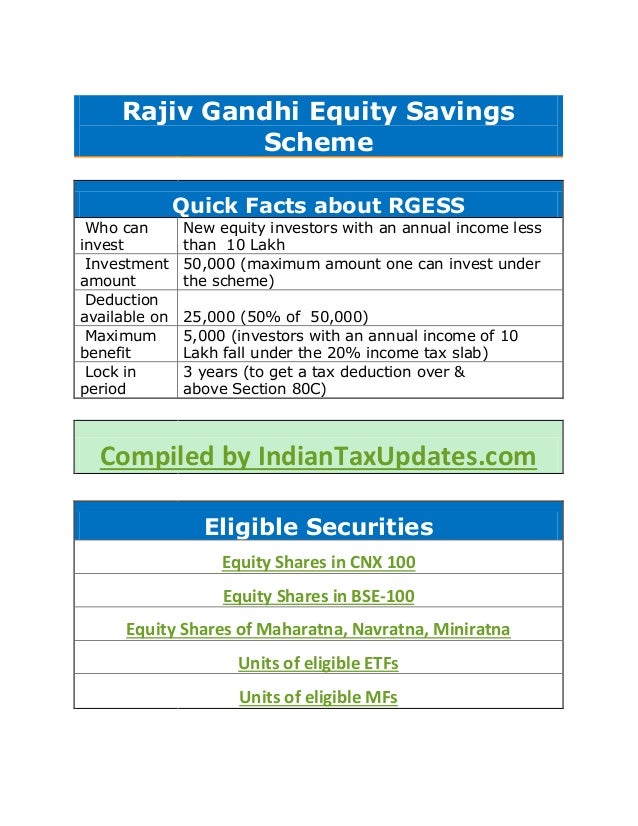

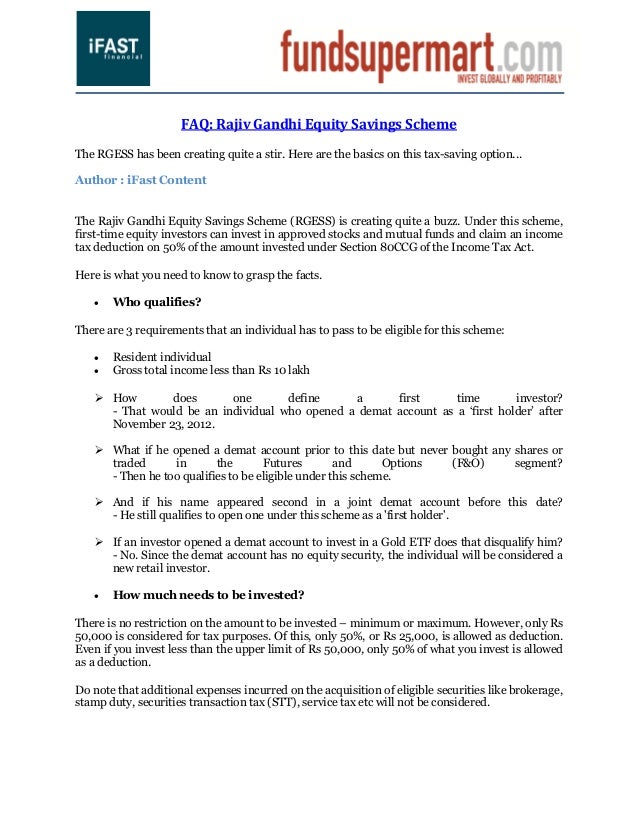

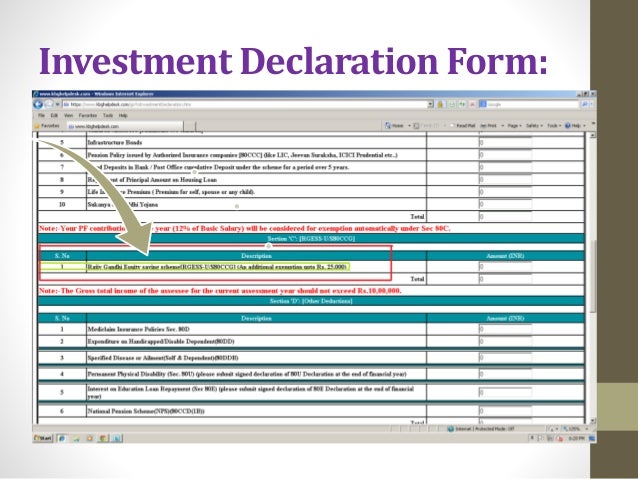

Rajiv Gandhi Elss Schemes Tax Rebate Web 23 juil 2019 nbsp 0183 32 Yes Rajiv Gandhi equity saving scheme allows extra rebates upto Rs 25000 p a over and above tax deduction cap of Rs 1 5 lakh under Section 80C However it

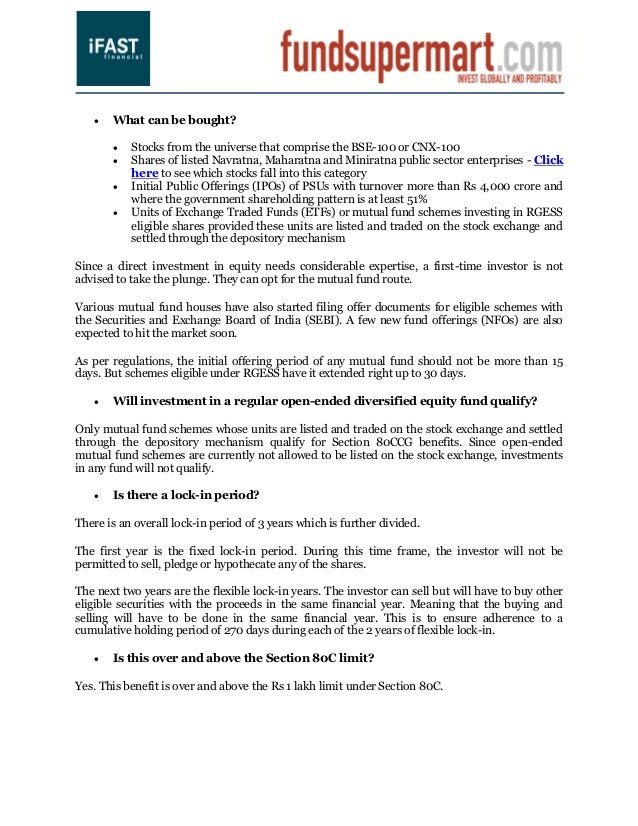

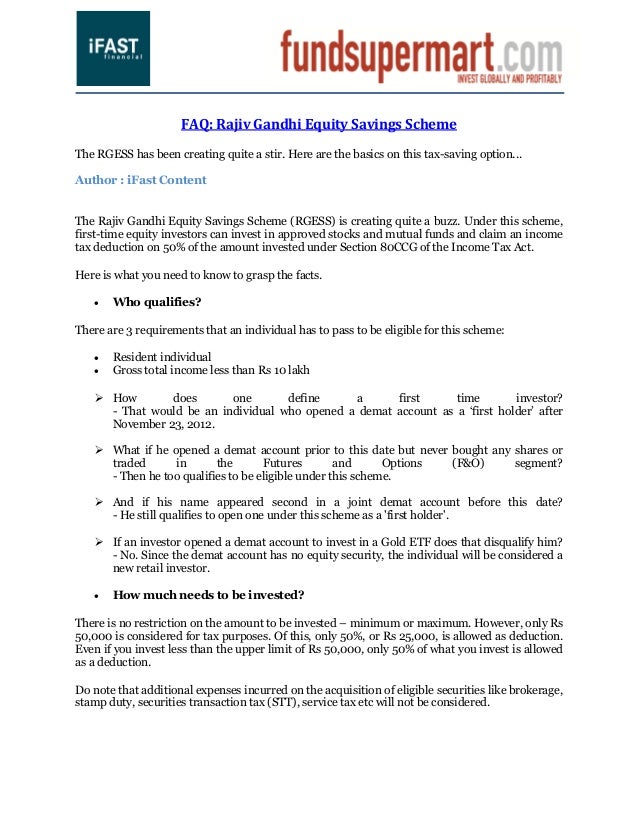

Web Popularly known as the Rajeev Gandhi Equity Saving Scheme Section 80CCG of Income Tax Act in India is formulated to offer incentives to equity market investors The Web The options Equity linked savings schemes ELSS and the newly introduced Rajiv Gandhi Equity Savings Scheme RGESS by some

Rajiv Gandhi Elss Schemes Tax Rebate

Rajiv Gandhi Elss Schemes Tax Rebate

http://4.bp.blogspot.com/-_BQS5lVGi_Y/UQAfFKK4t3I/AAAAAAAACmQ/4dWynzHZF00/s1600/RAJIV+GANDHI+EQUITY+SAVING+SCHEME+80CCG.jpg

Rajiv Gandhi Equity Savings Scheme

https://image.slidesharecdn.com/rajivgandhiequitysavingsschemeifast-130227073020-phpapp01/95/rajiv-gandhi-equity-savings-scheme-2-638.jpg?cb=1361954441

Rajiv Gandhi Equity Savings Scheme BSE

https://www.bseindia.com/rgess/include/images/banner_01.jpg

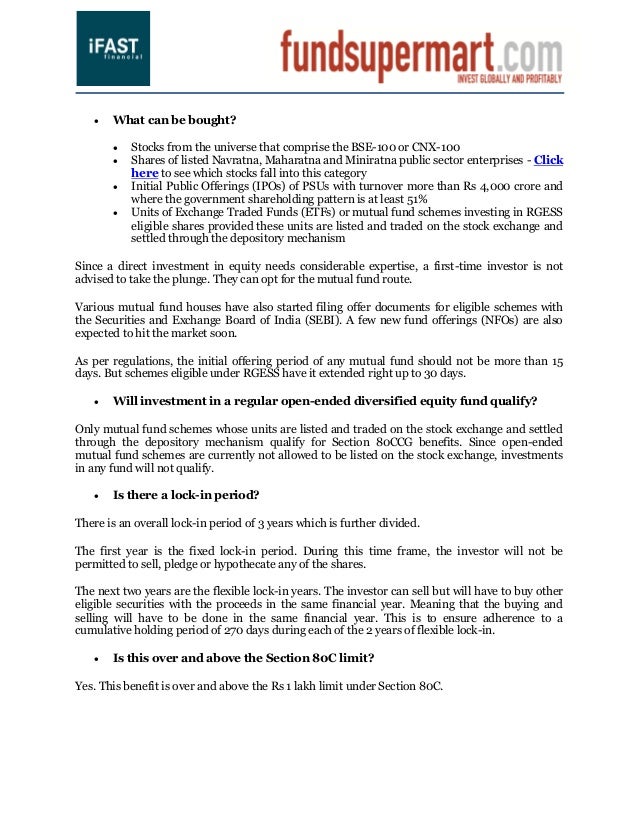

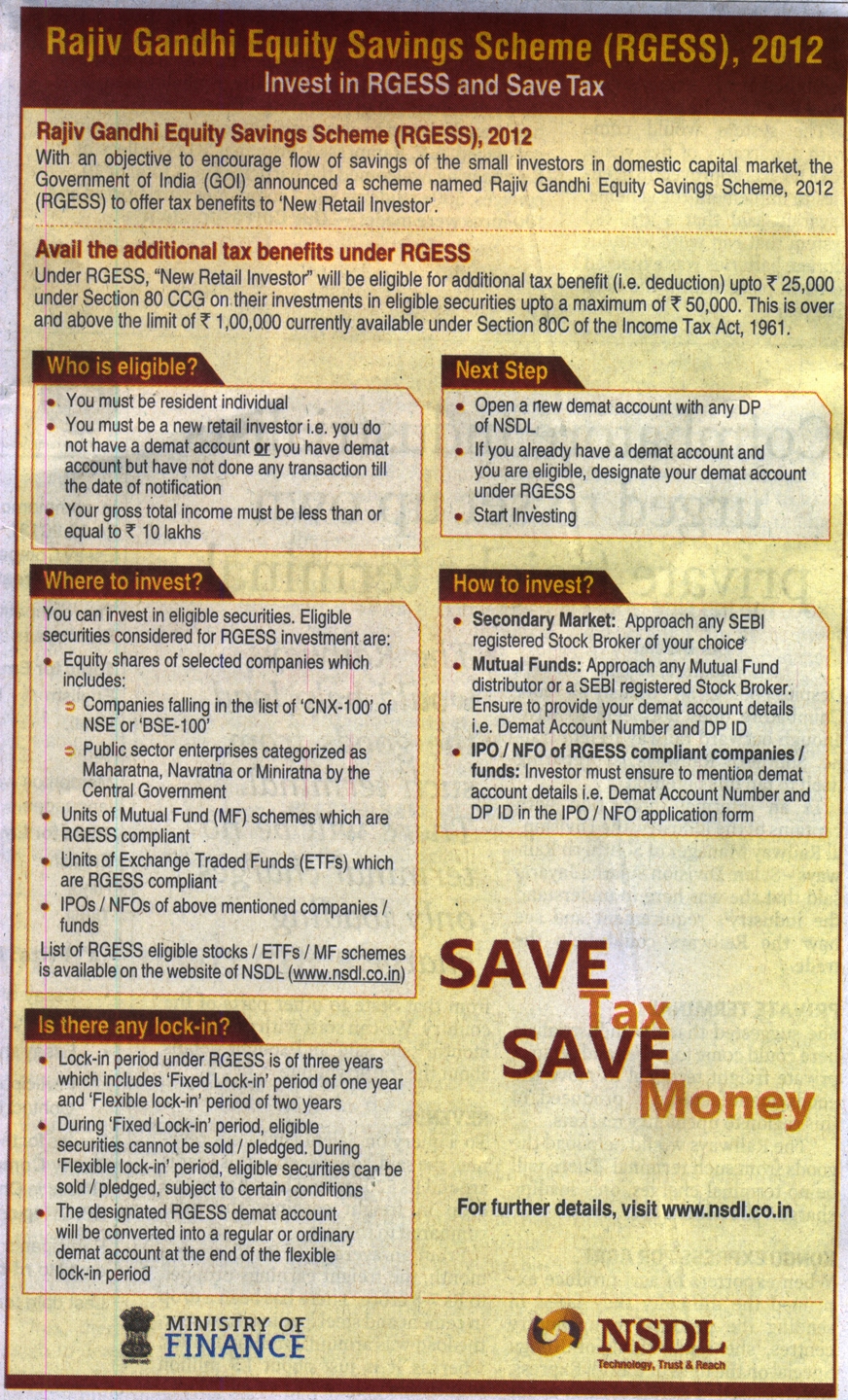

Web What do you mean by Initial Year Avail the additional tax benefits under RGESS Who is eligible Where to invest Is there any lock in For how many years I can avail of Web RGESS permits investments totalling up to a maximum of Rs 50 000 of which 50 is tax deductible The maximum possible tax savings is Rs 5150 In addition the scheme is

Web ELSS Vs RGESS Equity Linked Savings Scheme avail tax rebate under sec 80C of Income Tax on deposits with capital appreciation on investment on the other hand Rajiv Web 5 f 233 vr 2014 nbsp 0183 32 1 What is RGESS 2 What is the objective of the Scheme 3 What is the legal provision for RGESS 4 Would first time investors not lose money in the equity market Would it be too dangerous for them to

Download Rajiv Gandhi Elss Schemes Tax Rebate

More picture related to Rajiv Gandhi Elss Schemes Tax Rebate

Rajiv Gandhi Equity Savings Scheme For Tax Saving Investdunia

http://investdunia.com/wp-content/uploads/2016/01/Rajiv-Gandhi-Equity-Savings-Scheme.png

Eligible Investments Under Rajiv Gandhi Equity Savings Scheme

https://image.slidesharecdn.com/eligibleinvestmentsunderrajivgandhiequitysavingsscheme-130220051416-phpapp01/95/eligible-investments-under-rajiv-gandhi-equity-savings-scheme-1-638.jpg?cb=1361337420

Rajiv Gandhi Equity Savings Scheme RGESS

https://image.slidesharecdn.com/rajivgandhiequitysavingschemergess-130315043519-phpapp01/95/rajiv-gandhi-equity-savings-scheme-rgess-2-638.jpg?cb=1363323595

Web Rajiv Gandhi Equity Savings Scheme RGESS is a tax saving scheme announced in the Union Budget 2012 13 para 35 The scheme is designed exclusively for the first time Web Rajiv Gandhi Equity Savings Scheme RGESS is a tax saving scheme announced in the Union Budget 2012 13 para 35 and further expanded vide Union Budget 2013 14 para

Web 6 sept 2023 nbsp 0183 32 Rajiv Gandhi Equity Scheme has been discontinued starting from 1 April 2017 Therefore no deduction under section 80CCG will be allowed from FY 2017 18 However if you have invested in the RGESS Web 7 juin 2021 nbsp 0183 32 ELSS Rajiv Gandhi Equity Savings Scheme is a tax savings scheme designed for the first time retailed investor in the security market with providing the tax

Rajiv Gandhi Equity Savings Scheme

https://image.slidesharecdn.com/rajivgandhiequitysavingsschemeifast-130227073020-phpapp01/95/rajiv-gandhi-equity-savings-scheme-1-638.jpg?cb=1361954441

Rajiv Gandhi Equity Saving Scheme

https://image.slidesharecdn.com/rajicgandhiequitysavingscheme-181006125721/95/rajiv-gandhi-equity-saving-scheme-3-638.jpg?cb=1538830655

https://tax2win.in/guide/section-80ccg

Web 23 juil 2019 nbsp 0183 32 Yes Rajiv Gandhi equity saving scheme allows extra rebates upto Rs 25000 p a over and above tax deduction cap of Rs 1 5 lakh under Section 80C However it

https://groww.in/p/tax/section-80ccg

Web Popularly known as the Rajeev Gandhi Equity Saving Scheme Section 80CCG of Income Tax Act in India is formulated to offer incentives to equity market investors The

Rajiv Gandhi Equity Savings Scheme Tax Free Equity Savings In RS Puram

Rajiv Gandhi Equity Savings Scheme

EASY Ways To Invest In India Rajiv Gandhi Equity Scheme Official Notice

Rajiv Gandhi Scheme Govt Plans To Allow Tax Benefits Every Year The

4 Steps To Invest In Rajiv Gandhi Equity Saving Scheme RGESS Under 80CCG

KERALA GOVERNMENT Rajiv Gandhi Equity Savings Scheme Tax Benefits

KERALA GOVERNMENT Rajiv Gandhi Equity Savings Scheme Tax Benefits

On His Birth Anniversary Rajiv Gandhi s 5 Lasting Contributions

Rajiv Gandhi Equity Saving Scheme RGESS Details Eligibility

Rajiv Gandhi Equity Savings Scheme Tax Benefits NRI Banking And

Rajiv Gandhi Elss Schemes Tax Rebate - Web RGESS permits investments totalling up to a maximum of Rs 50 000 of which 50 is tax deductible The maximum possible tax savings is Rs 5150 In addition the scheme is