptions include the homestead exemption and the senior citizen exemption

Property Tax Exemptions Palm Beach County property tax exemptions are administered by the property appraiser s office These exemptions reduce your home s assessed value and your property tax bill All homestead exemption applications must be eligible as of January 1 and submitted by March 1 of the year in which the benefit will be applied A 25 000 exemption is applied to the first 50 000 of your property s assessed value This exemption applies to all taxes including school district taxes Exemptions Home

Property Tax Palm Beach 2023

https://propertytaxgov.com/wp-content/uploads/2022/03/Pay-Online-Property-Taxes-Palm-Beach-County-1536x888.jpg

Tax Exemptions For Homeowners

https://static.wixstatic.com/media/94cb92_d1b159444ca740628f8b6eb90929486b~mv2.jpg/v1/fill/w_1000,h_566,al_c,q_90,usm_0.66_1.00_0.01/94cb92_d1b159444ca740628f8b6eb90929486b~mv2.jpg

https://pbcpao.gov/do-you-qualify.htm

Several exemptions are available to Palm Beach County residents For more information on each of these click the links provided or visit Additional Exemptions Do You Qualify brochure Forms beginning with the prefix DR are available online or at any Palm Beach County Property Appraiser office

https://pbcpao.gov

I am committed to having the best staff and systems in place to ensure a fair and equitable determination of property values for all Palm Beach County property owners Quick Links Homestead Exemption E File

Property Tax Information Palm Beach FL Official Website

Property Tax Palm Beach 2023

Property Tax Exemptions For Members Of The Armed Forces Property Tax

Florida Homestead Exemption Application Deadline ASR Law Firm

Property Tax Palm Beach 2022

Jefferson County Property Tax Exemption Form ExemptForm

Jefferson County Property Tax Exemption Form ExemptForm

Homestead Exemptions Palm Beach County FLORIDA FINE HOMES AND

Property Tax Information Palm Beach FL Official Website

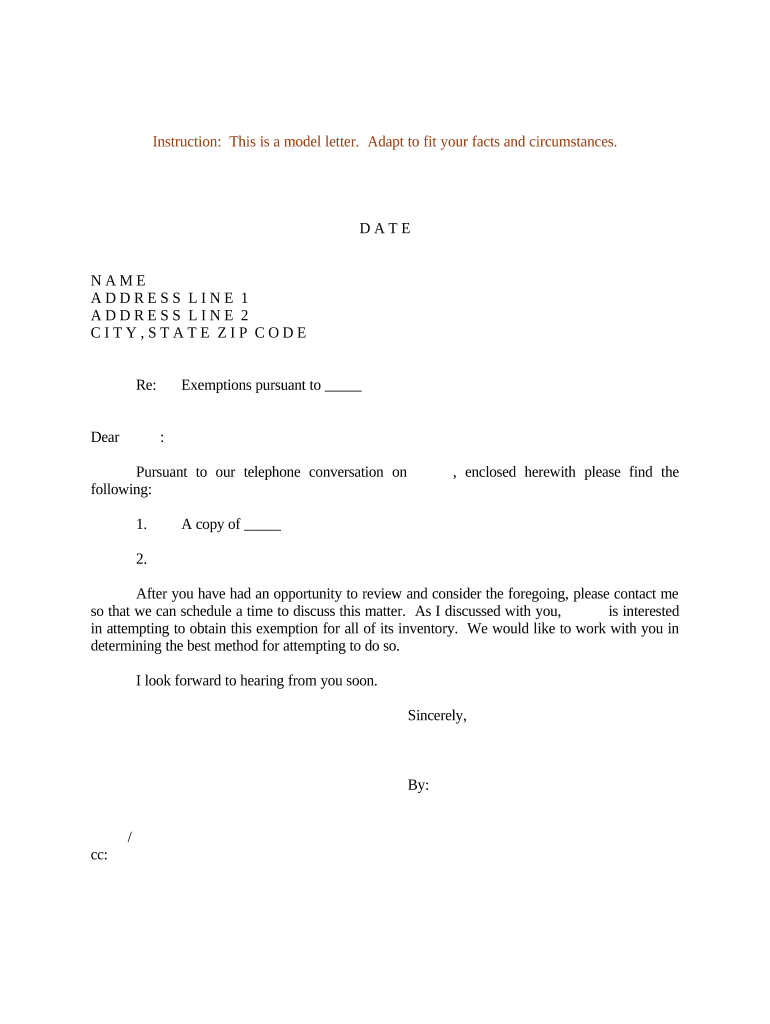

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

Property Tax Exemptions Palm Beach County - Only Three Steps to Get Started Request a Personal Identification Number PIN for secure application processing The PIN and your email address will be used as your authorization and electronic signature for filing a Homestead exemption on your property