Property Tax Relief Mn Minnesota offers property tax relief to both homeowners and renters Plus homeowners may be eligible for a special property tax refund depending on how much their taxes have increased Unfortunately about 1 in 3 people who are eligible don t file their application for property tax relief

The homestead credit refund is a state paid refund that provides tax relief to homeowners whose property taxes are high relative to their incomes The program was previously known as the homeowner s property tax refund program or PTR and sometimes popularly called the circuit breaker The additional or special property tax refund generally referred to as targeting directs property tax relief to homeowners who have large property tax increases from one year to the next Who qualifies

Property Tax Relief Mn

Property Tax Relief Mn

https://s.hdnux.com/photos/01/31/15/45/23386439/3/rawImage.jpg

Property Tax Relief Applications Are Due March 1 Nashua NH Patch

https://patch.com/img/cdn/users/546351/2015/02/raw/20150254d3952cf1964.jpg

Income Tax Relief Programs Services USA Tax Settlement

http://usataxsettlement.com/wp-content/uploads/2021/01/Tax-Relief.jpeg

The additional or special property tax refund generally referred to as targeting directs property tax relief to homeowners who have large property tax increases from one year to the next Who qualifies The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid

That s why the House Property Tax Division laid over two bills on Wednesday that would boost the size of most Minnesotans property tax refunds altering the algorithm to get more money back into the hands of homeowners The Senior Citizens Property Tax Deferral Program allows property taxpayers who are 65 years or older and whose total household income is 96 000 or less to defer a portion of their homestead property taxes until some later time

Download Property Tax Relief Mn

More picture related to Property Tax Relief Mn

NJ 2 Property Tax Relief Programs V1 0

https://s2.studylib.net/store/data/005419817_1-7b61982b2fb1a8f6639d61909c72af8b-768x994.png

Property Tax Relief Bristol TN Official Website

https://www.bristoltn.org/ImageRepository/Document?documentID=7717

4 Property Tax Relief Options Keep Asking

https://cdn.keepasking.com/keepasking/wp-content/uploads/2021/02/4-property-tax-relief-options-scaled.jpg

There are three property tax relief programs aimed at homeowners offered by the state of Minnesota Homestead Credit Refund Program Targeting Property Tax Refund Senior Citizen Property Tax Deferral Program Below is a basic description of each program its eligibility criteria and sample benefits calculations The Senate Property Tax Division considered its first bill to lower property taxes for homeowners this week a DFL bill that would make it easier for seniors to take advantage of the Senior Citizen Property Tax Deferral program

The programs listed below help reduce property taxes for various types of property and owners across Minnesota In some cases you will automatically receive a benefit if you qualify without needing to apply Others require you to file an application usually with your county assessor Minnesota has two property tax refund programs for homeowners the regular property tax refund and the special property tax refund You may be eligible for one or both depending

Property Tax Relief For Income qualified Homeowners Local Housing

https://localhousingsolutions.org/wp-content/uploads/2021/05/Property-tax-relief-for-income-qualified-homeowners.jpeg

Property Tax Relief For Senior Citizens Riverside Township Of Illinois

https://riversidetownship.org/wp-content/uploads/2022/01/propertytaxdeferral.jpg

https://habitatminnesota.org › blog › news › know-your...

Minnesota offers property tax relief to both homeowners and renters Plus homeowners may be eligible for a special property tax refund depending on how much their taxes have increased Unfortunately about 1 in 3 people who are eligible don t file their application for property tax relief

https://www.lrl.mn.gov › docs › other

The homestead credit refund is a state paid refund that provides tax relief to homeowners whose property taxes are high relative to their incomes The program was previously known as the homeowner s property tax refund program or PTR and sometimes popularly called the circuit breaker

Property Tax Relief Connecticut Sentry CommercialSentry Commercial

Property Tax Relief For Income qualified Homeowners Local Housing

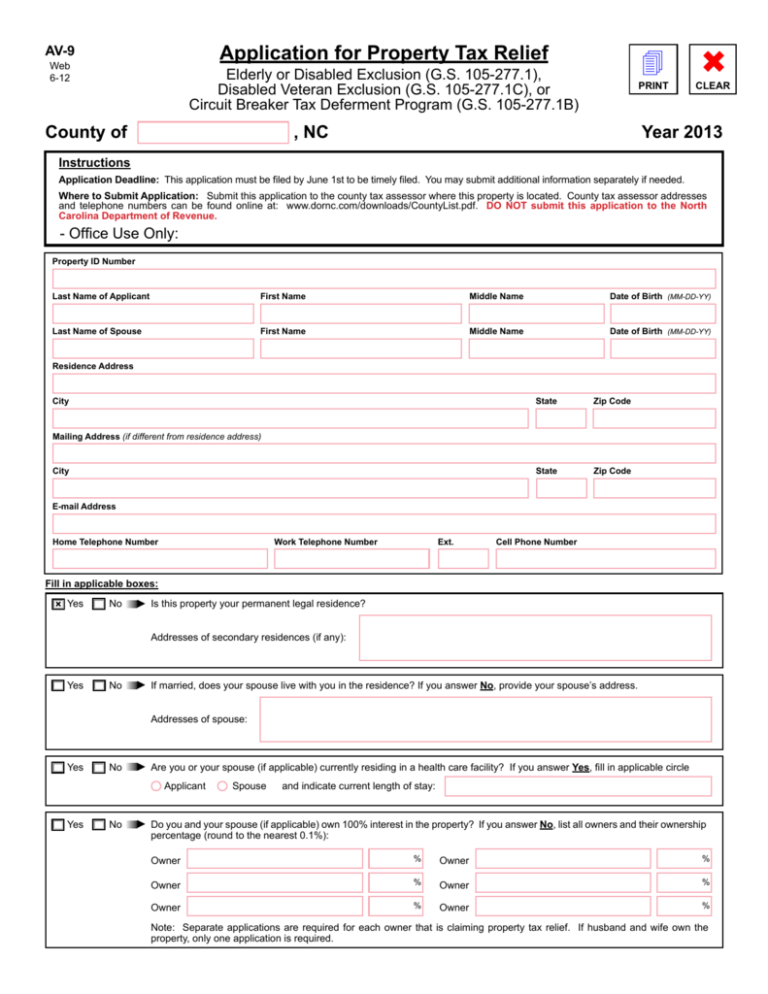

Application For Property Tax Relief

Real Estate Tax Relief Program Official Website Of Arlington County

How To Find Property Tax Relief In 2022 Comparisonsmaster

LHDN Tax Relief What You Need To Know Properly

LHDN Tax Relief What You Need To Know Properly

California Mortgage Relief Program Property Tax Relief Yolo County

NJ Property Tax Relief Program To Give 900M To Nearly 1 8M Residents

Property Tax Reduction Consultants Which Types Of Property Tax Relief

Property Tax Relief Mn - The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid