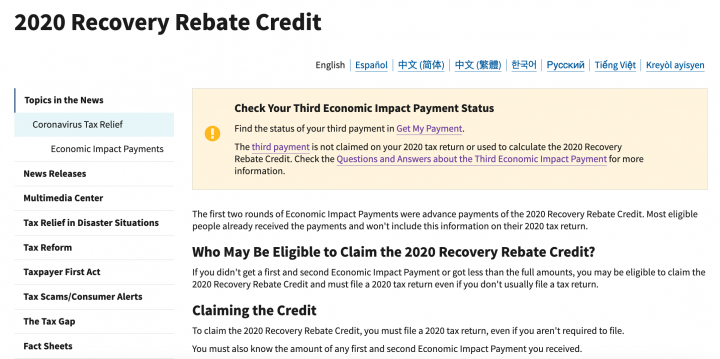

Rebate Credit For Stimulus Web 17 f 233 vr 2022 nbsp 0183 32 Unlike the 2020 Recovery Rebate Credits and first two rounds of Economic Impact Payments the 2021 Recovery Rebate Credit and third round of Economic

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 15 mars 2023 nbsp 0183 32 Most eligible people already received their Economic Impact Payments However people who are missing stimulus payments should review the information below to determine their eligibility to claim a

Rebate Credit For Stimulus

Rebate Credit For Stimulus

https://cdn.abcotvs.com/dip/images/9476384_recoery-rebate.jpg?w=1600

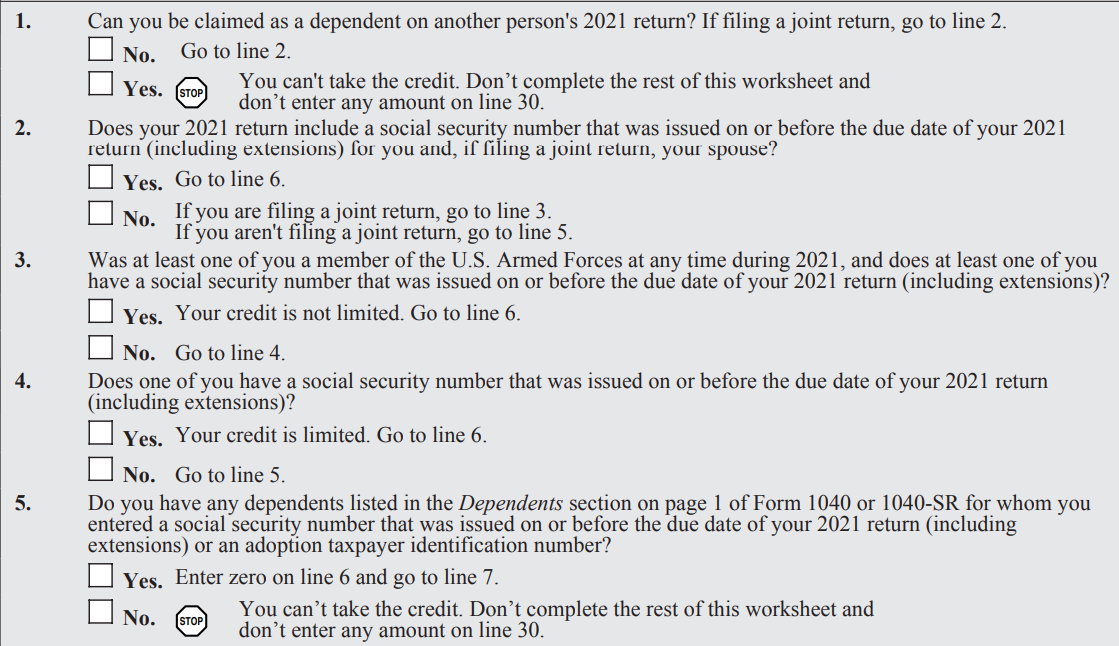

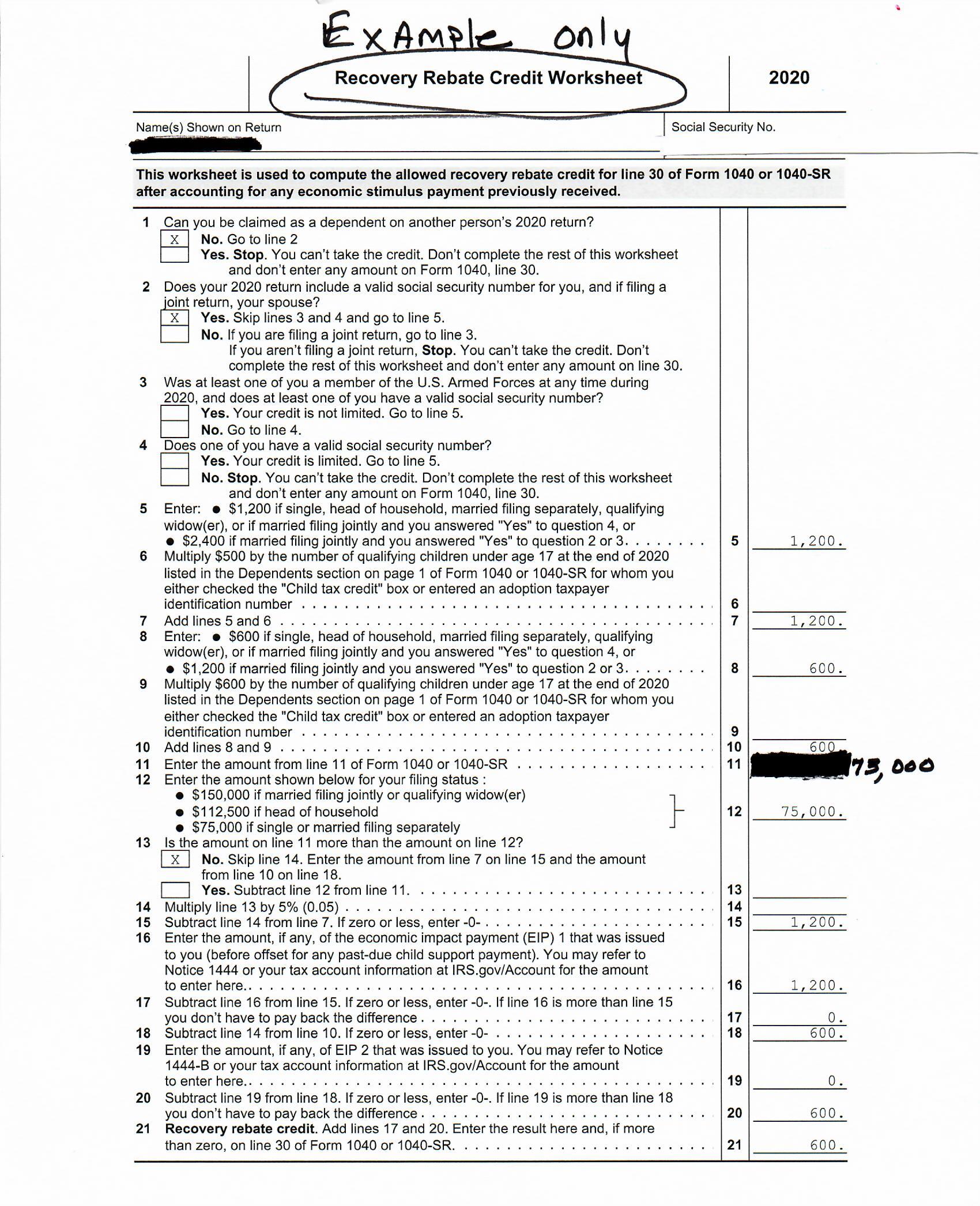

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415864484109/mceclip1.png

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

https://www.consumerismcommentary.com/wp-content/uploads/2009/01/recovery-rebate-credit-1040.jpg

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 17 ao 251 t 2022 nbsp 0183 32 Generally speaking if you received 1 200 stimulus payments 2 400 if married filing jointly and your family also received 500 for each qualifying dependent child under age 17 you likely

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 15 janv 2021 nbsp 0183 32 Recovery Rebate Credit and other benefits IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned

Download Rebate Credit For Stimulus

More picture related to Rebate Credit For Stimulus

Is The Recovery Rebate Credit The Same As The Stimulus Leia Aqui Is

https://media.cbs19.tv/assets/KYTX/images/3ca89be7-1360-4b18-a5ba-3c6279cb9539/3ca89be7-1360-4b18-a5ba-3c6279cb9539_1140x641.png

Fourth Stimulus Check News Summary 12 May 2021 AS USA

https://asmedia.epimg.net/les/20210513/771e0ffbc8b132b086ded22f488465b5/1f68b64e9f07a6dbf0851cca20a9e246_720.png

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-third-stimulus-stimulusinfoclub.png?w=1370&ssl=1

Web 19 janv 2022 nbsp 0183 32 The third stimulus and the plus up payments were technically advance payments of the 2021 rebate credit claimed on a 2021 tax return The payment amounts Web 10 d 233 c 2021 nbsp 0183 32 A5 A valid SSN for the Recovery Rebate Credit claimed on a 2020 tax return is one that is valid for employment in the United States and is issued by the Social

Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Web 3 f 233 vr 2023 nbsp 0183 32 Feb 3 2023 If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2023

How To Fill Out Form To Get Stimulus Check Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

10 Recovery Rebate Credit Worksheet

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Unlike the 2020 Recovery Rebate Credits and first two rounds of Economic Impact Payments the 2021 Recovery Rebate Credit and third round of Economic

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recovery Rebate Credit Calculator EireneIgnacy

How To Fill Out Form To Get Stimulus Check Printable Rebate Form

How To Recover Stimulus Check StimulusInfoClub

IRS 1040 NonFilers Stimulus Check Recovery Rebate Credit Walk Through

Who could Qualify For 2nd Stimulus

Stimulus Checks From The Government Explained Vox Recovery Rebate

Stimulus Checks From The Government Explained Vox Recovery Rebate

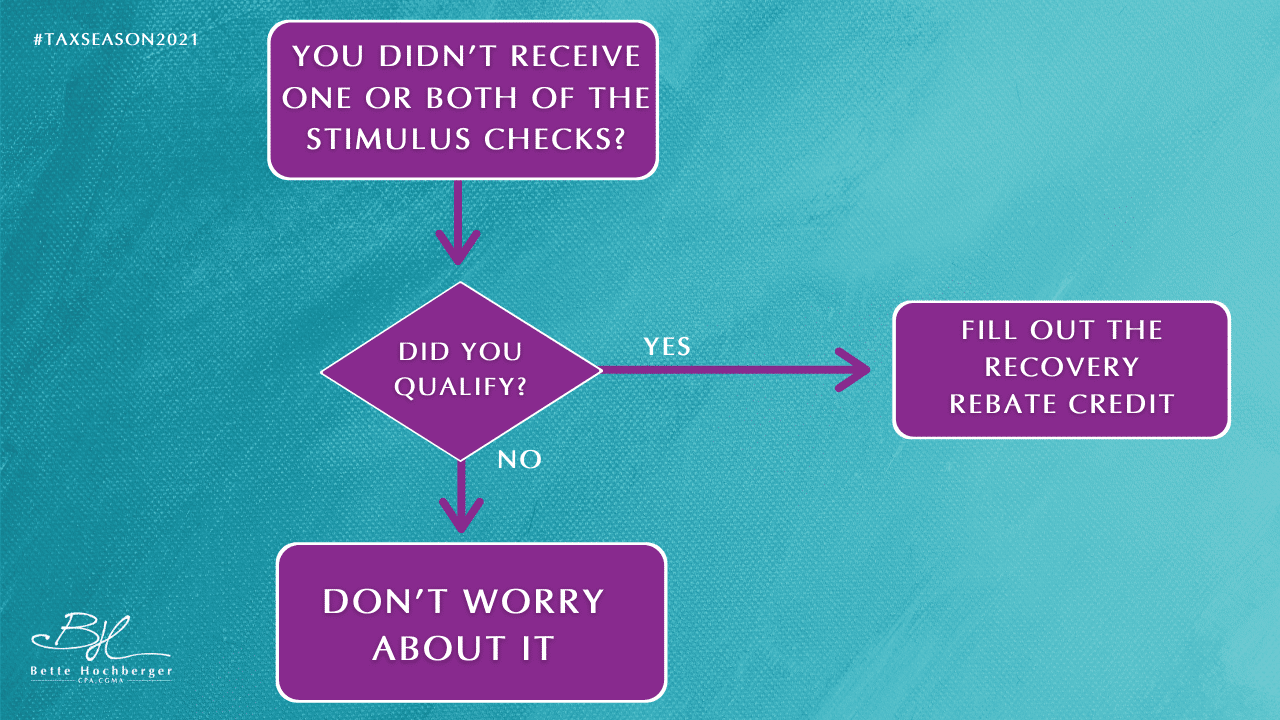

Stimulus Check Was Never Received Bette Hochberger CPA CGMA

The Recovery Rebate Credit Calculator MollieAilie

Recovery Rebate Credit stimulus Checks On Draft 1040

Rebate Credit For Stimulus - Web 17 ao 251 t 2022 nbsp 0183 32 Generally speaking if you received 1 200 stimulus payments 2 400 if married filing jointly and your family also received 500 for each qualifying dependent child under age 17 you likely