Rebate 87a For Ay 2023 23 For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual with taxable income up to 5 lakh is eligible to claim the tax rebate of 12 500 or the amount of tax payable whichever is lower

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme

Rebate 87a For Ay 2023 23

Rebate 87a For Ay 2023 23

https://i.ytimg.com/vi/jocxPhsi0f0/maxresdefault.jpg

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

https://i.ytimg.com/vi/wZNZ6YgMsIc/maxresdefault.jpg

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable whichever is lower This applies to both the old and new tax regimes

You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been amended from time to time In the beginning the maximum limit of tax rebate under Section 87A of the Income Tax Act was 2 000 Budget 2023 announced that individuals will not have to pay any tax if the taxable income does not exceed Rs 7 lakh in a financial year The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been increased to Rs 25 000 from Rs 12 500 in

Download Rebate 87a For Ay 2023 23

More picture related to Rebate 87a For Ay 2023 23

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

https://i.ytimg.com/vi/TQmyHGDz37M/maxresdefault.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

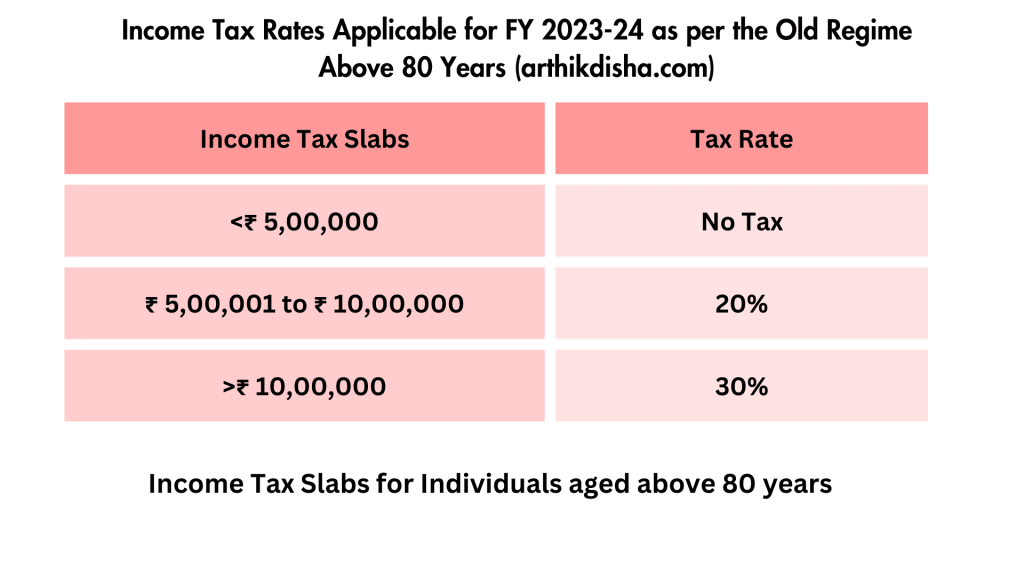

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-Old-Regime-Above-80-Years-arthikdisha.com_-1024x576.png

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

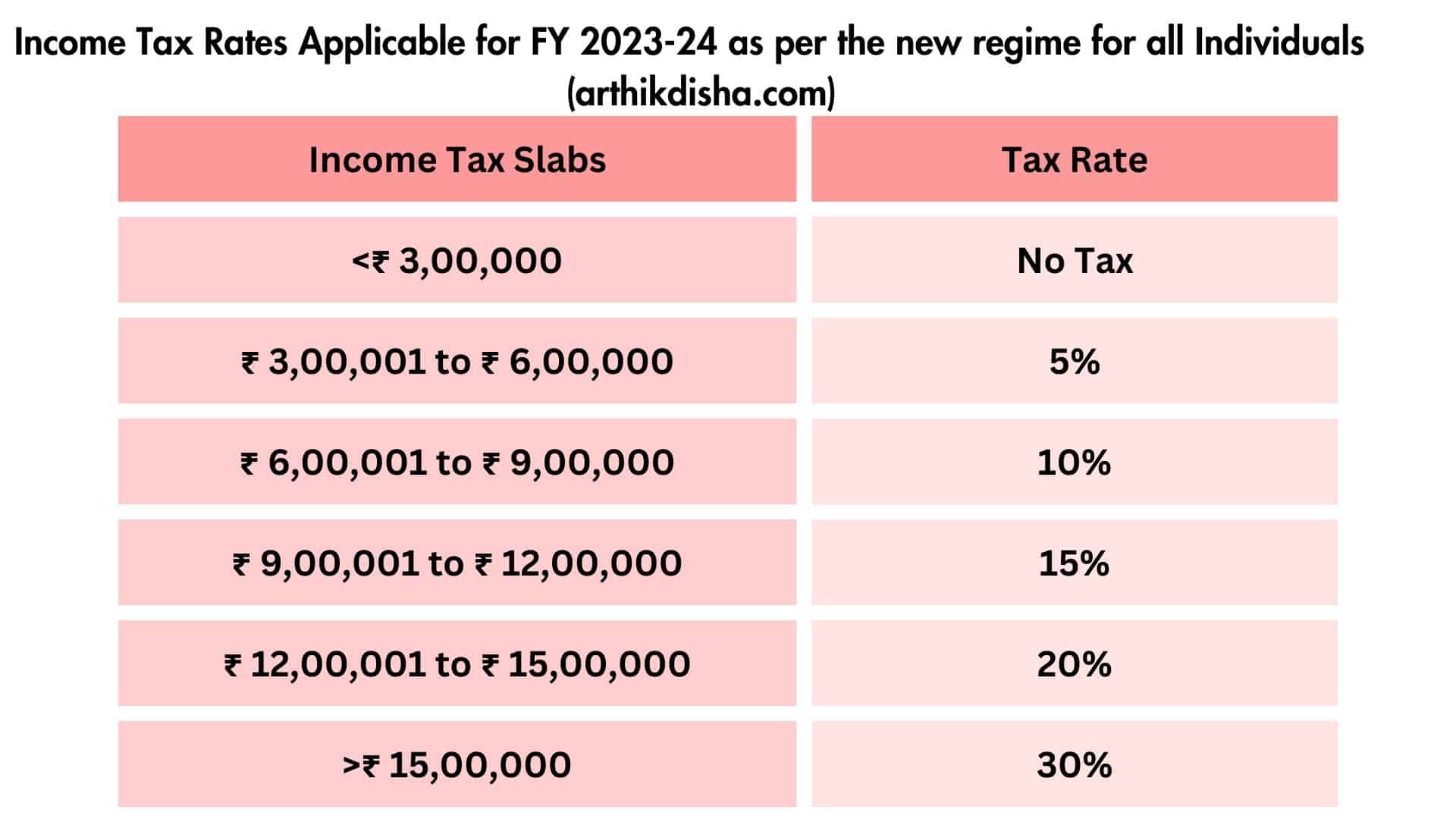

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-new-regime-for-HUF-and-all-Individuals-1.jpg

Section 87A Eligibility Criteria for FY 2022 23 and FY 2023 24 An individual can claim a tax rebate us 87A provided he or she meets the following conditions The individual must be an Indian resident The total income deductions under Section 80 has to be less than or equal to Rs 3 50 000 Individual assessee having total income up to 5 Lakhs can claim rebate of 12500 for AY 2023 24 under section 87A of Income Tax Act 1961 Amended and updated notes on section 87A of Income Tax Act 1961 as amended by the Finance Act 2022 and Income tax Rules 1962

Above all The Finance Act of 2023 introduces a substantial tax rebate for those choosing the new tax regime Section 115BAC in AY 2024 25 and beyond In addition Individuals with up to Rs 700 000 total income can claim a tax rebate of up to Rs 25 000 making it an attractive option In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim rebate under 87A under new tax regime which shall be applicable from FY 2023 24 AY 2024 25 onwards What are the Eligibility Criteria to Claim a Rebate u s 87A

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-section-87a-tax-rebate-fy-2019-20-how-to-check-rebate-eligibility-from-87a-rebate-ay-2023-20-post.jpg?w=979&ssl=1

BUDGET 2023 REBATE 87A NO TAX UPTO 700000 INCOME TAX CHANGE 2023 NEW

https://i.ytimg.com/vi/FDYNxnyIBew/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGH8gEygTMA8=&rs=AOn4CLC_c8Zdt8DX_8pqdAggWWBoHngwjw

https://tax2win.in/guide/section-87a

For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual with taxable income up to 5 lakh is eligible to claim the tax rebate of 12 500 or the amount of tax payable whichever is lower

https://m.economictimes.com/wealth/tax/who-is...

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

Know New Rebate Under Section 87A Budget 2023

Sec 87A Rebate Income Tax Malayalam AY 2022 23 CA Subin VR YouTube

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

Rebate U s 87A

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Rebate 87a For Ay 2023 23 - Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime