Real Estate Tax Deduction 2022 If you receive a refund or rebate of real estate taxes this year for amounts you paid this year you must reduce your real estate tax deduction by the amount refunded to you If the refund or rebate was for real estate taxes paid for a prior year you may have to include some or all of the refund in your income

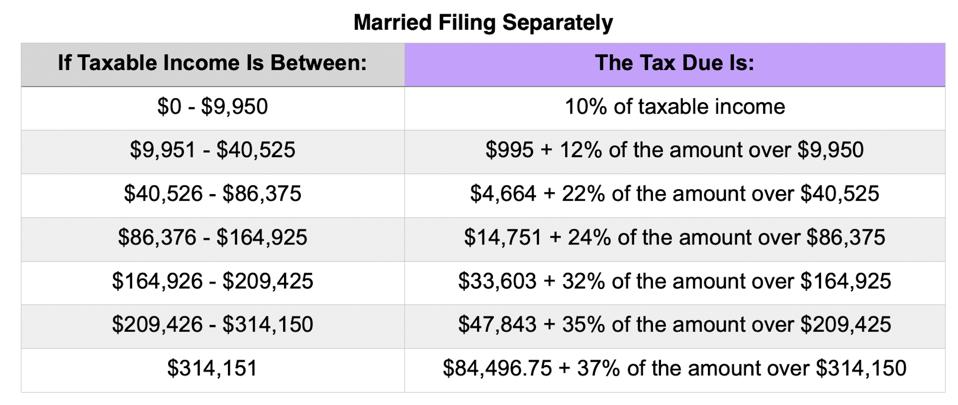

The standard deduction is set at these figures for the 2022 tax year 12 950 for single taxpayers and married taxpayers filing separate returns 25 900 for married taxpayers filing jointly and qualifying widow ers Itemized deductions standard deduction Sub Category Real estate taxes mortgage interest points other property expenses Page Last Reviewed or Updated 18 Oct 2023 Share Is the mortgage interest and real property tax I

Real Estate Tax Deduction 2022

Real Estate Tax Deduction 2022

https://specials-images.forbesimg.com/imageserve/5f972fc18ebf3d552a752c91/960x0.jpg?fit=scale

Real Estate Agent Tax Deductions Worksheet 2022 Fill Online

https://www.pdffiller.com/preview/354/967/354967762/large.png

16 Real Estate Tax Deductions For 2022 2022 Checklist Hurdlr

https://uploads-ssl.webflow.com/5a05fb886641360001022a3c/5cb4c028f6ecbe83122af9e8_%239.png

You deduct the tax in the taxable year you pay them The categories of deductible taxes are State local and foreign income taxes or state and local general sales taxes in lieu of state and local income taxes State and local real property taxes and State and local personal property taxes Eligible property tax deductions may include Primary residence Investment property Vacation home Land Boat Recreational vehicle

Key Takeaways State and local governments assess property taxes annually based on the value of a property A property owner can claim a tax deduction on some or all of the taxes paid on that Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 April 29 2024 3 52 PM OVERVIEW If you pay taxes on your personal property and real estate that you own you payments may be deductible from your federal income tax bill Most state and local tax authorities calculate property taxes based on the value of

Download Real Estate Tax Deduction 2022

More picture related to Real Estate Tax Deduction 2022

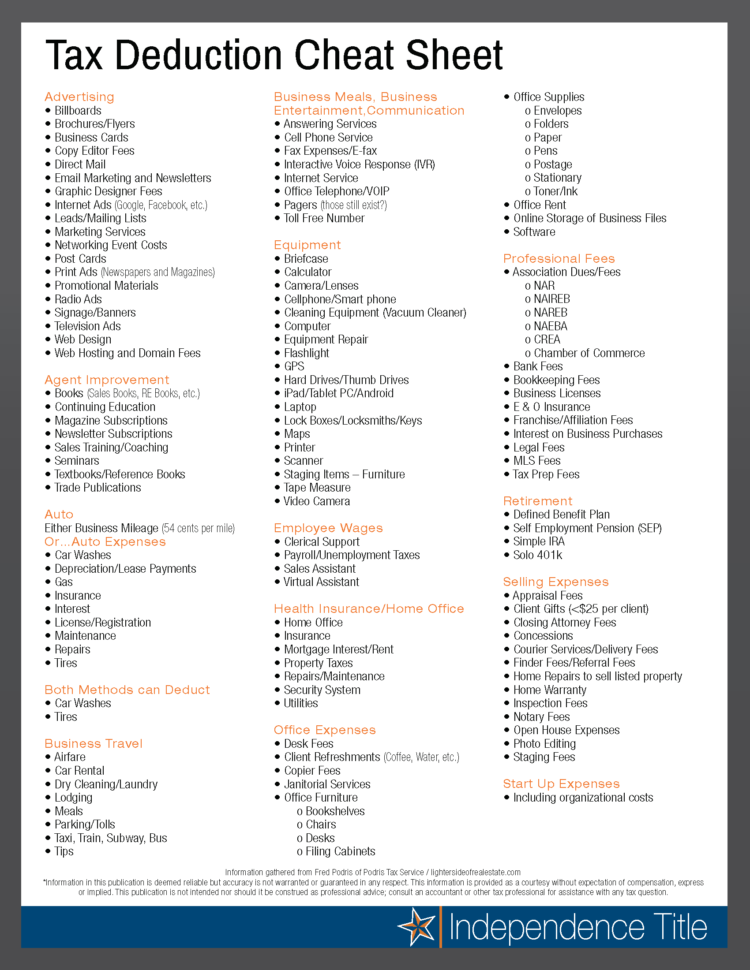

USA Real Estate Agents Are You Claiming All Your Expenses Free Handy

https://i.pinimg.com/originals/6a/08/61/6a0861d8982fefbb26417d347dca1c22.jpg

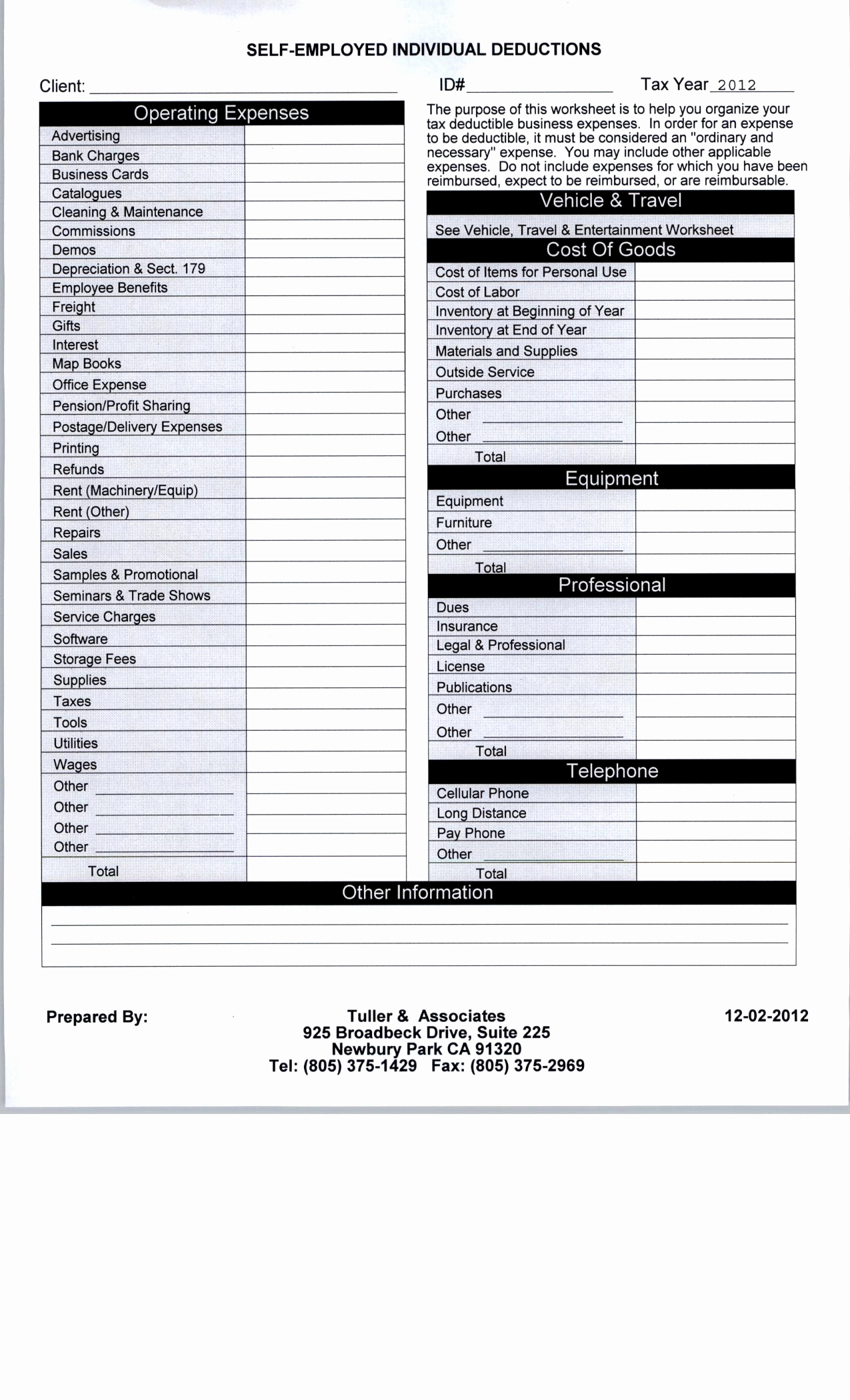

Business Expense Spreadsheet For Taxes New Self Employed Tax And

https://db-excel.com/wp-content/uploads/2018/11/business-expense-spreadsheet-for-taxes-new-self-employed-tax-and-business-expense-deductions-spreadsheet.jpg

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-1-750x970.png

Real estate taxes are deductible if Based on the value of the property Levied uniformly throughout your community Used for a governmental or general community purpose Assessed and paid before the end of the You can write off property taxes and potentially save a significant amount of money every year It s important to know what and how much you can claim how the property tax deduction also referred to as real estate tax deduction compares to the standard deduction and how to actually claim the deduction when tax season comes

Whether you re a homeowner or a real estate investor it s essential to understand what tax deductions you can take advantage of and how you can maximize your benefits Let s take a closer look at the best property tax deduction strategies for the current tax year What Is A Property Tax Deduction State and local income taxes SALT paid in 2022 and 2023 are limited to a 10 000 deduction 5 000 for married couples filing separately Real estate taxes paid on your home or second home are included in the total SALT deduction along with any state and local income taxes sales taxes and personal property taxes

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-CHART.jpg

Firefighter Tax Deduction Worksheet

https://i.pinimg.com/originals/ed/37/23/ed372359aac4e974a39e6494da5610e6.jpg

https://www.irs.gov/publications/p530

If you receive a refund or rebate of real estate taxes this year for amounts you paid this year you must reduce your real estate tax deduction by the amount refunded to you If the refund or rebate was for real estate taxes paid for a prior year you may have to include some or all of the refund in your income

https://www.thebalancemoney.com/prop…

The standard deduction is set at these figures for the 2022 tax year 12 950 for single taxpayers and married taxpayers filing separate returns 25 900 for married taxpayers filing jointly and qualifying widow ers

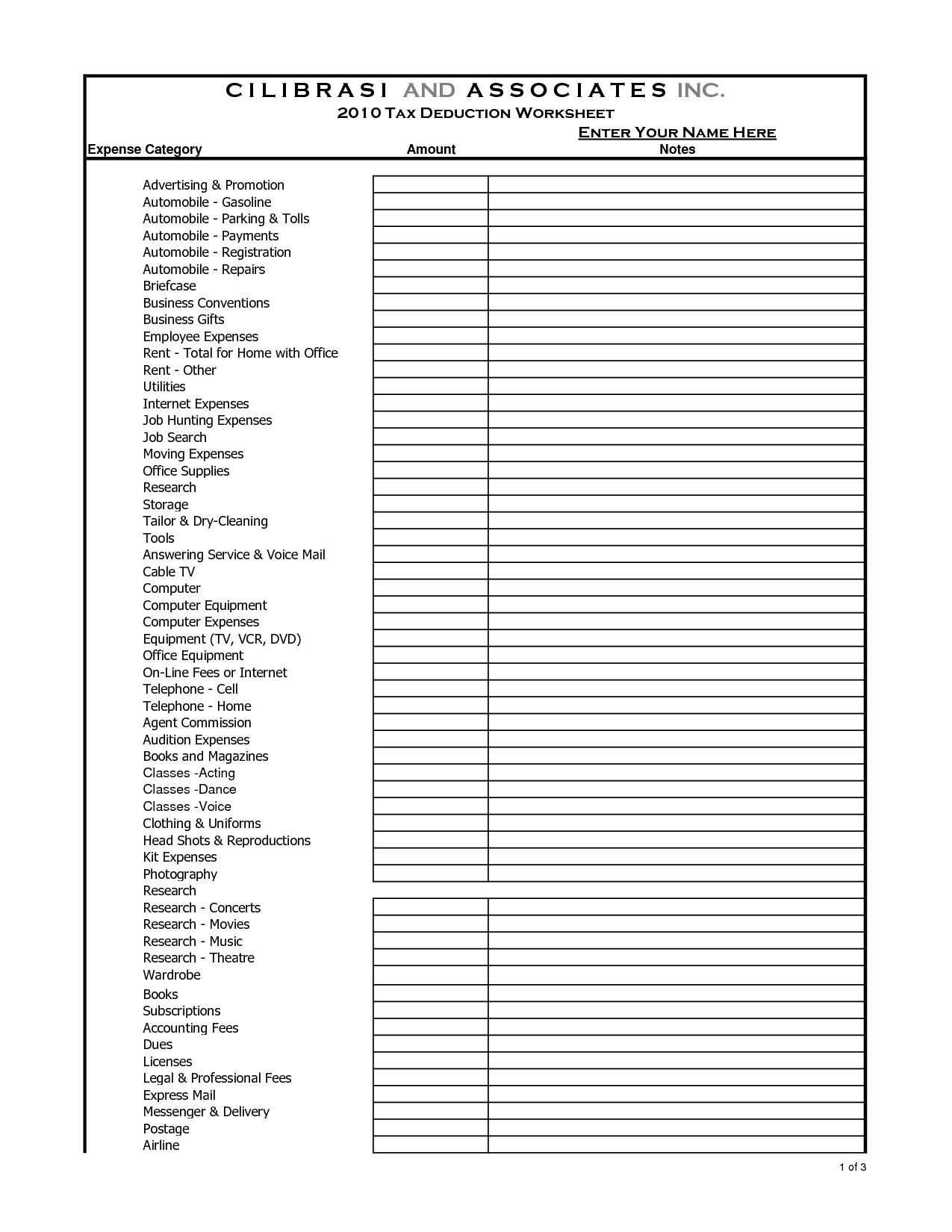

Itemized Deductions Spreadsheet In Business Itemized Deductions

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Http www anchor tax service financial tools deductions medical

Hair Stylist Tax Deduction Worksheet Pdf Fill Online Printable

Tax Deductions Real Estate Business Plan Real Estate Career Real

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real

10 Home Based Business Tax Worksheet Worksheeto

IRS Announces 2022 Tax Rates Standard Deduction

Pin On Worksheet

Real Estate Tax Deduction 2022 - Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 April 29 2024 3 52 PM OVERVIEW If you pay taxes on your personal property and real estate that you own you payments may be deductible from your federal income tax bill Most state and local tax authorities calculate property taxes based on the value of