Rebate From Highmark Incime Tax Aca Premium Credita Web Voir le Des instructions pour le formulaire 8962 Premium Tax Credit PTC pour plus d informations sur les montants du seuil de pauvret 233 f 233 d 233 ral Normalement les

Web for Affordable Care Act ACA enrollees Advance Premium Tax Credits APTC which may be applied in advance to lower what you pay each month for your premium on any Web 1 sept 2021 nbsp 0183 32 Individual policyholders will receive on average 405 and small group health plans will see on average 1 514 in rebates out of a total of over 10 000 The state

Rebate From Highmark Incime Tax Aca Premium Credita

Rebate From Highmark Incime Tax Aca Premium Credita

https://www.urban.org/sites/default/files/2021-02/blog_table_1_3.png

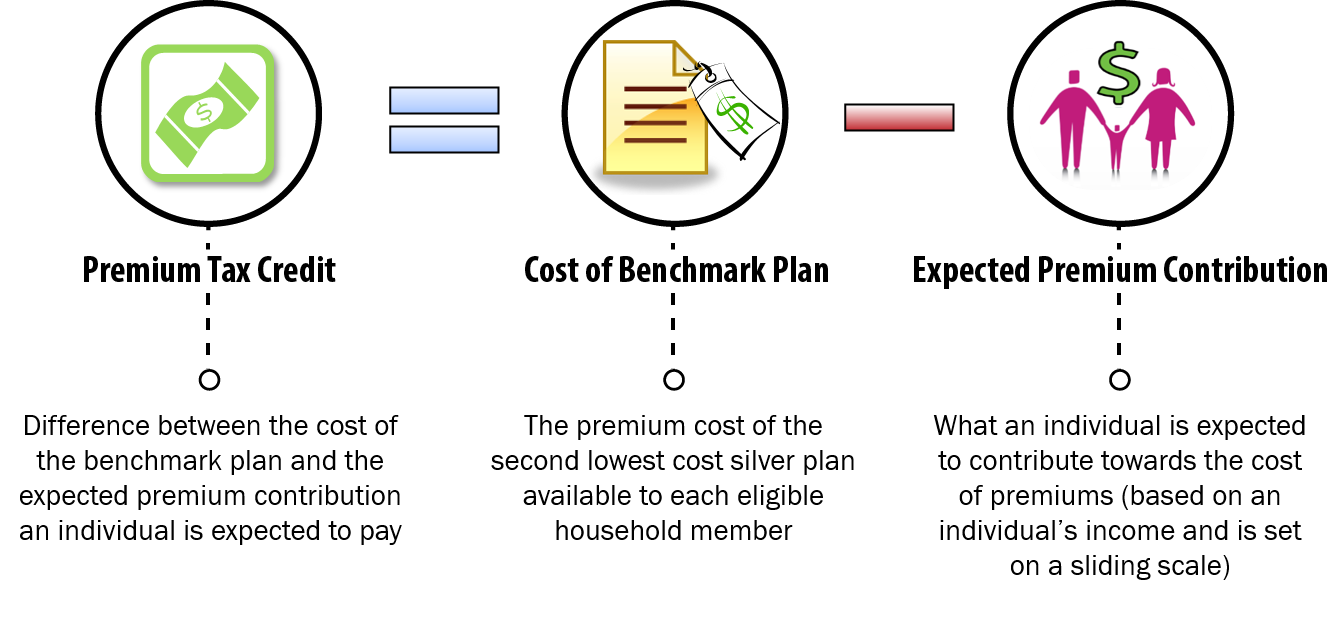

How Does The ACA Impact Your Taxes Group Plans Inc

http://groupplansinc.com/wp-content/uploads/2020/03/PTC.png

ACA Premium Tax Credits Outline

https://s3.studylib.net/store/data/009552456_1-eca5b14b19523f1a7fa7216b3c34c500-768x994.png

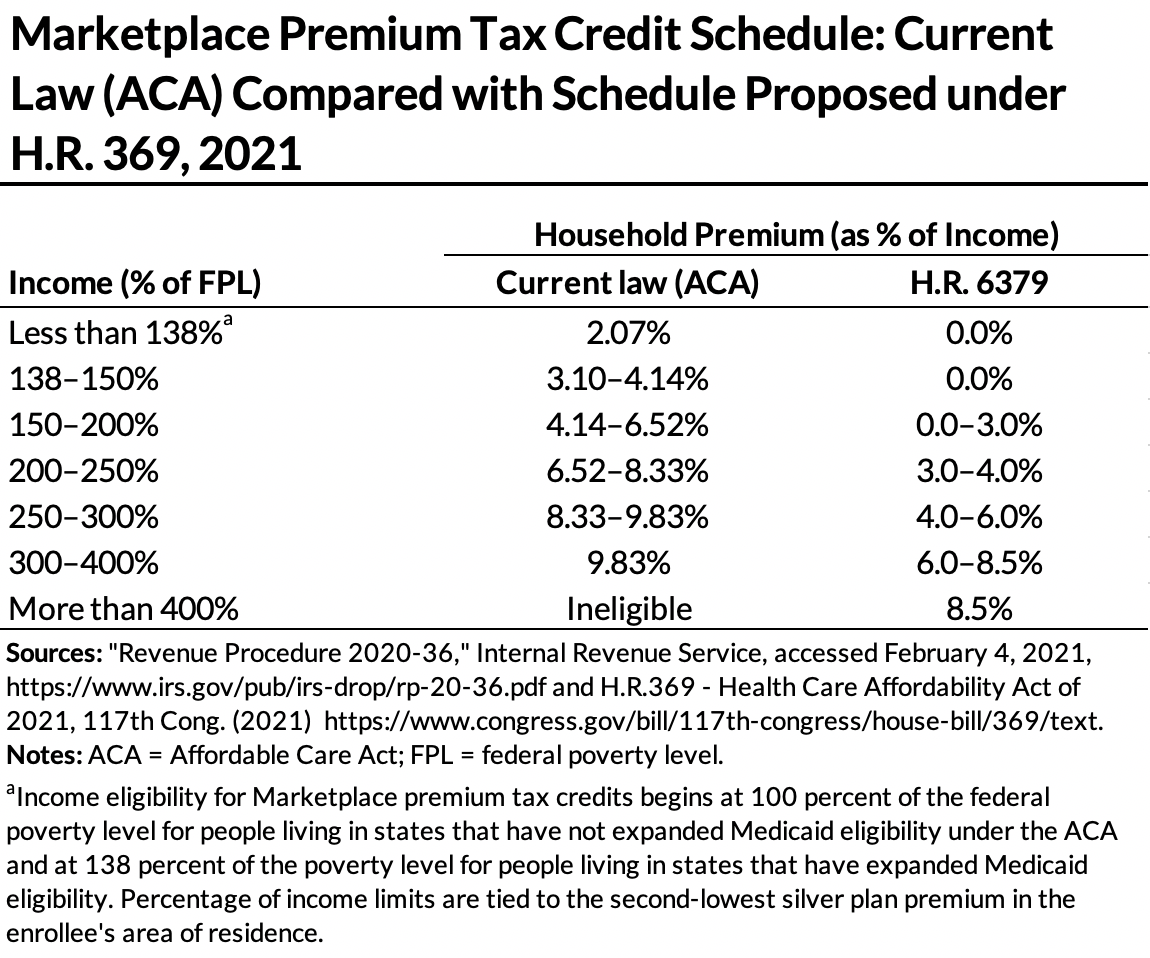

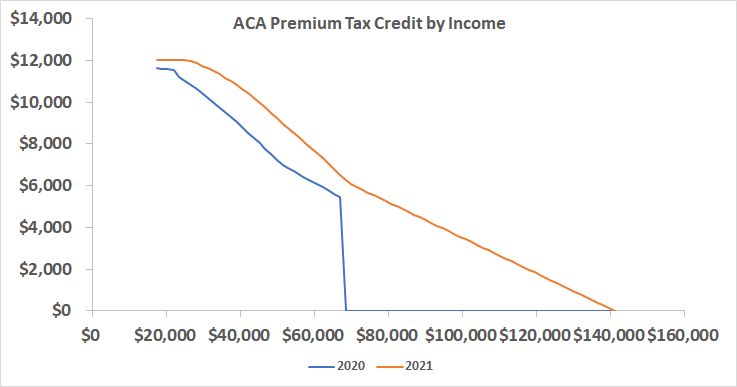

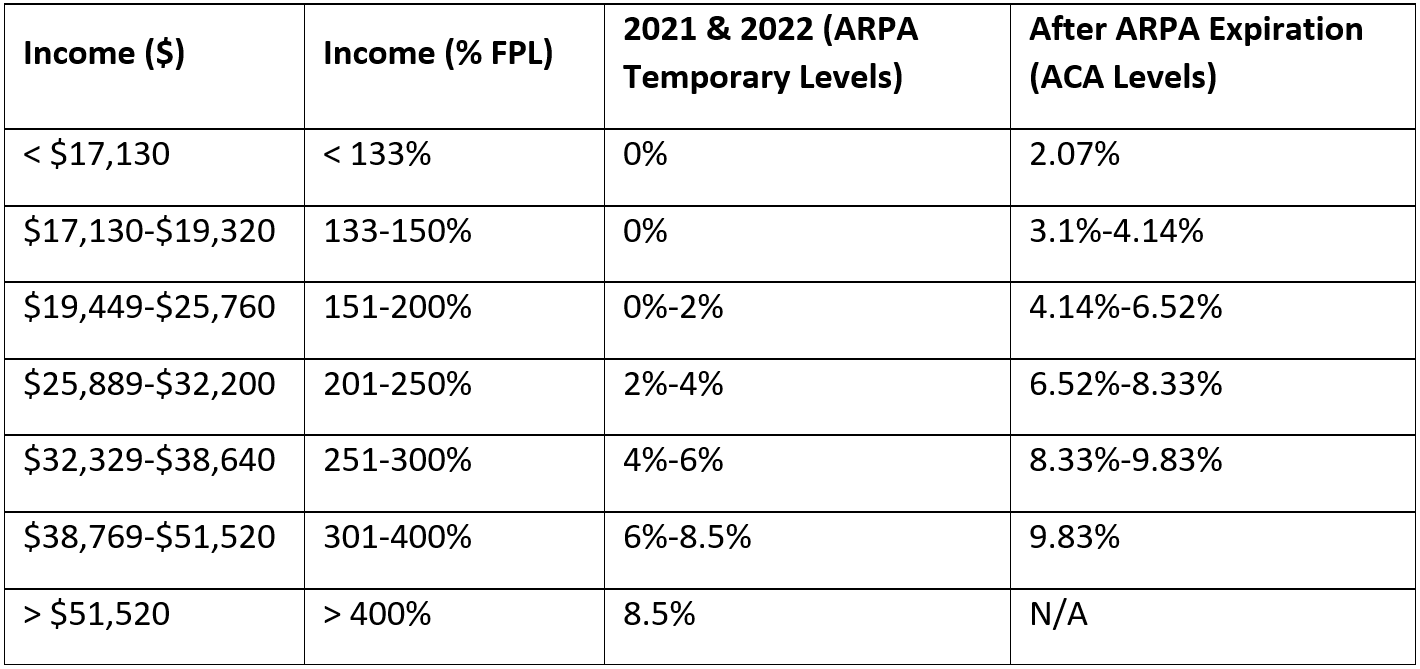

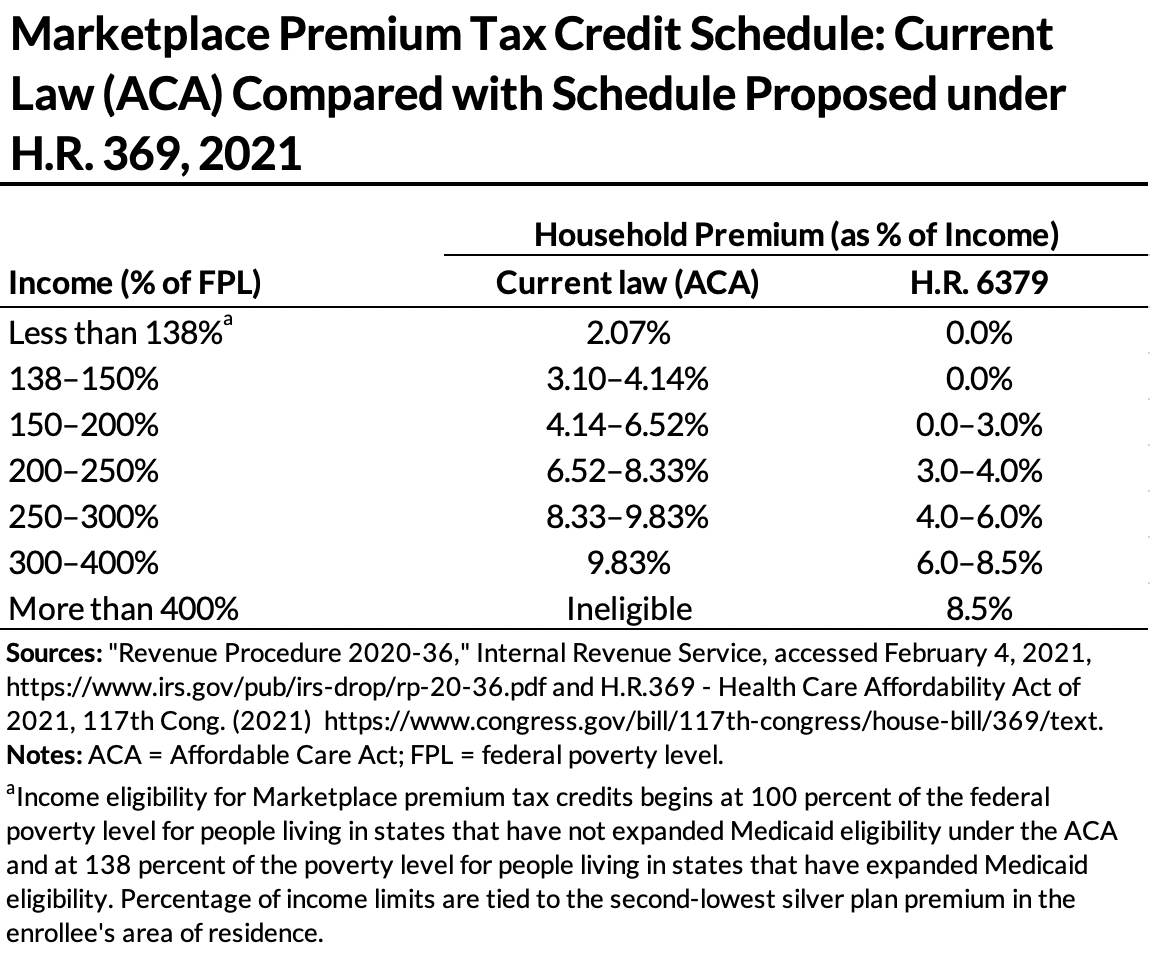

Web 17 mai 2023 nbsp 0183 32 Published May 17 2023 The Medical Loss Ratio MLR provision of the Affordable Care Act ACA limits the amount of premium income that insurers can keep Web 4 nov 2022 nbsp 0183 32 As part of the American Rescue Plan Act ARPA of 2021 the Biden administration s first tax base bill the premium tax credit was opened up to far more

Web 2022 1238 Enactment of Inflation Reduction Act extends expanded premium tax credits under the Affordable Care Act The newly enacted Inflation Reduction Act extends ACA Web Cr 233 dit pour imp 244 t 233 tranger Formulaire 1116 VISAS et investissement aux USA Formulaire 1040NR Test de pr 233 sence substantielle Taxes sur la valeur nette 233 lev 233 e

Download Rebate From Highmark Incime Tax Aca Premium Credita

More picture related to Rebate From Highmark Incime Tax Aca Premium Credita

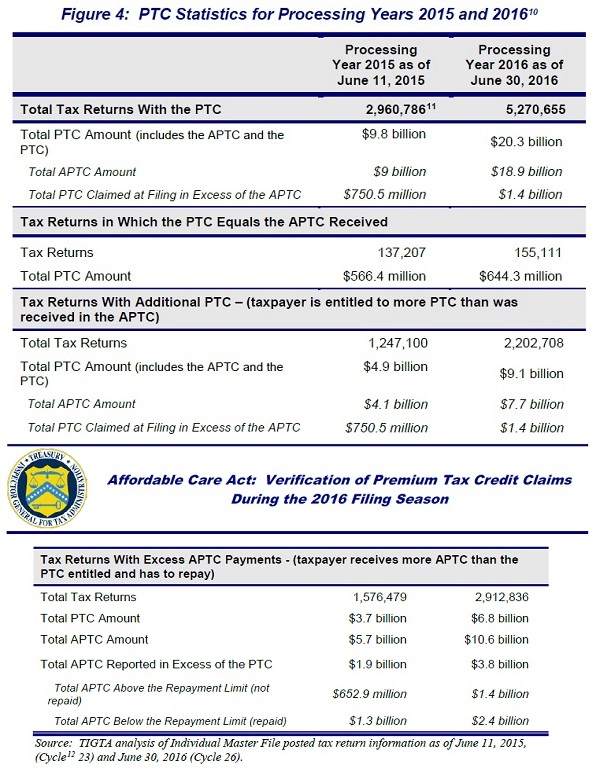

Limits On Repayment Of Excess Premium Tax Credits

https://www.healthaffairs.org/do/10.1377/hpb20130801.398718/full/hpb97_2.jpg

ACA Tax Credits To Help Pay Premiums White Insurance Agency

https://www.whiteinsuranceokc.com/wp-content/uploads/sites/4713/2021/11/2022-FPL-CHART_0001-1536x738.png

ACA Premium Subsidy Cliff Turns Into A Slope In 2021 And 2022

https://thefinancebuff.com/wordpress/wp-content/uploads/2021/04/aca-ptc-2021.jpg

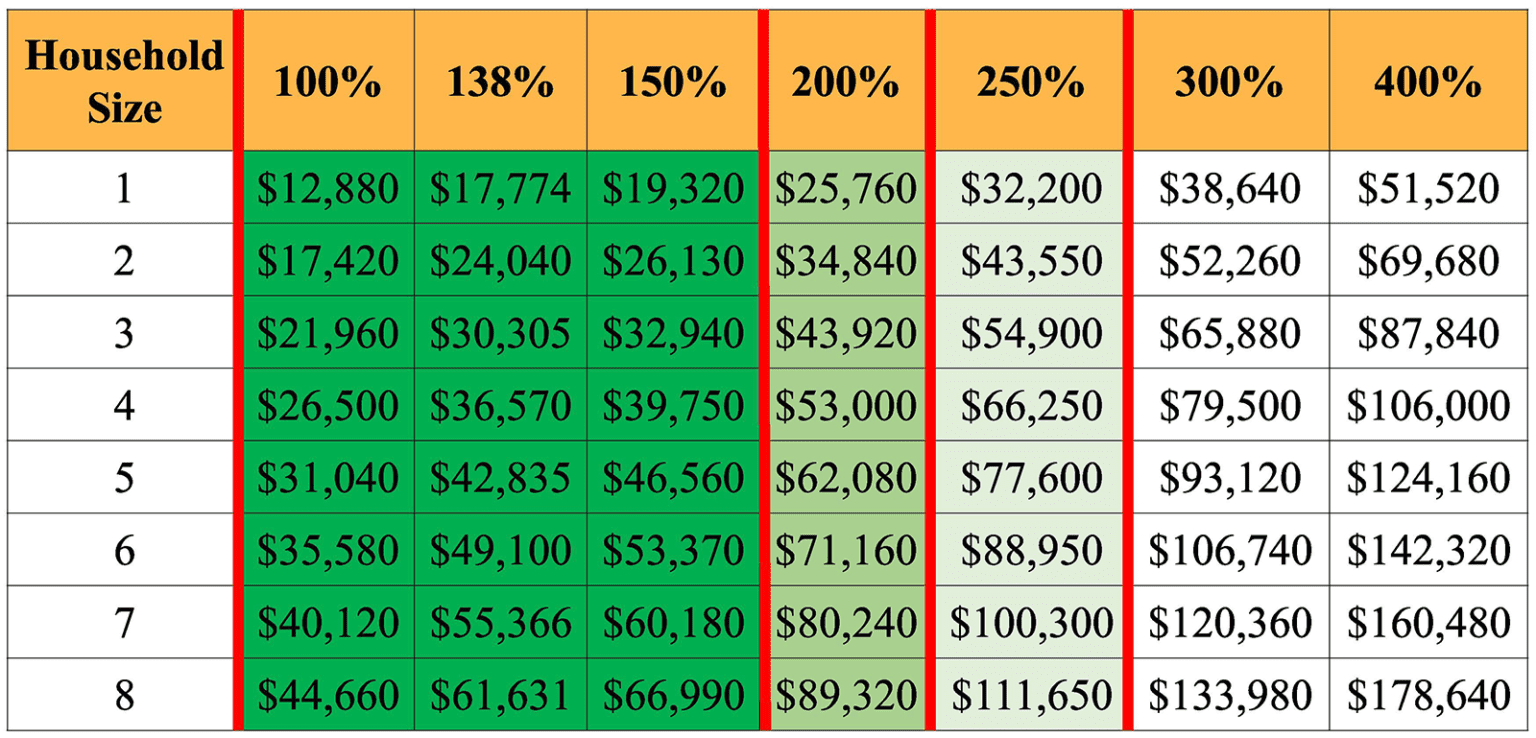

Web of our ACA members qualify to save Advance Premium Tax Credits APTC which may be applied in advance to lower what you pay each month for your premium on any Web 17 janv 2023 nbsp 0183 32 To be eligible to receive the premium tax credit in 2023 individuals must have annual household income at or above 100 of the federal poverty level not be

Web 23 mai 2023 nbsp 0183 32 Health insurers sent 1 billion in rebates to consumers in 2022 bringing 11 year total to 10 8 billion Rebate amounts vary considerably by state and insurer For Web 24 ao 251 t 2023 nbsp 0183 32 Under the ACA individuals and households with incomes above 400 percent of the federal poverty level FPL are ineligible for PTCs Under the ARPA however they

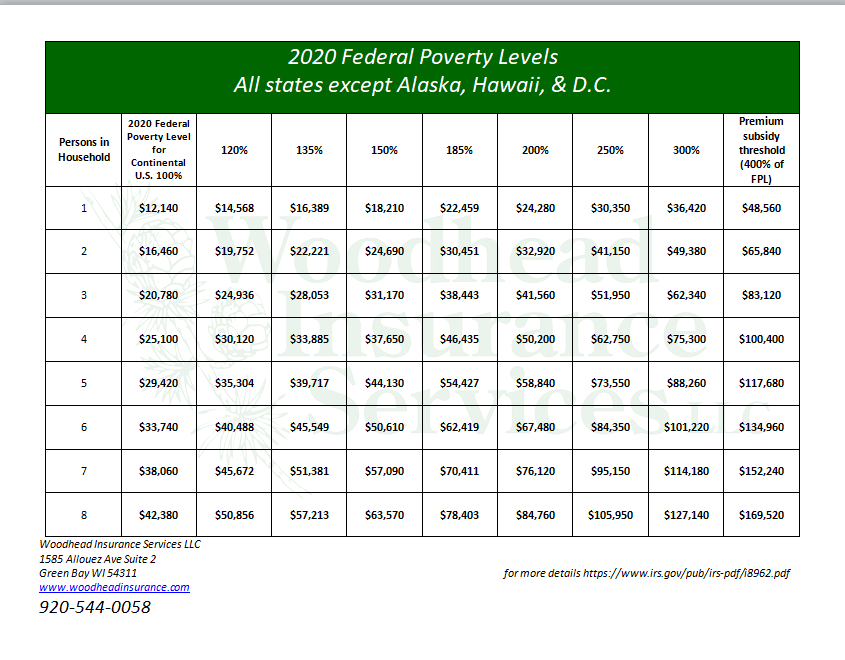

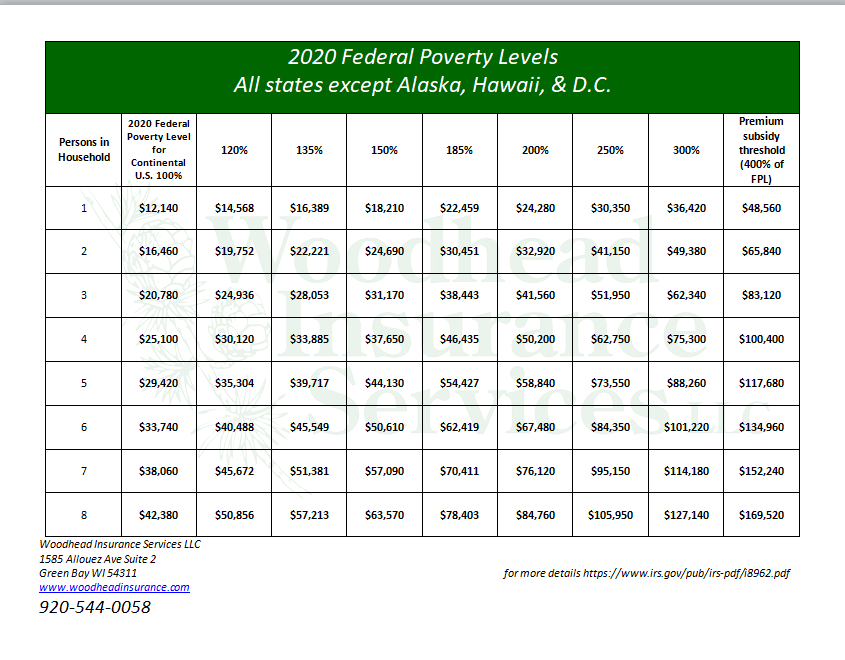

News Woodhead Insurance

http://woodheadinsurance.com/wp-content/uploads/2019/08/Annotation-2019-08-30-130930.png

After The American Rescue Plan s Enhanced Premium Tax Credits End AAF

https://www.americanactionforum.org/wp-content/uploads/2022/04/ARPATable.png

https://protaxconsulting.com/fr/blog/advance-payments-premium-tax-credit

Web Voir le Des instructions pour le formulaire 8962 Premium Tax Credit PTC pour plus d informations sur les montants du seuil de pauvret 233 f 233 d 233 ral Normalement les

https://www.discoverhighmark.com/.../ACA/2022-ACA-Prod…

Web for Affordable Care Act ACA enrollees Advance Premium Tax Credits APTC which may be applied in advance to lower what you pay each month for your premium on any

Highmark Seeks 2019 ACA Premium Hike Delaware First Media

News Woodhead Insurance

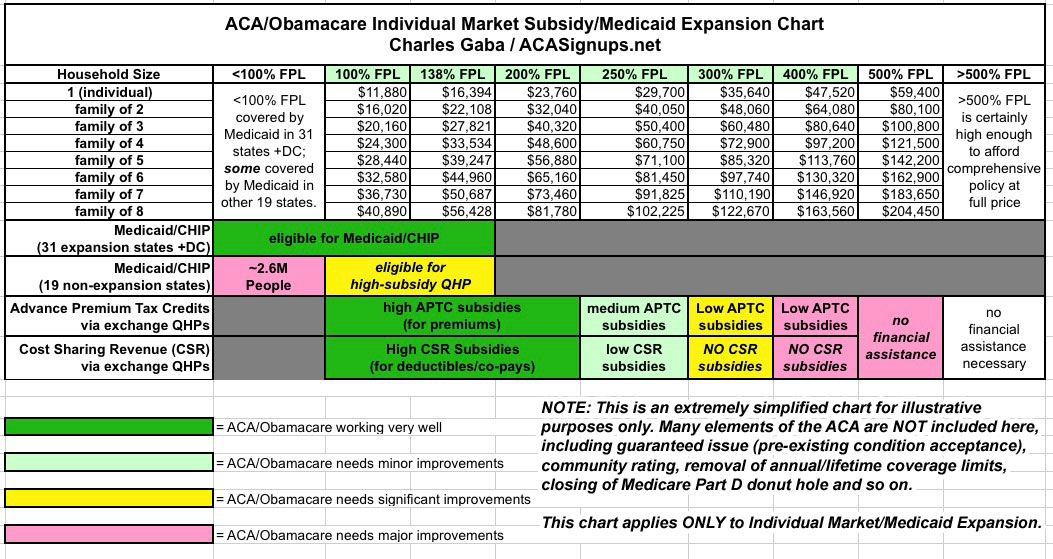

Trump RyanCare Really Screws Over Older Low Income And Rural Americans

IT Issues Prevent IRS From Easily Verifying Correct ACA Subsidies For

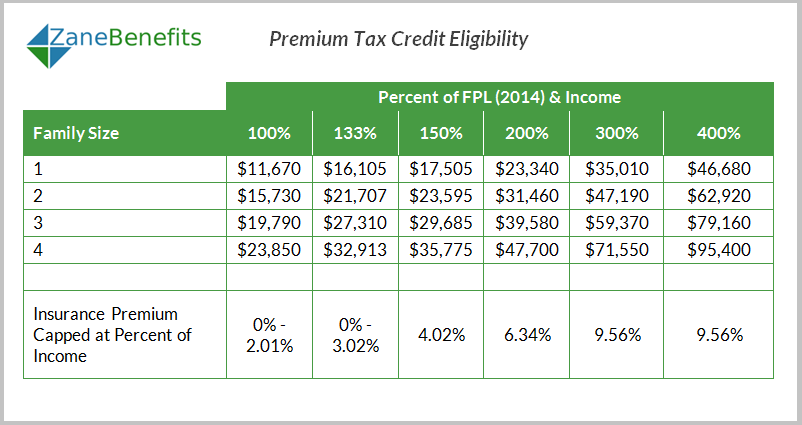

Aca Insurance Eligibility Employees Obtaining Premium Tax Credits Can

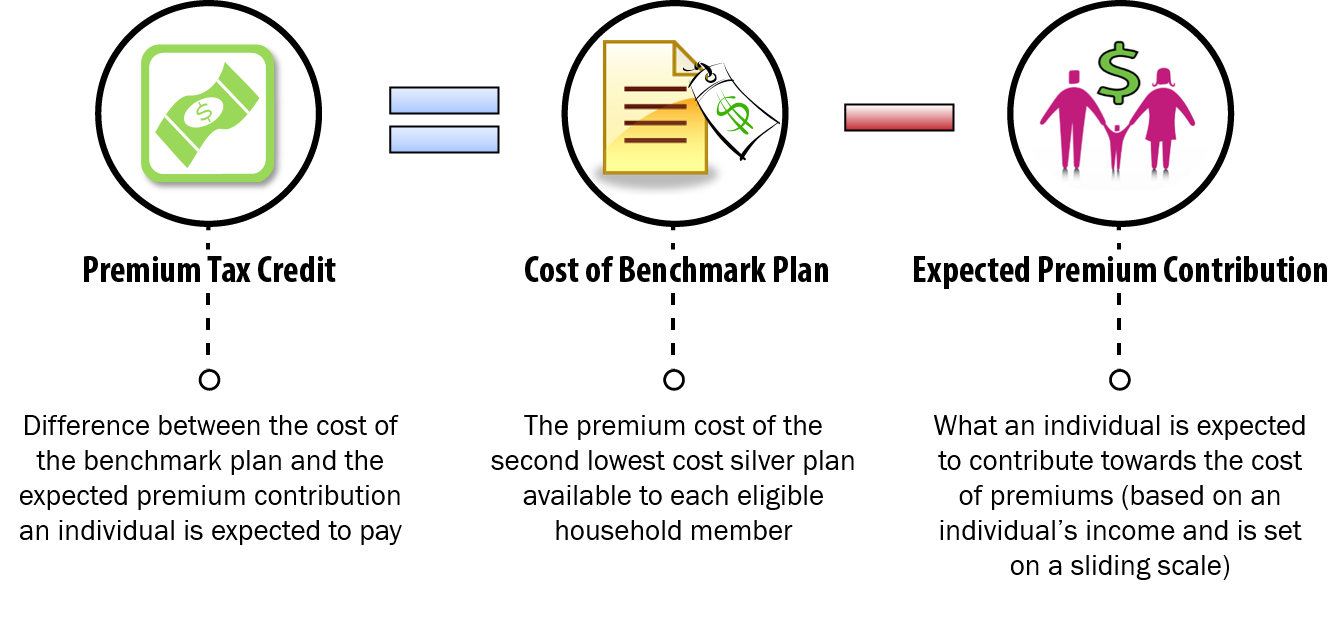

What Are Premium Tax Credits Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Aca Percentage Of Income 2022 INCOMUNTA

January 2017 ACA Signups

Rebate From Highmark Incime Tax Aca Premium Credita - Web Cr 233 dit pour imp 244 t 233 tranger Formulaire 1116 VISAS et investissement aux USA Formulaire 1040NR Test de pr 233 sence substantielle Taxes sur la valeur nette 233 lev 233 e