Rebate Excess Excise Tax Colorado Web The Fuels Impact Enterprise is funded through a 0 006125 per gallon Fuels Impact Reduction Fee FIRF Beginning September 1 2023 the Fuels Impact Reduction Fee is

Web Colorado allows a refund of fuel tax paid for gasoline aviation fuel and special fuels The allowance of the refund depends on how the fuel is used the type of fuel and if and Web 10 janv 2023 nbsp 0183 32 Colorado Gov Jared Polis signed the law in May to return money to taxpayers and originally intended for the payment to be 400 for individual filers and

Rebate Excess Excise Tax Colorado

Rebate Excess Excise Tax Colorado

https://data.templateroller.com/pdf_docs_html/1732/17329/1732941/form-dr-0449-personal-excise-tax-return-alcohol-beverages-colorado_big.png

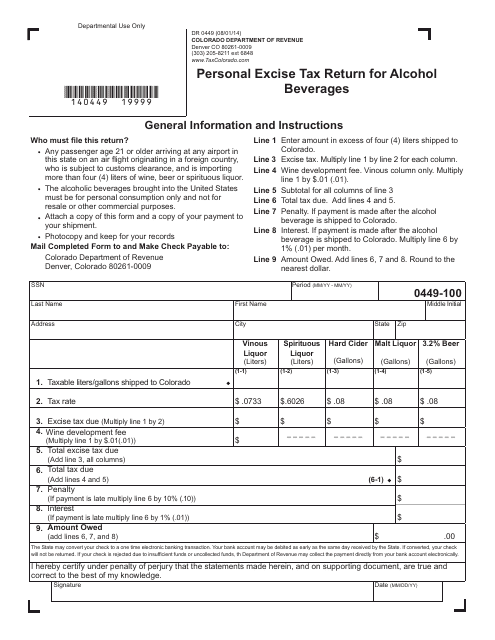

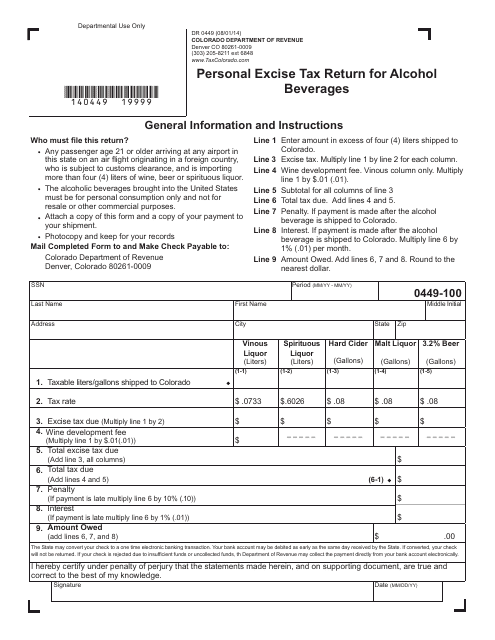

Colorado Department Of Revenue Fill Out And Sign Printable PDF

https://www.signnow.com/preview/249/269/249269303/large.png

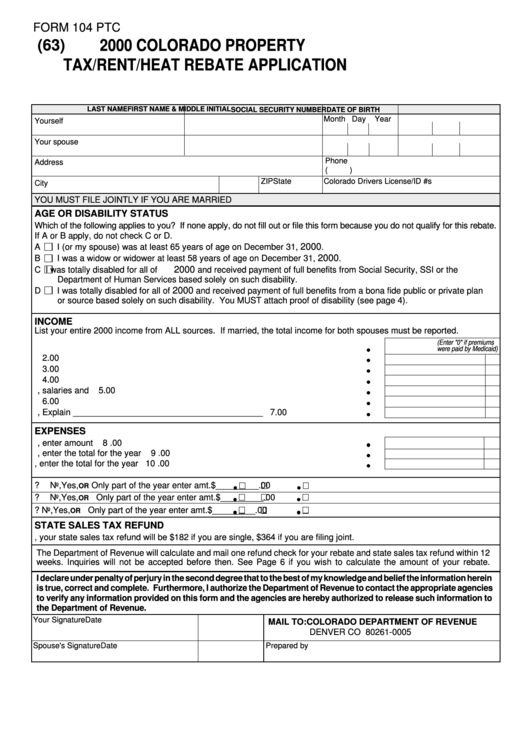

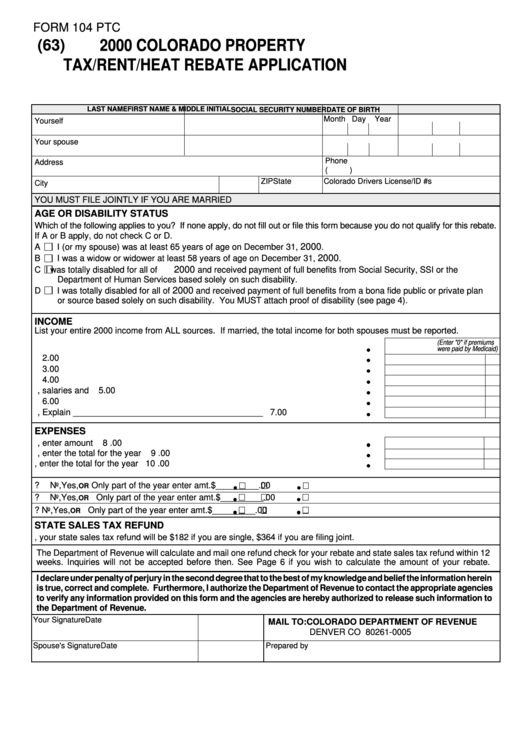

How Much Is The Colorado Ptc Rebate Torres Louise

https://i2.wp.com/data.formsbank.com/pdf_docs_html/256/2567/256784/page_1_thumb_big.png

Web 23 mai 2022 nbsp 0183 32 Colorado Cash Back Refunds On May 23 2022 Gov Jared Polis signed a new law Senate Bill 22 233 to give Coloradans a tax rebate of 750 for individual filers Web Retailers Sellers If you overpaid sales or use tax on a tax return you filed you may deduct the overpayment on your next return If you cannot deduct the overpayment on your next

Web Exempt Use of Fuel Colorado tax law allows for a refund of fuel tax paid for gasoline aviation fuel and special fuels when the fuel is used for approved commercial purposes Web Part 1 Taxable Fuels and Exemptions Part 2 Fuel Tax Licensing Part 3 Taxes Surcharges and Fees Part 4 Filing Remittance and Recordkeeping Part 5 Refunds

Download Rebate Excess Excise Tax Colorado

More picture related to Rebate Excess Excise Tax Colorado

Form 104 Ptc Colorado Property Tax Rent Heat Rebate Application

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/form-104-ptc-colorado-property-tax-rent-heat-rebate-application-1.png?fit=530%2C749&ssl=1

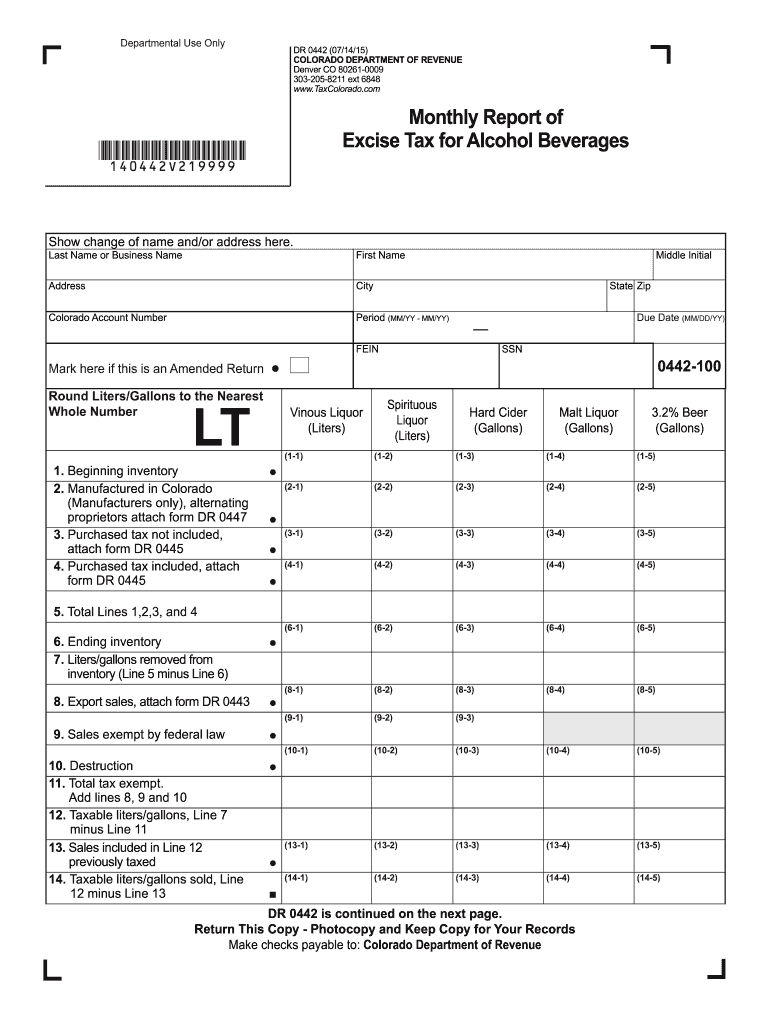

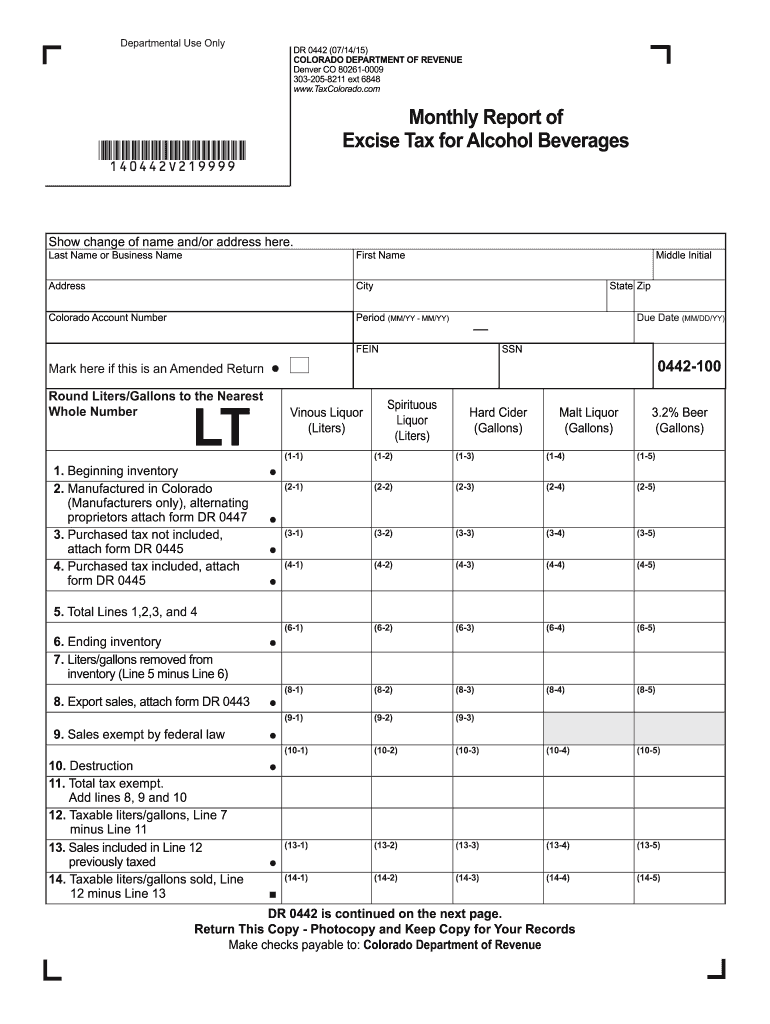

2019 Form CO DR 0442 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/494/812/494812071/large.png

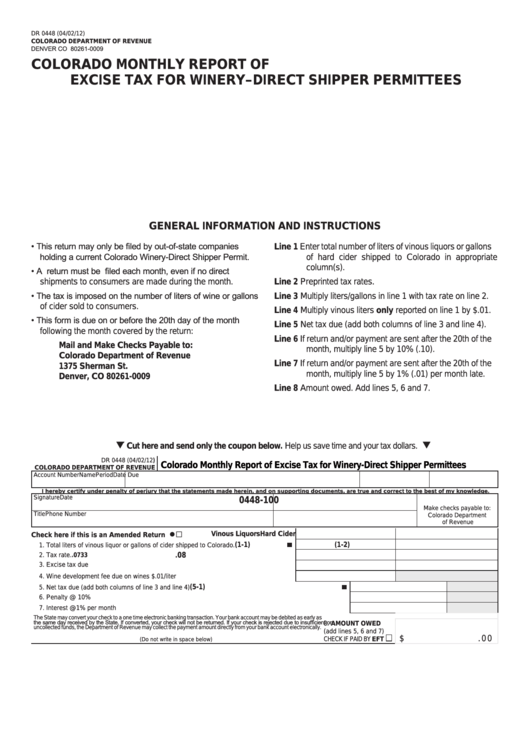

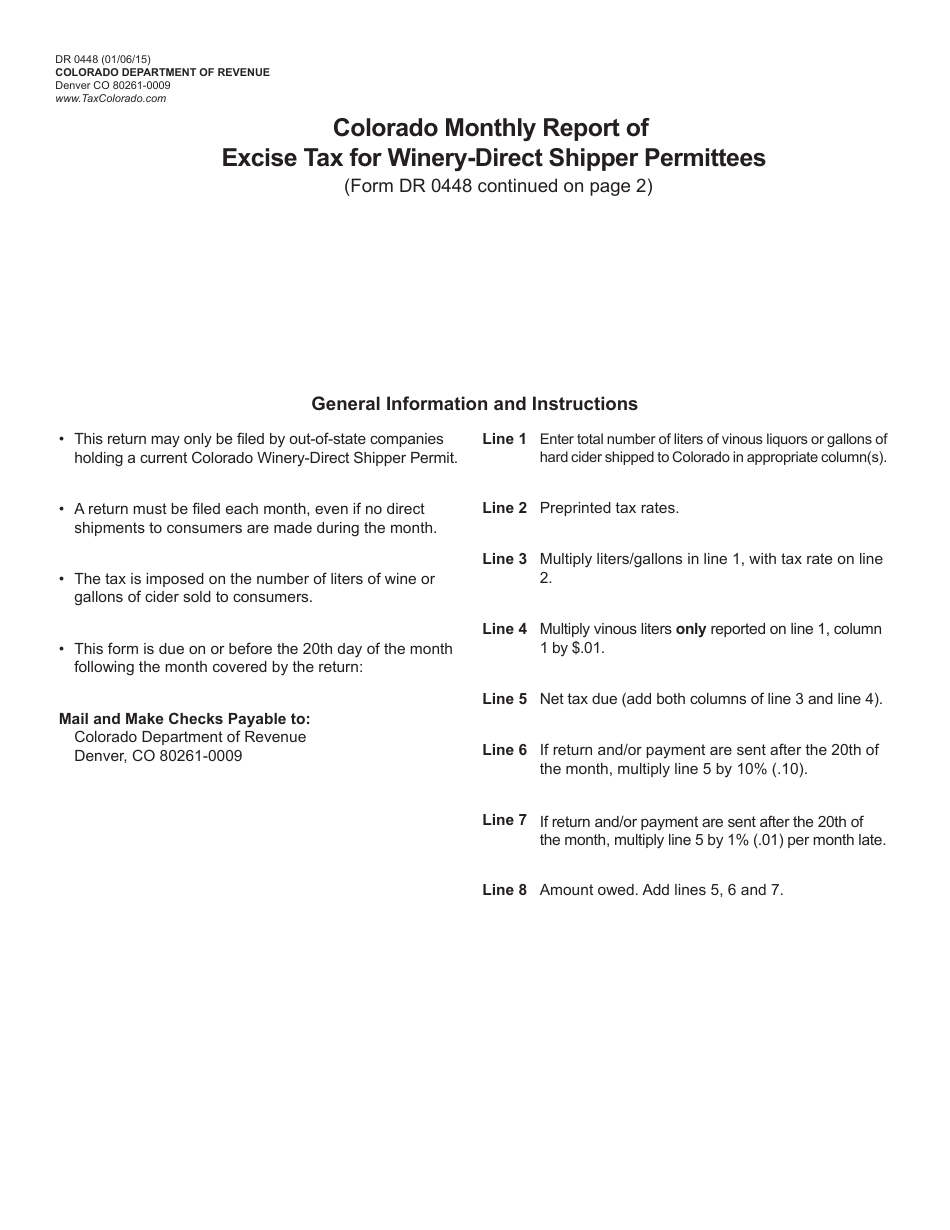

Fillable Form Dr 0448 Colorado Monthly Report Of Excise Tax For

https://data.formsbank.com/pdf_docs_html/359/3594/359480/page_1_thumb_big.png

Web Colorado tax law allows for a refund of fuel tax paid for gasoline aviation fuel and special fuels when the fuel is used for approved commercial purposes off Colorado roads Web For improvements made after January 1 2023 households may qualify for a 1 200 annual tax credit replacing the previous 500 lifetime limit up to a cap of 600 per measure with exceptions noted below The tax credit

Web 25 avr 2022 nbsp 0183 32 Published on April 25 2022 Gov Jared Polis announced a 400 rebate for Colorado taxpayers April 25 2022 at the Colorado State Capitol Credit Governor Web If purchasers are using excise tax paid fuel for purposes exempt by statute they can apply to the Colorado Department of Revenue for a refund permit to receive a refund of the

Form 104 Ptc Colorado Property Tax rent heat Rebate Application

https://data.formsbank.com/pdf_docs_html/281/2814/281406/page_1_thumb_big.png

Ev Car Tax Rebate Calculator 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png?resize=840%2C923&ssl=1

https://tax.colorado.gov/excise-fuel-tax

Web The Fuels Impact Enterprise is funded through a 0 006125 per gallon Fuels Impact Reduction Fee FIRF Beginning September 1 2023 the Fuels Impact Reduction Fee is

https://tax.colorado.gov/fuel-tax-refunds

Web Colorado allows a refund of fuel tax paid for gasoline aviation fuel and special fuels The allowance of the refund depends on how the fuel is used the type of fuel and if and

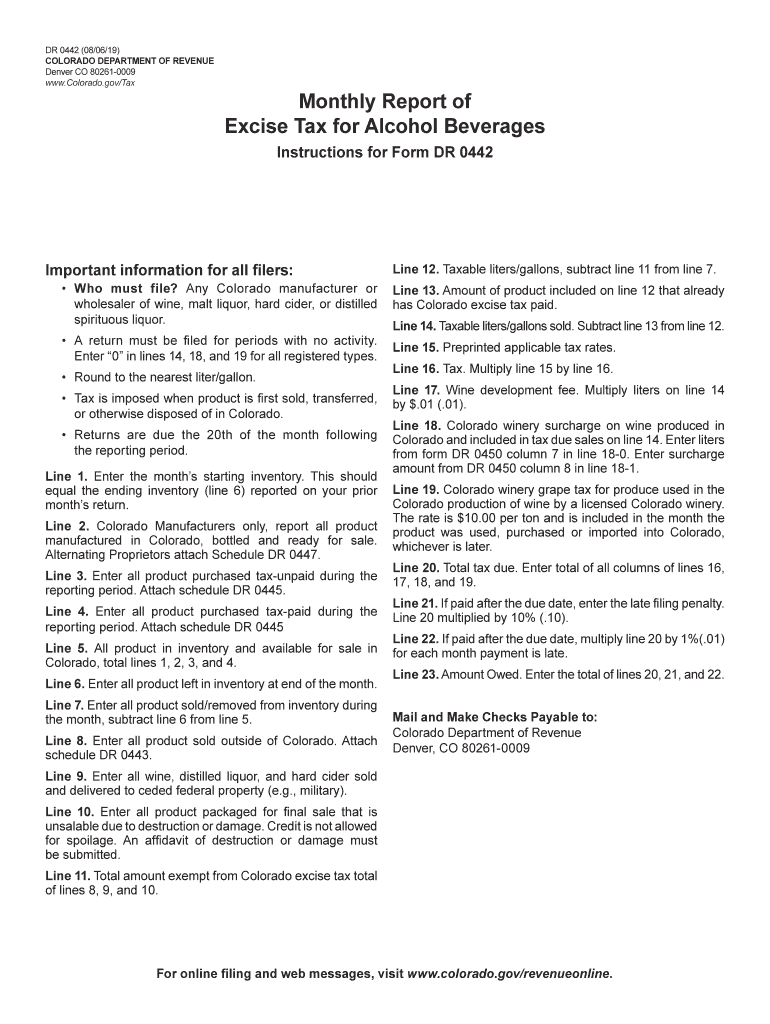

Form DR0448 Download Fillable PDF Or Fill Online Colorado Monthly

Form 104 Ptc Colorado Property Tax rent heat Rebate Application

68 Construction Rfp Template Page 2 Free To Edit Download Print

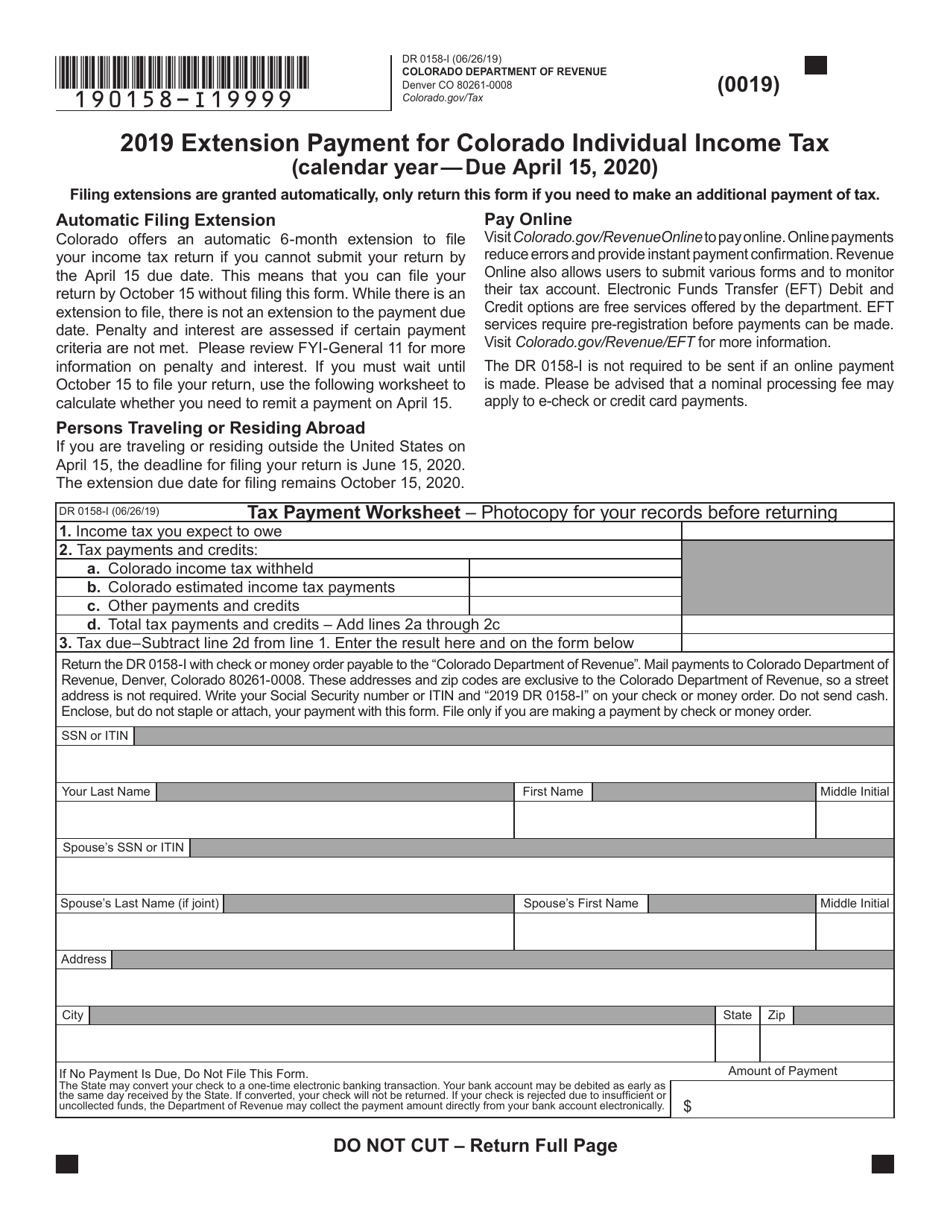

Form DR0158 I Download Fillable PDF Or Fill Online Extension Payment

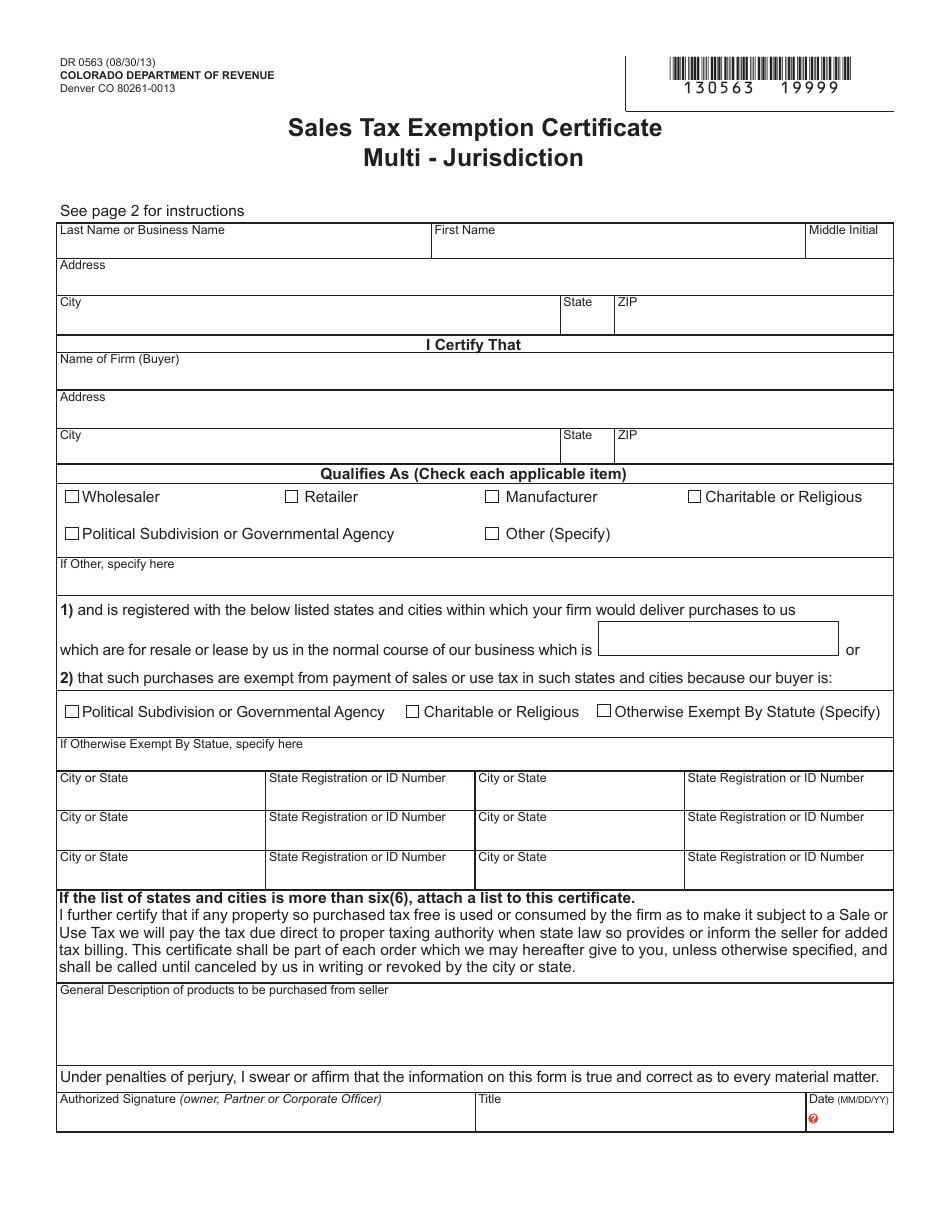

Form DR0563 Download Fillable PDF Or Fill Online Sales Tax Exemption

How To File Colorado State Taxes For Free Franks Cedric

How To File Colorado State Taxes For Free Franks Cedric

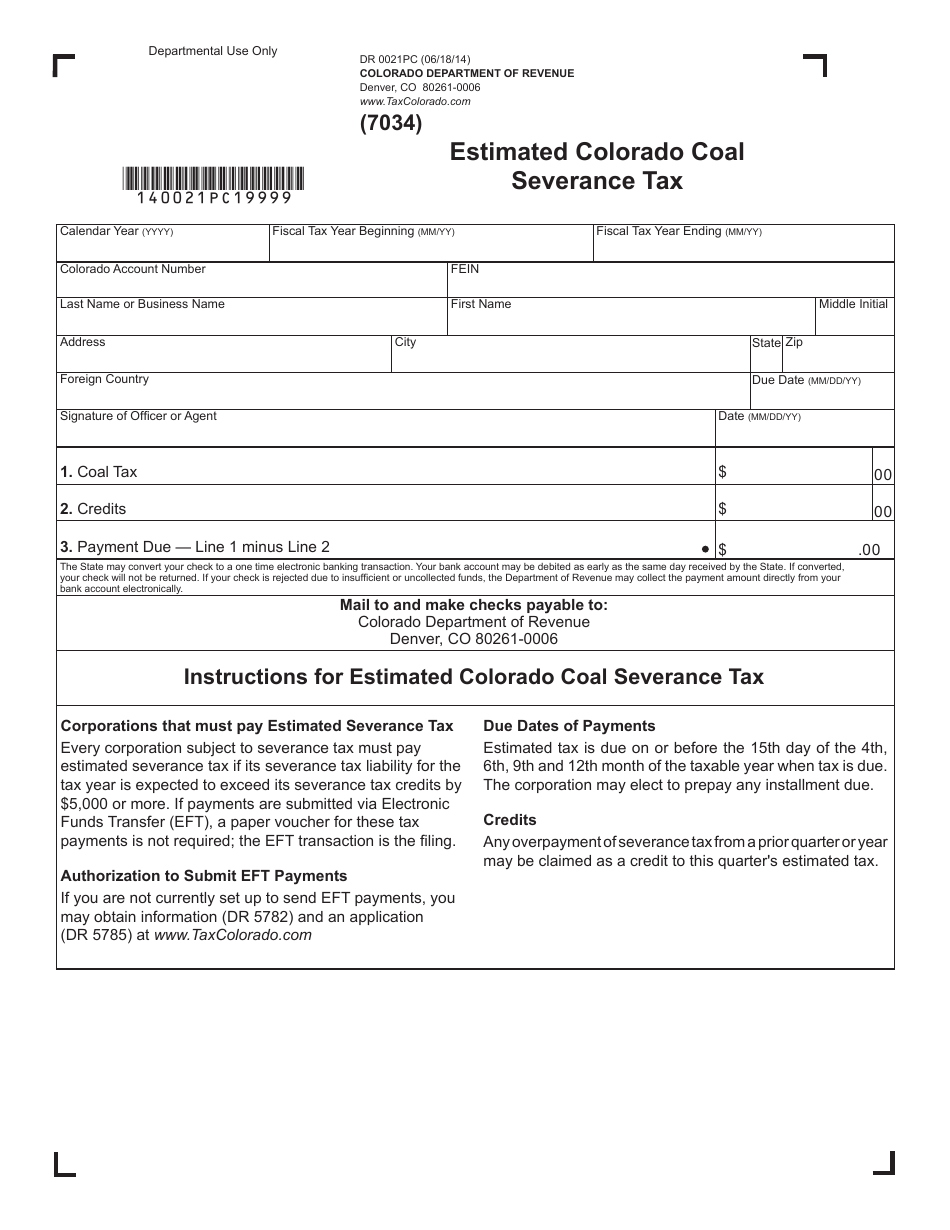

Form DR0021PC Download Printable PDF Or Fill Online Estimated Colorado

Colorado Property Tax And Rent Rebate Formula PropertyRebate

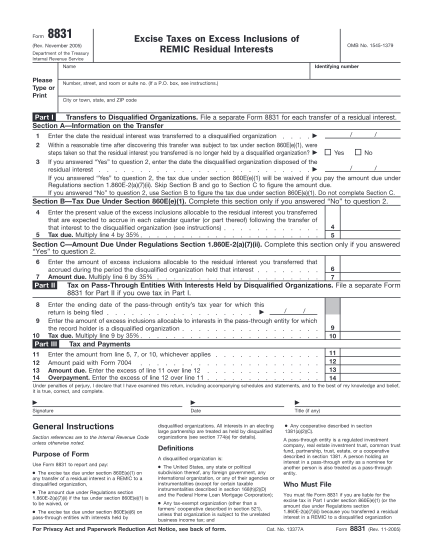

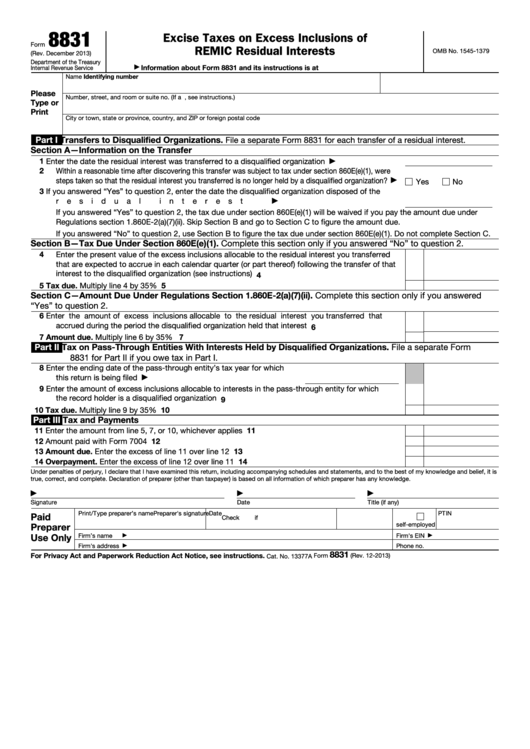

Fillable Form 8831 Excise Taxes On Excess Inclusions Of Remic

Rebate Excess Excise Tax Colorado - Web Excise Tax Evaluations Colorado levies excise taxes on a variety of goods and activities including motor and aviation fuel cigarettes and tobacco products marijuana and