R D Tax Incentive Capitalised Expenditure In the case where the related R D expenditure is capitalised the R D tax offset is deferred as deferred income and amortised to profit or loss as the

Incentives for R D expenditures Today s map will focus on the latter showing to what degree European OECD and EU countries grant expenditure based R D capitalization is the process of classifying research and development activity as an asset rather than an expense Under GAAP companies must expense

R D Tax Incentive Capitalised Expenditure

R D Tax Incentive Capitalised Expenditure

https://www.fullstack.com.au/fullstack/wp-content/uploads/2021/06/RD.jpg

AUSTRALIAN FUNDING FACTSHEET R D Tax Incentive Finance By Bourkehood R

https://image.isu.pub/220201092341-c1717b66e1c41f3572ae3b96ed96ecb1/jpg/page_1.jpg

Capitalisation Of R D Can I Receive Tax Relief On Capitalised R D

https://www.abgi-uk.com/wp-content/uploads/2017/08/Lending-crowd-case-study-image.jpg

Of the tax law with regard to R D expenditures Guoshuifa 2008 no 116 in China the new tax rule allows firms to deduct expensed R D expenditures plus 50 in the current Following the Autumn Statement the Government published Finance Bill 2023 24 commonly known as the Autumn Finance Bill covering the new merged

This summary table covers national expenditure based R D tax incentives and is confined to tax incentives available to the business sector excluding tax incentive The empirical evidence suggests that firms facing a higher tax rate exhibit a significantly lower capitalisation ratio of R D expenditures than firms facing a lower tax

Download R D Tax Incentive Capitalised Expenditure

More picture related to R D Tax Incentive Capitalised Expenditure

Capitalised Costs And R D Tax Claims What Are The Rules News YesTax

https://yes.tax/storage/news/capitalised-costs-and-rd-tax-claims-what-are-the-rules.jpg

Reasons To Do Business In Ireland Research And Development R D Tax

http://www.robertsnathan.com/wp-content/uploads/2015/10/RD-edit.jpg

R D Tax Incentive AusGrant Leading R D Grant Writers

https://ausgrant.com.au/wp-content/uploads/2012/12/Example-RD-Tax-Incentive-e1457099530708-new.jpg

The results provide new insights into the generosity of R D tax incentives from the perspective of firms that decide on whether or where to invest in R D What are R D capital allowances Research and Development Capital Allowances RDAs provide a valuable deduction for capital expenditure on R D on assets used for R D purposes or on

Tax incentives play a key role in the business R D support policy mix in the OECD area and beyond In 2022 33 out of 38 OECD countries gave preferential tax treatment to Providing that a company s R D expenditure is increasing expensing provides a more substantial R D benefit than capitalisation This means that growing

Does The 16 17 Federal Budget Impact The R D Tax Incentive AusGrant

https://ausgrant.com.au/wp-content/uploads/2016/05/bigstock-A-Law-Book-With-A-Gavel-Tax-86988275.jpg

Software specific R D Tax Incentive Proposed For SMEs In Tech Inside

https://insidesmallbusiness.com.au/wp-content/uploads/2021/04/bigstock-Tax-Incentive-Audit-Benefit-Ca-153577676-e1610334700820.jpg

https://hlb.com.au/accounting-for-the-rd-tax-incentive

In the case where the related R D expenditure is capitalised the R D tax offset is deferred as deferred income and amortised to profit or loss as the

https://taxfoundation.org/data/all/eu/rd-tax-incentives-europe-2021

Incentives for R D expenditures Today s map will focus on the latter showing to what degree European OECD and EU countries grant expenditure based

Does Your Startup Qualify For An R D Tax Incentive In 2021

Does The 16 17 Federal Budget Impact The R D Tax Incentive AusGrant

R D Costs How To Journalize And Record Expenses Thales Learning

R D Tax Incentive Regime Planning For The Year Ahead Tax Alert

The R D Tax Incentive An Explainer Guide Standard Ledger

Claiming Overseas R D Expenditure Under The Australian R D Tax Incentive

Claiming Overseas R D Expenditure Under The Australian R D Tax Incentive

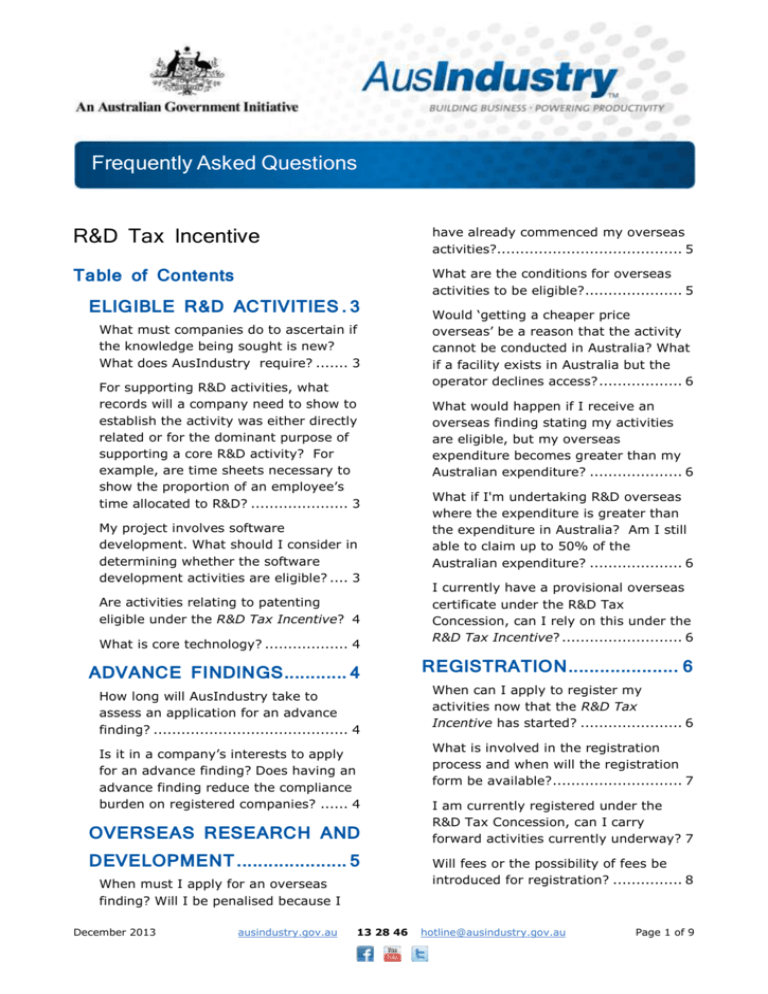

Frequently Asked Questions R D Tax Incentive

R D Tax Incentive How To Get The Feedstock Adjustment Right

R D Tax Incentive Business Consulting Services Aspire Corporate

R D Tax Incentive Capitalised Expenditure - To be eligible as qualifying R D expenditure expenditure must be allowable as a deduction in calculating the profits of the trade Capital expenditure is