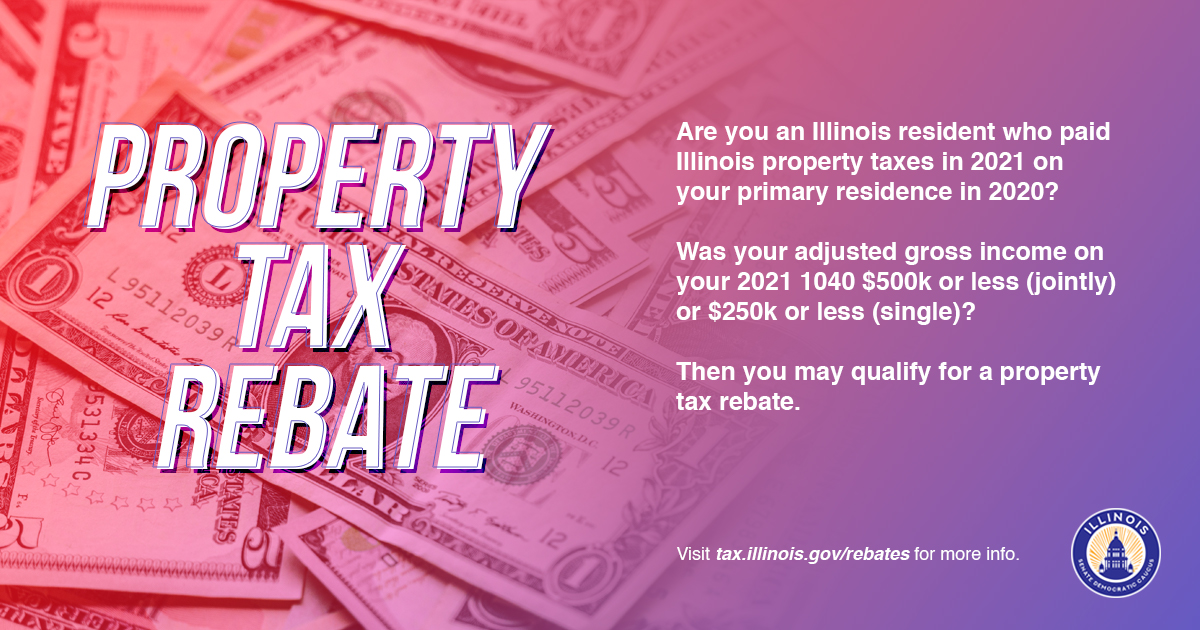

Property Tax Rebate Illinois 2024 The Property Tax Rebate requires that recipients be Illinois residents who paid property taxes on their primary residence in 2021 and 2022 Their adjusted gross income must be 500 000

The Senior Citizens Real Estate Tax Deferral program allows qualifying seniors to defer up to 7 500 per year in property taxes The loan is repaid to the state when the property is sold or upon the death of the participant March 1 is the last day to apply for the program and seek deferral for 2023 taxes that will be due in 2024 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid

Property Tax Rebate Illinois 2024

Property Tax Rebate Illinois 2024

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

How Does Illinois s Property Tax Rebate Work

https://media.marketrealist.com/brand-img/SxFDcHPyG/1600x837/illinois-property-tax-rebate-1659496759243.jpg?position=top

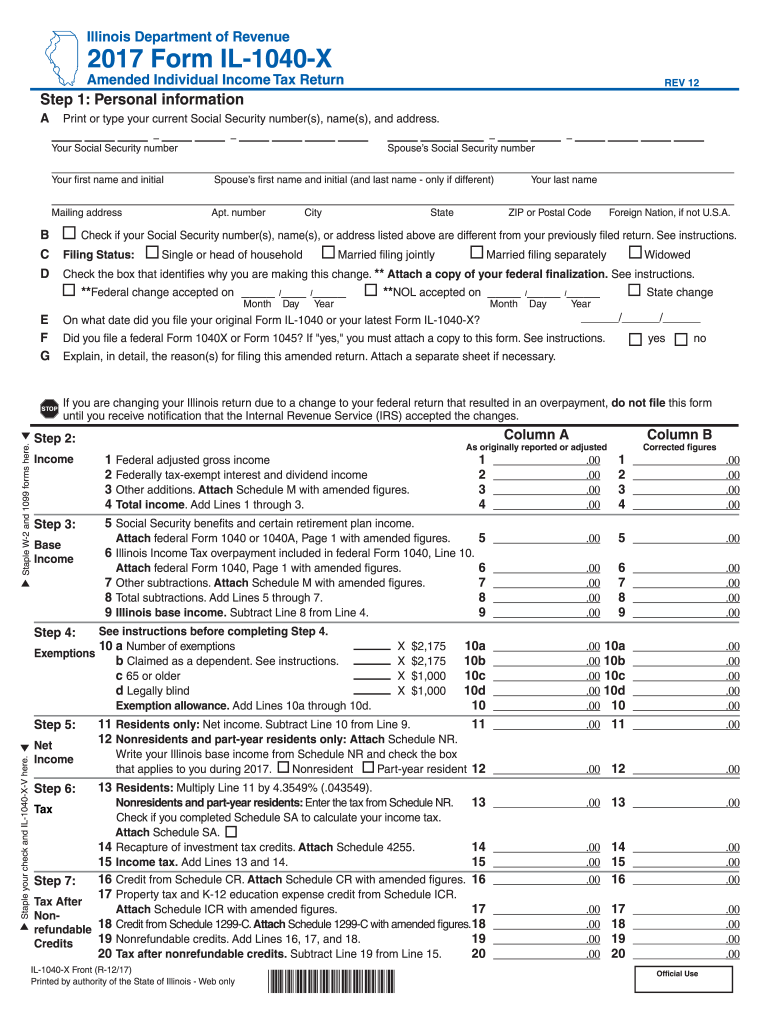

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/453/14/453014487/large.png

Under state law changes in place through tax year 2025 the maximum amount of property taxes that can be deferred annually has been temporarily increased to 7 500 There was also a temporary increase in the maximum annual household income for eligibility from 55 000 to 65 000 Any taxes owed that are not deferred are due as usual Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid

The property tax rebate is a maximum of 300 per household that is equal to the credit claimed for residential real estate property taxes on the 2021 Illinois income tax return The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can have adjusted gross incomes of

Download Property Tax Rebate Illinois 2024

More picture related to Property Tax Rebate Illinois 2024

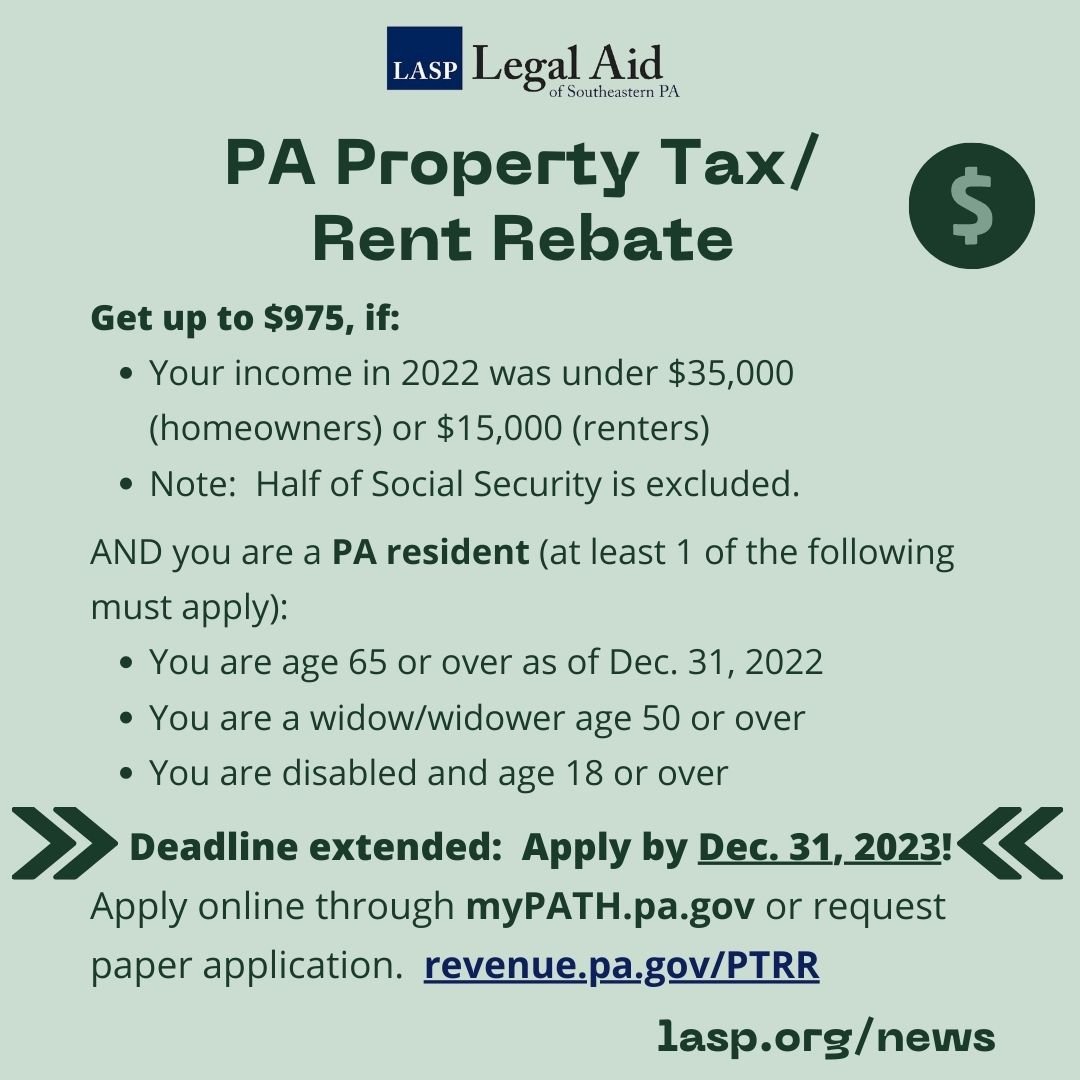

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

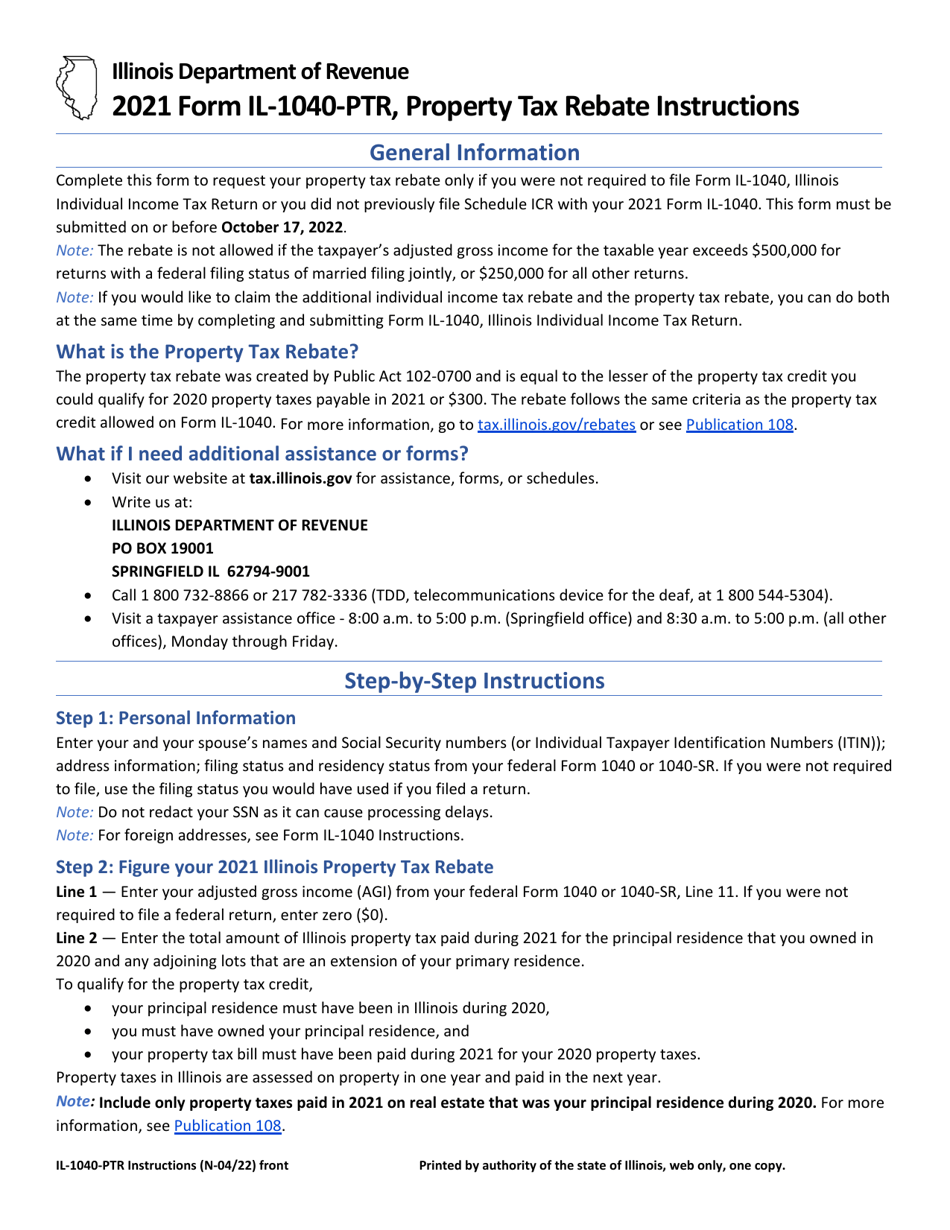

The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300 The property tax rebate goes up to 300 For the income tax rebate taxpayers who file as a single person will get a 50 rebate couples who file jointly get 100 and families with dependents can

Updated Jan 25 2024 03 51 PM CST ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their property tax rebate of up to 300 by submitting Form IL 1040 PTR to the Illinois Department of Revenue

2021 Illinois Property Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

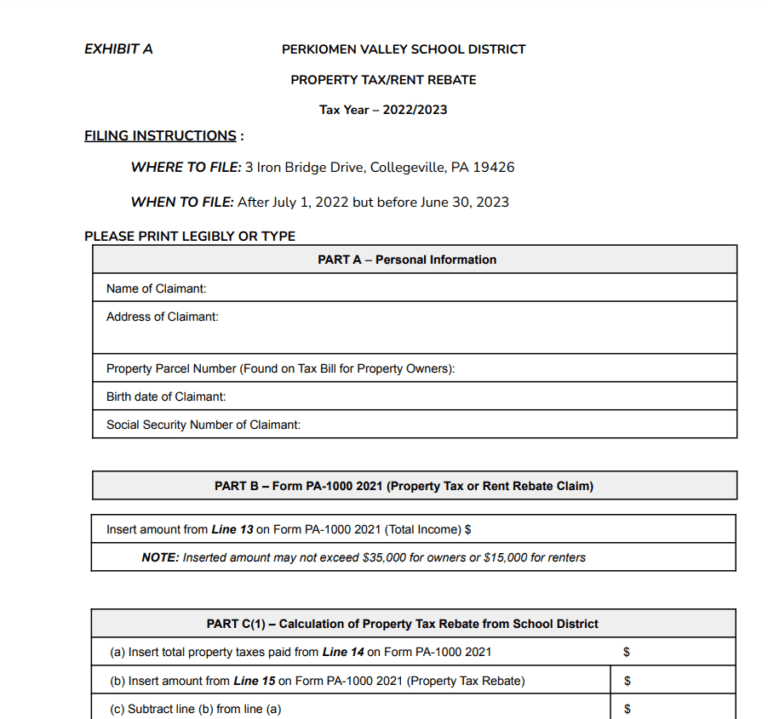

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

https://www.nbcchicago.com/news/local/who-is-eligible-for-illinois-income-and-property-tax-rebates-heres-what-to-know/2928403/

The Property Tax Rebate requires that recipients be Illinois residents who paid property taxes on their primary residence in 2021 and 2022 Their adjusted gross income must be 500 000

https://suburbanchicagoland.com/2024/01/21/illinois-program-lets-senior-citizens-defer-up-to-7500-per-year-in-property-taxes/

The Senior Citizens Real Estate Tax Deferral program allows qualifying seniors to defer up to 7 500 per year in property taxes The loan is repaid to the state when the property is sold or upon the death of the participant March 1 is the last day to apply for the program and seek deferral for 2023 taxes that will be due in 2024

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

2021 Illinois Property Tax Rebate Printable Rebate Form

Residents Can File Property Tax Rent Rebate Program Applications Online Lower Bucks Times

Deadline For Tax And Rent Relief Extended

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois Rebate2022

Download Instructions For Form IL 1040 PTR Illinois Property Tax Rebate PDF 2021 Templateroller

Download Instructions For Form IL 1040 PTR Illinois Property Tax Rebate PDF 2021 Templateroller

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Property Tax Rebate Illinois 2024 - If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can have adjusted gross incomes of