Rebate For Senior Citizens For Ay 2024 23 The US government opted to increase old age payments through Old Age Relief to 2 000 dollars after discovering that about 50 percent of seniors in the country are struggling financially to make

04 23 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 www revenue pa gov IMPORTANT DATES Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Rebate Claim 03 23 PA Department of Revenue 11 min read CONTENTS Show Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers reduce their income tax liability

Rebate For Senior Citizens For Ay 2024 23

Rebate For Senior Citizens For Ay 2024 23

https://storage.googleapis.com/burbcommunity-glensidelocal/2023/05/untitled-64.jpg

Income Tax Rebate For Senior Citizens Fy 201920 In India TAX

https://wealthtechspeaks.in/wp-content/uploads/2021/02/Senior-Citizen-New-Tax-System-2021-22.png

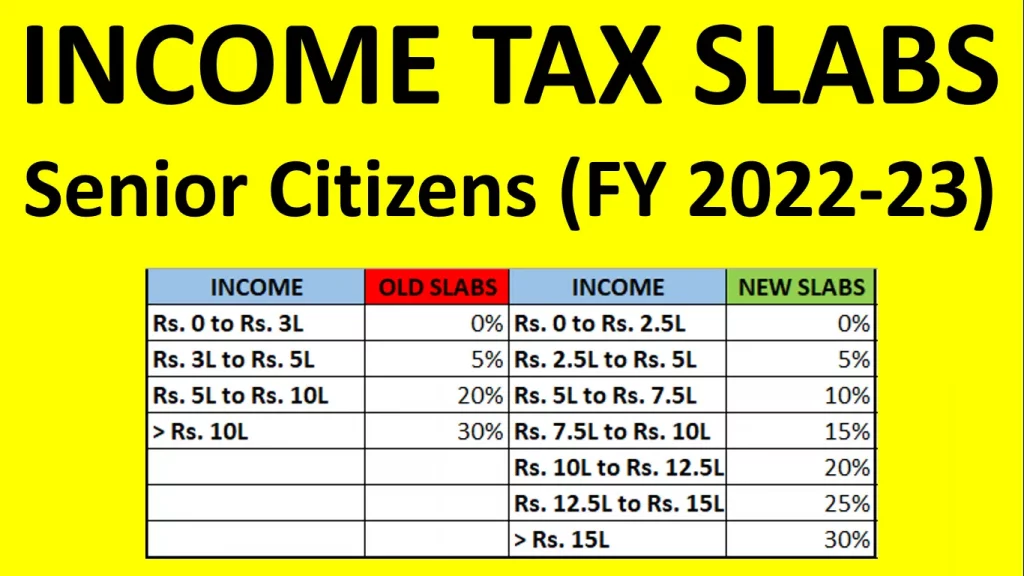

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-for-senior-citizens-FY-2022-23-1024x576.webp

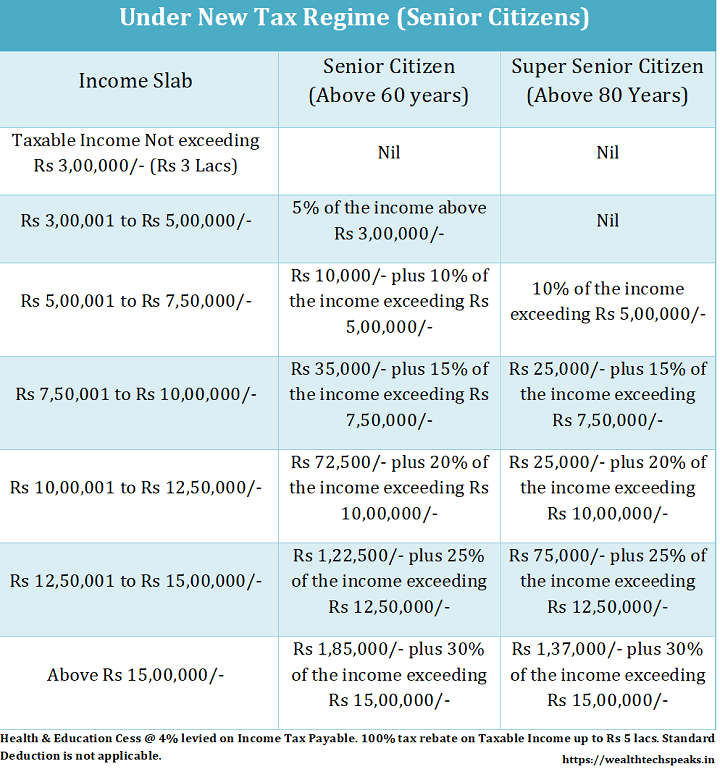

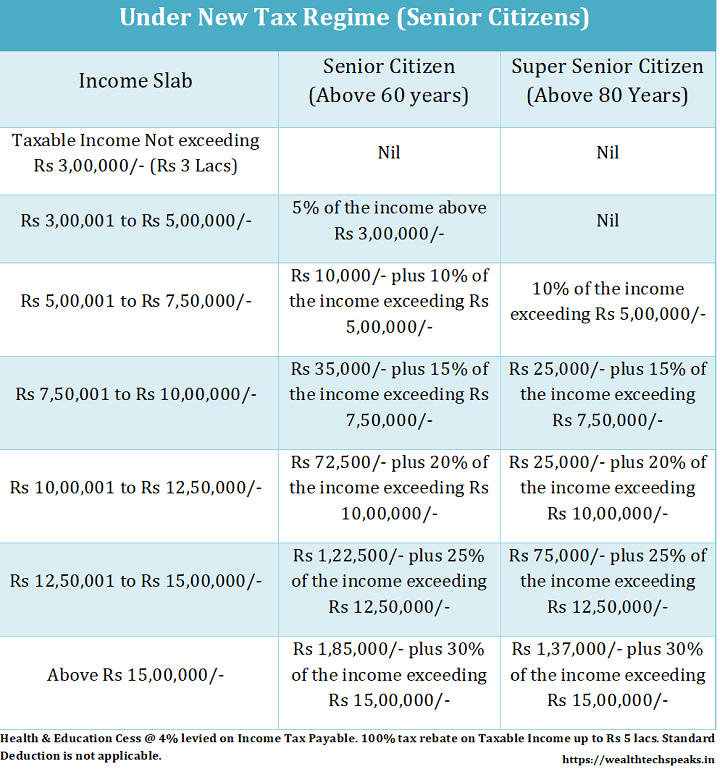

Given below are the income tax rates for FY 2023 24 AY 2024 25 FY 2022 23 AY 2023 24 and FY 2021 22 AY 2022 23 under the old tax regime The basic exemption limit depends on the age of an individual and status of an individual For an individual below 60 years of age the basic exemption limit is of Rs 2 5 lakh As per Income Tax Act 1961 senior citizen is an Indian resident whose age is 60 years or more but less than 80 years While a super senior citizen is an Indian resident whose age is 80 years or more This article briefly explains all the income tax provisions applicable to the resident senior citizen and super senior citizen

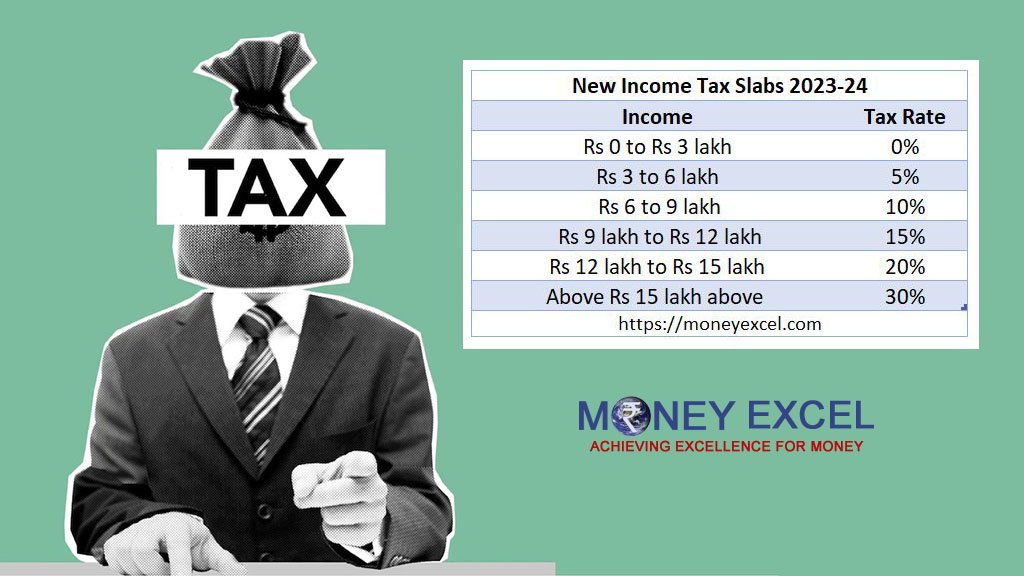

CIRCULAR NO 1 2024 DATED the 23rd of January 2024 AMENDMENTS OF THE INCOME TAX ACT 1961 CARRIED OUT THROUGH FINANCE ACT 2023 87 Rebate to be allowed in computing income tax Income chargeable to tax Rate of income tax for AY 2023 24 Individual other than senior and very senior citizen HUF association of Income Tax Slabs Rates for Senior Citizens in AY 2024 25 FY 2023 24 As a result if an individual of HUF opts for the new tax regime in FY 23 24 the total rebate available will be up to 100 of the total income tax payable up to Rs 25 000 ARN NO Jul23 Bg 06J

Download Rebate For Senior Citizens For Ay 2024 23

More picture related to Rebate For Senior Citizens For Ay 2024 23

Unskilled Immigrants Help To Ease The Pain Of Dying Americans Citizen Truth

https://citizentruth.org/wp-content/uploads/2019/06/29609189022_51f4694776_h.jpg

Income Tax Benefits For Senior Citizens 2020 Income Tax Rebate For Senior Citizens Fy 2020 21

https://i.ytimg.com/vi/VfG-TdpojnQ/maxresdefault.jpg

New Income Tax Slab 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

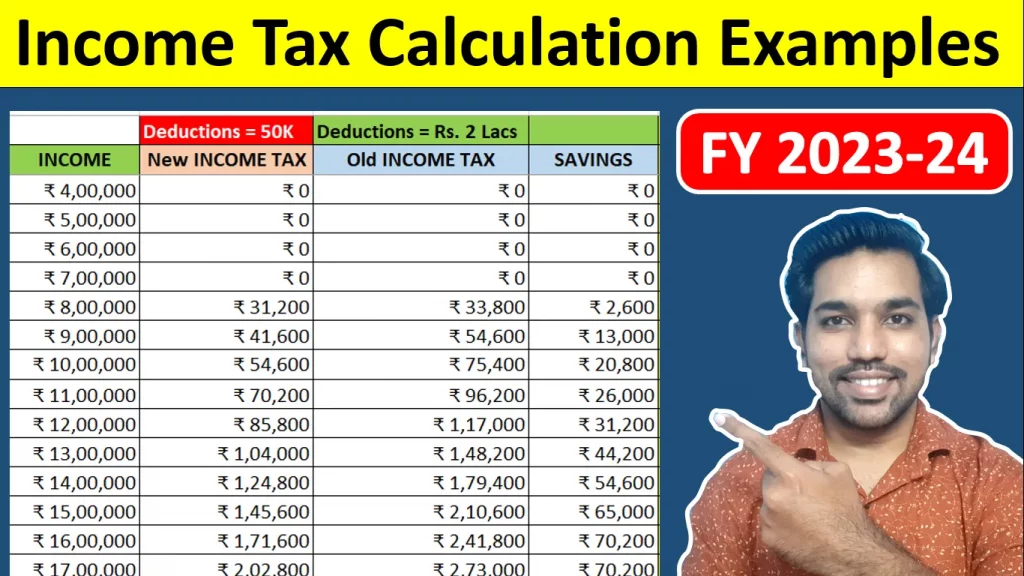

For AY 2021 22 the maximum limit for deduction u s 80D in respect of payment made for health insurance premium in respect of a senior citizen has been allowed at Rs 50 000 as against that allowed to other individuals at Rs 25 000 The tax payable under both the new and the old regimes without claiming deductions and exemptions for FY 2023 24 AY 2024 25 is as below Assumed that the annual income is after considering the standard deduction under both old and new regimes

The assistance is intended for households with an adjusted gross income AGI of up to 75 000 for individuals up to 150 000 for married couples filing jointly and up to 112 500 for heads of About the Property Tax Rent Rebate Program The Property Tax Rent Rebate Program supports homeowners and renters across Pennsylvania This program provides a rebate ranging from 380 to 1 000 to eligible older adults and people with disabilities age 18 and older This program is supported by funds from the Pennsylvania Lottery and gaming

Changes To The Senior Citizens Property Tax Rebate Patricia Arab

https://www.patriciaarab.ca/wp-content/uploads/2018/09/seniors4.jpg

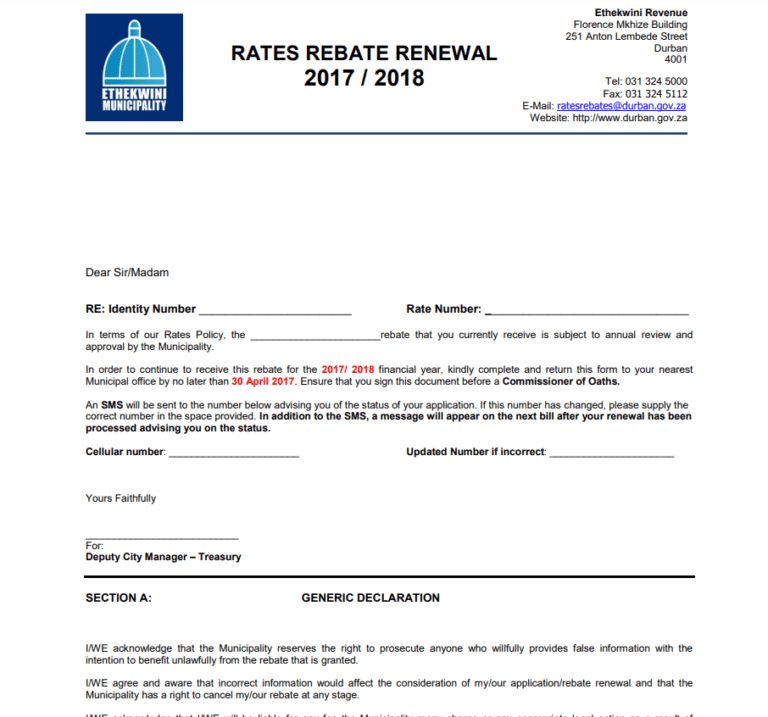

Ethekwini Pensioners Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Ethekwini-Pensioners-Rates-Rebate-Form-768x717.png

https://www.msn.com/en-us/money/retirement/stimulus-checks-for-seniors-when-will-the-payments-be-sent/ar-AA1laguL

The US government opted to increase old age payments through Old Age Relief to 2 000 dollars after discovering that about 50 percent of seniors in the country are struggling financially to make

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

04 23 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 www revenue pa gov IMPORTANT DATES Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Rebate Claim 03 23 PA Department of Revenue

Senior And Super Senior Citizens May Choose The Old Tax Regime Or The New Tax Regime I e

Changes To The Senior Citizens Property Tax Rebate Patricia Arab

Senior Citizen Income Tax Calculator FY 2023 24 Excel DOWNLOAD FinCalC Blog

ITR Filing Due Date And Last Date For Senior Citizens AY 2023 24 Money News The Financial

Senior Citizen Tax Rebate Program Participants Honored By LPS Board Littleton Public Schools

Rebate Ngh a L G nh Ngh a V D Trong Ti ng Anh

Rebate Ngh a L G nh Ngh a V D Trong Ti ng Anh

Senior Citizen 12 AY 2023 24 Big Relief For Senior Citizen

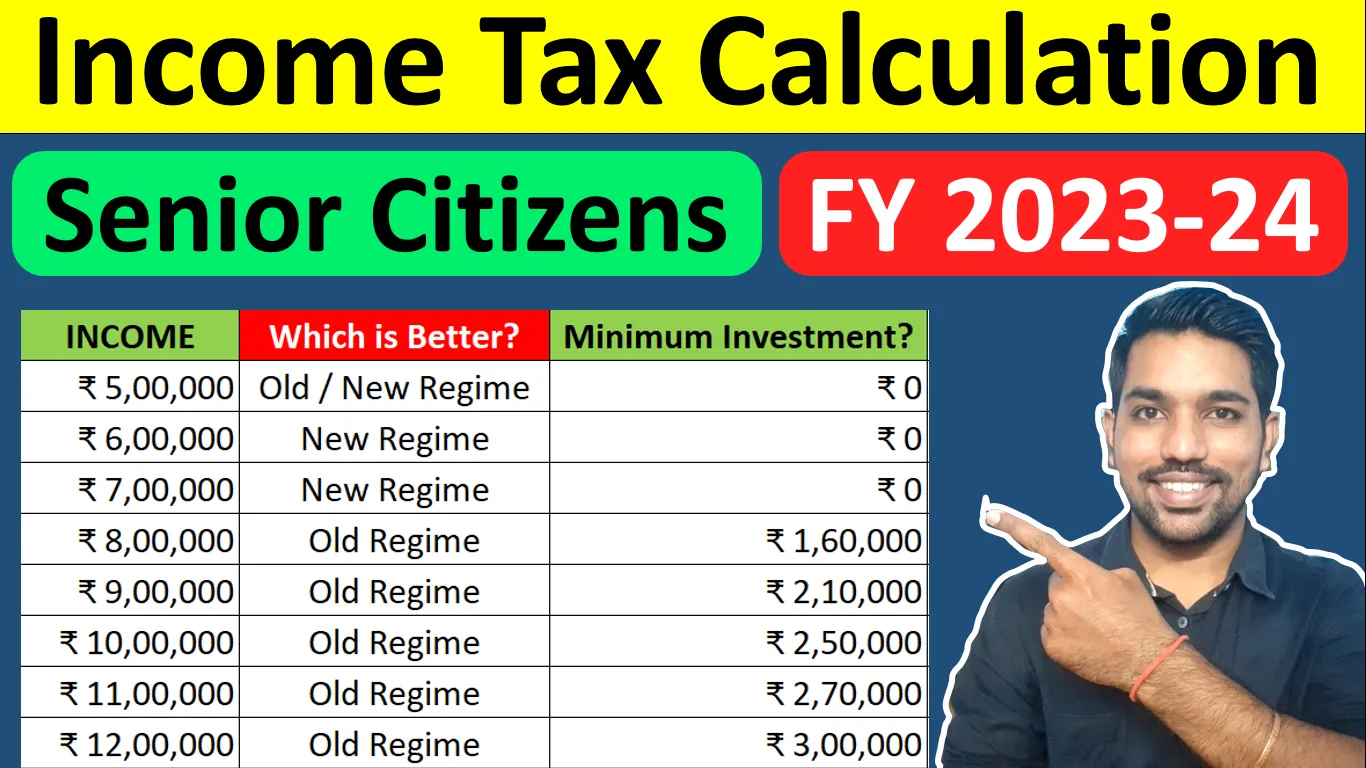

Income Tax Calculation For FY 2023 24 Examples FinCalC Blog

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com Www vrogue co

Rebate For Senior Citizens For Ay 2024 23 - In this comprehensive guide we will explore the key provisions and changes that affect individual taxpayers and HUFs for the Assessment Year 2024 25 enabling you to make informed financial decisions and take full advantage of the tax benefits provided by the government