Rebate For Early Loan In Income Tax Web 19 janv 2018 nbsp 0183 32 The Early Refund Advance Loan which has a 34 22 APR is available in December 2022 while the No Fee Refund Advance Loan

Web a pension a Self Assessment tax return a redundancy payment UK income if you live abroad interest from savings or payment protection insurance PPI income from a life Web The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a

Rebate For Early Loan In Income Tax

Rebate For Early Loan In Income Tax

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Web 24 d 233 c 2021 nbsp 0183 32 Answer Since you have already sold the house in respect of which you were entitled to claim pre EMI interest for the next two years as no income is taxable in respect of the same house property Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 17 ao 251 t 2022 nbsp 0183 32 A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money Web 16 f 233 vr 2021 nbsp 0183 32 Eligibility for and the amount of the Recovery Rebate Credit are based on 2020 tax year information while the Economic Impact Payments were based on 2019 tax

Download Rebate For Early Loan In Income Tax

More picture related to Rebate For Early Loan In Income Tax

401k Early Withdrawal Tax Calculator AndrenaCarla

https://blog.mint.com/wp-content/uploads/2020/11/How-to-Determine-If-You-Want-to-Cash-Out-Your-Retirement-.png

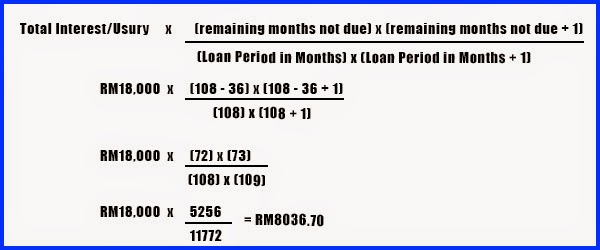

Debt Tales The Bank And You Legal Action Procedures Hire Purchase

http://2.bp.blogspot.com/-MMnp0L2hMbY/VE4R6FSCmiI/AAAAAAAAAdQ/xvrYLxYfEAo/s1600/rebatecalcenglish.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web 20 d 233 c 2022 nbsp 0183 32 Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how eligible individuals Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web A5 Tax year 2020 returns can be filed electronically only by paid or volunteer tax preparers If you prepare a prior year tax return yourself you must print sign and mail Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

https://www.nerdwallet.com/article/loans/per…

Web 19 janv 2018 nbsp 0183 32 The Early Refund Advance Loan which has a 34 22 APR is available in December 2022 while the No Fee Refund Advance Loan

https://www.gov.uk/claim-tax-refund

Web a pension a Self Assessment tax return a redundancy payment UK income if you live abroad interest from savings or payment protection insurance PPI income from a life

Mortgage Calculator Free Home Mortgage Calculator For Excel Calculate

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

FREE 6 Sample Income Based Repayment Forms In PDF

Can I Get My Tax Rebate Early Tax Walls

Auto Loan Rebate Financing Comparison Calculator

Auto Loan Rebate Financing Comparison Calculator

Tax Return Fake Fake Documents Mortgage Calculator Tax Deductions

How To Declare Home Loan In Income Tax Grizzbye

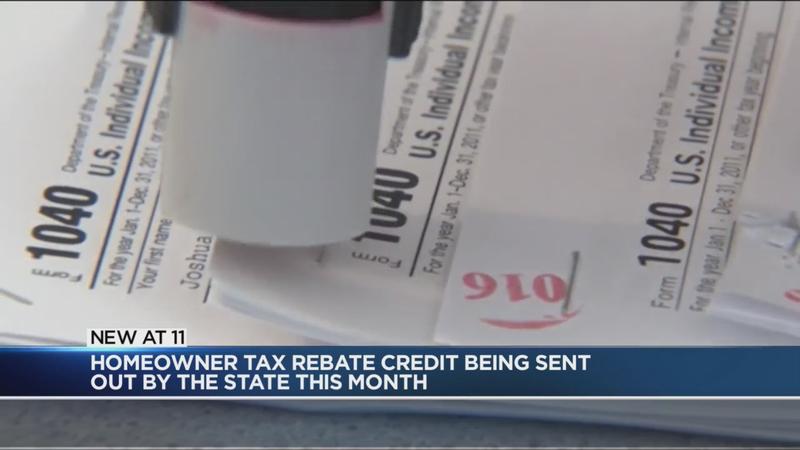

NY Homeowner Tax Rebate Checks Arriving Early WHEC

Rebate For Early Loan In Income Tax - Web 26 juin 2023 nbsp 0183 32 Minimum federal tax refund amount 500 Tax preparation fee Not disclosed Early Refund Advance Loan amounts 300 500 1 100 No Fee Refund