Property Tax Relief Illinois The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own and reside in your residence in order to take this credit

Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable residents including The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special assessment payments on their principal residences The deferral is similar to a loan against the property s market value

Property Tax Relief Illinois

Property Tax Relief Illinois

https://www.illinoisopportunity.org/wp-content/uploads/2021/05/6350c8c7-4904-48d2-9793-f41753e936a7-GettyImages-185121887.jpg

Texas Property Tax Relief Your Questions Answered

https://s.hdnux.com/photos/01/31/15/45/23386439/3/rawImage.jpg

Property Tax Relief Bristol TN Official Website

https://www.bristoltn.org/ImageRepository/Document?documentID=7717

To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly If filing alone your income The Senior Citizen Real Estate Tax Deferral Program is similar to a loan against a home s market value that allows a qualifying taxpayer to defer property taxes or special assessments owed by taking out a loan from

To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly If filing alone your income Most Illinois taxpayers will be getting a tax rebate from the state all you need to know Distribution of the one time income and property tax rebates to qualifying Illinois residents starts Monday By Satchel Price Sept 9 2022 3 15am PDT Illinois state officials say it could take eight weeks to get the money to everyone who s eligible

Download Property Tax Relief Illinois

More picture related to Property Tax Relief Illinois

Tax Relief Free Of Charge Creative Commons Financial 3 Image

https://pix4free.org/assets/library/2021-04-28/originals/tax_relief.jpg

Denver Property Tax Relief Program City And County Of Denver

https://www.denvergov.org/files/assets/public/denver-human-services/images/property-tax-relief.png?w=1200

Property Tax Relief For Senior Citizens Riverside Township Of Illinois

http://riversidetownship.org/wp-content/uploads/2022/01/propertytaxdeferral.jpg

A 3 tax on individual income over 1 million would flood Illinois coffers with at least 4 5 billion in new revenues annually a new state estimate shows weeks ahead of an advisory referendum on earmarking that money for property tax relief A property tax exemption is like a discount applied to your EAV If you qualify for an exemption it allows you to lower your EAV This would result in a lower property tax bill for you

[desc-10] [desc-11]

Property Tax Relief Applications Are Due March 1 Nashua NH Patch

https://patch.com/img/cdn/users/546351/2015/02/raw/20150254d3952cf1964.jpg

Property Tax Relief Available To Texas Homeowners Through Homestead

https://thumbnails.texastribune.org/-_FqXRIfyACjXuzikpLCHglvKy0=/1200x804/smart/filters:quality(95)/static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG

https://tax.illinois.gov/individuals/credits/propertytaxcredit.html

The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own and reside in your residence in order to take this credit

https://www.nbcchicago.com/news/local/new-illinois-law-provides...

Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable residents including

Meaningful Substantive Property Tax Relief In Illinois Is Critical

Property Tax Relief Applications Are Due March 1 Nashua NH Patch

R D Tax Relief In 2022 What You Need To Know

Maryland Property Tax Assessment Values Increase Clearview Group

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

Here s The Real Story On Tax Relief RateMuse

Here s The Real Story On Tax Relief RateMuse

Property Tax Relief How It Works Credit Karma

4 Property Tax Relief Options Keep Asking

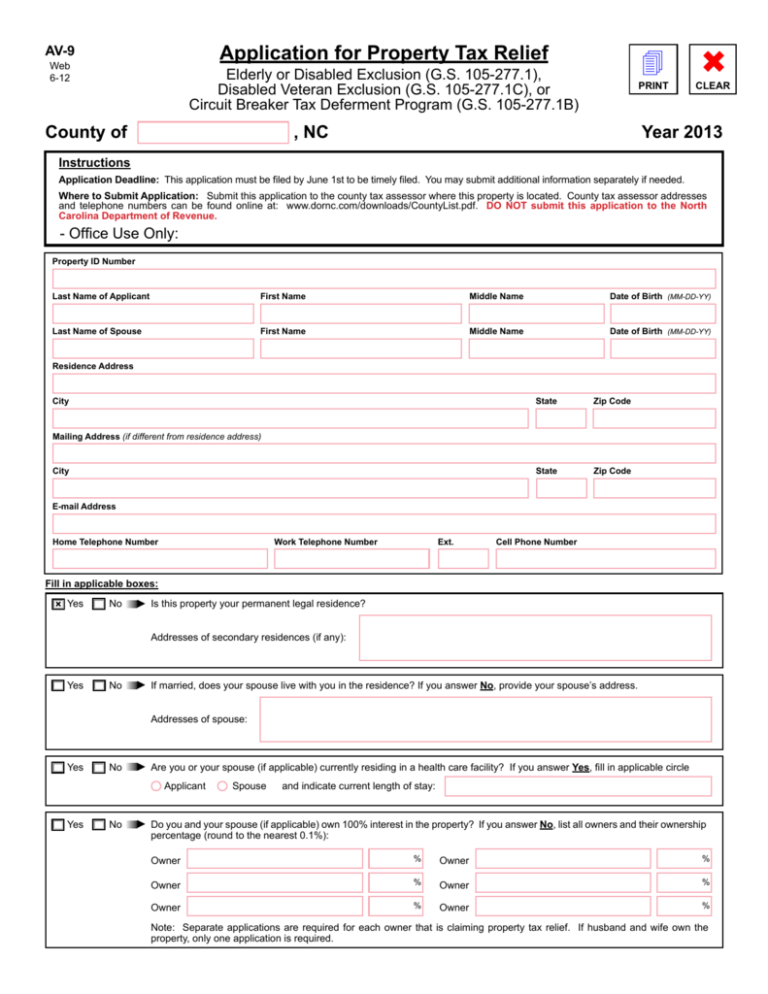

Application For Property Tax Relief

Property Tax Relief Illinois - [desc-14]

/static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)