Property Tax Relief Program Under the program qualifying homeowners age 65 or older disabled homeowners as well as disabled veteran homeowners or their surviving spouses receive tax relief from the taxes due on their property Homeowners must have been 65 by December 31 of the tax year for which they are applying Applicants must present For homeowners age 65 or

The law that established the property tax relief task force also laid the groundwork for the creation of an envisioned new program called Stay NJ that calls for it to operate as a tax credit program Under Stay NJ benefits as large as 6 500 have been promised to income qualified senior homeowners with the first credits to be E Services for Tax Professionals Free Tax Return Preparation Payroll Service Companies Selecting a Tax Preparer Vehicle Use Tax Calculator E File Your Return Free E File for Individual E File for Corporate E File for TPT E File for W 2 1099 E File for Luxury Direct Deposit Information Upload Guide Templates See More of E

Property Tax Relief Program

Property Tax Relief Program

https://townsquare.media/site/99/files/2023/04/attachment-property-tax-refund.jpg?w=980&q=75

Tennessee Property Tax Relief Program Celebrates 50th Anniversary

https://comptroller.tn.gov/content/dam/cot/administration/images/press-release-images/2023/TaxReliefGoldRibbonSeal.jpg

NJ ANCHOR Property Tax Relief Program Application Deadline Extended To

https://middletownship.com/wp-content/uploads/2022/11/315868169_675151700647024_4862430220857408753_n.jpg

The Anchor program June 15 2022 Gov Phil Murphy announces agreement with Assembly Speaker Craig Coughlin and Senate President Nick Scutari on property tax relief measures A former state treasurer and the chief data officer for a key state department are among the policy experts Gov Phil Murphy and lawmakers picked This exemption would not pass on to the new owner and the tax could change considerably when the exemption is removed from the property Disability Senior Citizens 65 and older STAR School Tax Relief Program Veterans For further information regarding exemptions you must contact the Department of Assessment at

Nebraska Homestead Exemption Information Guide March 4 2022 Page 1 Information Guide March 2022 Overview The Nebraska homestead exemption program is a property tax relief program for six categories of homeowners 1 Persons over age 65 see page 4 2 Veterans totally disabled by a nonservice connected accident or illness see page 7 3 Property Tax Aide has independently selected the property tax relief programs featured on this website that we think are the most relevant and beneficial to older adults It is not an exhaustive list of all property tax relief programs available in each state Please consult your local tax agency for a comprehensive listing of property tax

Download Property Tax Relief Program

More picture related to Property Tax Relief Program

California Mortgage Property Tax Relief Program Placer County CA

https://www.placer.ca.gov/ImageRepository/Document?documentID=63015

Tennessee Property Tax Relief Program YouTube

https://i.ytimg.com/vi/NV8vSxx2vPk/maxresdefault.jpg

Apply For Historic Property Tax Relief Program City Of Perth Amboy

https://cdn5-hosted.civiclive.com/UserFiles/Servers/Server_11204924/Image/News/2022/ANCHOR Program.png

The legislation now allows for anyone 62 or older to qualify for a property tax freeze One year after they passed the original legislation Missouri legislators have approved a fix to a law allowing property tax freezes for seniors Members of the House voted 139 0 Friday to pass the bill Since it has already gone through the Senate it now The proposed FY2024 budget also continues the historic ANCHOR property tax relief program proposing another 2 billion in direct relief to homeowners and renters With this proposed allocation Governor Murphy will have provided nearly 2 billion more in direct property tax relief in the first two years of his second term than the

Kent County residents may be eligible for some property tax exemptions and county officials want to remind residents about them as tax season begins Kent County Assessment Office assessment supervisor Sue Wilson says the window to apply for the Annual Elderly Disability Tax Exemption is open People over the age of 65 you have Property tax rates are based on the physical location of the property and are set by the County Commissioners and municipalities annually If you own personal property that must be listed and did not receive a listing form you may use our Online Listing System or contact the Assessor s Office at 980 314 4CAO 4226 or email protected to

2016 2017 Real Property Tax Relief Program Updates

https://u.realgeeks.media/residekauai/blog_graphics/paper2.jpg

NJ property Tax Relief Program To Give 900M To Nearly 1 8M Residents

https://s.yimg.com/ny/api/res/1.2/tPm7PRQjJNZ_TspJsusDIg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://s.yimg.com/hd/cp-video-transcode/prod/2022-03/03/6221502d2ff034282b44e767/6221502d2ff034282b44e768_o_U_v2.jpg

https://www.nashville.gov/departments/trustee/property-tax-relief

Under the program qualifying homeowners age 65 or older disabled homeowners as well as disabled veteran homeowners or their surviving spouses receive tax relief from the taxes due on their property Homeowners must have been 65 by December 31 of the tax year for which they are applying Applicants must present For homeowners age 65 or

https://www.njspotlightnews.org/2024/05/nj...

The law that established the property tax relief task force also laid the groundwork for the creation of an envisioned new program called Stay NJ that calls for it to operate as a tax credit program Under Stay NJ benefits as large as 6 500 have been promised to income qualified senior homeowners with the first credits to be

Help With ANCHOR Property Tax Relief Applications Offered In Ocean Co

2016 2017 Real Property Tax Relief Program Updates

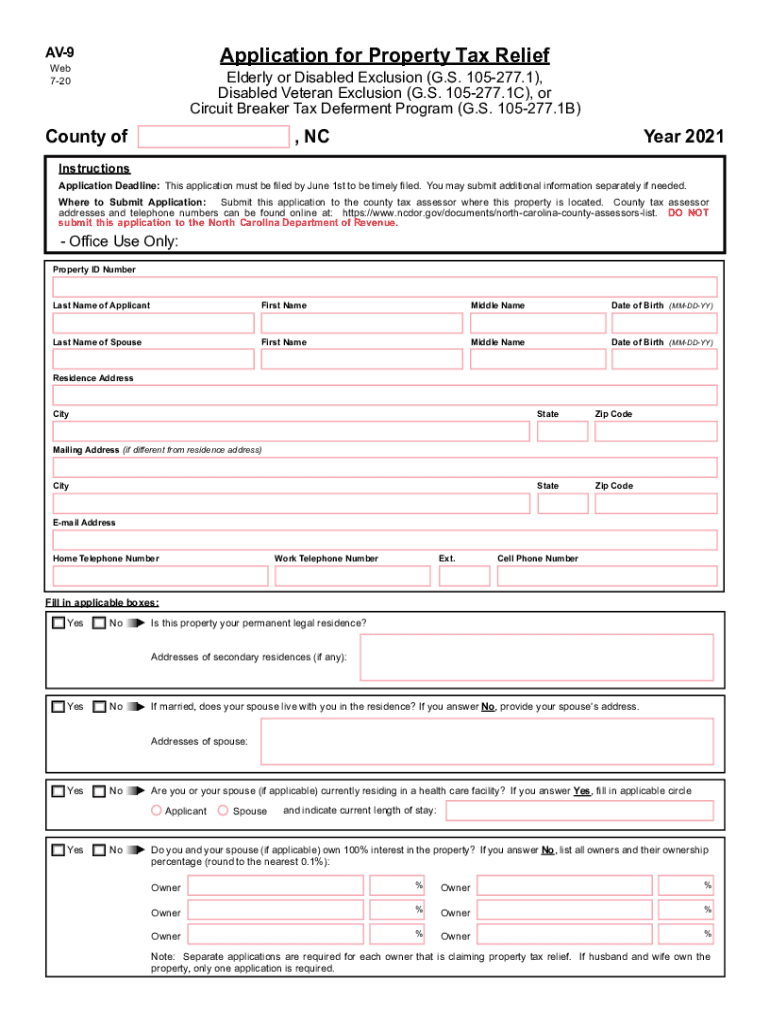

Application Property Tax Relief Fill Out Sign Online DocHub

Ewing New Jersey ANCHOR Property Tax Relief Program Deadline Extended

Business Report Interest Rates Rise High Demand For Property tax

Legislature Makes Changes To Property Tax Relief Programs Whidbey

Legislature Makes Changes To Property Tax Relief Programs Whidbey

Tennessee Property Tax Relief Program Celebrates 50th Anniversary

Senior Disabled Property Tax Relief Program In Stratford Stratford

Property Tax Relief Programs

Property Tax Relief Program - Nebraska Homestead Exemption Information Guide March 4 2022 Page 1 Information Guide March 2022 Overview The Nebraska homestead exemption program is a property tax relief program for six categories of homeowners 1 Persons over age 65 see page 4 2 Veterans totally disabled by a nonservice connected accident or illness see page 7 3