Rebate For Agricultural Income Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two

There is a complete tax rebate on agriculture income in these cases If your total agricultural income is less than Rs 5 000 p a If the income from agricultural land For the period 2023 27 the planned EU budget for income support is nearly 188 billion Related information CAP at a glance how it s paid for Legal basis The following rules

Rebate For Agricultural Income

Rebate For Agricultural Income

https://s3.studylib.net/store/data/007155201_1-df64c3e5d3307cf3cac4c14604b2d96b-768x994.png

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Treatment Of Taxation For Agriculture Income Complete Guide

https://financialcontrol.in/wp-content/uploads/2018/11/schedule-EI-ITR2.jpg

Agricultural income is exempt under Section 10 1 of the Act so long as the income is derived from agricultural land situated in India This income is however Agriculture income is exempt under section 10 1 of the Income tax Act However it is included for tax rate purposes in computing the total Income tax liability if the following

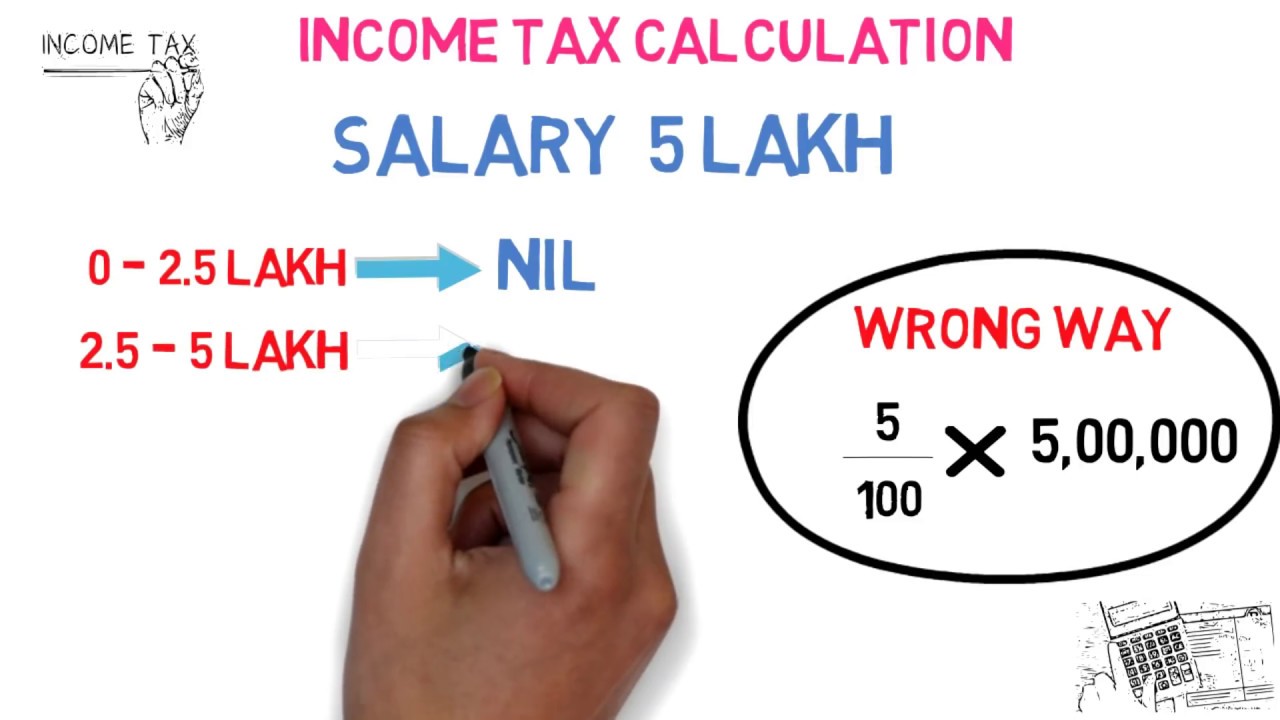

Step 2 Calculation of tax on net agricultural income maximum exemption limit as per slab rates Step 3 Calculation of the final tax as a difference of the figures derived in Is rebate 87A applicable on agricultural income Yes The resident individuals earning from agricultural income sources are eligible to claim tax rebate under section 87A I have agricultural income as the

Download Rebate For Agricultural Income

More picture related to Rebate For Agricultural Income

HOW TO FILE TAX RETURN FOR AGRICULTURAL INCOME

https://i.ytimg.com/vi/p2MgiO3r-NY/maxresdefault.jpg

Rebate Forms Site Menards MenardsRebateForms

https://i0.wp.com/struggleville.net/wp-content/uploads/2019/11/MenardsRebate8702.jpg

Tax On Agricultural Income YouTube

https://i.ytimg.com/vi/LfD-Eonmxss/maxresdefault.jpg

1 Agricultural Land Rental Income 2 Agricultural Operations Revenue 3 Farm Building Income Agriculture Income Tax In India Examples of Agricultural Step 1 Calculate tax on non Agricultural Income net Agricultural Income Step 2 Calculate tax on net Agricultural Income max exemption limit as

Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax Rebate of Agriculture Income Individuals are eligible for a complete refund of tax on their agricultural income if the following prerequisites are An individual s total

Entitlement Of TAX REBATE With Reference To AGRICULTURAL INCOME TIPS

https://i.ytimg.com/vi/2iqY_EFGdBg/maxresdefault.jpg

Agricultural Income AND ITS TAX Treatment AGRICULTURAL INCOME AND ITS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/748155764a6a4fbe172a78e423567d85/thumb_1200_1697.png

https://taxguru.in/income-tax/calculate-t…

Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two

https://tax2win.in/guide/income-tax-agricultural-income

There is a complete tax rebate on agriculture income in these cases If your total agricultural income is less than Rs 5 000 p a If the income from agricultural land

AGRICULTURAL INCOME YouTube

Entitlement Of TAX REBATE With Reference To AGRICULTURAL INCOME TIPS

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

Capital Gain On Sale Of Agricultural Land Tax Planning For

Income Tax Rebate U s 87A For The Financial Year 2022 23

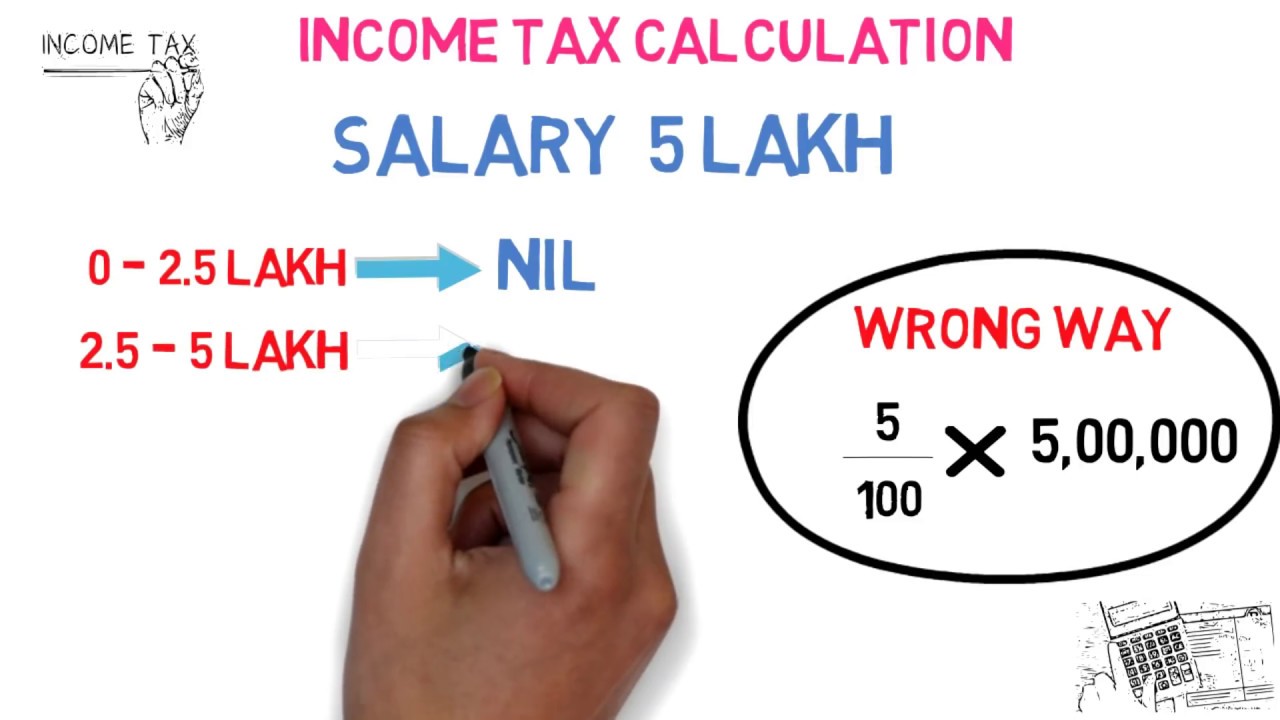

New Income Tax Calculation Rebate 2018 19 Explained YouTube

New Income Tax Calculation Rebate 2018 19 Explained YouTube

Income Tax Rebate Under Section 87A Rebate For Financial Year GST

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Rebate For Agricultural Income - Step 2 Calculation of tax on net agricultural income maximum exemption limit as per slab rates Step 3 Calculation of the final tax as a difference of the figures derived in