Property Tax Rebate 2024 Pennsylvania s Property Tax Rent Rebate program is now open Gov Josh Shapiro announced on Tuesday The maximum standard rebate is now 1 000 up from 650 after Shapiro signed bipartisan

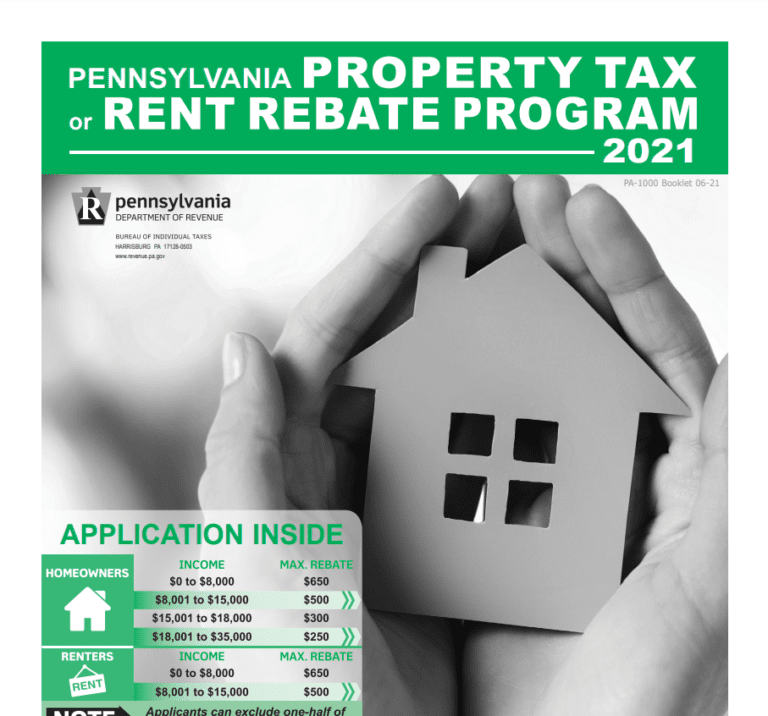

Starting in 2024 the maximum standard rebate will increase from 650 to 1 000 Also in 2024 the household income limit for property tax rebates will increase to 45 000 up from the current 35 000 limit The household income limit for rent rebates will also increase to 45 000 up from 15 000 Half of Social Security income is excluded If you re 65 or older or receive disability benefits and paid rent or property taxes last year you qualify if you meet the income requirements The income limit is 35 000 per household for homeowners and 15 000 per household for renters If you receive Social Security benefits the state only counts half of that towards the income cap

Property Tax Rebate 2024

Property Tax Rebate 2024

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

The new measure eliminates this disparity by raising the limit to 45 000 for both As before the program s rules only count half of someone s income from Social Security benefits The lowest income households will be eligible for rebates of 1 000 up from 650 the previous maximum The law also resolves the mismatch between state and Governor Shapiro Signs Into Law Bill Expanding the Property Tax Rent Rebate Program on August 4 2023 at an event in Scranton Photo courtesy of Manuel Bonder

The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year 2022 and another rebate available for property taxes paid for Tax Year 2023 Check the status of your Property Tax Rebate Rebate Resources County Property Tax Lookup About the Property Tax Rent Rebate Program Rebates will be distributed beginning July 1 2024 as required by law New or first time filers should anticipate that it will take additional time to review their applications and process their rebates The deadline to apply is June 30 2024

Download Property Tax Rebate 2024

More picture related to Property Tax Rebate 2024

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

Nearly 175 000 additional eligible Pennsylvanians can apply for a rebate of up to 1 000 through the Property Tax Rent Rebate PRTT program 2024 The deadline to apply is June 30 however 2024 Property Tax Bill You will receive your 2024 Property Tax bill from Dec 2023 On this page Understanding property tax Property tax payment Understanding property tax Property tax is a tax on ownership of property whether it is rented out owner occupied or vacant Our Taxes Our Nation

Processing Time and Refund Information Refund Fraud Unclaimed Refunds Amend a Return Forms All Forms and Instructions By Tax Type By Tax Year Fact Sheets and Guides 2024 Property Tax Credit Calculator Calculator Thursday January 25 2024 12 00 File HS 122 2024 PTC Calculator 1 xls 91 KB File Format Spreadsheet The rebate program established in 1971 benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

2023 Rent Rebate Form Printable Forms Free Online

https://www.pdffiller.com/preview/47/686/47686220/large.png

https://www.msn.com/en-us/money/taxes/eligible-pennsylvanians-can-now-apply-for-property-tax-and-rent-rebates-of-up-to-1000/ar-AA1n5mAk

Pennsylvania s Property Tax Rent Rebate program is now open Gov Josh Shapiro announced on Tuesday The maximum standard rebate is now 1 000 up from 650 after Shapiro signed bipartisan

https://www.patreasury.gov/newsroom/archive/2023/08-09-Property-Tax-Rebate-Expansion.html

Starting in 2024 the maximum standard rebate will increase from 650 to 1 000 Also in 2024 the household income limit for property tax rebates will increase to 45 000 up from the current 35 000 limit The household income limit for rent rebates will also increase to 45 000 up from 15 000 Half of Social Security income is excluded

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Residents Can File Property Tax Rent Rebate Program Applications Online Lower Bucks Times

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

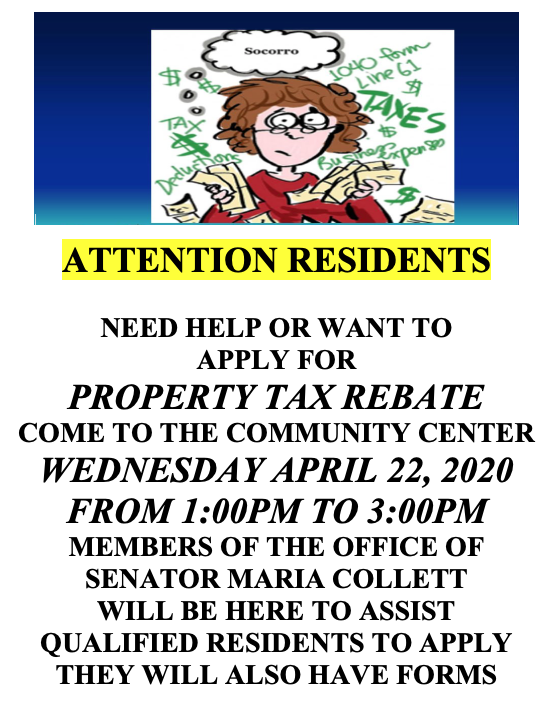

PROPERTY TAX REBATE Information Flyer Warminster Heights

Homeowner Renters District 16 Democrats

City Of Chicago Proper ty Tax Rebate Program CLARETIAN ASSOCIATES BUILDING COMMUNITY IN

Property Tax Rebate 2024 - The Property Tax Rent Rebate program s income limit has also increased to 45 000 which will allow more people to become eligible Wednesday January 17 2024 5 03PM Pennsylvania property