Property Tax Rebate For Seniors In New Brunswick Property Tax Deferral Program for Seniors This program provides property tax relief to eligible seniors in New Brunswick by allowing those interested in the program to apply

That program has been extended to include all properties for 2024 and applies to the provincial and local portions of property tax excluding recent sales new This program provides property tax relief to eligible seniors in New Brunswick by allowing those interested in the program to apply for a deferral of the annual increase in property

Property Tax Rebate For Seniors In New Brunswick

Property Tax Rebate For Seniors In New Brunswick

https://www.pressherald.com/wp-content/uploads/sites/4/2018/12/47307620_883741535157190_3114257705175351296_n-1.jpg?w=1024

Bonus Property Tax And Rent Rebate Arriving Soon For Eligible

https://www.pennlive.com/resizer/9__l3v8PgaVRb7vyfHFdyNzfxkM=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OPZBRT6KQNA2DBHYBAEUKDMWK4.png

Tax Credits Could Replace Senior Freeze Rebates New Jersey Monitor

https://newjerseymonitor.com/wp-content/uploads/2022/09/seniorfreeze-scaled.jpeg

Property Tax Deferral Program for Seniors This program provides property tax relief to eligible seniors in New Brunswick who want to apply for a deferral of the annual This program provides property tax relief to eligible seniors in New Brunswick by allowing those interested in the program to apply for a deferral of the annual increase in property

SocialSupportsNB is a user friendly website where people can easily find information about social programs in New Brunswick The site currently focuses on social supports provided by the Department of Social Property tax relief to eligible seniors who want to apply for a deferral of the annual increase in property taxes on their principal residence deferred property tax and interest amounts

Download Property Tax Rebate For Seniors In New Brunswick

More picture related to Property Tax Rebate For Seniors In New Brunswick

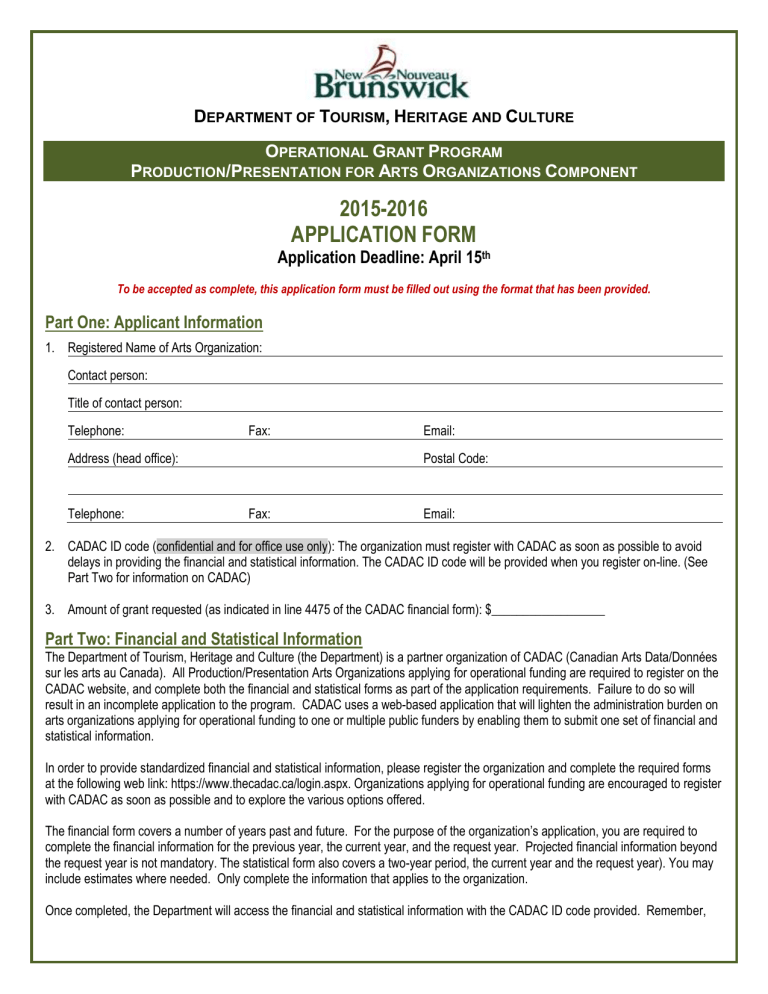

Application Form Government Of New Brunswick

https://s3.studylib.net/store/data/006937943_1-73a49e99a6bffb289232c5b585d782bb-768x994.png

Property Tax Rebate For Seniors In Ontario PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/ontario-senior-homeowners-property-tax-grant-qualifications-canadian-1.png

Property Tax Rebate For Seniors Ben Jessome

https://benjessome.ca/wp-content/uploads/2017/07/JB-Seniors-Property-1024x538.jpg

The Property Tax Allowance gives a tax break to low income property owners If you and your spouse have a combined taxable income of less than 22 000 you are eligible for This program provides property tax relief to eligible seniors in New Brunswick who want to apply for a deferral of the annual increase in property taxes on their principal residence

Rebate on property tax for people over 65 years of age with low income Property taxes are on the rise while social programs for low income seniors are not keeping pace We lobbied for this rebate program in an effort to Less than 22 000 you are eligible for up to a 300 rebate Between 22 001 and 25 000 you are eligible for up to a 200 rebate Between 25 001 and 30 000 you

Property Tax Rebate For Seniors Bc PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/canadian-seniors-homeowner-grants-over-100-grants-rebates-tax-2.jpg

Property Tax Rebate For Seniors Iain Rankin

https://i0.wp.com/www.iainrankin.ca/wp-content/uploads/2022/07/MLA-SeniorsTax.jpg?fit=1024%2C538&ssl=1

https://www2.gnb.ca › ... › finance › taxes › other.html

Property Tax Deferral Program for Seniors This program provides property tax relief to eligible seniors in New Brunswick by allowing those interested in the program to apply

https://www2.snb.ca › content › snb › en › news

That program has been extended to include all properties for 2024 and applies to the provincial and local portions of property tax excluding recent sales new

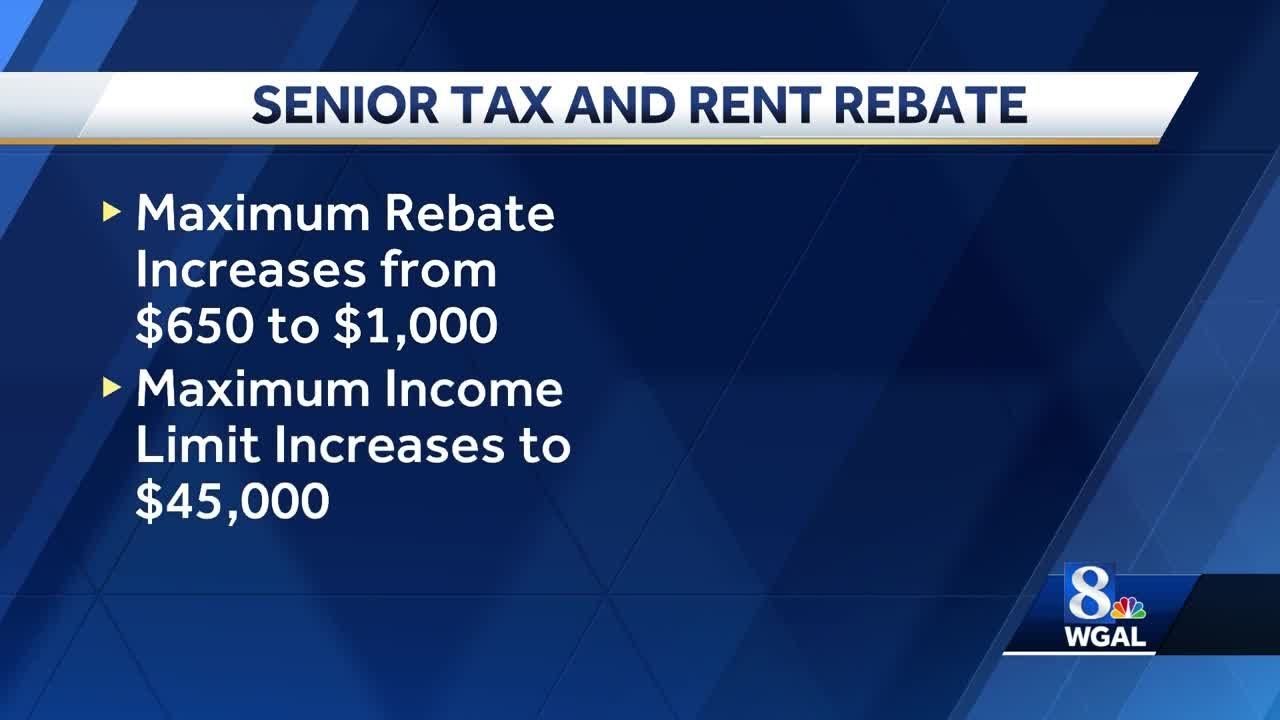

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Property Tax Rebate For Seniors Bc PropertyRebate

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Ontario New Housing Rebate Form By State Printable Rebate Form

Pennsylvania Seniors Can Get Bigger Rebate On Taxes Rent YouTube

Property Tax Rebate Pennsylvania LatestRebate

Property Tax Rebate Pennsylvania LatestRebate

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Tax Rebate For Individuals Swaper Investing Blog

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Property Tax Rebate For Seniors In New Brunswick - Property Tax Deferral Program for Seniors This program provides property tax relief to eligible seniors in New Brunswick who want to apply for a deferral of the annual