Property Tax Rebate And Inheritance Web 4 avr 2014 nbsp 0183 32 Use form IHT38 to claim relief if you re liable for Inheritance Tax on the value of land or buildings that were part of the deceased s estate if you sell the land or

Web 12 juin 2012 nbsp 0183 32 Inheritance tax IHT paid on inherited property is based on its value at the time of death However should you sell the property for less within four years then you Web 29 ao 251 t 2019 nbsp 0183 32 The department will only issue a rebate to the surviving spouse executor or executrix of the estate or the personal representative If you are a personal

Property Tax Rebate And Inheritance

Property Tax Rebate And Inheritance

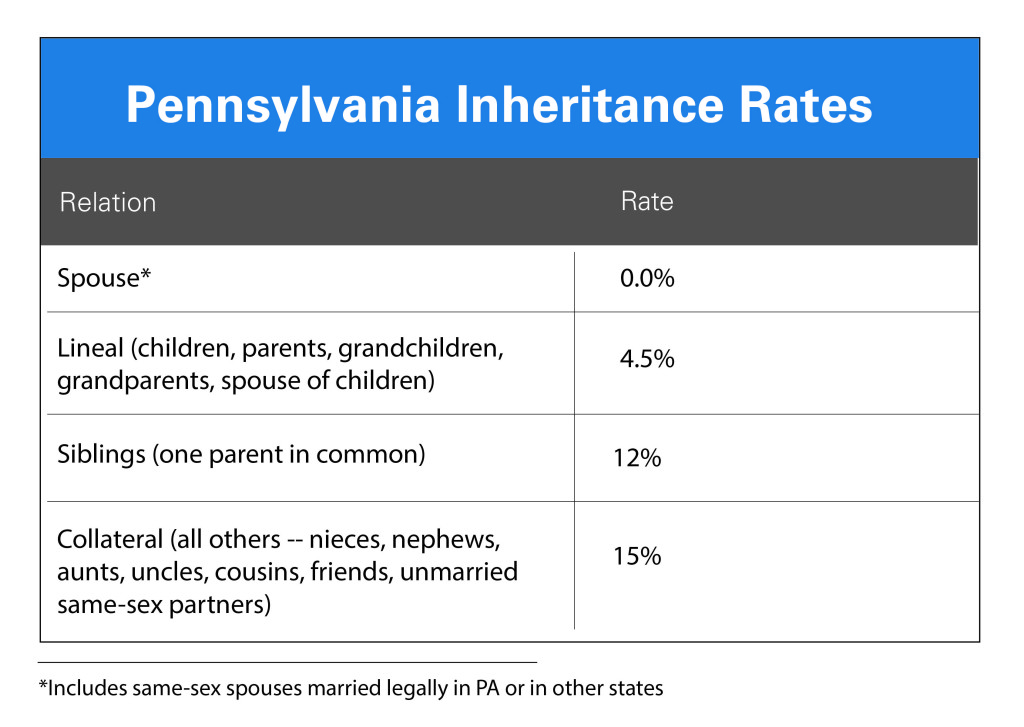

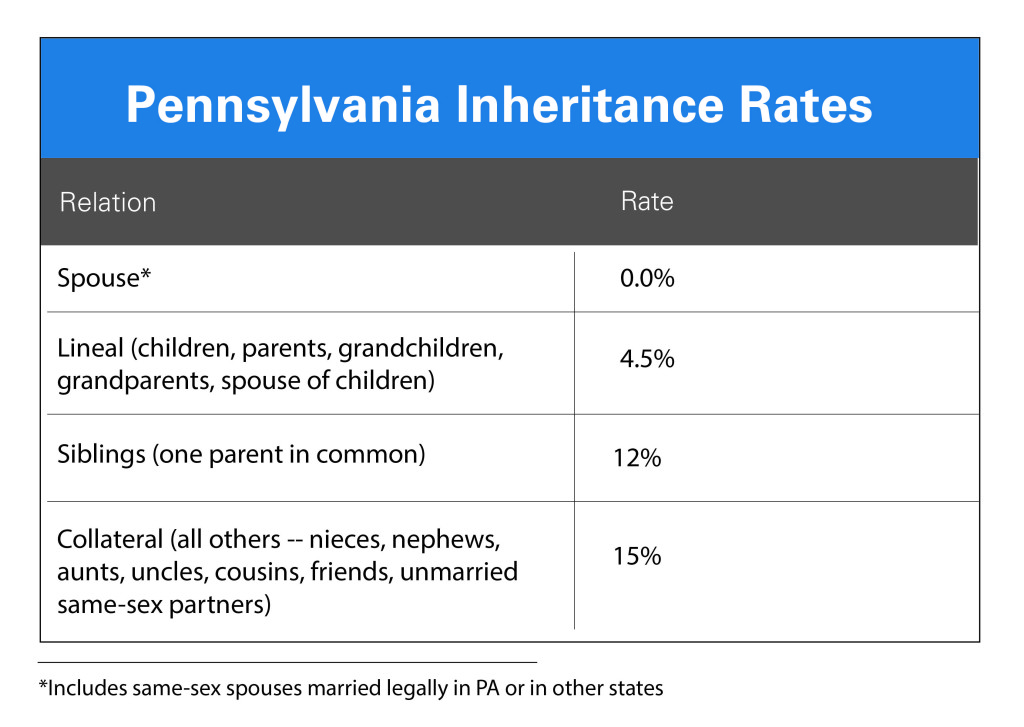

http://www.rklcpa.com/wp-content/uploads/2014/02/inheritance_tax_rates_3-1024x727.jpg

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

https://files.taxfoundation.org/20180417165034/EstateTax-2018-01.png

Property Tax In Delhi All You Need To Know In 2022

http://www.capitalgreensdelhi.com/blog/wp-content/uploads/2022/07/table-02.jpg

Web Inheritance tax progression 10 15 20 30 10 15 20 30 10 15 20 30 Inheritance tax thresholds USD 300 000 500 000 1 000 000 3 000 000 Web 12 mai 2021 nbsp 0183 32 A majority of OECD countries currently levy inheritance or estate taxes 24 in total However these taxes typically raise very little revenue Today only 0 5 of total

Web 6 avr 2023 nbsp 0183 32 The property allowance will be layered on top of your inheritance tax allowance which has been set at 163 325 000 since 2010 This means that in 2023 24 you can pass on as much as 163 500 000 tax Web New enquiries 01616 966 229 Residential conveyancing enquiries 0333 344 4778

Download Property Tax Rebate And Inheritance

More picture related to Property Tax Rebate And Inheritance

Inheritance Tax Rebates For Non residents In Spain By Regions FIRMALEX

https://firmalex.com/wp-content/uploads/2023/03/inheritance-tax-rebates-non-residents-by-regions.jpg

Inheritance Tax In The UK Explained INFOGRAPHIC

http://infographicplaza.com/wp-content/uploads/Inheritance-Tax-in-the-UK-Infographic-plaza-thumb.jpg

Iowa Inheritance Tax Rates 2020 Leonie Durr

https://kurtzcpa.com/wp-content/uploads/2019/09/Federal-Estate-Tax-Rate-Schedule.png

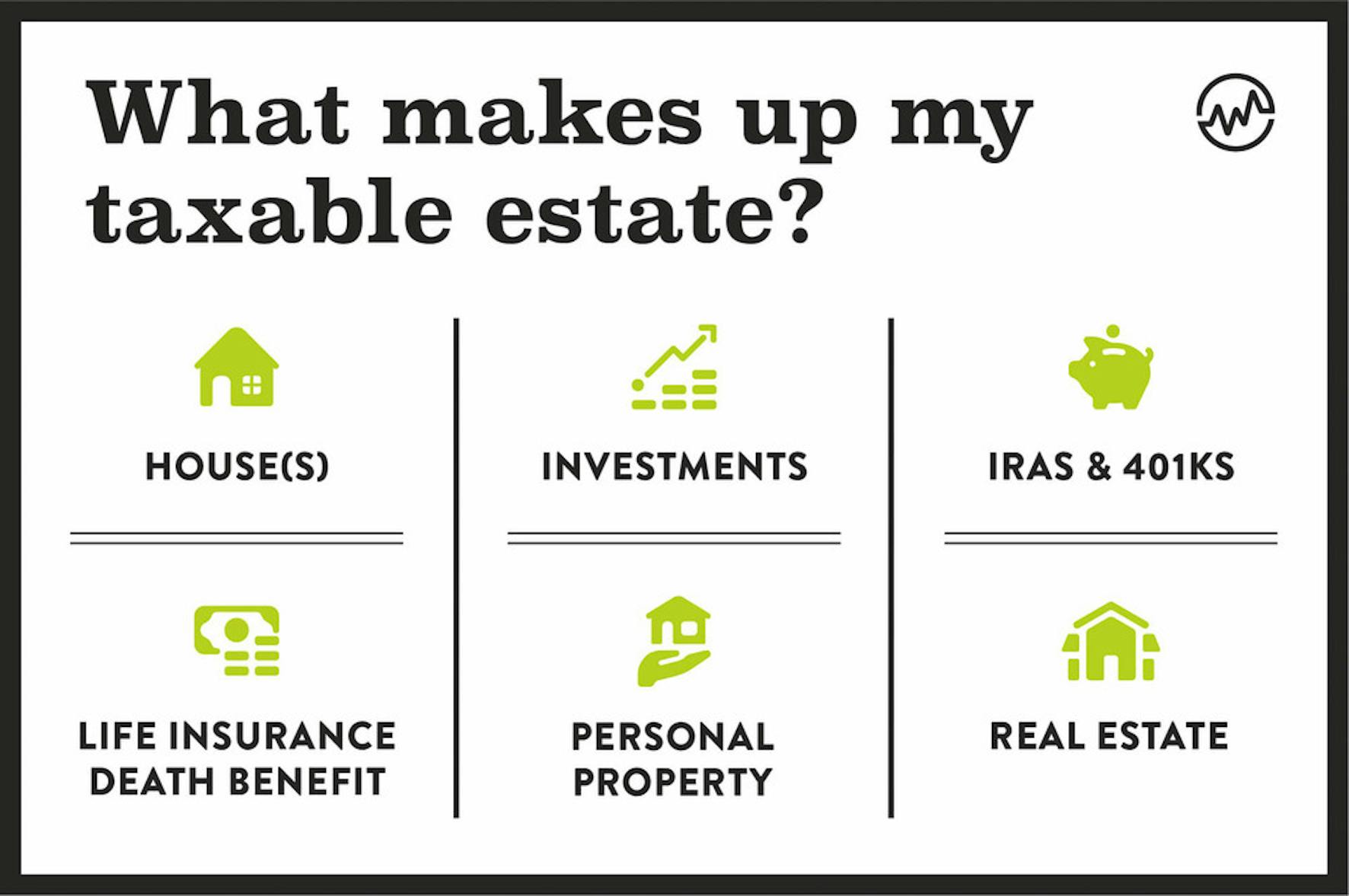

Web 16 d 233 c 2021 nbsp 0183 32 When you inherit a house you will be responsible for the property taxes which may be reassessed based on your step up in basis depending on your state and Web 21 oct 2022 nbsp 0183 32 La taxe d habitation est un imp 244 t per 231 u au profit des collectivit 233 s locales d 251 chaque ann 233 e La r 233 forme de 2018 a cependant enclench 233 un processus de

Web Inheritance tax is recalculated and a rebate paid to the executors for the benefit of the estate The claim must be made within four years from the date of death Investments Web If property in the death estate is valued by the related property rule and is then sold for a lower amount within 3 years of death the taxpayer may be able to claim relief

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax

https://files.taxfoundation.org/legacy/docs/estate_inheritance_large.png

2019 State Estate Taxes State Inheritance Taxes

https://files.taxfoundation.org/20191016110753/Estate-Inheritance-2019-fv-01-1024x887.png

https://www.gov.uk/government/publications/inheritance-tax-claim-for...

Web 4 avr 2014 nbsp 0183 32 Use form IHT38 to claim relief if you re liable for Inheritance Tax on the value of land or buildings that were part of the deceased s estate if you sell the land or

https://moneytothemasses.com/tax/tax-mitigation-tax/claim-an...

Web 12 juin 2012 nbsp 0183 32 Inheritance tax IHT paid on inherited property is based on its value at the time of death However should you sell the property for less within four years then you

Inheritance Tax How Much Will Your Children Get Your Estate Tax

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax

Property Tax In Delhi All You Need To Know In 2022

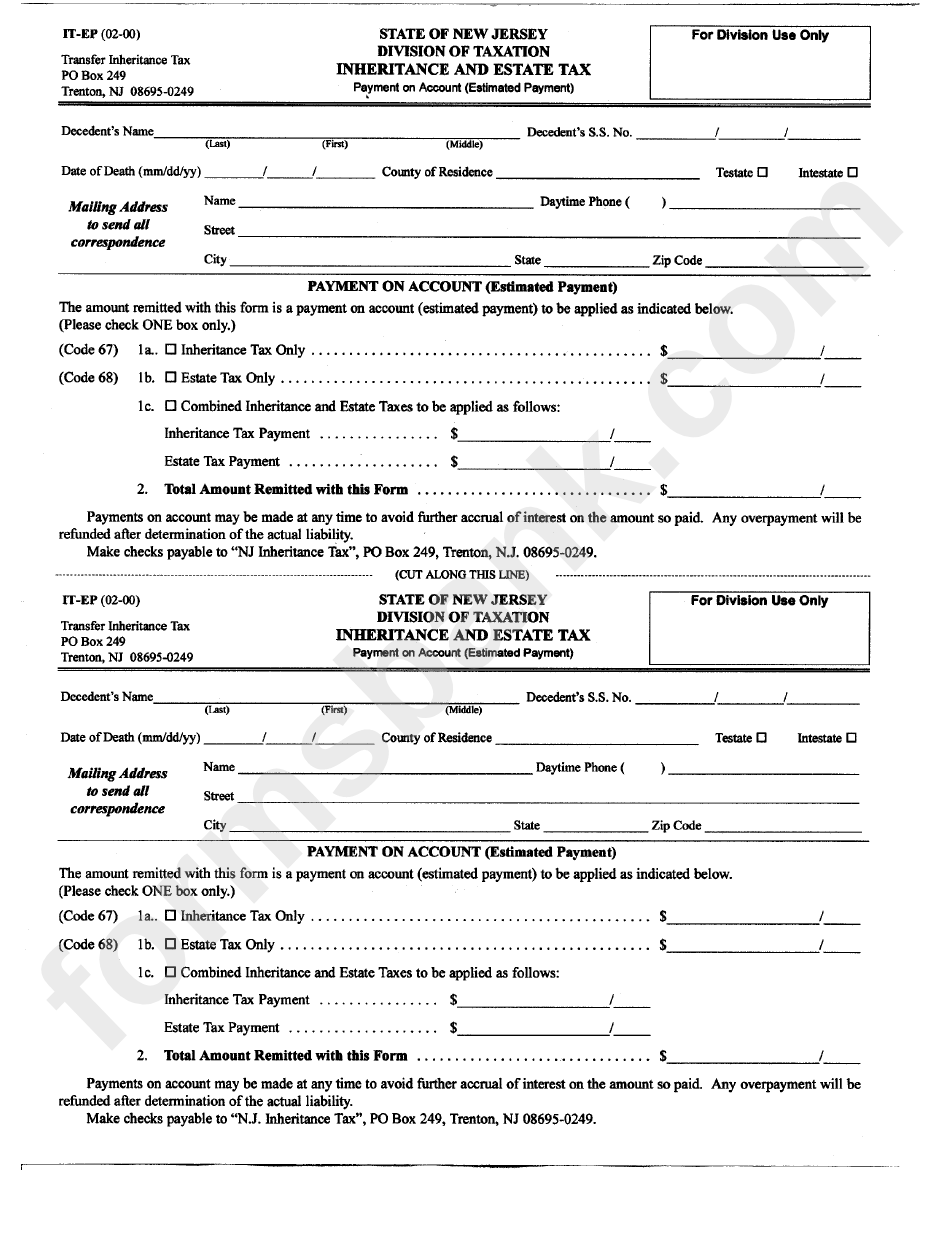

Form It Ep State Of New Jersey Division Of Taxation Inheritance And

Prince s Lack Of A Will Highlights The Need For Estate And Inheritance

How Much Money Can You Inherit Without Paying Inheritance Tax Johana

How Much Money Can You Inherit Without Paying Inheritance Tax Johana

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries

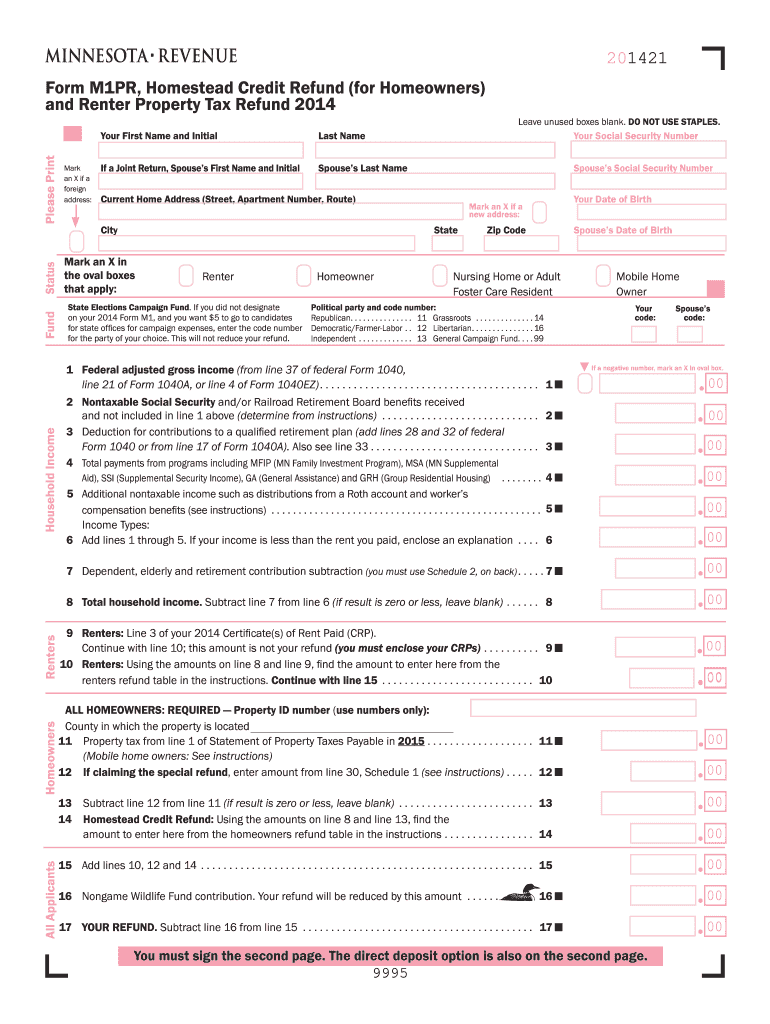

2014 Mn Form Property Tax Fill Out Sign Online DocHub

Vt Property Tax Rebate Calculator PropertyRebate

Property Tax Rebate And Inheritance - Web 12 mai 2021 nbsp 0183 32 A majority of OECD countries currently levy inheritance or estate taxes 24 in total However these taxes typically raise very little revenue Today only 0 5 of total