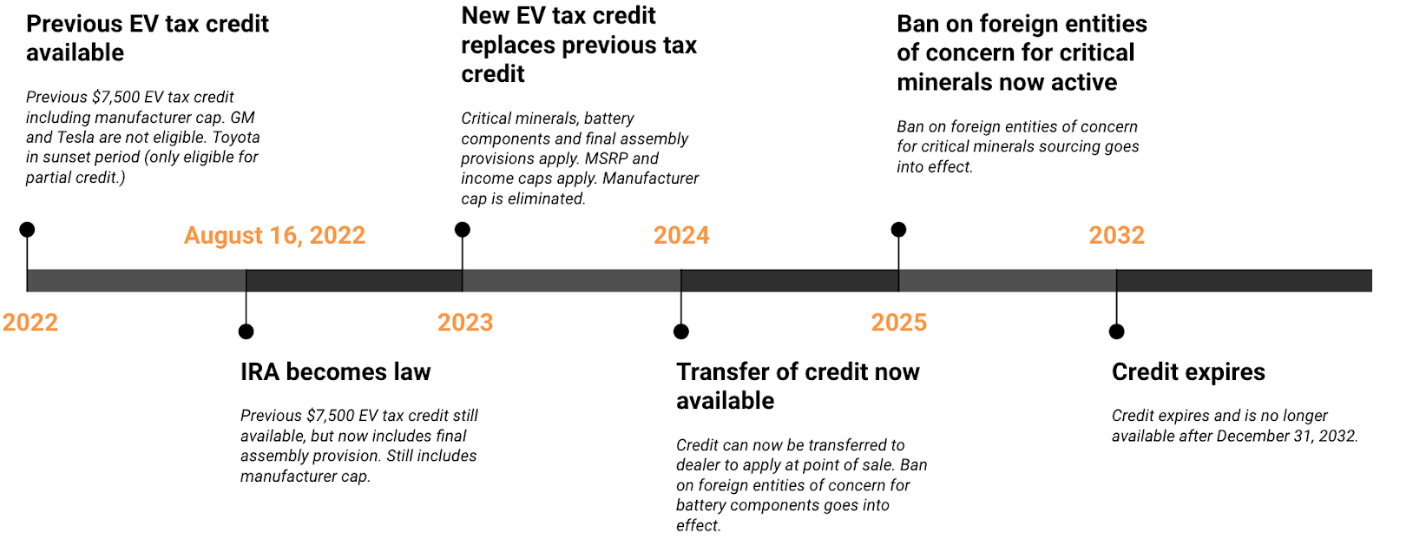

Purchase New Vehicle Tax Credit Beginning with tax year 2023 in addition to a new North America final assembly requirement the former 7 500 credit is broken into two new credits worth up

EV Tax Credit 2024 Rules and Qualifications for Electric Vehicle Purchases The 2024 electric vehicle tax credit has been expanded and modified Three new tax credits are available to individual purchasers of clean vehicles To find out if your purchase will qualify you ll first need to decide whether you re interested in a new or used vehicle You ll also need to

Purchase New Vehicle Tax Credit

Purchase New Vehicle Tax Credit

https://deyuan.enterprises/export/wp-content/uploads/2022/08/irs-clarifies-new-ev-tax-credit-rules-lists-2022-23-vehicles-that-may-be-eligible.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Rivian Federal Tax Credit Frank Mccain

https://i.pinimg.com/originals/a8/a6/3e/a8a63eb4506b99f18685ddcabb4a756d.jpg

The Notice of Proposed Rulemaking NPRM provides clarity and certainty to manufacturers on the Inflation Reduction Act requirements that vehicles eligible for the Prior to the IRA new passenger vehicles were eligible for up to a 7 500 tax credit subject to a 200 000 cap on the total number of vehicles by manufacturer The

Under the Inflation Reduction Act like the previous provision if you purchase a new plug in EV or fuel cell vehicle in 2023 or later you may still qualify for a clean vehicle tax credit potentially up to 7 500 You technically can t write off the entire purchase of a new vehicle However you can deduct some of the cost from your gross income There are also

Download Purchase New Vehicle Tax Credit

More picture related to Purchase New Vehicle Tax Credit

Electric Vehicle Tax Credit Update For New Models Fuoco Group

https://eadn-wc03-3529432.nxedge.io/wp-content/uploads/2021/01/EV-Tax-Credit-2020-1024x632.jpg

Clean Vehicle Tax Credit Guidance Fuel Economy Labeling

https://www.wilsonlewis.com/wp-content/uploads/2023/02/EV-tax-credit-Atlanta-CPA.jpg

HMRC Company Car Tax Rates 2020 21 Explained

https://blog-media.vimcar.com/uk-blog/uploads/2021/04/21142208/Optimized-210419_car-taxes-1024x683.jpg

To deduct vehicle sales tax you can either Save all sales receipts and deduct actual sales taxes paid throughout the year or Use the IRS sales tax tables to figure your deduction These tables calculate the estimated The minimum credit for vehicles placed in service from January 1 to April 17 2023 will be 3 751 The credit amount for vehicles placed in service after April 18

The big climate and health care bill signed into law by President Biden has what at first sight looks like a big incentive for those shopping for a car a revamped The EV tax credit is a federal incentive to encourage consumers to purchase EVs Taxpayers who meet the income requirements and buy a vehicle that

How To Claim The 7 500 Electric Vehicle Tax Credit And Which Cars

https://www.cnet.com/a/img/resize/48d9bb172d9acfe65b3f4ea795c85cd117f35a50/hub/2023/04/27/37310e36-583e-4cf5-a63f-45ba12ab8e50/gettyimages-1418148473.jpg?auto=webp&fit=crop&height=675&width=1200

Who Benefits From The Renewed Clean Vehicle Tax Credit Now That

https://miro.medium.com/v2/resize:fit:1200/1*Pyxw3o4oE-_DAGEFEXVIyA.jpeg

https:// turbotax.intuit.com /tax-tips/going-green/...

Beginning with tax year 2023 in addition to a new North America final assembly requirement the former 7 500 credit is broken into two new credits worth up

https://www. nerdwallet.com /article/taxes/ev-tax...

EV Tax Credit 2024 Rules and Qualifications for Electric Vehicle Purchases The 2024 electric vehicle tax credit has been expanded and modified

IRS Offers A Host Of Car Credits Hobe Lucas

How To Claim The 7 500 Electric Vehicle Tax Credit And Which Cars

New Vehicle Tax Rates Come Into Force Today GOV UK

Qualifying Cars For The 2022 Electric Vehicle Tax Credit Verified

The States With The Lowest Car Tax The Motley Fool

Using Your Tax Return As Down Payment For A Car ULiveUSA

Using Your Tax Return As Down Payment For A Car ULiveUSA

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

2022 EV Tax Credits From Inflation Reduction Act Plug In America

My Quality Tax Service Posted On LinkedIn

Purchase New Vehicle Tax Credit - Federal EV Tax Credit for New Car Buyers New car buyers who meet the law s income restrictions and who buy new vehicles that meet the Act s numerous