R D Tax Credit Examples Web R amp D Tax Credit Examples Blog Oct 2022 Fuelling growth and rewarding innovation R amp D Tax Credits are a vital asset for scaling up Describing various forms of tax relief can make it difficult for businesses to grasp them properly They re a theoretical solution

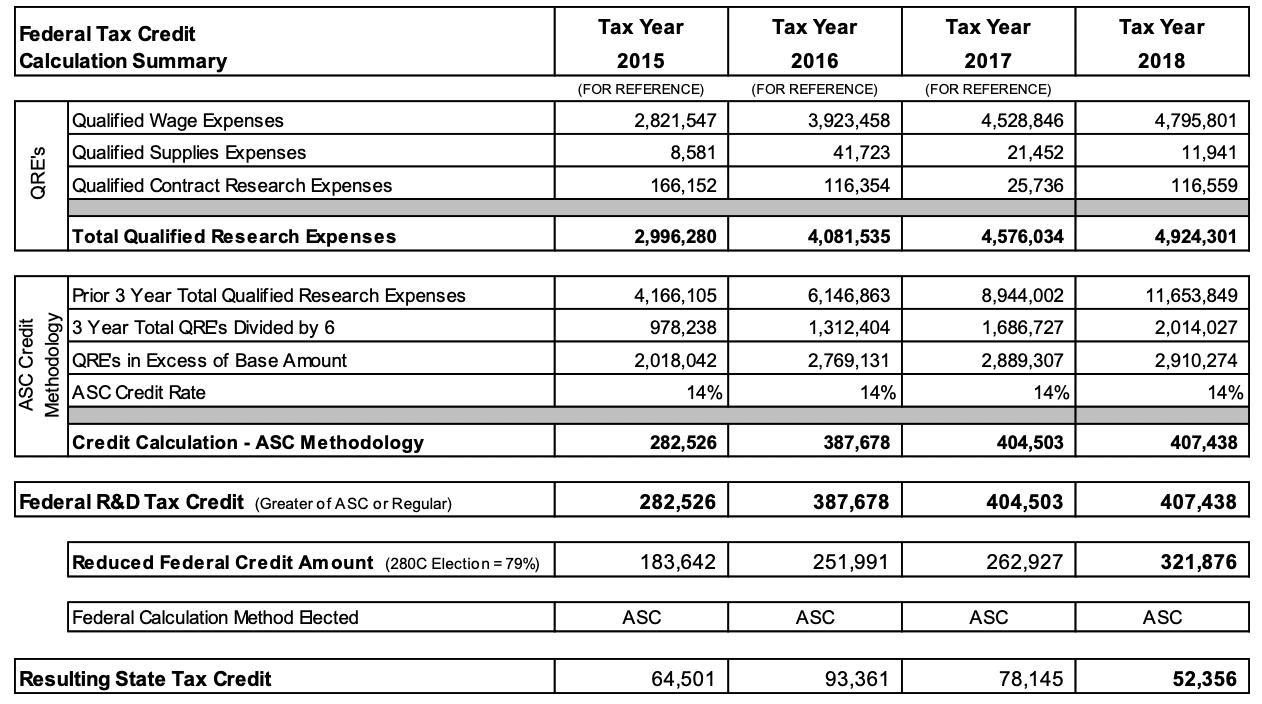

Web The R amp D tax credit is a tax incentive in the form of a tax credit for U S companies to increase spending on research and development in the U S A tax credit generally reduces the amount of tax owed or increases a tax refund If a company s activities qualify for the R amp D tax credit there are two ways to calculate it Traditional method Web 12 M 228 rz 2021 nbsp 0183 32 For example R amp D tax credits have the potential to offset income tax which can reduce a company s tax burden in the years qualified activities occur Companies that haven t previously taken advantage of the credit also have the option to look back at all open tax years typically three to four years depending on when tax

R D Tax Credit Examples

R D Tax Credit Examples

https://i.ytimg.com/vi/O5XEWHzgIuE/maxresdefault.jpg

Automotive Remanufacturer Earns Nearly 350 000 In Annual Federal And

https://tri-merit.com/wp-content/uploads/2020/02/federal-tax-credit-summary.png

Qualifying Expenses For The Expanded Research And Development Credit

https://www.nysscpa.org/cpaj-images/CPA.2019.89.10.036.t001.jpg

Web 13 Apr 2021 nbsp 0183 32 Introduction Evaluating the Federal R amp D Tax Credit Effectiveness of the R amp D Tax Credit Does the R amp D Credit Increase R amp D Spending Does Increased R amp D Spending Reflect Real Investment or Reclassification of Expenses Does Increased R amp D Investment Drive Useful Innovation Administration Compliance and Lobbying Web 10 Mai 2021 nbsp 0183 32 A company that spends 163 100 000 on R amp D can generate up to 163 33 000 in R amp D tax credits If you have investors behind you they are presumably aware of the R amp D credit and will want you to make use of it In our R amp D tax credit case studies you can see three instances of our R amp D tax credit claims and the benefits these companies have

Web Excluded activities 1 Activities that generally do not qualify for R amp D tax credits include Projects that are Conducted outside of the U S Not based on engineering or the physical biological or computer sciences Rely on aesthetics arts social sciences or humanities Funded by an unrelated third party Web 16 M 228 rz 2023 nbsp 0183 32 The following R amp D tax credit examples include a VC firm and a healthtech company whose commitment to innovation allowed them to receive government funds and reinvest them into their business Both companies used BoastClaim R amp D to automate the tax claim process and ensure they maximized their claim TRAC Venture Capital

Download R D Tax Credit Examples

More picture related to R D Tax Credit Examples

Acena Consulting R D Tax Credit Cheat Sheet

https://www.acenaconsulting.com/hs-fs/hubfs/Tax_Credit_Cheat_Sheet.jpg?width=900&name=Tax_Credit_Cheat_Sheet.jpg

Practical Documentation Of QRAs For The R D Tax Credit

https://www.thetaxadviser.com/content/tta-home/issues/2016/jul/practical-documentation-of-qras-for-r-and-d-tax-credit/_jcr_content/contentSectionArticlePage/article/articleparsys/image.img.jpg/1486964635987.jpg

PPT R D Tax Credit PowerPoint Presentation Free Download ID 1415066

https://image.slideserve.com/1415066/r-d-tax-credit-what-is-r-d1-l.jpg

Web 29 Juni 2018 nbsp 0183 32 Examples of R amp D Tax Credit Qualified Research Expenses Startup Tips Taxes One of the most momentous parts of business is nailing down what makes your product or service different For some companies like law firms this can be the talent experience and expertise of your team or even just your location Web Estimating your R amp D tax credit entitlement isn t always straightforward because there are two methods to choose from the regular research credit or the alternative simplified credit method Form 6765 credit for increasing research activities provides a series of steps to calculate your potential tax credits using either approach

Web 8 Sept 2021 nbsp 0183 32 Luckily the R amp D tax credit facilitates small businesses and start up companies In other words small business and start up companies may be eligible to claim up to 25 000 per year for up to five years in a total amount of 1 25 million 250 000 x 5 years to offset payroll taxes Web Industry Specific R amp D Tax Credits Examples 1 Manufacturing Industry Manufacturing company ABC is a medium sized carpet business that invested in an automated technology that enables it to streamline its weaving processes With the new technology ABC has been able to reduce its manufacturing time by 25 percent and decrease labor costs

R D Tax Credit Calculator Find Out How Much You re Owed Green Jellyfish

https://www.greenjellyfish.co.uk/wp-content/uploads/2022/04/AdobeStock_332235123-1536x1024.jpeg

R D Tax Credit Guidance For SMEs Market Business News

https://marketbusinessnews.com/wp-content/uploads/2019/11/RD-tax-credit-image-499499.jpg

https://theaccountancycloud.com/blogs/r-d-tax-credit-examples

Web R amp D Tax Credit Examples Blog Oct 2022 Fuelling growth and rewarding innovation R amp D Tax Credits are a vital asset for scaling up Describing various forms of tax relief can make it difficult for businesses to grasp them properly They re a theoretical solution

https://www.bench.co/blog/tax-tips/rd-tax-credit

Web The R amp D tax credit is a tax incentive in the form of a tax credit for U S companies to increase spending on research and development in the U S A tax credit generally reduces the amount of tax owed or increases a tax refund If a company s activities qualify for the R amp D tax credit there are two ways to calculate it Traditional method

What Is The R D Tax Credit Froehling Anderson

R D Tax Credit Calculator Find Out How Much You re Owed Green Jellyfish

How Do R D Tax Credits Can Transform Your Business

R D Tax Credit Questionnaire Indinero

Are You Eligible For R D Tax Credit Find Out Using This Infographic

R D Tax Credit Testimonial Finances Made Simple LLC

R D Tax Credit Testimonial Finances Made Simple LLC

What Is The R D Tax Credit And Could Your Company Qualify

Pin By R D Tax Solutions On R D Tax Credits Explained Tax Credits

R D Tax Credit And Manufacturing Equipment Delta ModTech

R D Tax Credit Examples - Web Excluded activities 1 Activities that generally do not qualify for R amp D tax credits include Projects that are Conducted outside of the U S Not based on engineering or the physical biological or computer sciences Rely on aesthetics arts social sciences or humanities Funded by an unrelated third party