Rebate Calculation In Income Tax Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay

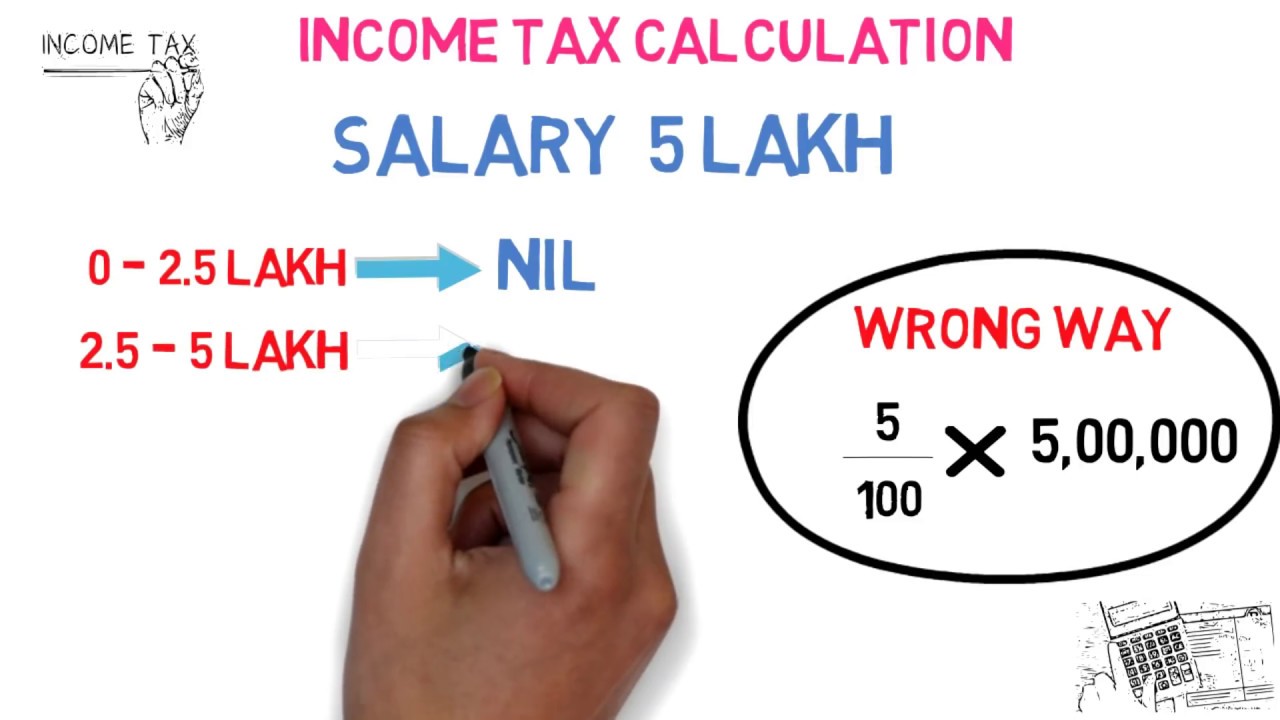

Web 11 avr 2023 nbsp 0183 32 Exclude income that is exempt or not included in the total income calculation Apply the rebate If your total income is equal to or less than Rs 5 lakh Web 6 f 233 vr 2023 nbsp 0183 32 13 4 5Y CAGR Income Tax Rebate u s 87A Of Income Tax Act 1961 Section 87A of the Income Tax Act was introduced in 2013 to provide relief to taxpayers The Budget 2023 introduces tax rebate

Rebate Calculation In Income Tax

Rebate Calculation In Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Retirement Income Tax Rebate Calculator Greater Good SA

https://gg.myggsa.co.za/how_to_calculate_tax_rebate_for_retirement_annuity_south_africa.pnJFwS5NsgwzDjQtZcjDf9sR_wTndXTKWakA_IzLSfZHvkGnDxIMjTWOn4h_qpnCoymGxeORadFt6dq56FOJNQWinH22TSkj=w1200-h630-pd

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Web Income Tax Rebate When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money is Web 16 ao 251 t 2022 nbsp 0183 32 You can calculate the income tax rebate under section 87A by taking the following steps Step 1 Compute your total gross income for the financial year Step 2

Web 5 avr 2017 nbsp 0183 32 Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year Web 4 f 233 vr 2023 nbsp 0183 32 Tax Rebate Calculation Rules A person s monthly income is 50 000 TK Then his total income in 12 months is 600 000 TK Think his annual bonus is 50 000 TK Festival Allowance is 30 000 TK

Download Rebate Calculation In Income Tax

More picture related to Rebate Calculation In Income Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Web 19 f 233 vr 2023 nbsp 0183 32 Rebate under 87A of Income Tax rebate meaning calculation of rebate income tax taxation laws 12K views 4 months ago Financial Planning and Tax Web 1 d 233 c 2022 nbsp 0183 32 The National Bureau of Economic Research credited this tax rebate with helping to counteract the recession by increasing aggregate consumption by 2 9 percent in the third quarter of 2001 and 2 percent in

Web Using our free tax rebate calculator it instantly gives you an estimate of how much of a tax refund you could be due from HMRC Why wait Claim your tax rebate with Web 19 janv 2023 nbsp 0183 32 Rebate under Sec 87A Tax rebate is a form of tax incentive provided by the government to individuals earning an income below a specified limit In case your

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

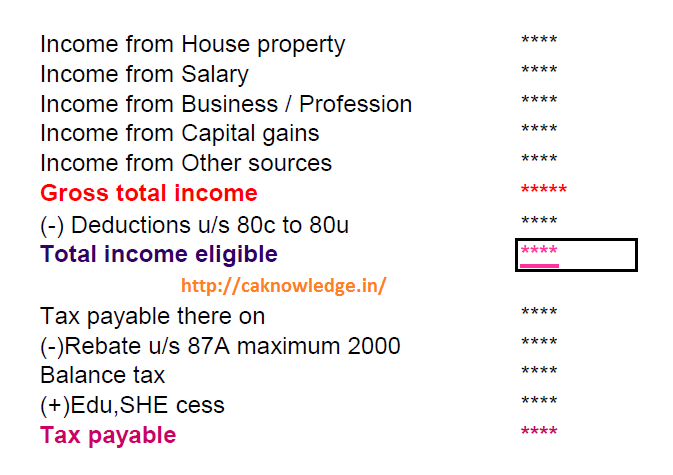

Is Rebate U s 87A Available For Financial Year 2016 17

https://caknowledge.com/wp-content/uploads/2015/06/Rebate-Income-Calculation.png

https://www.gov.uk/claim-tax-refund

Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay

https://www.bajajfinserv.in/insights/income-tax-rebate

Web 11 avr 2023 nbsp 0183 32 Exclude income that is exempt or not included in the total income calculation Apply the rebate If your total income is equal to or less than Rs 5 lakh

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Tds Slab Rate For Ay 2019 20

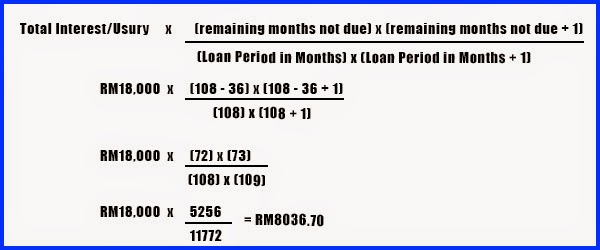

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

Debt Tales The Bank And You 2014

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Rebate Calculation In Income Tax - Web 18 ao 251 t 2017 nbsp 0183 32 At first we will calculate the total investment allowance based on total taxable amount i e BDT 954 000 So your investment allowance will be BDT 190 800