Rebate For Homeowners For 2024 Fl For Insulation Rebate What can I get a rebate for and how much money can I save You can get rebates on the following items through the two Home Energy Rebate programs Home Efficiency Rebates Recommended when you re taking several actions to reduce your energy usage All households are eligible with the largest rebates going to those with lower incomes

The HOMES program will provide rebates for energy efficient retrofits that range between 2 000 4 000 for individual households and between 2 000 4 000 per dwelling for multi family buildings If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified

Rebate For Homeowners For 2024 Fl For Insulation Rebate

Rebate For Homeowners For 2024 Fl For Insulation Rebate

https://911atticinsulation.com/wp-content/uploads/2023/04/23-1152x1536.jpg

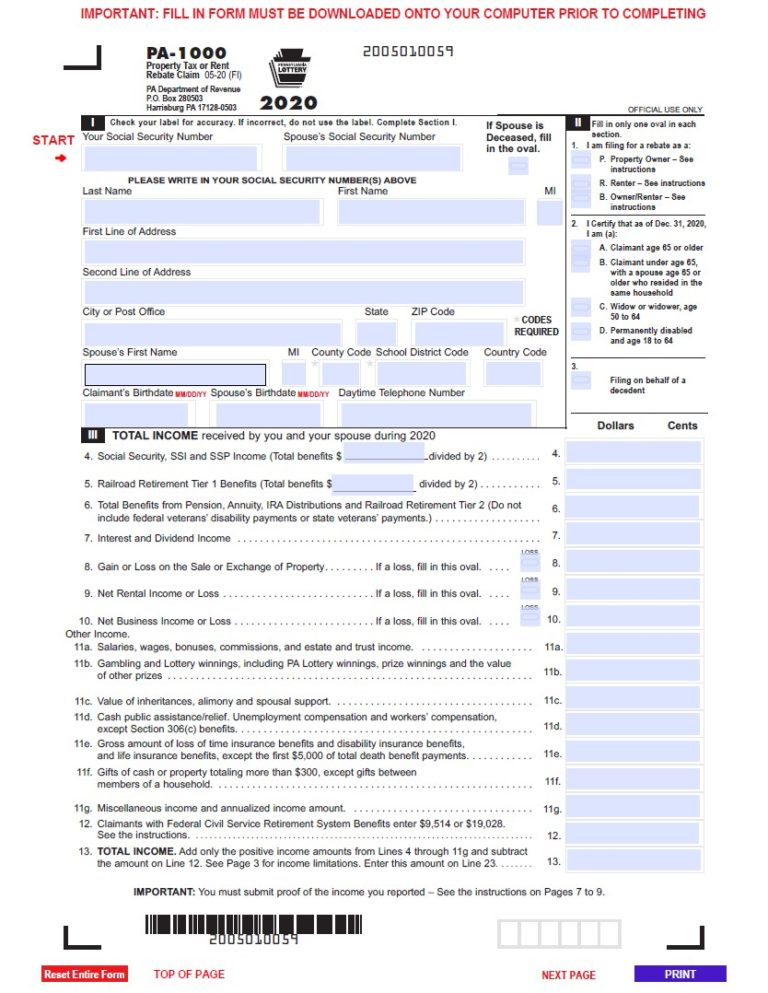

PA Rent Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-768x993.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the IRA Home Electrification and Appliance Rebates collectively the Home Energy Rebates The Home Energy Rebates together authorize 8 8 billion in funds for the benefit of U S households Common structural rebates include those for adding attic insulation and shading or replacing old or inefficient windows Making these upgrades helps to lower the demand on a home s heating ventilation and air conditioning HVAC systems which means that the same level of indoor comfort heating and cooling services can be achieved with

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and Floridians can now save more than 3 000 through tax credits from the Inflation Reduction Act and Florida Power Light rebates when investing in energy efficient equipment

Download Rebate For Homeowners For 2024 Fl For Insulation Rebate

More picture related to Rebate For Homeowners For 2024 Fl For Insulation Rebate

![]()

Ceiling Insulation Rebate Your Energy Saving Solutions

https://yess.net.au/wp-content/uploads/2021/09/Icons-Web-69.jpg

2021 City Utilities Insulation Rebate Bolivar Insulation Insulation And Exteriors

http://static1.squarespace.com/static/60b8d97d63f47e0c6b54c3dc/t/61bbbe8cb5e445602d27e88c/1639693971975/2021-CU-Rebate-WEB-01.png?format=1500w

How To Qualify For A Tax Rebate For Insulating Your Home

https://cdn-www.terminix.com/-/media/Feature/Terminix/Articles/Insulation-Attic-Installment-Technician.jpg?rev=1a8cb3da7c0a447989639e28fe8462d4

The maximum credit that can be claimed each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers Floridians will have the opportunity to apply for millions in home energy rebates We answer questions about what qualifies for the program and how the state plans to roll out the rebates

The second type of funding is for low to middle income families who are upgrading and electrifying their homes The program will provide rebates of up to 14 000 covering 50 of the cost of the Another way that Florida homeowners can save with the Inflation Reduction Act is through HOMES or Homeowners Managing Energy Savings Program This program offers a rebate of up to 8 000 off the cost of heat pump installation

2022 SRP ATTIC INSULATION REBATE UPDATE Convenient Home Services Inc

https://www.chsenergyaudit.com/wp-content/uploads/2021/09/Air-sealing-and-attic-insulation-6.jpg

ATTIC INSULATION REBATE Convenient Home Services Inc

https://www.chsenergyaudit.com/wp-content/uploads/2021/09/CHS_MARKETING1.jpg

https://www.energy.gov/sites/default/files/2024-03/...

What can I get a rebate for and how much money can I save You can get rebates on the following items through the two Home Energy Rebate programs Home Efficiency Rebates Recommended when you re taking several actions to reduce your energy usage All households are eligible with the largest rebates going to those with lower incomes

https://www.pnj.com/story/money/2024/07/30/florida...

The HOMES program will provide rebates for energy efficient retrofits that range between 2 000 4 000 for individual households and between 2 000 4 000 per dwelling for multi family buildings

Ontario Rebate Programs Green Ontario Rebate

2022 SRP ATTIC INSULATION REBATE UPDATE Convenient Home Services Inc

Blog Efficiency Manitoba Rebate North Shield Winnipeg

Energy Efficient Insulation Provider In Layton UT GreenHome

Hawaii State Rebate 2023 Printable Rebate Form

Government Solar Rebate QLD Everything You Need To Know

Government Solar Rebate QLD Everything You Need To Know

Ga Tax Rebate 2023 Status Tax Rebate

Attic Services South Miami FL Attic Insulation Cleaning

CleanBC Income Qualified Program Rebates For Insulation CleanBC Better Homes

Rebate For Homeowners For 2024 Fl For Insulation Rebate - The Inflation Reduction Act created two consumer rebate programs tied to energy efficiency Florida has signaled it won t apply for the federal funding