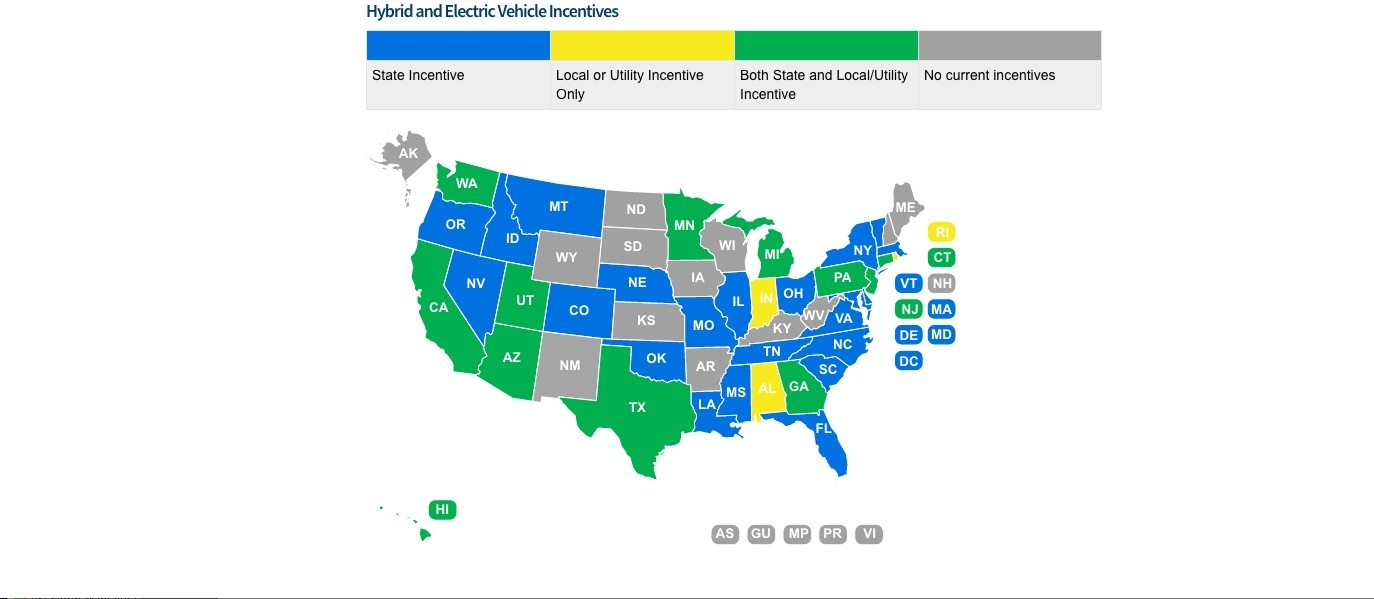

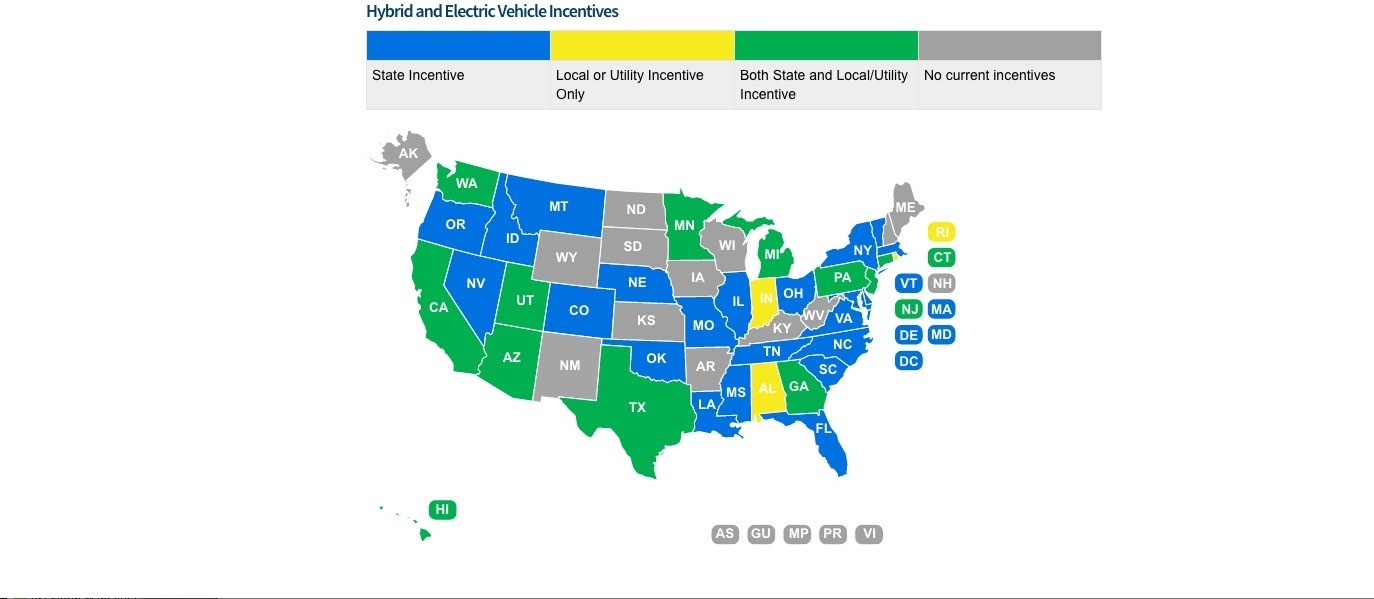

Rebate For Plug In Hybrid Web 25 juil 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the

Web 16 ao 251 t 2022 nbsp 0183 32 With President Biden signing the Inflation Reduction Act on Tuesday time is nearly up to get your purchase paperwork completed for a new EV or plug in hybrid and Web Incentives and Rebates Available for the Purchase of Electric Vehicles and Plug In Hybrid Vehicles Find rebates in your state 62 Records Found The links below will take you to

Rebate For Plug In Hybrid

Rebate For Plug In Hybrid

https://www.electricrebate.net/wp-content/uploads/2022/08/electric-car-and-plug-in-hybrid-incentives-in-the-usa-a-quick-guide.jpg

Planet Ford EV Plug in Hybrid Vehicle Rebate Program Randall Reed s

https://www.planetford45.com/WebSites/1903/widgetimages/220613-45-59-EV Dollars.jpg

7 000 Gov Rebate 2023 Ford Escape Plug in Hybrid PHEV FWD White

https://images.craigslist.org/01616_kSao3RLcVqE_0CI0t2_600x450.jpg

Web 18 ao 251 t 2022 nbsp 0183 32 Electric and plug in hybrid vehicles previously eligible for up to 7 500 in tax credits through 2022 are no longer eligible because of the Inflation Reduction Web 16 mai 2022 nbsp 0183 32 Try A No Risk 14 Day Free Trial Free Trial What is the Electric Vehicle Tax Credit Currently the plug in electric drive vehicle tax credit is up to 7 500 for qualifying

Web 25 janv 2022 nbsp 0183 32 Things are a bit more complicated with plug in hybrids as the federal tax credit amounts for each model vary depending on the capacity of its battery pack Here s Web All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based

Download Rebate For Plug In Hybrid

More picture related to Rebate For Plug In Hybrid

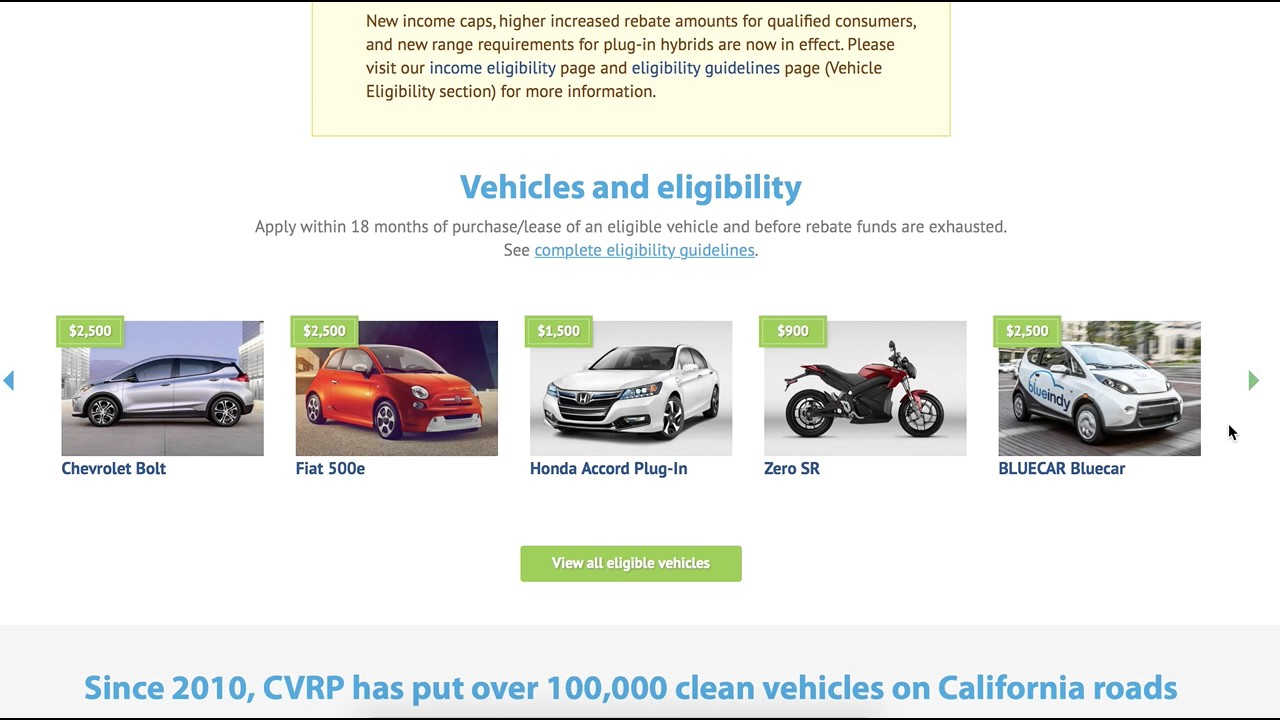

Rebates For Hybrid Cars California 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/california-drops-ev-rebates-for-cars-over-60k-plug-ins-below-35-miles.jpg

Fillable Online PLUG IN HYBRID VEHICLE CHARGING STATION REBATE

https://www.pdffiller.com/preview/568/706/568706519/large.png

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

https://www.californiarebates.net/wp-content/uploads/2023/04/federal-plug-in-hybrid-rebate-used-cars-2022-carrebate-6.jpg

Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for

Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a Web Plug in hybrids with electric ranges under 35 miles or EVs with a base price above 60 000 are not eligible The California rebate is cash or a check at the point of sale A mailed

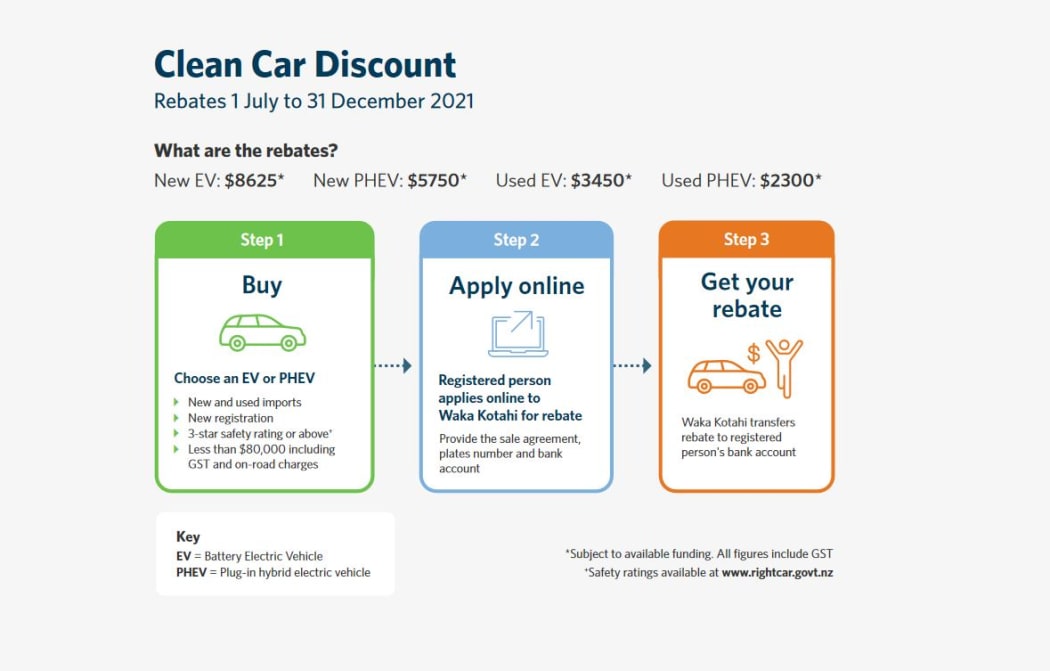

Rebate Scheme Announced For Buyers Of New And Used Electric And Hybrid

https://rnz-ressh.cloudinary.com/image/upload/s--DFqAjmwG--/c_scale,f_auto,q_auto,w_1050/4M90YBW_copyright_image_266129

Table 1 From Characterizing Plug In Hybrid Electric Vehicle Consumers

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/df7ed74b4fa0f1b23b4eca4d9c9e319a6e4a4324/3-Table1-1.png

https://www.consumerreports.org/cars/hybrids-evs/electric-cars-plug-in...

Web 25 juil 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the

https://www.greencarreports.com/news/1136839_tax-credit-unlikely-to...

Web 16 ao 251 t 2022 nbsp 0183 32 With President Biden signing the Inflation Reduction Act on Tuesday time is nearly up to get your purchase paperwork completed for a new EV or plug in hybrid and

Govt Rebate On Hybrid Cars 2023 Carrebate

Rebate Scheme Announced For Buyers Of New And Used Electric And Hybrid

U S Needs To Boost Incentives For Electric Vehicles

Autolite Spark Plug Rebate

Massachusetts Plug In Hybrid Rebate

PDF Electric Vehicle Rebates Lessons Learning EVs Plug in Hybrid

PDF Electric Vehicle Rebates Lessons Learning EVs Plug in Hybrid

PDF Electric Vehicles Used Vehicle Battery Second Life And

Detailed Instructions For The Best Ada Requirements For Ev Charging

Massachusetts Rebates For Hybrid Cars 2023 Carrebate

Rebate For Plug In Hybrid - Web 18 ao 251 t 2022 nbsp 0183 32 Electric and plug in hybrid vehicles previously eligible for up to 7 500 in tax credits through 2022 are no longer eligible because of the Inflation Reduction