Qualified Medical Expenses Paid Using Hsa Distributions See Instructions You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons

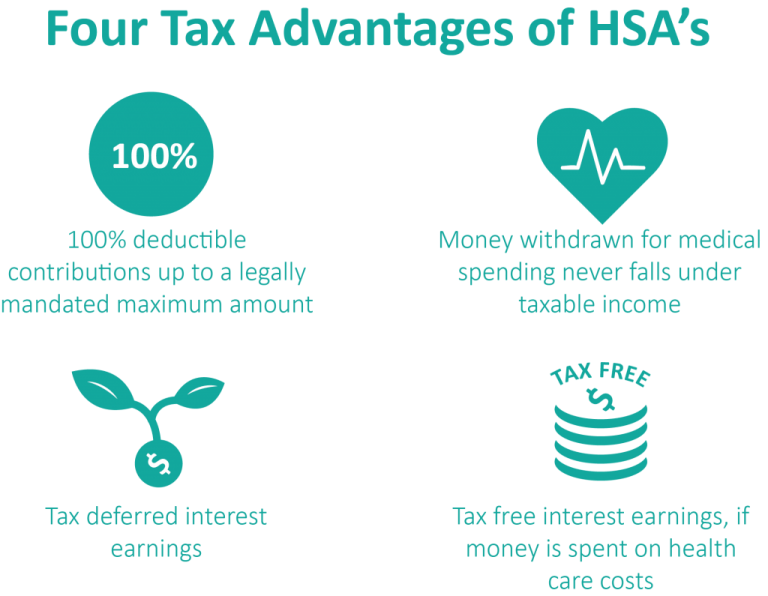

HSAs offer significant tax benefits but there are strict limitations on deducting medical expenses paid with HSA funds Contributions are made with pre tax dollars and Form 1099 SA reports distributions from Health Savings Accounts HSA and Medical Savings Accounts MSA detailing whether withdrawals are taxable or qualified medical expenses Understanding how to report these

Qualified Medical Expenses Paid Using Hsa Distributions See Instructions

Qualified Medical Expenses Paid Using Hsa Distributions See Instructions

https://i.pinimg.com/originals/0b/7d/6a/0b7d6a419e534849db35671b64946b5f.jpg

Why Do My Health Insurance Premiums Keep Going Up Each Year Part 2

https://www.trustedunion.com/wp-content/uploads/2019/01/shutterstock_premium-increases-part-2-875x410.jpg

Am I Eligible For A Health Savings Account SKP Advisors Accountants

https://skpadvisors.com/wp-content/uploads/2021/10/HSA_rsz.jpg

Distributions used for qualified medical expenses Pulls to line 15 Form 8889 Include distributions from your HSA that were used to pay for qualified medical expenses not When it s time to use the money in your HSA it s important to understand the types of medical expenses that can be paid or reimbursed tax free 1 Distributions from an HSA are tax free1

Individuals can withdraw money from their HSA to pay for eligible medical expenses also known as qualified medical expenses for the account holder their spouse or their dependents Many employers offer health savings accounts HSAs to their employees as a tax advantaged way to pay eligible medical expenses However it s the employee s responsibility to properly report their HSA contributions and

Download Qualified Medical Expenses Paid Using Hsa Distributions See Instructions

More picture related to Qualified Medical Expenses Paid Using Hsa Distributions See Instructions

The Best Health Savings Accounts HSA Providers Fidelity And Lively

https://www.mymoneyblog.com/wordpress/wp-content/uploads/2021/11/hsa_better.jpg

Your Quick Guide To Qualified Medical Expenses SavingsOak

https://savingsoak.com/wp-content/uploads/2021/06/blog5-cover.png

HSA Growin

https://blog.growin.tv/wp-content/uploads/2021/08/HSA精選圖.jpg

This article will provide instructions on how to fill out the form calculate deductions and ensure accurate reporting of HSA contributions and withdrawals on your tax return Using an HSA health savings account for your health The second section on Form 8889 HSA Distributions is where you report the total amount of money taken out of your HSA in 2023 and how much of it was spent on

See the Form 8889 instructions for the kinds of products and services that qualify Note that a qualified medical expense paid for by an HSA cannot also be included as an itemized deduction on Schedule A Form 1040 Ed Zurndorfer discusses the tax savings when HSA distributions are made to pay medical expenses including which expenses are qualified IRS reporting requirements and

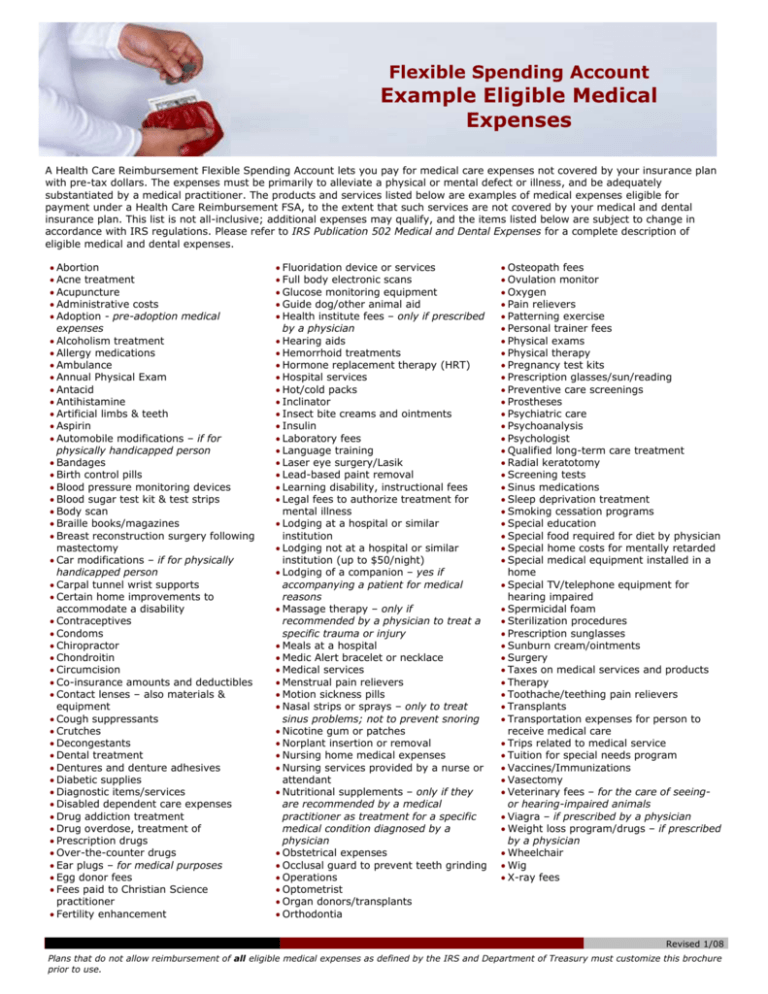

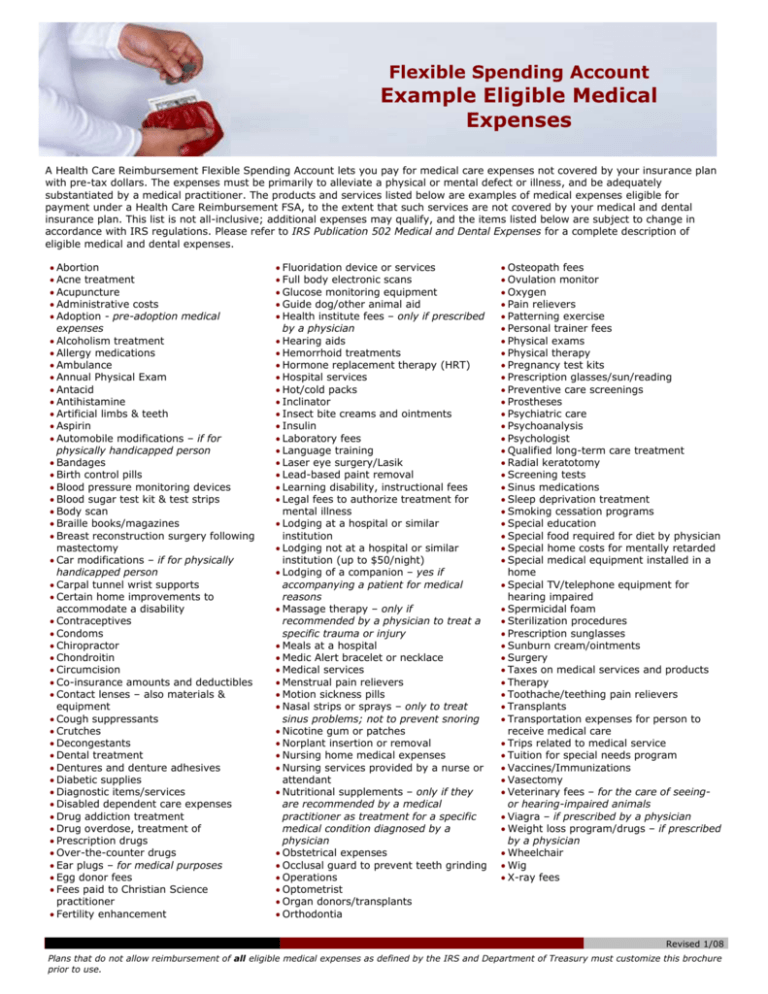

Flexible Spending Account Example Eligible Medical Expenses

https://s3.studylib.net/store/data/007783568_2-ce6693b5ed4cb9d25441e26bfd42732d-768x994.png

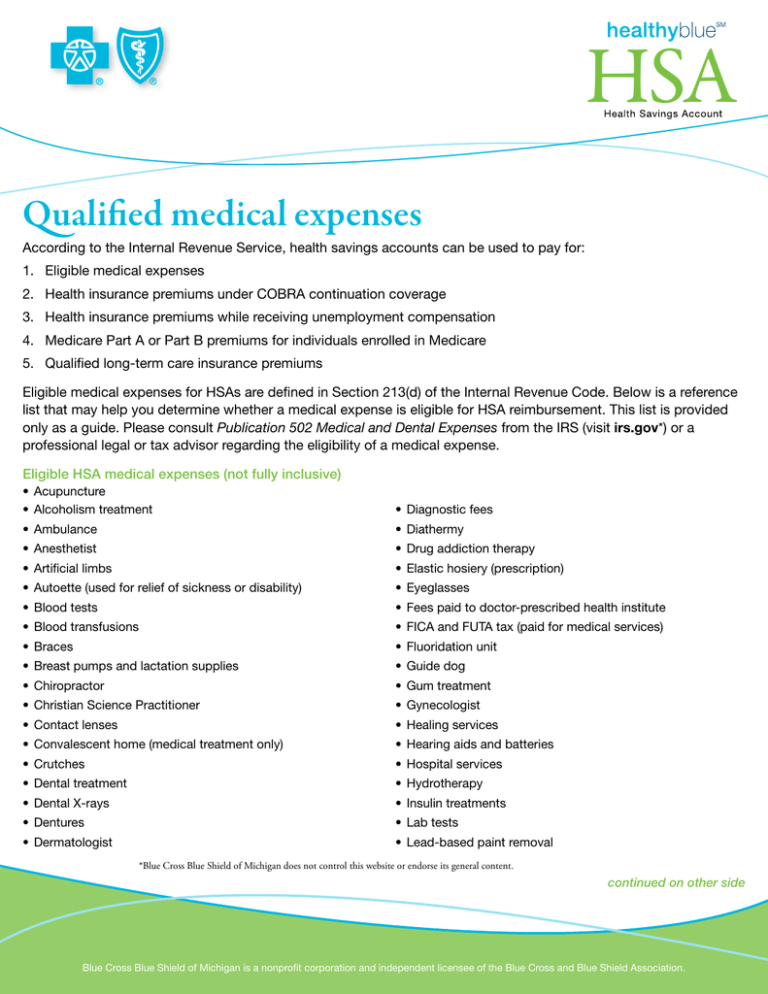

Health Savings Account Qualified Medical Expenses MTB Management

https://mtbmanagement.zendesk.com/hc/article_attachments/5386049021332/Capture2.JPG

https://www.irs.gov › publications

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons

https://accountinginsights.org › can-you-deduct...

HSAs offer significant tax benefits but there are strict limitations on deducting medical expenses paid with HSA funds Contributions are made with pre tax dollars and

HSA Qualified Medical Expenses

Flexible Spending Account Example Eligible Medical Expenses

5 Things To Know About Health Savings Accounts ThinkHealth

Discover The HSA Triple Tax Savings Advantage

Health Savings Accounts How HSAs Work And The Tax Advantages

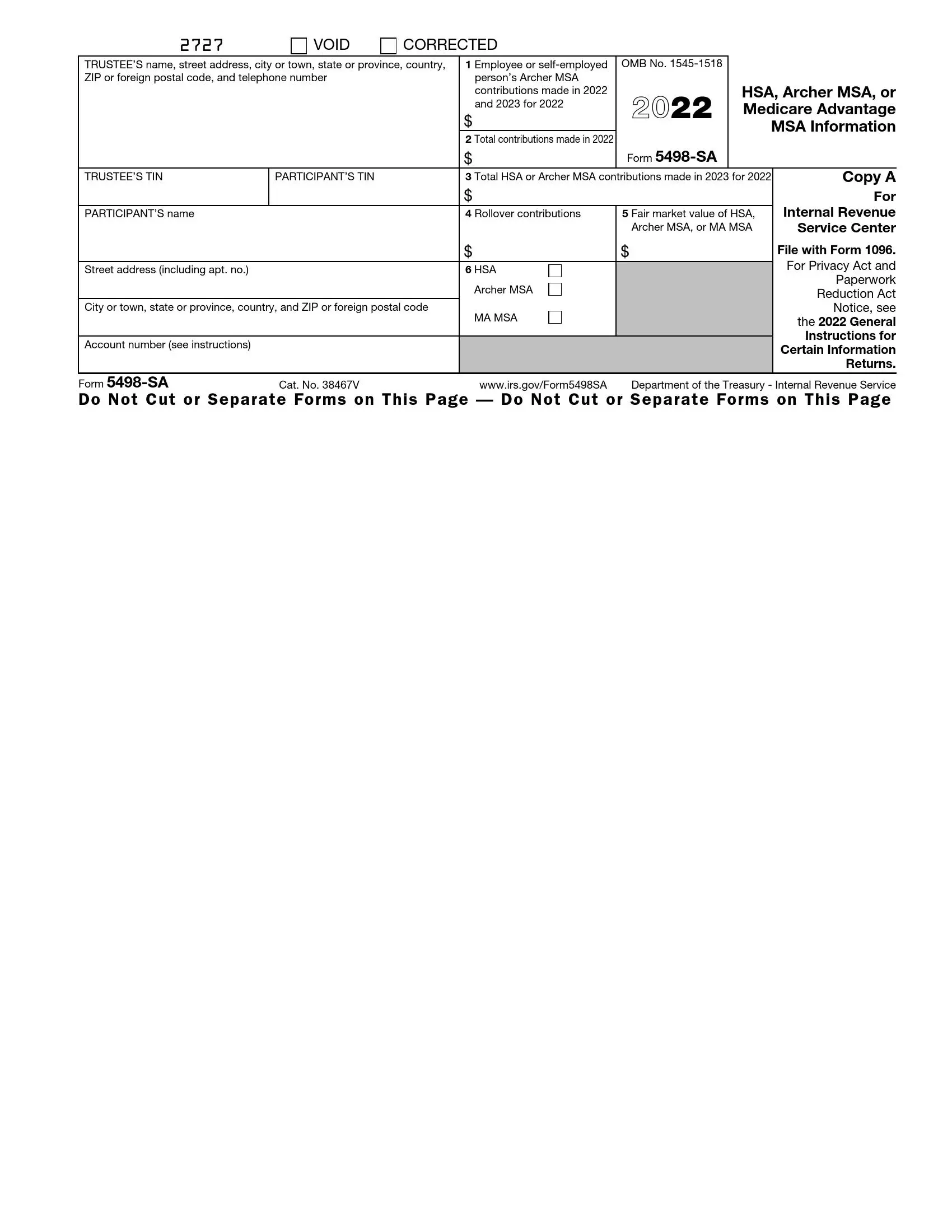

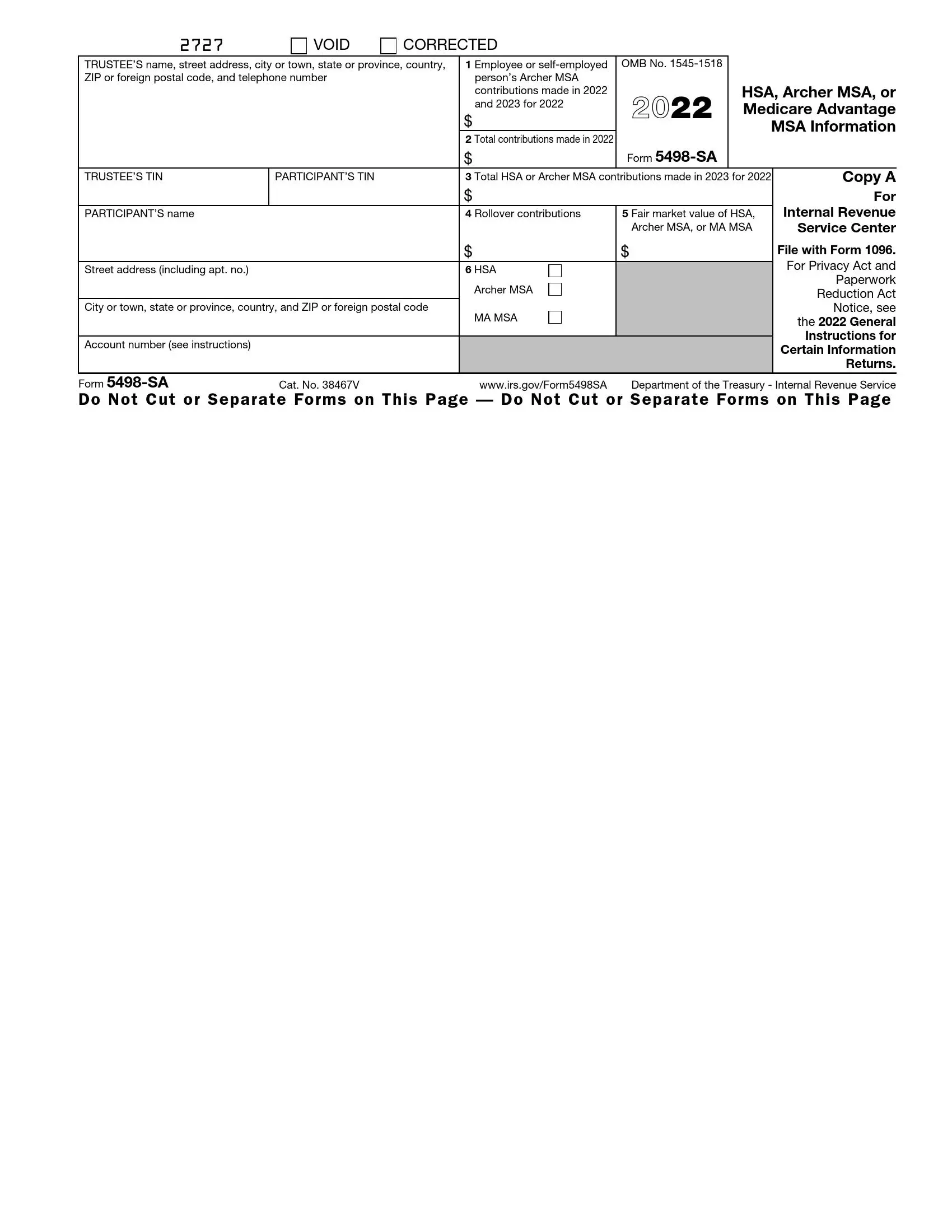

IRS Form 5498 SA Fill Out Printable PDF Forms Online

IRS Form 5498 SA Fill Out Printable PDF Forms Online

4 Healthy Habits For Health Savings Accounts Members League

Health Savings Accounts HSA High Deductible Plans Only Wellesley MA

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

What Is Fsa hra Eligible Health Care Expenses Judson Lister

Qualified Medical Expenses Paid Using Hsa Distributions See Instructions - Individuals can withdraw money from their HSA to pay for eligible medical expenses also known as qualified medical expenses for the account holder their spouse or their dependents