Provident Fund Income Tax Rebate Web Income tax on provident fund On August 31 2021 the Central Board of Direct Taxes CBDT issued a notification making Provident Fund PF payments exceeding specific

Web 6 sept 2021 nbsp 0183 32 The Finance Act 2021 provided that any interest to the extent it relates to the amount of Provident Fund contribution exceeding Rs 2 50 000 made by employees Web The employer deducts you EPF contribution 12 of your basic salary at the time of payment of the salary All the persons whose basic salary is upto Rs 15 000 are

Provident Fund Income Tax Rebate

Provident Fund Income Tax Rebate

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

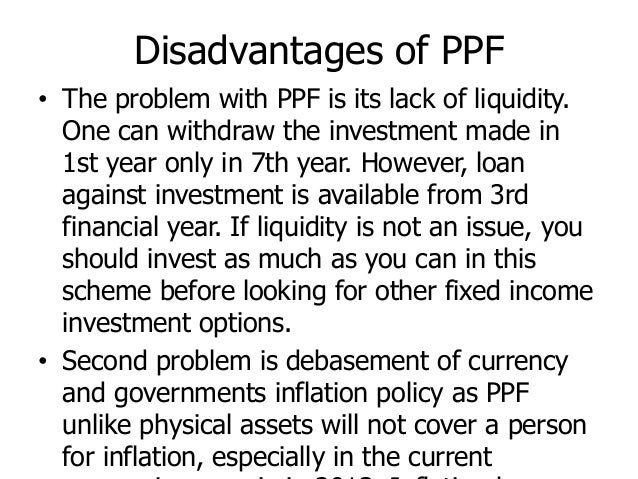

Public Provident Fund 2

https://image.slidesharecdn.com/publicprovidentfund2-131115025234-phpapp01/95/public-provident-fund-2-10-638.jpg?cb=1384484021

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

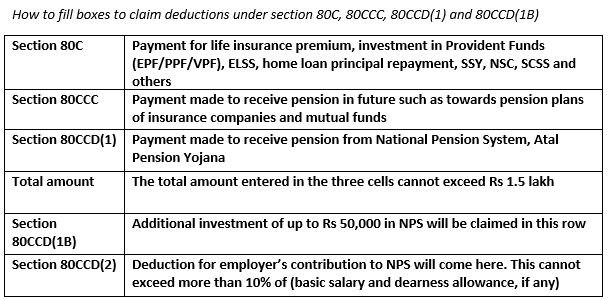

Web 21 f 233 vr 2020 nbsp 0183 32 The deduction can be claimed by an employee under section 80CCD 2 of the Act for maximum of 10 per cent of the total of his her basic salary plus Web 1 be a Singapore Citizen Permanent Resident and 2 have made cash top ups in 2022 under the CPF Retirement Sum Topping Up Scheme quot RSTU quot For each Year of

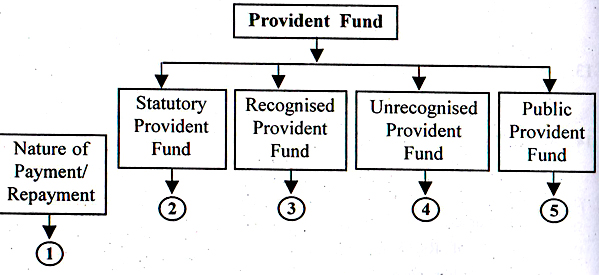

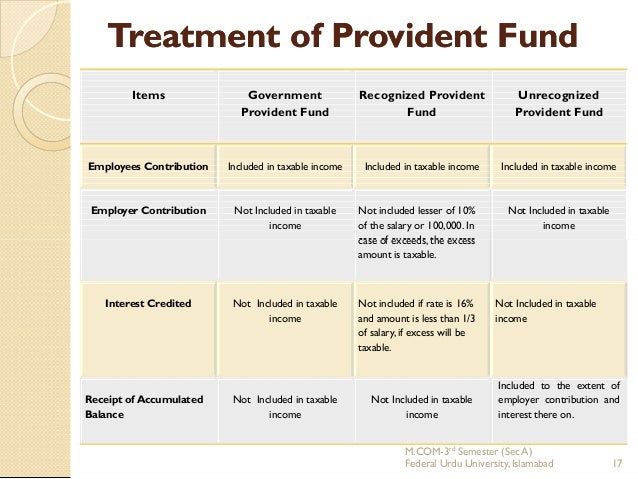

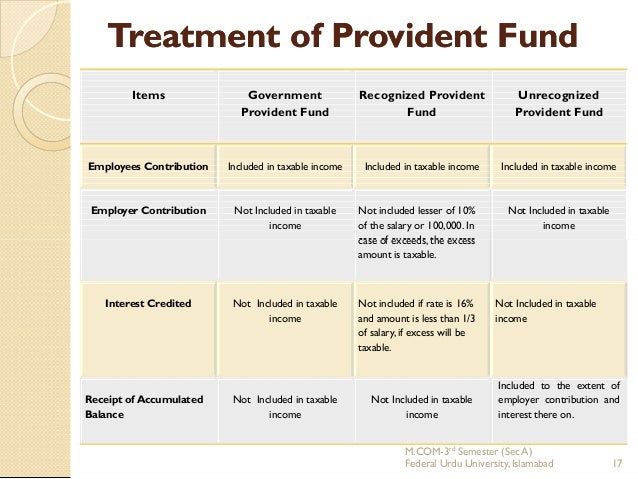

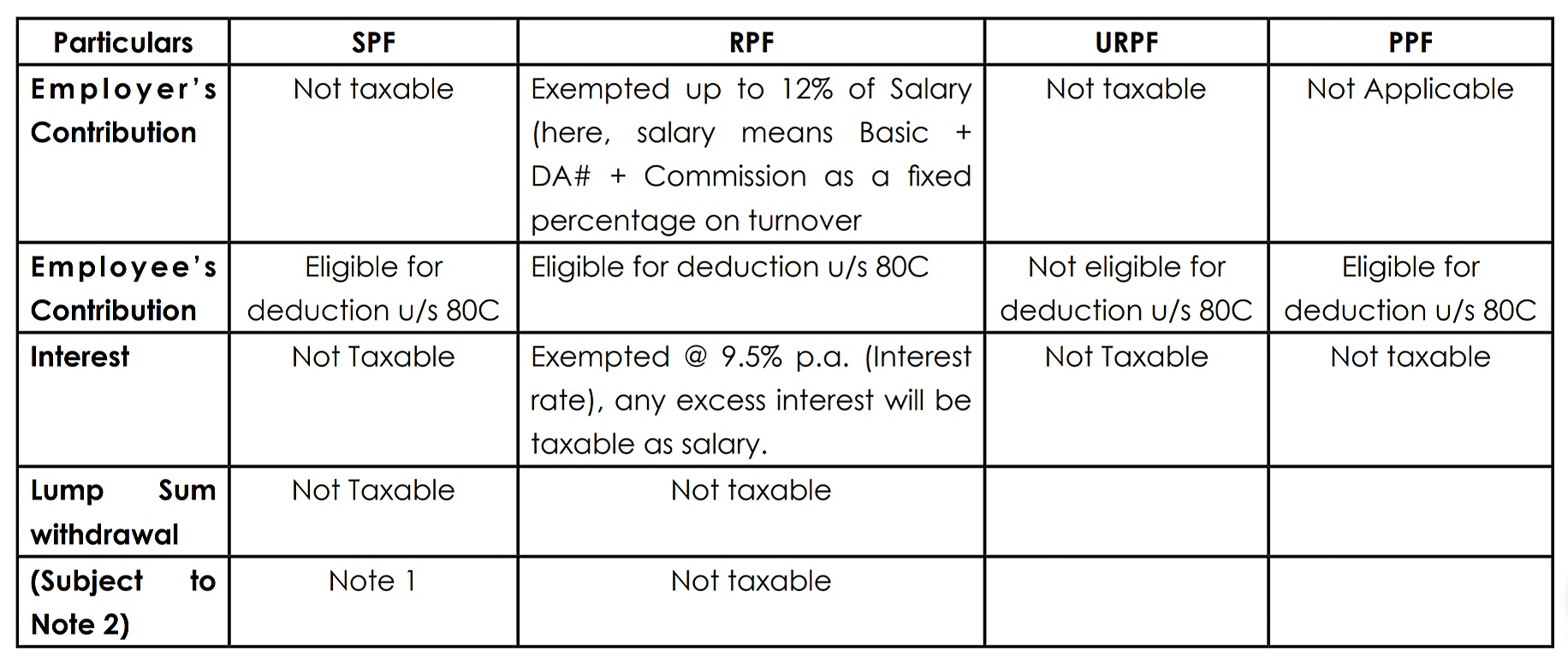

Web Statutory Provident fund Public Provident fund Recognized Provident fund like EPF Unrecognized Provident fund Employer s contribution Fully exempt N A 12 of employee s salary Fully exempt Employee s Web In excess of 12 the contributions are taxable in the year of contribution Tax Deduction u s 80C is available for amount invested by the employee up to Rs 1 5 Lakh in a Financial Year Interest amount earned up to

Download Provident Fund Income Tax Rebate

More picture related to Provident Fund Income Tax Rebate

Graphical Chat Presentation Of Provident Fund Tax Treatement

https://incometaxmanagement.com/Images/Graphical-ITAX/Provident-Fund-1.jpg

.jpg)

Income From Salaries Section 15 To 17 Graphical Table Presentation

https://incometaxmanagement.com/Images/Graphical-ITAX/Salary/8-Provident Fund ( SPF, PPF, URPF, RPF ).jpg

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Web 21 sept 2021 nbsp 0183 32 Provident Fund A provident fund is a compulsory government managed retirement savings scheme similar to the Social Security program in the United States Web 1 avr 2022 nbsp 0183 32 Taxation on Provident Fund PF contributions above 2 50 Lakh is certainly considered one among them After the explanation of the provident fund introduced in

Web 26 mai 2021 nbsp 0183 32 A s salary contribution in PF is Rupees 480 000 i e 12 of 40 00 000 earlier full amount is tax free but as per the budget 2021 excess tax is charge in excess Web 5 f 233 vr 2021 nbsp 0183 32 Talking on PPF contributions Gopal Bohra Partner NA Shah Associates said As per the budget proposal interest accrued to a taxpayer on contribution made

Income From Salary Sec 12

https://image.slidesharecdn.com/incomefromsalary-140111024830-phpapp02/95/income-from-salary-sec-12-17-638.jpg?cb=1389408623

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

https://babatax.com/income-tax-on-provident-fund-new-rule-to-tax-pf...

Web Income tax on provident fund On August 31 2021 the Central Board of Direct Taxes CBDT issued a notification making Provident Fund PF payments exceeding specific

https://www.financialexpress.com/money/income-tax-tax-on-provident...

Web 6 sept 2021 nbsp 0183 32 The Finance Act 2021 provided that any interest to the extent it relates to the amount of Provident Fund contribution exceeding Rs 2 50 000 made by employees

Provident Fund Meaning Types Taxation Example Vs Gratuity

Income From Salary Sec 12

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Provident Fund Tax Treatment Of Provident Fund For Salary Employee

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Income Tax Rebate Under Section 87A

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Provident Fund Income Tax Rebate - Web In excess of 12 the contributions are taxable in the year of contribution Tax Deduction u s 80C is available for amount invested by the employee up to Rs 1 5 Lakh in a Financial Year Interest amount earned up to