Rebate And Relief Of Income Tax Web Key Difference Tax Relief is any program or incentive that helps reduce the tax in some way or another This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax

Web 20 ao 251 t 2022 nbsp 0183 32 Rebates and Reliefs Chapter 8 of Income Tax Law Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8 of Income Tax Act What is Rebate Section 87 In simple terms rebate is deduction from income tax payable Web 2 mars 2023 nbsp 0183 32 Tax relief refers to any government program or policy designed to help individuals and businesses reduce their tax burdens or resolve their tax related debts Tax relief

Rebate And Relief Of Income Tax

Rebate And Relief Of Income Tax

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2021/10/REBATE-AND-RELIEFS-UNDER-INCOME-TAX.jpg

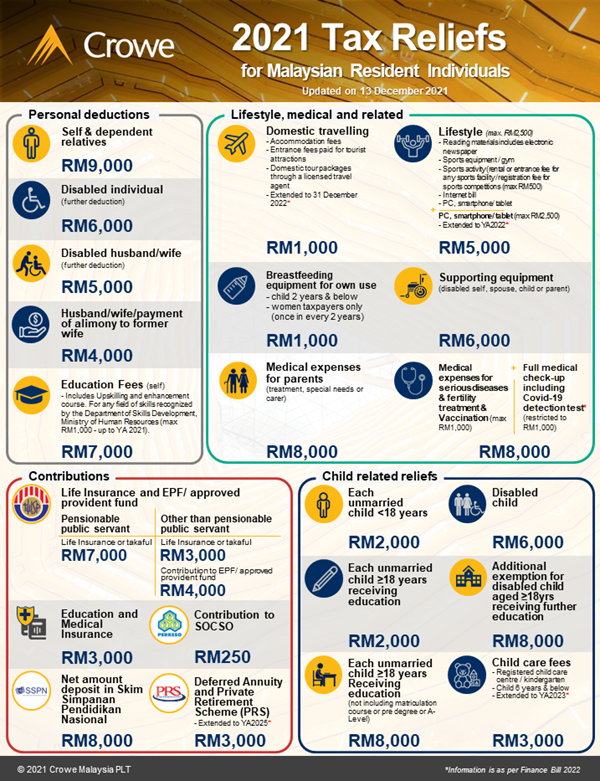

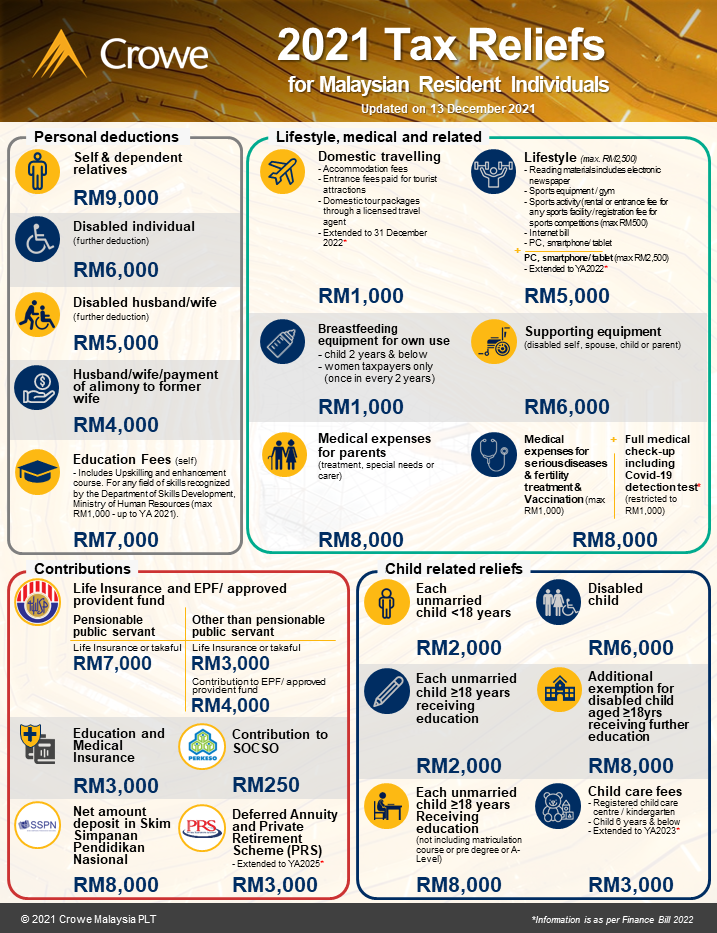

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals

https://www.crowe.com/my/-/media/crowe/firms/asia-pacific/my/crowemy/news/2021-tax-reliefs-for-malaysian-resident-individuals.png?h=781&w=600&rev=ca64b313404a480589a4e913b30d4d2a&hash=549C3D1D0DA2EF681378767559105F22

Rebates And Reliefs Of Income Tax Law

https://taxguru.in/wp-content/uploads/2022/08/Rebates-and-Reliefs-of-Income-Tax-Law.jpg

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web Coronavirus Tax Relief and Economic Impact Payments Internal Revenue Service We re offering tax help for individuals families businesses tax exempt organizations and others including health plans affected by coronavirus Child Tax Credit The 2021 Child Tax Credit is up to 3 600 for each qualifying child Web 15 janv 2021 nbsp 0183 32 For 2021 eligible taxpayers who did not receive the full amount can claim it as the Recovery Rebate Credit when they file their 2020 tax return Use IRS Free File to file and claim this important benefit IRS Free File also can be used by working families to claim EITC which provides a refundable tax credit based on income and family size

Download Rebate And Relief Of Income Tax

More picture related to Rebate And Relief Of Income Tax

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals

https://www.crowe.com/my/-/media/Crowe/Firms/Asia-Pacific/my/CroweMY/News/2020-Tax-Reliefs-Infographic.jpeg?la=en-GB&modified=20201125053743&hash=39B9A9939274CBC04492F0A4DC1F7034E7801D8E

Malaysia Personal Income Tax Relief 2020 Walang Merah

https://d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2020/12/malaysia-tax-relief-2020-mypf.png

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Web Il y a 2 heures nbsp 0183 32 FRANKFURT The European Central Bank is set to keep rates steady Thursday as economic activity in the euro area decelerates at a faster pace than previously expected Shoppers in the region are Web Il y a 14 heures nbsp 0183 32 Photograph Sasko Lazarov RollingNews ie Tue Sep 12 2023 20 00 The budget tax debate now in full swing is badly in need of some perspective Amid talk of increases in income tax bands

Web Il y a 1 jour nbsp 0183 32 The taxpayer will not be entitled to enjoy the tax on the income benefit of reduced tax rate and tax rebate Hence this provision is expected to increase compliance culture We all talk Web 6 avr 2021 nbsp 0183 32 Tax reliefs and tax exemptions are deducted from your total annual income After deduction this amount is known as chargeable income Meanwhile tax rebate is calculated AFTER you have determined the amount of tax charged on your chargeable income It will be deducted from your actual taxed amount

Personal Tax Relief 2022 Latest CN Advisory

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

Guide On Tax Reliefs For First Time Working Parents Heartland Boy

https://i2.wp.com/heartlandboy.com/wp-content/uploads/Child-Related-Reliefs-1.jpg?ssl=1

http://www.differencebetween.info/difference …

Web Key Difference Tax Relief is any program or incentive that helps reduce the tax in some way or another This tax relief can be in the form of a tax deduction or a tax credit A tax deduction is basically a deduction of tax

https://taxguru.in/income-tax/rebates-reliefs-income-tax-law.html

Web 20 ao 251 t 2022 nbsp 0183 32 Rebates and Reliefs Chapter 8 of Income Tax Law Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8 of Income Tax Act What is Rebate Section 87 In simple terms rebate is deduction from income tax payable

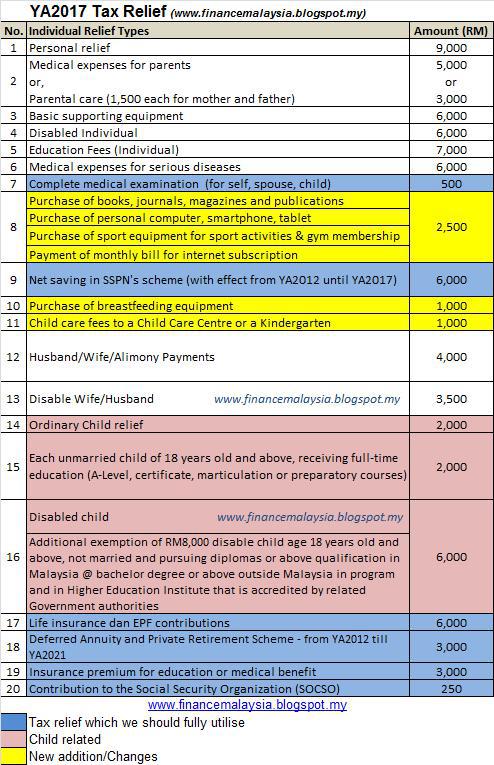

Finance Malaysia Blogspot YA2017 Tax Relief For Personal Income Tax Filing

Personal Tax Relief 2022 Latest CN Advisory

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Understanding Tax Reliefs Loanstreet

How To File Income Tax In Malaysia Using E Filing Mr stingy

How To File Income Tax In Malaysia Using E Filing Mr stingy

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

Malaysia Personal Income Tax Guide 2020 YA 2019

Rebate And Relief Of Income Tax - Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program