Rebate For New Heater If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

The Inflation Reduction Act includes rebates and tax credits to help homeowners install new heaters and other appliances Product Rebate Finder Enter your zip code to find rebates and other special offers on ENERGY STAR certified products available in your area

Rebate For New Heater

Rebate For New Heater

http://www.swimming-pool-information.com/images/SoCalGas-pool-heater-rebate.jpg

Residential Water Heater Rebate Hirsch Pipe Supply

https://www.hirsch.com/ASSETS/IMAGES/CMS/STATIC_IMAGES/March 2023 Socal Gas Tankless Storage Tank Rebates.png

SoCalGas Rebate On Navien Tankless Water Heaters Navien

https://navien-production-3.s3-us-west-2.amazonaws.com/2020/08/31/22/51/19/9ab172bd-2f71-4684-bf13-bc0514c6db12/SoCal-Gas-$1000-Rebate-Lading-Page.jpg

You may be eligible for a Home Electrification and Appliance Rebate in your locality if the heat pump is a for a newly constructed home b replacing a non electric heating unit or c a first time purchase of a heat pump for space conditioning in an existing home and is installed to be the household s primary heating and cooling source The following are questions and answers regarding the Home Energy Rebates administered by the U S Department of Energy DOE and funded by the Inflation Reduction Act IRA For more information please visit the Home Energy Rebates page

If you replace your water heater the following year you would be eligible for another 30 tax credit up to 2 000 plus up to 600 if you need an electric panel upgrade to accommodate the new water heater Learn the latest on federal tax credits for energy efficiency Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year

Download Rebate For New Heater

More picture related to Rebate For New Heater

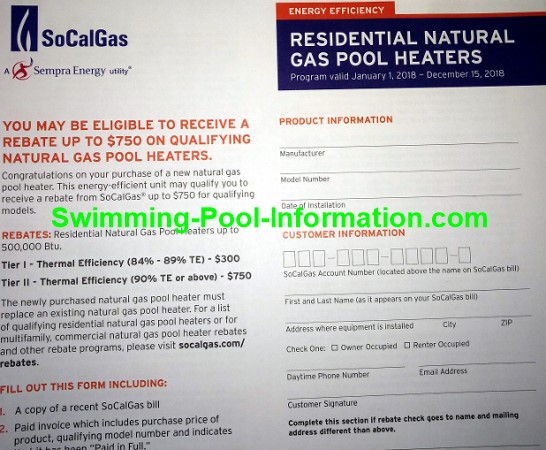

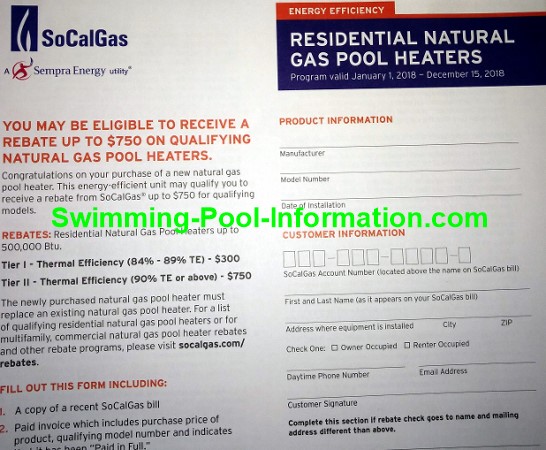

SoCal Gas 300 Rebate For Pool Heater Upgrade

https://static.wixstatic.com/media/53d4f0_3173620972b04ea4bf64c1a8daacfa76~mv2.jpg/v1/fit/w_1000%2Ch_1000%2Cal_c%2Cq_80/file.jpg

Heat Pump Rebates From Utility Providers Minneapolis St Paul

https://www.genzryan.com/wp-content/uploads/2020/05/HomeSystemSavingsEXTENDEDV2_FB_Post.jpg

Heat Pumps Rebates 2019 Coastal Energy

https://www.coastalenergy.ca/wp-content/uploads/2019/10/Heat-Pumps-Rebates-2019.png

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses

Government rebates for air conditioning and heating in 2024 make it easier and more affordable for homeowners to upgrade to energy efficient HVAC systems By taking advantage of these programs you can reduce your upfront costs and enjoy long term savings on your energy bills All households can access rebates of up to 4 000 while low income households could receive up to 8 000 for home efficiency Low and moderate income households can access rebates covering up

Williams Plumbing Water Heater Repair Replacement

https://uploads-ssl.webflow.com/5b082132cf65a9f8d97c9bc1/5d016846ef429760439c025b_Oklahoma Waterheater Rebate Form.jpg

Heat Pump Rebates Atmosphere Climate Control Specialists

https://www.atmospherecomfort.com/wp-content/uploads/2021/05/Rebates_2021.png

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.cbsnews.com/news/inflation-reduction...

The Inflation Reduction Act includes rebates and tax credits to help homeowners install new heaters and other appliances

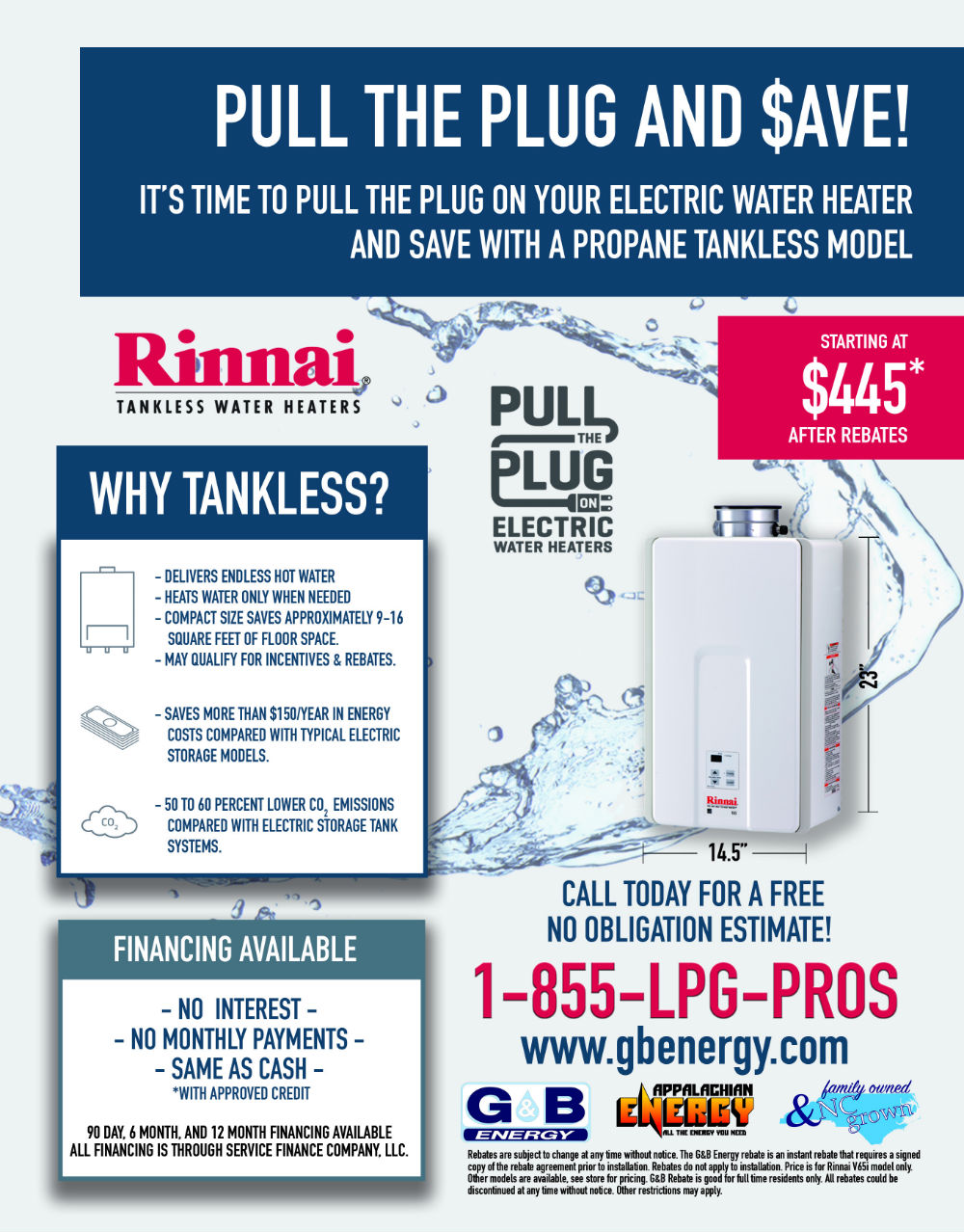

Tankless Water Heaters Elkin Advance Boone Millers Creek Mills

Williams Plumbing Water Heater Repair Replacement

Tankless Water Heater Rebates

Up To 2 050 Rebates Available On Industry Leading Tankless Water

Switch To Propane And Receive Up To 1 100 In Rebates

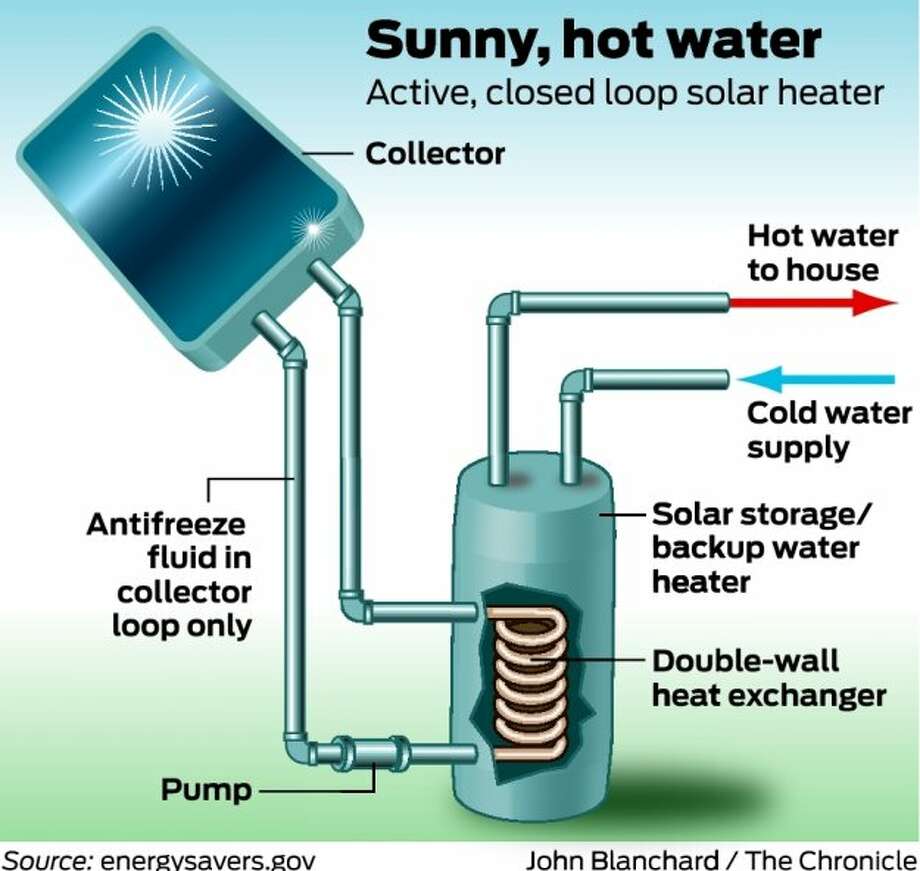

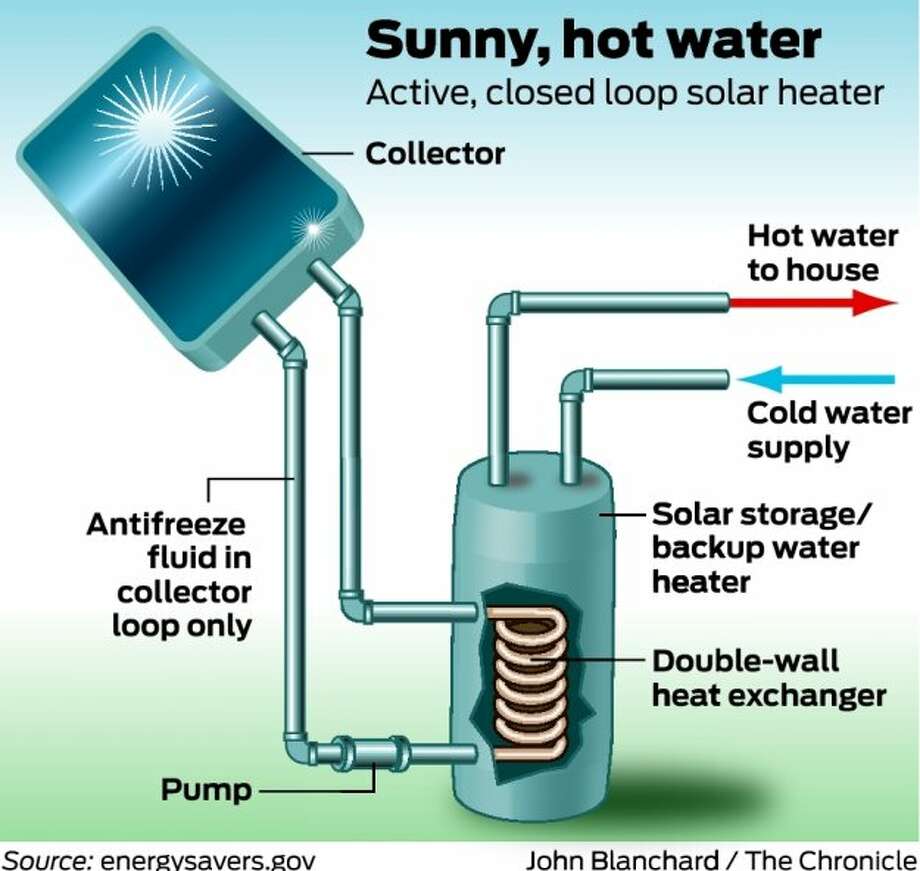

Rebates For Solar Water Heaters Approved SFGate

Rebates For Solar Water Heaters Approved SFGate

Xcel Water Heater Rebate 2023 Rebate2022

Heat Pump Water Heater Rebate Massachusetts PumpRebate

Ameren Missouri Water Heater Rebate WaterRebate

Rebate For New Heater - Power your home and save money with Home Energy Rebates Through the Home Energy Rebates you may be eligible for cash back on appliances and other home improvements that can lower your energy bills The map below shows your state s progress toward launching its rebates