Property Tax Rate In Houston County Texas The median property tax also known as real estate tax in Houston County is 750 00 per year based on a median home value of 67 600 00 and a median effective property tax rate of 1 11 of property value

Property taxes in Texas are the seventh highest in the U S as the average effective property tax rate in the Lone Star State is 1 60 Compare that to the national average which currently stands at 0 99 The typical Texas homeowner pays 3 797 annually in property taxes Estimate Property Tax Our Houston County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in

Property Tax Rate In Houston County Texas

Property Tax Rate In Houston County Texas

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Texas Has The 6th Highest Real Estate Property Taxes New Report Finds

https://austin.culturemap.com/media-library/redwine-property.jpg?id=31492740&width=2000&height=1500&quality=85&coordinates=124%2C0%2C125%2C0

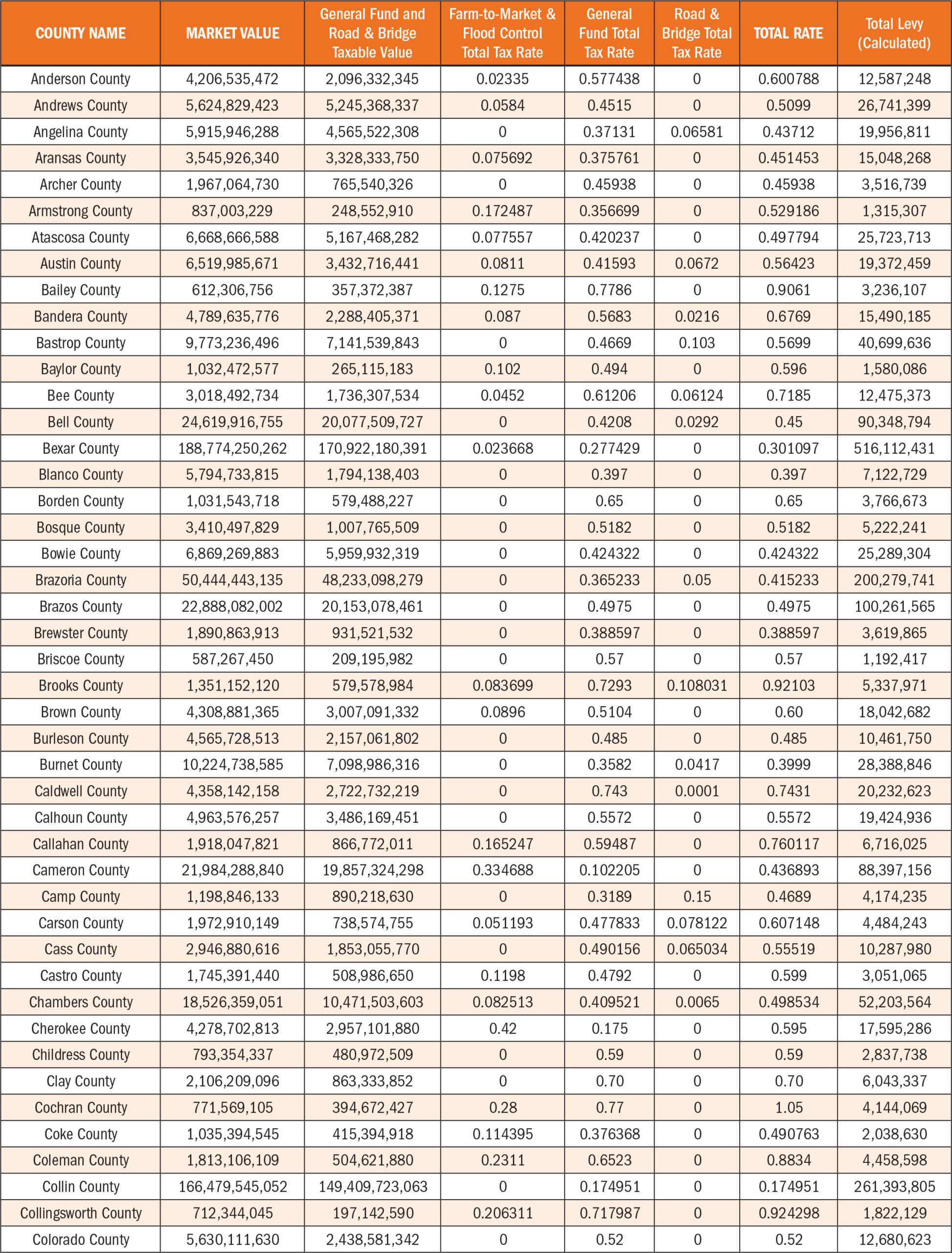

2019 County Property Tax Report Texas County Progress

https://countyprogress.com/wp-content/uploads/2020/09/10-20_CP_PROPERTY_TAX_REPORT_PG1-scaled.jpg

20200807 141225 1 Notice About Form 50 212 2020 Tax Rates current year Property Tax Rates in This notice concerns the HOUSTON COUNTY taxing unit s name Houston County taxing units name 2020 property tax rates for cur nt year This notice provides information about two tax rates used in adopting the current tax year s tax rate Property Tax One of the primary responsibilities of the Office of Laronica Wooten Smith Houston County Tax Assessor Collector is to collect record and disburse property taxes The Tax Office disburses the taxes to the various taxing entities for which it serves as collector When we receive the certified tax roll the truth in taxation

Property Search Basic Search By Owner By Property All Criteria Advanced Search Houston County Appraisal District Taxing Entities 2023 Tax Rates 0 44800000 Houston County 0 68130000 City Of Crockett 0 34490000 City Of Grapeland 0 14020000 City Of Kennard 0 36520000 City Of Lovelady 0 66920000 Grapeland This new site allows you to search by owner name street owner ID or property ID You can also narrow your search by year and pay status Taxpayers can now update their mailing address view tax statements and review their property tax history In addition multiple tax bills can be paid in one session using our shopping cart feature

Download Property Tax Rate In Houston County Texas

More picture related to Property Tax Rate In Houston County Texas

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Individual Tax Rate Tax Rates Income Tax Rates For Resident

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a696ac3a274f79c15646086b98a09d5a/thumb_1200_1698.png

Houston area Property Tax Rates By County

https://s.hdnux.com/photos/35/52/03/7774430/3/rawImage.jpg

While every property in the state is subject to distinctly different taxing entities and rates Texas counties assess an average annual tax rate of 1 81 percent Considering area property values Lone Star State homeowners pay a median yearly property tax of about 2 275 Houston County has an average property tax rate of 0 52 which is slightly lower than the state average of 0 54 This rate is applied to the assessed value of a property to calculate the amount of taxes due Property taxes in Houston County are relatively low compared to other counties in the state

In the Houston area the yearly tax was roughly 5 400 on a 368 623 home the data showed The rate was 1 46 Meanwhile in Dallas the effective tax rate was 1 36 and people living there The property tax account is being reviewed prior to billing You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement s Please call 713 274 8000 or send an email to tax office hctx to receive a payment amount for your 2023 property taxes The 2023 property taxes are

Set Sales Tax Rates In The TSYS Mobile App Talus Pay

https://theme.zdassets.com/theme_assets/1867027/13f2ebb84fa5f64995493792818211d4e095edf3.png

Tax Rate In Puerto Rico Everything You Need To Know ScrollBucks

https://scrollbucks.com/wp-content/uploads/2021/07/tax-rate-in-puerto-rico.jpg

https://www.propertytax101.org/texas/houstoncounty

The median property tax also known as real estate tax in Houston County is 750 00 per year based on a median home value of 67 600 00 and a median effective property tax rate of 1 11 of property value

https://smartasset.com/taxes/texas-property-tax-calculator

Property taxes in Texas are the seventh highest in the U S as the average effective property tax rate in the Lone Star State is 1 60 Compare that to the national average which currently stands at 0 99 The typical Texas homeowner pays 3 797 annually in property taxes

Cahnman s Musings TXLEGE On Property Taxes Several Good Proposals

Set Sales Tax Rates In The TSYS Mobile App Talus Pay

Tax Assessor Houston County

Sales Tax By State Here s How Much You re Really Paying Sales Tax

How High Are Property Taxes In Your State Tax Foundation

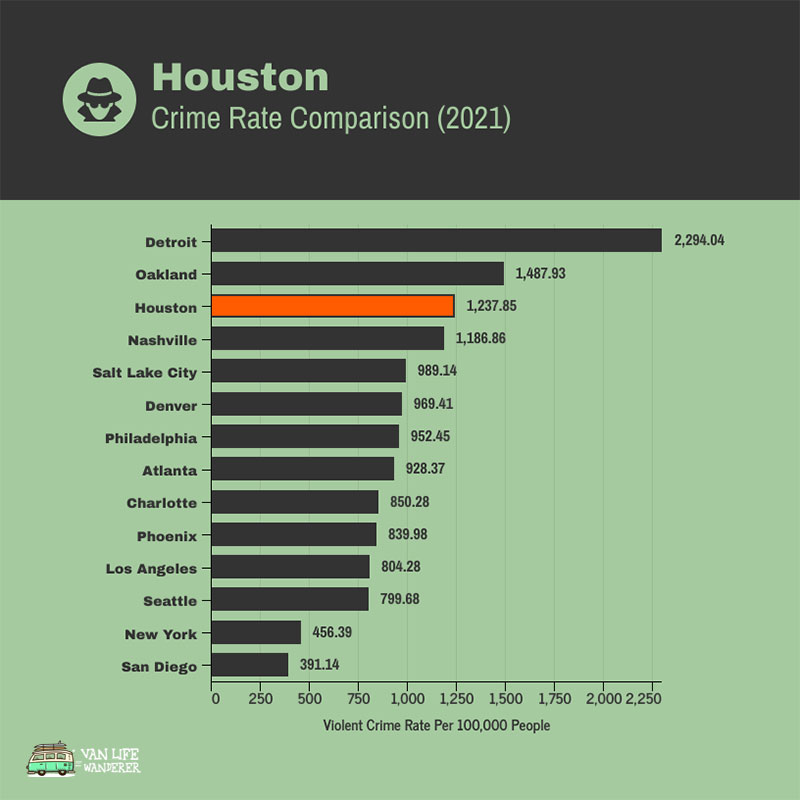

Is Houston Safe To Visit 2022 Crime Rates And Crime Stats Van Life

Is Houston Safe To Visit 2022 Crime Rates And Crime Stats Van Life

Texas Has The Fifth Highest Property Taxes In The Nation But Do We Get

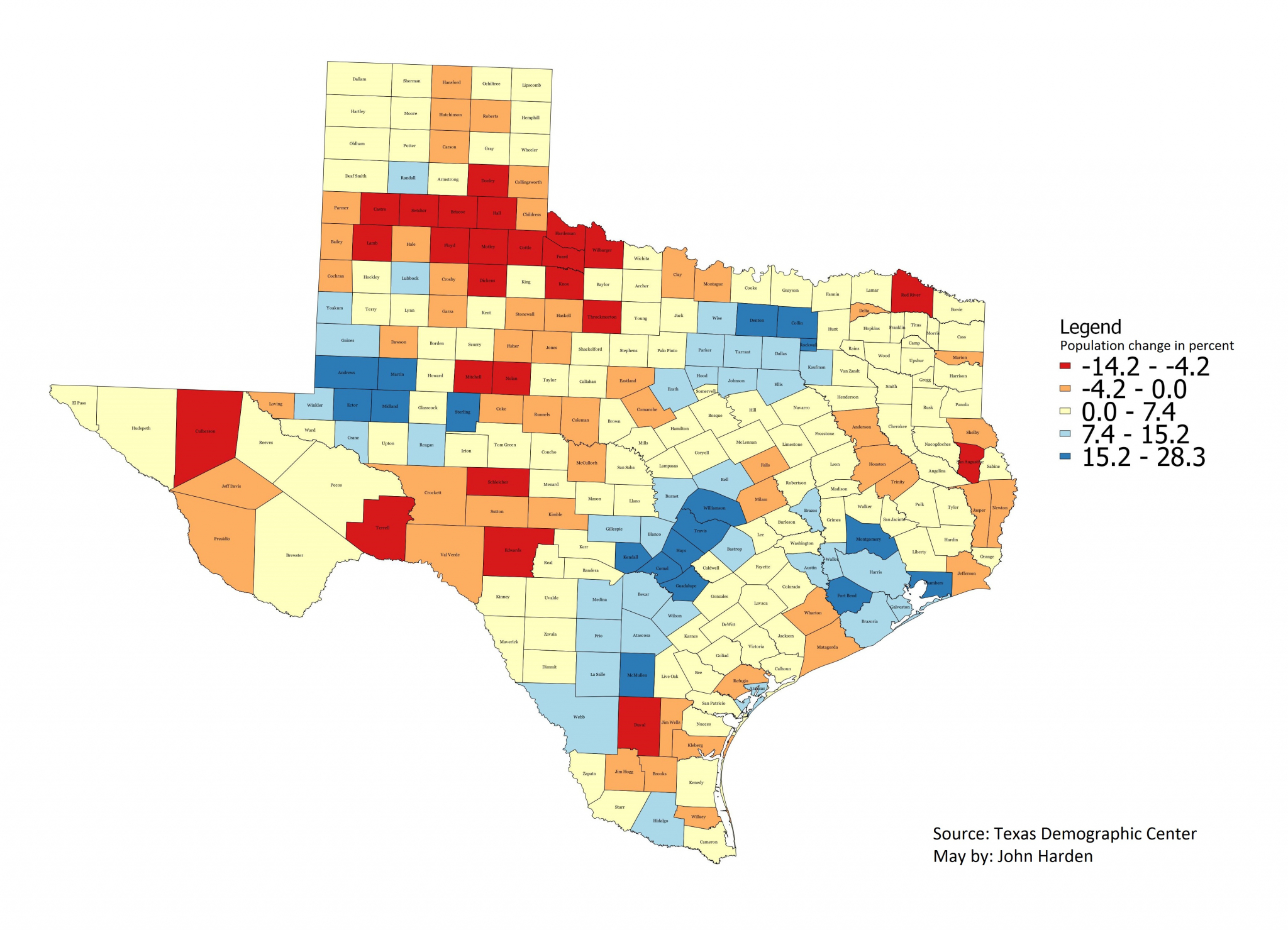

New 2016 Texas County Population Data Show Rise In Urban Areas

Smith County Appraisal District Map Cities And Towns Map

Property Tax Rate In Houston County Texas - This new site allows you to search by owner name street owner ID or property ID You can also narrow your search by year and pay status Taxpayers can now update their mailing address view tax statements and review their property tax history In addition multiple tax bills can be paid in one session using our shopping cart feature