Property Tax Rebate In Income Tax India Web 30 juil 2016 nbsp 0183 32 It is possible to claim deduction in income tax from property municipal tax payment See the article in the link mentioned below visit the section on the page

Web 1 f 233 vr 2023 nbsp 0183 32 Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will Web Income Tax Rebate When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money is

Property Tax Rebate In Income Tax India

Property Tax Rebate In Income Tax India

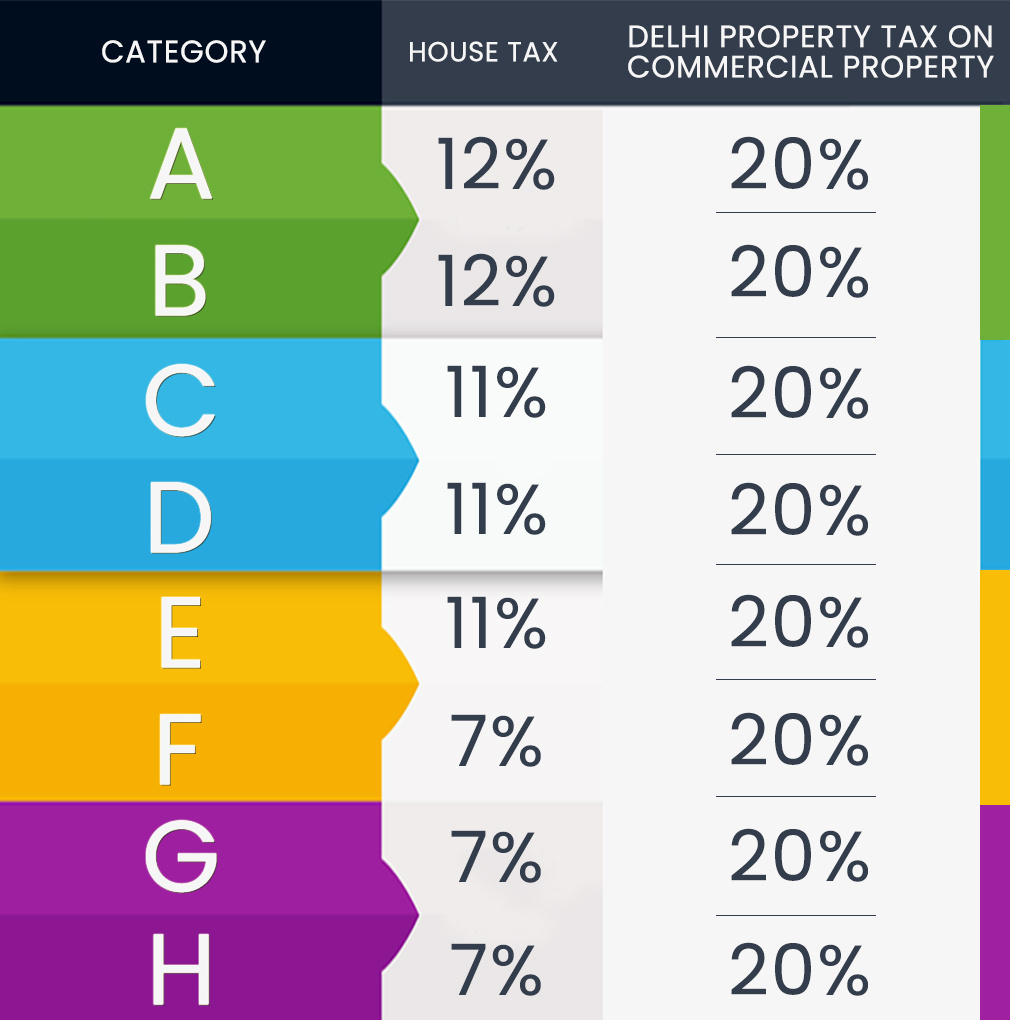

http://www.capitalgreensdelhi.com/blog/wp-content/uploads/2022/07/table-01.jpg

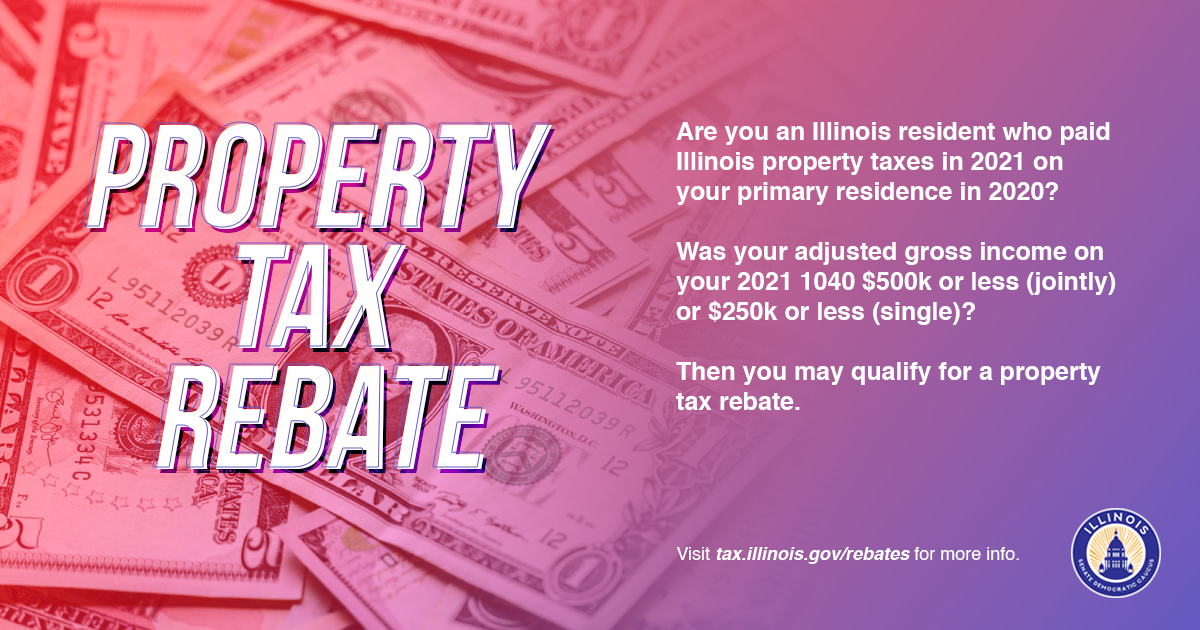

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

https://www.senatorstadelman.com/images/PropertyTaxRebate_2022_FB.JPG

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

Web 5 avr 2022 nbsp 0183 32 Income tax deduction for first time home buyer in India under section 80EE An individual is given extra tax benefit amounting to Rs 50 000 for interest paid on the Web 31 mars 2023 nbsp 0183 32 The civic body s property tax department has proposed an 8 rebate in annual property tax next fiscal for clearing the yearly tax by May Property owners to

Web 13 juin 2020 nbsp 0183 32 Generally in case of self occupied house the annual value is NIL Therefore any municipal taxes paid will not be allowed amp standard deduction will also be NIL The Web FAQs on Income from house property 1 Record s Page 1 of 1 in 0 032 seconds As amended upto Finance Act 2023 Disclaimer The above FAQs are for information

Download Property Tax Rebate In Income Tax India

More picture related to Property Tax Rebate In Income Tax India

Muth Encourages Eligible Residents To Apply For Extended Property Tax

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Budget 2023 Income Tax Slabs Savings Explained New Tax Regime Vs Old

https://static.toiimg.com/thumb/msid-97531244,width-1070,height-580,imgsize-103792,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less Web 1 f 233 vr 2023 nbsp 0183 32 rebate on property tax News New Income Tax Slabs 2023 2024 Highlights Full list of new tax slabs for new income tax regime amp FAQs answered

Web 11 avr 2023 nbsp 0183 32 To claim income tax rebate in India follow these steps Determine eligibility Check if you meet the eligibility criteria for claiming an income tax rebate Rebates are Web 7 f 233 vr 2023 nbsp 0183 32 New Income Tax Slabs 2023 2024 Highlights Full list of new tax slabs for new income tax regime comparison amp FAQs answered TIMESOFINDIA COM Feb 01

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

https://www.jagoinvestor.com/forum/is-property-tax-eligible-for...

Web 30 juil 2016 nbsp 0183 32 It is possible to claim deduction in income tax from property municipal tax payment See the article in the link mentioned below visit the section on the page

https://indianexpress.com/article/explained/ex…

Web 1 f 233 vr 2023 nbsp 0183 32 Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

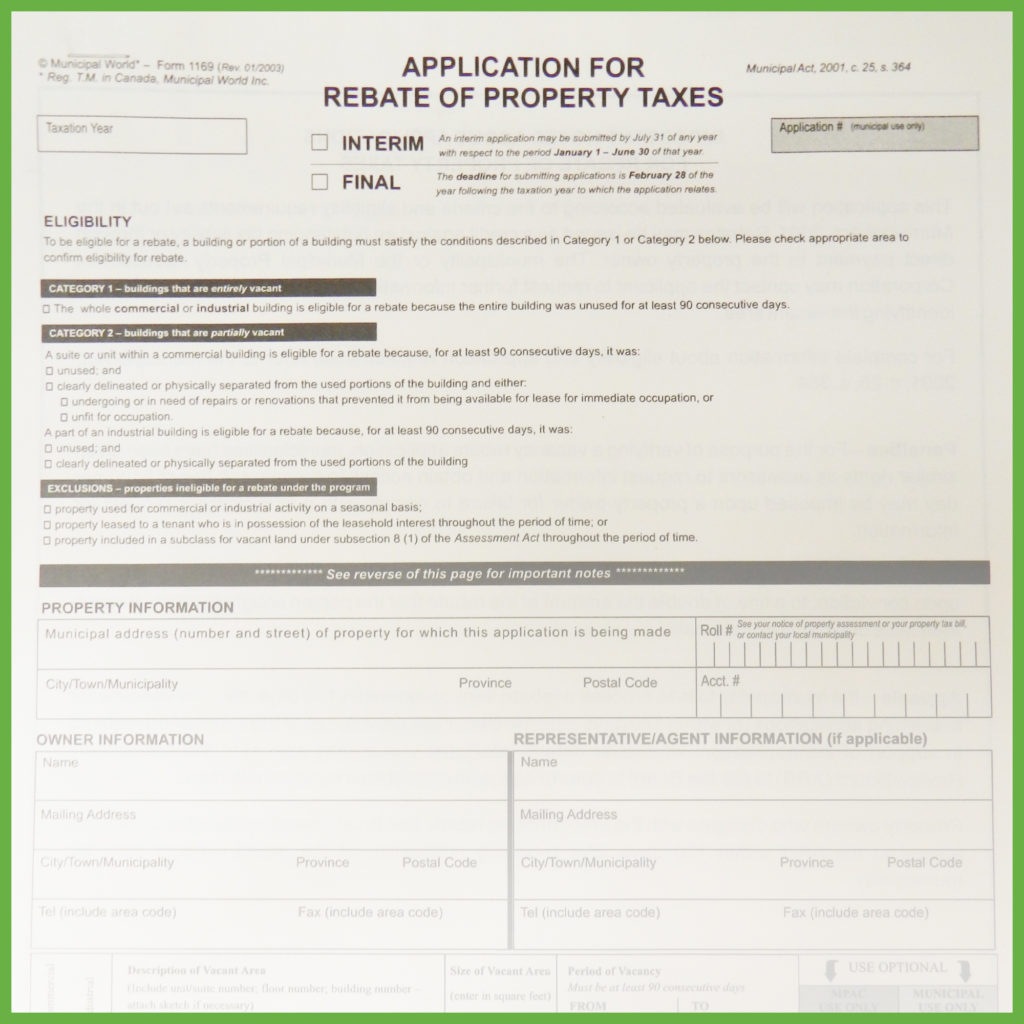

Application For Rebate Of Property Tax 2 Pages Verification Sheet

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Property Tax Rebate In Income Tax India - Web 31 mars 2023 nbsp 0183 32 The civic body s property tax department has proposed an 8 rebate in annual property tax next fiscal for clearing the yearly tax by May Property owners to