Rebate Allowed In New Tax Regime Web 27 f 233 vr 2022 nbsp 0183 32 Prorogation de la hausse du plafond pour les dons La hausse du plafond pour les dons 224 1 000 euros pour les versements en faveur d organismes qui fournissent

Web 2 f 233 vr 2023 nbsp 0183 32 An individual can claim maximum deduction of Rs 25 000 for insurance premium paid for self spouse and dependent children For senior citizens the maximum Web 21 juil 2022 nbsp 0183 32 Remboursement d imp 244 t sur les revenus en 2022 Les remboursements d imp 244 t sur les revenus seront vers 233 s le jeudi 21 juillet 2022 ou le mardi 2 ao 251 t 2022

Rebate Allowed In New Tax Regime

Rebate Allowed In New Tax Regime

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

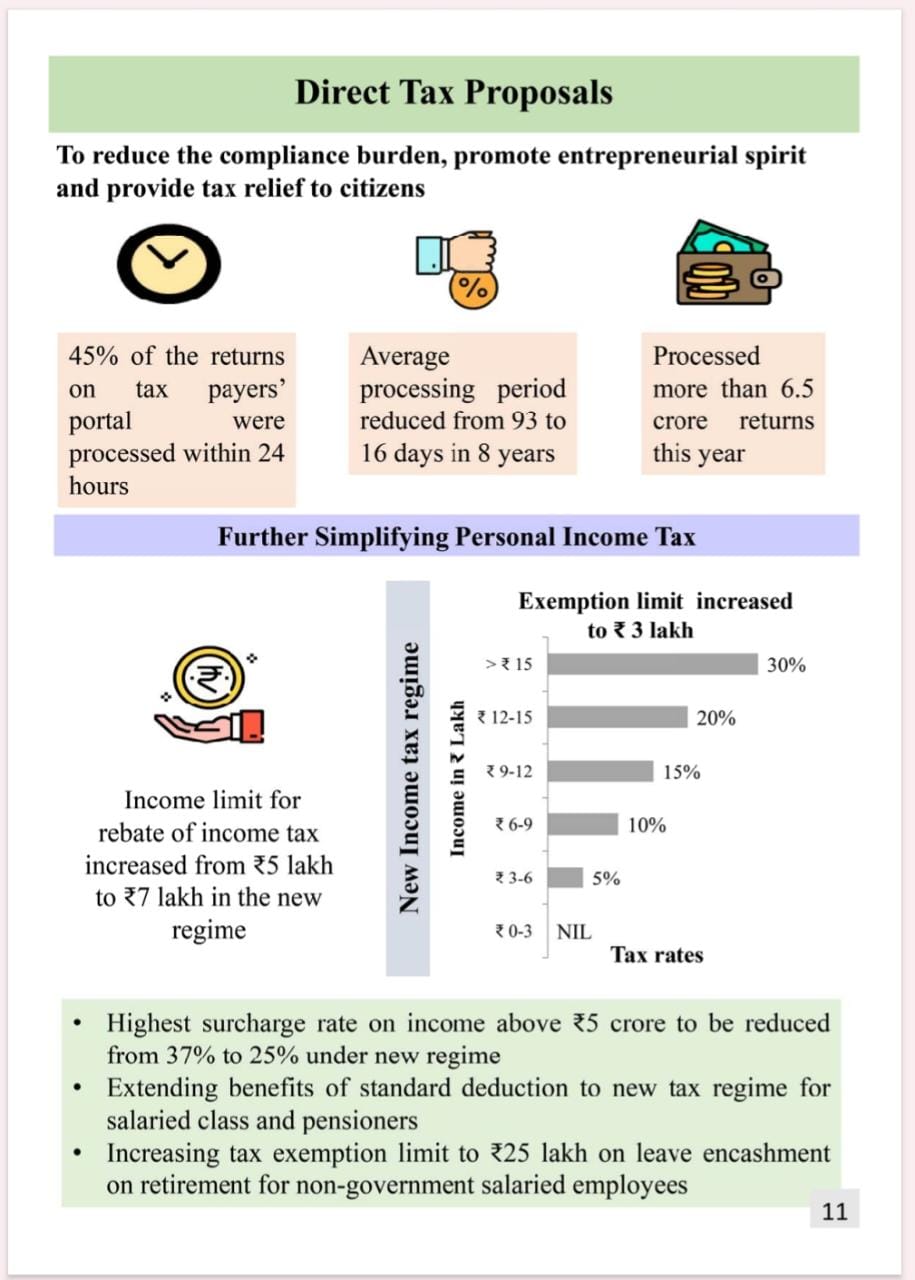

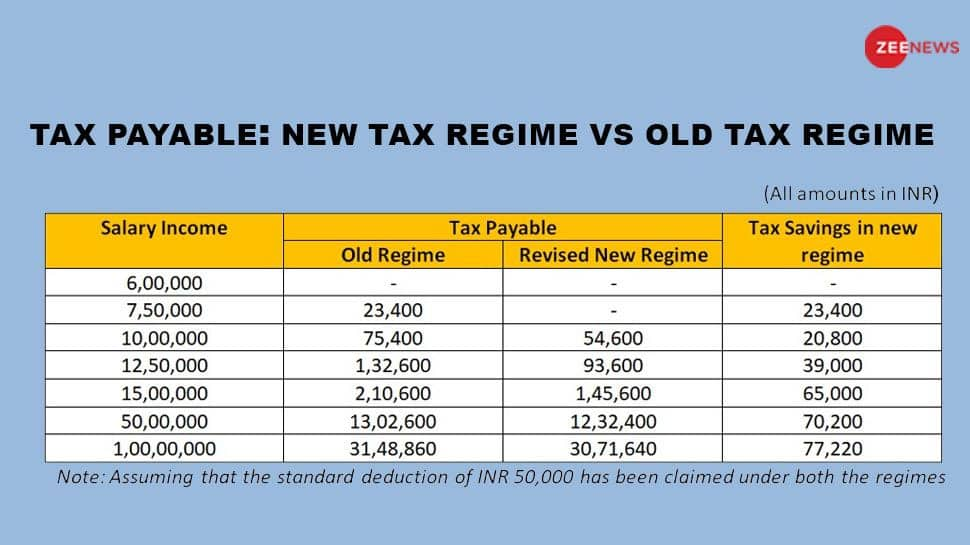

Web 9 f 233 vr 2023 nbsp 0183 32 Deductions Allowed Under the New Income Tax Regime Although most of tax deductions and exemptions cannot be claimed under the new tax regime the Web 3 f 233 vr 2023 nbsp 0183 32 Some of the other steps announced to make the new tax regime more beneficial for small taxpayers include the increase in the threshold limit of rebate under

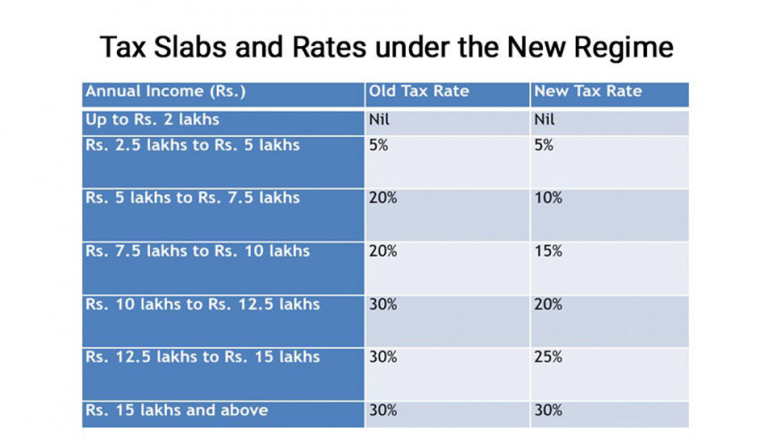

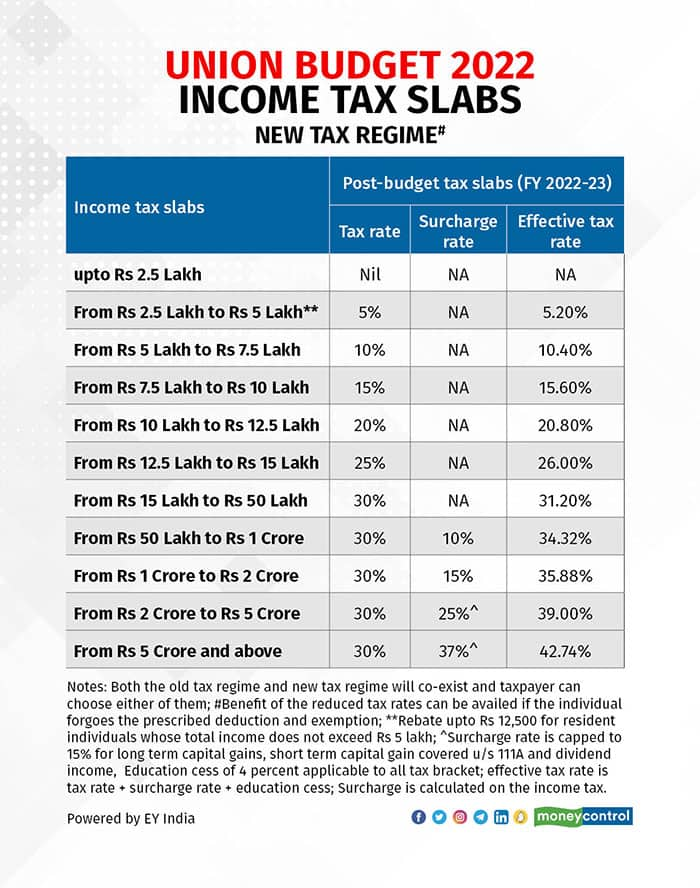

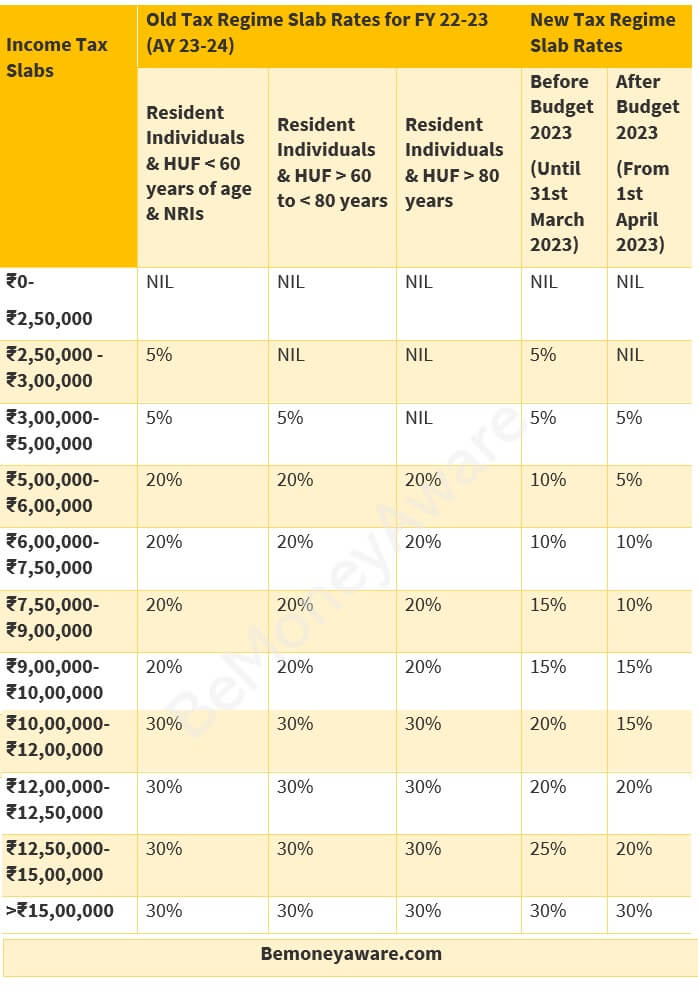

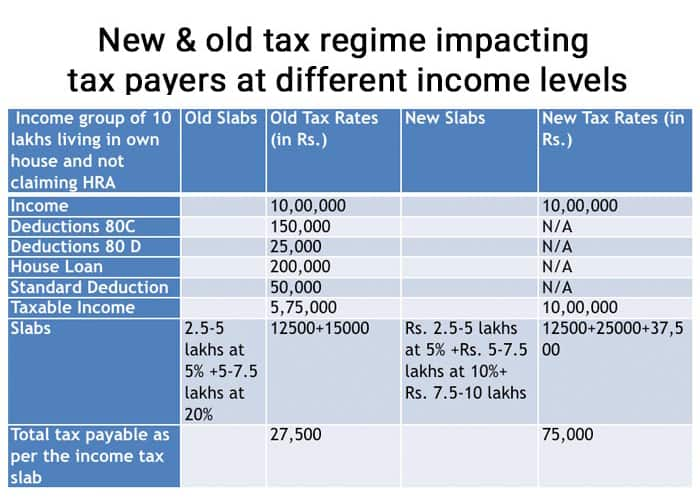

Web 25 mars 2023 nbsp 0183 32 Income tax slab rate FY 2022 23 AY 2023 24 Applicable for New Tax regime List of common Exemptions and deductions not allowed under the New Tax Web 2 mai 2023 nbsp 0183 32 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified A resident individual with taxable

Download Rebate Allowed In New Tax Regime

More picture related to Rebate Allowed In New Tax Regime

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Tax-Slab-1-600x600.png

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Salary Structure Income Tax A Useful Article For HR IT Professionals

https://taxguru.in/wp-content/uploads/2023/04/New-Tax-Regime-1.jpg

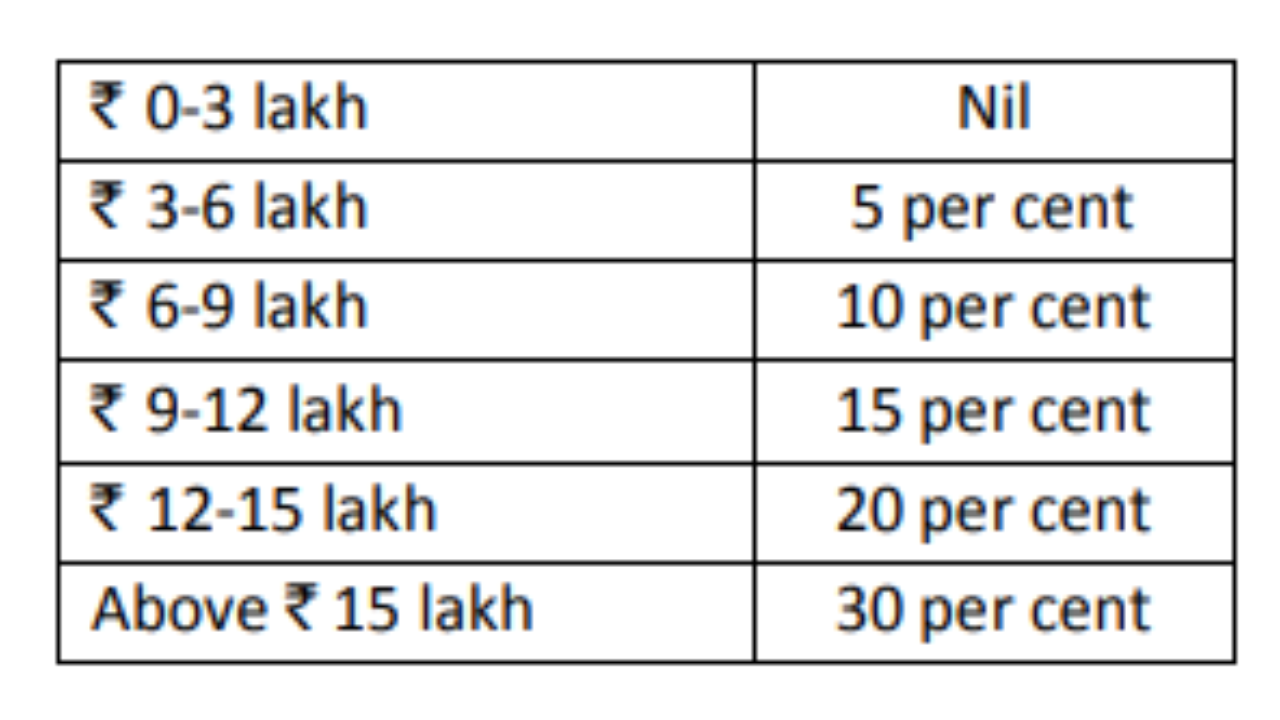

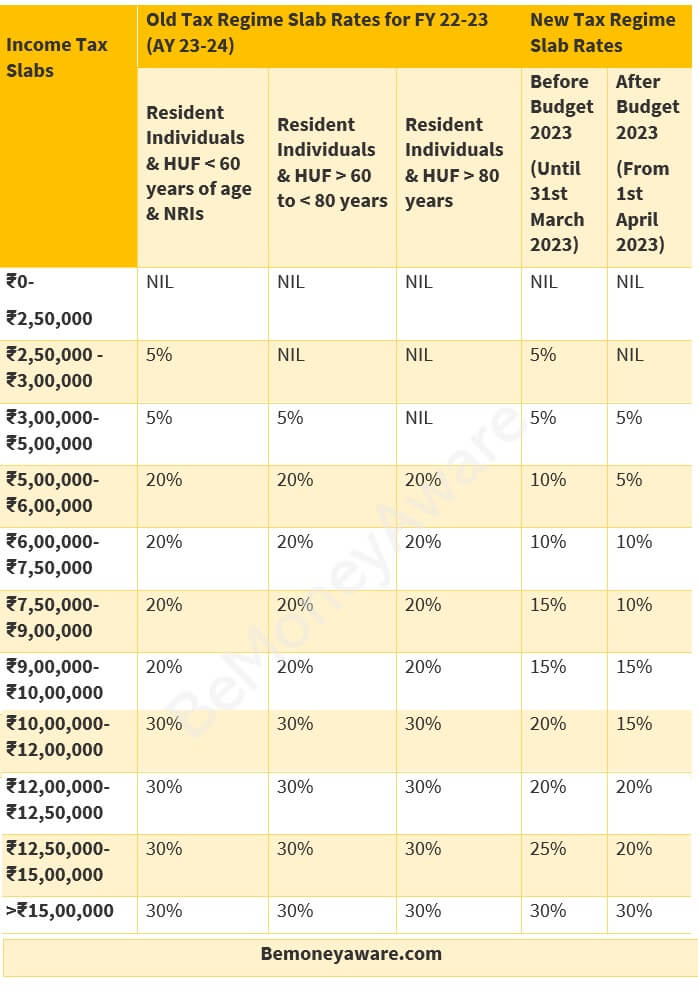

Web 4 ao 251 t 2023 nbsp 0183 32 What are the tax rates under the new regime In Budget 2023 the income tax slabs under the new tax regime have been revised The new tax slabs and tax Web 1 f 233 vr 2023 nbsp 0183 32 Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their

Web 14 avr 2023 nbsp 0183 32 The rebate benefit will be up to Rs 25 000 provided income doesn t exceed the limit of 7 lakh Technically anyone who has an income of Rs 7 5 lakh or less per Web 2 f 233 vr 2023 nbsp 0183 32 Under the old tax regime a maximum Rs 12 500 rebate was given if the taxable income did not exceed Rs 5 lakh However beginning April 1 2023 the new tax

Budget 2023 Summary Of Direct Tax Proposals

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

Budget Decoder How To Choose Between Old And New Tax Regime Times Of

https://www.cagmc.com/wp-content/uploads/2020/05/Screenshot-3-768x440.png

https://www.lerevenu.com/impots-et-droits/les-grandes-nouveautes...

Web 27 f 233 vr 2022 nbsp 0183 32 Prorogation de la hausse du plafond pour les dons La hausse du plafond pour les dons 224 1 000 euros pour les versements en faveur d organismes qui fournissent

https://economictimes.indiatimes.com/wealth/tax/new-tax-regime-2023...

Web 2 f 233 vr 2023 nbsp 0183 32 An individual can claim maximum deduction of Rs 25 000 for insurance premium paid for self spouse and dependent children For senior citizens the maximum

Why The New Income Tax Regime Has Few Takers

Budget 2023 Summary Of Direct Tax Proposals

Budget 2023 How You Can Get Rebate On Rs 7 5 Lakh Income Under New Tax

How To Choose Between The New And Old Income Tax Regimes

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Old new tax regime slabs

Old new tax regime slabs

Old Tax Regime Vs New Tax Regime Which Is Better For You Check What

Old Vs New Income Tax Slab PolicyBazaar

New Tax Regime Vs Old Tax Regime For Fy 2020 21 Gambaran

Rebate Allowed In New Tax Regime - Web List of Tax Deductions and Exemptions Allowed Under the New Tax Regime source blogspot Go through the following list of revised deductions and exemptions under the